Global Linear Alpha Olefins Market Expected to Reach USD 13.7 Billion by 2033 - IMARC Group

Global Linear Alpha Olefins Market Statistics, Outlook and Regional Analysis 2025-2033

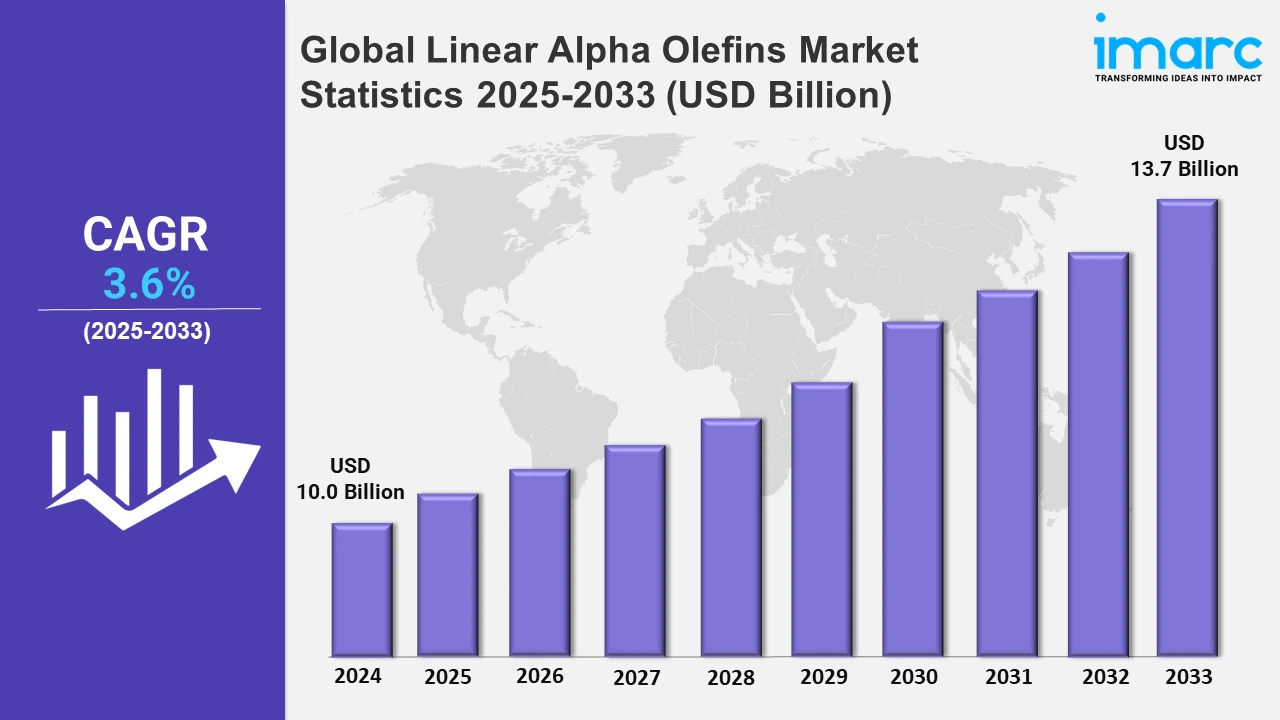

The global linear alpha olefins market size was valued at USD 10.0 Billion in 2024, and it is expected to reach USD 13.7 Billion by 2033, exhibiting a growth rate (CAGR) of 3.6% from 2025 to 2033.

To get more information on this market, Request Sample

The global market is significantly driven by the increasing usage of linear alpha olefins in various industries, such a detergents, lubricants, and polymer production. In addition to this, the increasing global demand for polypropylene, especially in packaging, automotive, and construction sectors, is impelling manufacturers to improve their production capacities. Investment in advanced chemical facilities allows companies to meet this demand while supporting sustainable growth and strengthening their position in competitive markets. For instance, on 1st January 2024, ExxonMobil announced the expansion of its Baytown, Texas, chemical production facility. The project includes a new polypropylene unit, enhancing capacity by 450,000 tons annually to meet rising global demand. This expansion underscores ExxonMobil's commitment to strengthening its chemical manufacturing capabilities and supporting sustainable growth in key markets. Apart from this, the increasing environmental awareness and regulations that favor eco-friendly cleaning products are further enhancing the adoption of LAO. Also, strategic partnerships and joint ventures among chemical manufacturers are fostering innovation and market penetration.

