Global Lime Market Expected to Reach USD 64.8 Billion by 2033 - IMARC Group

Global Lime Market Statistics, Outlook and Regional Analysis 2025-2033

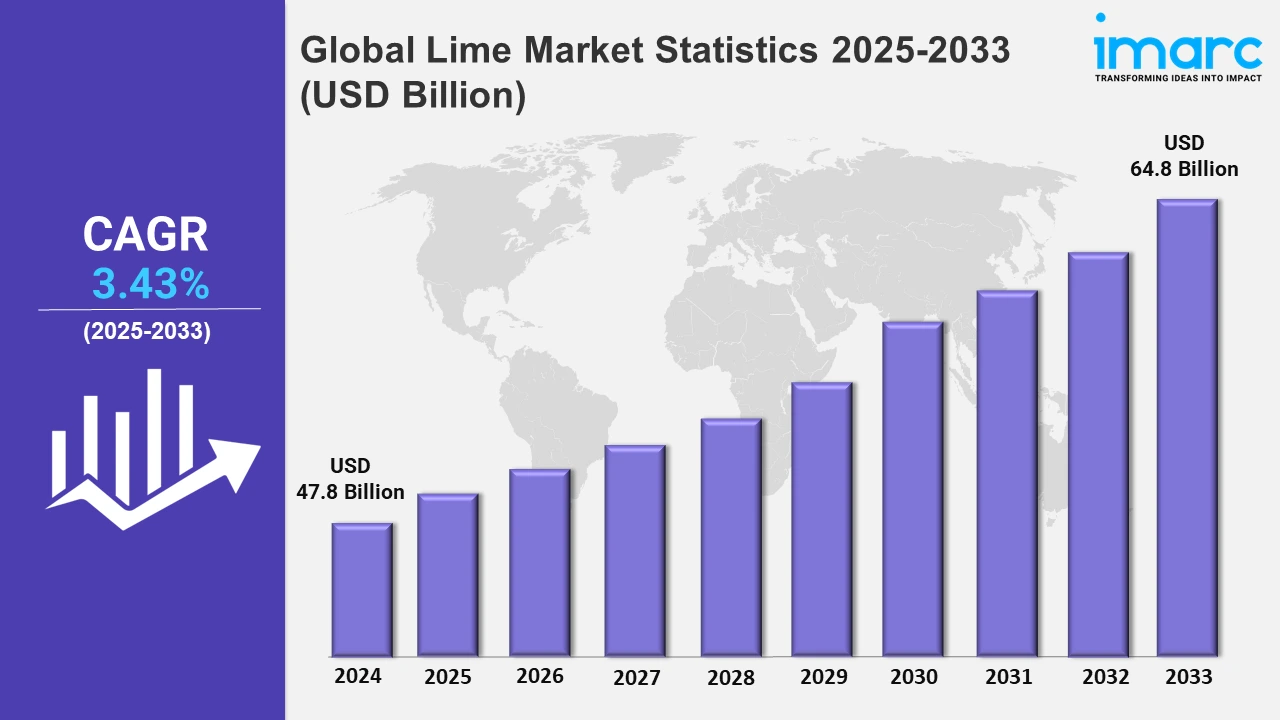

The global lime market size was valued at USD 47.8 Billion in 2024, and it is expected to reach USD 64.8 Billion by 2033, exhibiting a growth rate (CAGR) of 3.43% from 2025 to 2033.

To get more information on this market, Request Sample

The global lime market is experiencing robust growth due to the increasing demand in various sectors such as construction, agriculture, steel, and environmental services. The booming construction industry in developing economies, where urbanization and industrialization are fast paced, is one of the major factors for the market. This substance is heavily used in constructions as an integral component for preparing cements, mortars, and plasters. Accelerating investment in smart city concepts and modernization of existing infrastructures escalates the consumption demand for lime as it is widely used for soil stabilization, masonry works, water treatment systems, urban water supply, and drainage management. For example, UltraTech Cement recently collaborated with UCLA in October 2024 to pilot Zero Carbon Lime technology that reduces cement production emissions by 98%. This project supports UltraTech's Net Zero Goal for 2050. In line with this, another significant factor for the growth of the lime market is the steel and metallurgical industries. The primary use of lime in steel manufacturing is as a fluxing agent. The growing production of steel globally, spurred by ongoing infrastructure and automotive needs, has triggered increased consumption of lime, primarily quicklime, to help remove impurities and further improve the quality of steel.

Rising awareness of the need for environmental sustainability along with stricter regulations for decreasing emissions and pollution are amplifying lime's use in flue gas desulfurization (FGD) systems. Lime-based solutions help remove sulfur dioxide from exhaust gases, particularly in industries like power generation, cement, and chemicals. Moreover, lime is commonly used in water treatment plants to neutralize acidic waste and purify water as part of international efforts to protect water supplies and implement environmentally friendly industrial activities. For instance, Oilchem Chemical & Allied Industries launched state-of-the-art lime products in 2024, including pH adjustment formulation optimization, wastewater treatment neutralization of contaminants, and pure lime for construction and industrial processes to provide the best possible performance and environmental responsibility. Consequently, the demand for lime is also driven by the agricultural sector, as it improves soil quality by neutralizing acidity and enhancing crop yield. With global food security emerging as a critical issue, lime application in agricultural lands is becoming more prevalent. In regions like Asia-Pacific and Latin America, where agriculture remains a vital economic activity, the demand for agricultural lime is accelerating, supported by government subsidies and farmer awareness programs.

