Global Laminating Adhesives Market Expected to Reach USD 5.9 Billion by 2033 - IMARC Group

Global Laminating Adhesives Market Statistics, Outlook and Regional Analysis 2025-2033

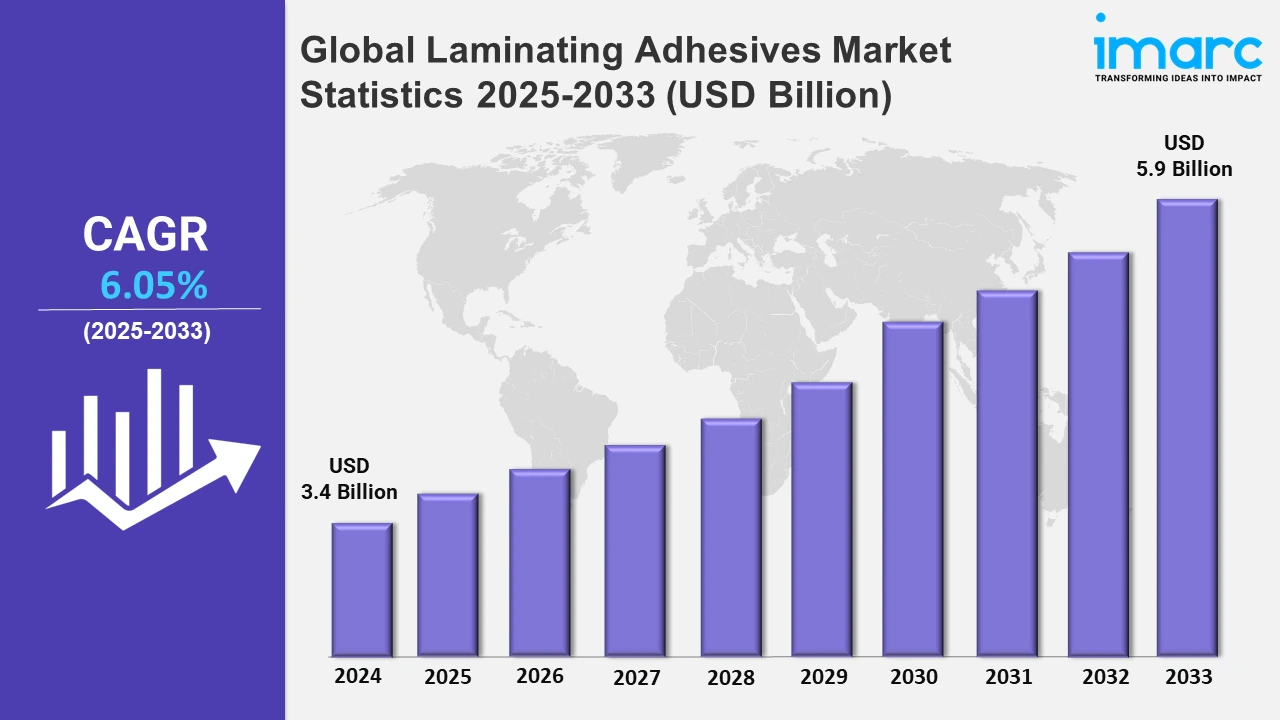

The global laminating adhesives market size was valued at USD 3.4 Billion in 2024, and it is expected to reach USD 5.9 Billion by 2033, exhibiting a growth rate (CAGR) of 6.05% from 2025 to 2033.

To get more information on this market, Request Sample

The rising sales of automotive vehicles are significantly driving the laminating adhesives market growth. For instance, according to the Society of Indian Automobile Manufacturers, total passenger vehicle sales rose from 30,69,523 to 38,90,114 units. In FY-2022-23, sales of passenger cars climbed from 14,67,039 to 17,47,376, utility vehicles from 14,89,219 to 20,03,718, and vans from 1,13,265 to 1,39,020 units, compared to the previous year. Laminating adhesives are widely used in automotive interior applications for bonding vinyl, fabrics, synthetic leathers, and foam materials. This is especially important in car seats, dashboards, and door panels, where high-quality, durable laminates are needed for both aesthetic and functional purposes.