The market is further driven by the increasing demand for linear low-density polyethylene, used extensively in flexible packaging, films, and containers as LAOs act as comonomers in LLDPE production, the rapid expansion of e-commerce and food packaging industries has raised the demand for such materials. Furthermore, the increasing focus on sustainability and carbon footprint reduction is driving the adoption of renewable energy in industrial operations. This shift supports the production of key chemicals, aligns with environmental regulations, and enhances operational efficiency, making sustainability a crucial driver for innovation and competitiveness in the chemical manufacturing sector. In April 2024, INEOS announced the construction of a solar farm to supply CO2-free electricity to its Feluy, Belgium, site. The initiative supports the production of linear alpha-olefins, aligning with INEOS' sustainability goals by reducing carbon emissions and enhancing renewable energy usage in its operations. In addition, ongoing improvements in catalyst technology is enhancing efficiency in production and allow tailoring LAOs to industrial-specific needs, further encouraging innovation and opening new application fields.

Global Linear Alpha Olefins Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Middle East, Western Europe, South America, and others. According to the report, North America accounted for the largest market share on account of strong manufacturing, advanced technologies, R&D, and growing demand from polyethylene and synthetic lubricants industries, alongside sustainable practices, and regulatory compliance.

North America Linear Alpha Olefins Market Trends:

North America is a dominant player in the linear alpha olefins market, mainly due to the growing demand from the polyethylene and synthetic lubricants industries. The strong manufacturing capacity in the region, improved chemical processing technologies, and heavy research and development activities is driving the market growth. Moreover, the growth of sustainable practices and regulatory compliance standards increases the innovation for production processes and ensures that the market is constantly expanding.

Middle East Linear Alpha Olefins Market Trends:

Growth in the Middle East petrochemicals market is driven by its solid infrastructural foundation, and products like linear alpha olefins are particularly in demand for the manufacturing of polyethylene, synthetic lubricants, and detergents. Investments into the region. Also, strategic investments are encouraging innovations, and high-end production capabilities, meeting the demands globally, positioning the Middle East as an essential manufacturing and export hub for petrochemicals. For instance, the Jubail United Petrochemical Company Al-Jubail Complex, operational since 2004 in Saudi Arabia's Eastern Province, produces ethylene glycol, ethylene, and ethylene oxide. The facility also manufactures linear alpha olefins, essential in producing polyethylene, synthetic lubricants, and detergents. This complex underscores the Middle East's significant role in the global petrochemical industry.

Western Europe Linear Alpha Olefins Market Trends:

The linear alpha olefins market in Western Europe grows steadily and is supported by regulatory concerns over the use of eco-friendly lubricants and packaging solutions. The region also boasts modern manufacturing capabilities and advances sustainability, making it a prominent market force.

South America Linear Alpha Olefins Market Trends:

South America's linear alpha olefins market is growing due to the increasing demand for polyethylene in packaging and construction. The market is expanding with the rising industrialization and urbanization, especially in Brazil and Argentina. Regional collaborations and infrastructure development improve the market's potential.

Top Companies Leading in the Linear Alpha Olefins Industry

Some of the leading linear alpha olefins market companies include Shell International B.V., Chevron Phillips Chemical Company LLC, INEOS AG, Sasol LTD, The Dow Chemical Company, Exxon Mobil Corporation, among many others.

Global Linear Alpha Olefins Market Segmentation Coverage

- On the basis of the type, the market has been categorized into butene, hexene, octene, decene, dodecene, tetradecene, hexadecene, octadecene, eicosene, and others wherein butene represent the leading segment. Butene is predominantly the market leader in alpha olefins due to its versatile application in producing polymer materials such as polyethylene and elastomers. The product is significantly cost-effective and efficient in raising polymer properties, such as strength, flexibility, and durability. Manufacturers tend to use this significantly to increase their sales in various industries, including packaging, automotive, and construction.

- Based on the end use, the market is classified into LLDPE, detergent alcohols, HDPE, lubricants, LDPE, and others amongst which LLDPE dominates the market. LLDPE leads in linear alpha olefins usage, due to the high usage in materials for packaging, agricultural film, and industrial products. It owes its high demand to flexibility, cost efficiency, and impact resistance, which has pushed demand even higher. Global demands for lightweight and durable forms of packaging have made LLDPE the largest consumer of linear alpha olefins.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 10.0 Billion |

| Market Forecast in 2033 | USD 13.7 Billion |

| Market Growth Rate 2025-2033 | 3.6% |

| Units | Billion USD, Million Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Butene, Hexene, Octene, Decene, Dodecene, Tetradecene, Hexadecene, Octadecene, Eicosene, Others |

| End Uses Covered | LLDPE, Detergent Alcohols, HDPE, Lubricants, LDPE, Others |

| Regions Covered | North America, Middle East, Western Europe, South America, Others |

| Companies Covered | Shell International B.V., Chevron Phillips Chemical Company LLC, INEOS AG, Sasol LTD, The Dow Chemical Company, Exxon Mobil Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)