Global Lime Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of rapid industrialization, construction growth, and agricultural demand expansion.

Asia-Pacific Lime Market Trends:

The Asia-Pacific lime market is growing rapidly because of the booming construction and infrastructure development in the region. Rapid urbanization and industrialization in countries like China, India, and Southeast Asia have fueled the demand for lime in cement, mortar, and soil stabilization applications. According to the sources, in November 2024, Valmet announced a lime kiln delivery to Kuantum Papers Limited, India, boosting capacity to 200 tonnes daily. The kiln provides energy efficiency, circularity, and sustainability with the inclusion of biofuel compatibility and advanced gas handling. In line with this, the lime usage is accelerated due to the expansion of the steel industry, triggered by the accelerating demand from automobiles and construction. Heightening environmental regulations to reduce industrial emissions further stimulate the use of lime in flue gas desulfurization systems, particularly in power plants and cement factories. Further, demand for lime as a soil improver by the agriculture sector in countries like India and Vietnam is proliferating the markets.

North America Lime Market Trends:

The North American lime market is driven by the region's robust industrial base and stringent environmental regulations. The steel industry, a major lime consumer, benefits from infrastructure development and automotive production. Additionally, boosting adoption of lime in flue gas desulfurization systems addresses emission control requirements in power plants and cement factories. Agricultural demand for soil improvement, especially in the U.S., further supports market growth, making North America a key player in the lime industry.

Europe Lime Market Trends:

Europe's lime market is driven by its advanced industrial and environmental regulations. The steel and metallurgical industries utilize lime for impurity removal, while stringent emission norms promote its use in flue gas desulfurization systems. Construction activities in Western Europe and infrastructure upgrades in Eastern Europe fuel lime demand for cement and mortar production. Additionally, agriculture benefits from lime application for soil improvement, enhancing crop yields across the region.

Latin America Lime Market Trends:

Latin America's lime market growth is fueled by its expanding construction and agriculture sectors. Infrastructure development in countries like Brazil and Mexico drives lime demand for cement and soil stabilization. The agricultural industry's reliance on lime to neutralize acidic soils supports crop productivity, catering to the region's food security needs. Environmental initiatives are also boosting lime adoption in water treatment and emission control systems.

Middle East and Africa Lime Market Trends:

The Middle East and Africa lime market is propelled by growing construction and industrial activities, particularly in Gulf countries and South Africa. Lime is essential for cement production in infrastructure projects, including mega-developments and urbanization efforts. Environmental regulations are increasing lime usage in water treatment and flue gas desulfurization. Additionally, the agriculture sector relies on lime to improve soil fertility and enhance crop yields in arid and semi-arid regions.

Top Companies Leading in the Lime Industry

Some of the leading lime market companies include Afrimat, Boral Limited, Carmeuse, Cheney Lime & Cement Company, Cornish Lime, Graymont Limited, Lhoist Group, Minerals Technologies Inc., Mississippi Lime Company, Nordkalk Corporation (SigmaRoc plc), Pete Lien & Sons Inc., Sigma Minerals Limited, United States Lime & Minerals Inc., among many others.

- In October 2024, Afrimat and Hemporium collaborated to construct a seven-storey extension in Cape Town using fire-resistant hemp-lime blocks. The project reflects on the commitment of Afrimat to creating eco-friendly innovations that integrate renewable materials with advanced construction methods to create environmental sustainability in South Africa.

Global Lime Market Segmentation Coverage

- On the basis of the type, the market has been categorized into quick lime and hydrated lime, wherein quick lime represents the leading segment. It is extensively used in construction, steel manufacturing, and environmental applications. Its high reactivity and efficiency in processes like soil stabilization, water treatment, and steel refining make it indispensable across industries. The segment's dominance is further supported by growing infrastructure development and industrial activities globally, especially in developing regions.

- Based on the application, the market is classified into agriculture, building material, mining and metallurgy, water treatment, and others, amongst which building material dominates the market. It is a key ingredient in cement, mortar, and plaster, essential for construction. Rapid urbanization, infrastructure projects, and real estate development drive demand for lime in this segment. Additionally, its role in soil stabilization and durability enhancement in construction materials reinforces its leading position in the market.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 47.8 Billion |

| Market Forecast in 2033 | USD 64.8 Billion |

| Market Growth Rate 2025-2033 | 3.43% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Quick Lime, Hydrated Lime |

| Applications Covered | Agriculture, Building Material, Mining and Metallurgy, Water Treatment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Afrimat, Boral Limited, Carmeuse, Cheney Lime & Cement Company, Cornish Lime, Graymont Limited, Lhoist Group, Minerals Technologies Inc., Mississippi Lime Company, Nordkalk Corporation (SigmaRoc plc), Pete Lien & Sons Inc., Sigma Minerals Limited, United States Lime & Minerals Inc.,etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Lime Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)