Moreover, the expanding flexible packaging industry is a key driver of the laminating adhesives market. For instance, according to IMARC, the global flexible packaging market size reached US$ 136.0 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 190.5 Billion by 2032, exhibiting a growth rate (CAGR) of 3.7% during 2024-2032. Laminating adhesives are crucial for making flexible packaging materials, labels, and pouches. These materials provide advantages, such as better product protection, longer shelf life, and increased visual appeal. Concurrently, laminating adhesives combine many substrates, allowing manufacturers to create packaging materials that meet specific product specifications, creating profitable market potential. The demand for laminating adhesives in the packaging sector is further accentuated by trends, such as single-serve packaging, e-commerce, and the need for lightweight, space-efficient packaging materials. Besides this, product innovations, such as the development of waterborne adhesives, are also significantly driving the market demand. Waterborne adhesives are water-based formulations that use water as a solvent instead of harmful chemicals like solvents and volatile organic compounds (VOCs). This makes them a more environmentally friendly alternative to traditional solvent-based adhesives. The global push for eco-friendly and sustainable solutions across industries, particularly in packaging, automotive, and construction, is driving the adoption of waterborne adhesives. For instance, in July 2024, Trinseo, a specialty materials solutions provider, launched LIGOS™ A 9200, an acrylic waterborne adhesive designed for the dry lamination of flexible packaging components that come into contact with food. This strong and versatile acrylic emulsion is ideal for a variety of films and helps to produce high-quality, cost-effective, and sustainable packaging end products.

Global Laminating Adhesives Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific accounted for the largest market share, owing to the expanding packaging industry and the rising investments in the consumer electronics sector.

North America Laminating Adhesives Market Trends:

The expanding packaging sector, particularly in countries like the United States and Canada, is a primary driver of the laminating adhesives market. Laminating adhesives are extensively used in flexible packaging applications, such as pouches, wraps, and sachets. With the rise in consumer demand for ready-to-eat and on-the-go food products, particularly in the U.S., there is a growing need for high-quality, durable, and lightweight packaging solutions that use laminating adhesives.

Europe Laminating Adhesives Market Trends:

Europe's laminating adhesives market thrives on technological innovations. Germany and the Netherlands have led the development of UV-curable and hot-melt adhesives for automotive and electronics applications. For instance, Henkel introduced high-performance adhesives offering superior bonding strength and environmental benefits. The EU's green initiatives and demand for high-tech, sustainable solutions in packaging and industrial applications shape Europe’s adhesive landscape.

Asia-Pacific Laminating Adhesives Market Trends:

Asia-Pacific is dominating the overall market, owing to the rapid growth in packaging demand, particularly in food and beverage, driven by urbanization and rising disposable incomes. Countries like China and India are major consumers of flexible packaging materials. Laminated packaging using adhesives is increasingly used for ready-to-eat meals, snacks, and beverages. Leading players like H.B. Fuller are investing in innovative adhesives to cater to this growing market demand in Asia-Pacific.

Latin America Laminating Adhesives Market Trends:

In Latin America, the expansion of flexible packaging solutions is driving growth in the laminating adhesives market. As the region's middle class expands, the demand for packaged food, personal care products, and beverages rises. For instance, Brazil is a major producer and consumer of flexible packaging, with companies like Amcor driving innovation in laminated films and adhesives for food safety and shelf-life extension in the region.

Middle East and Africa Laminating Adhesives Market Trends:

In countries like South Africa and Egypt, the automotive and electronics industries are becoming significant consumers of laminating adhesives. In the automotive sector, adhesives are used for bonding composites, interior components, and protective films in vehicles. As the demand for electric vehicles (EVs) and more lightweight materials grows, the need for advanced laminating adhesives is increasing.

Top Companies Leading in the Laminating Adhesives Industry

Some of the leading laminating adhesives market companies include 3M Company, Ashland Global Specialty Chemicals Inc., Bostik SA (Arkema S.A), Coim Group, DIC Corporation, Dow Inc., DuPont de Nemours Inc., Evonik Industries AG, Flint Group, H.B. Fuller Company, Henkel AG & Co. KGaA, L.D. Davis Industries Inc., Sika AG, and Vimasco Corporation, among many others. For instance, in April 2023, Bostik, an arm of the French multinational chemical company Arkema, introduced HERBERTS LF686/H186, a new solvent-free laminating adhesive designed specifically for the pharmaceutical industry. Also, in December 2022, Dow, a multinational chemical corporation located in the United States, received RecyClass clearance for mechanical recycling of their MOR-FREE L 75-300/CR88-300 and ROBOND L-350/CR-3 laminating adhesives.

Global Laminating Adhesives Market Segmentation Coverage

- On the basis of the resin, the market has been bifurcated into acrylic, polyurethane, and others, wherein polyurethane represented the largest segment due to its exceptional flexibility, durability, and resistance to environmental factors.

- Based on the technology, the market is categorized into solvent-based, water-based, and others, amongst which solvent-based accounted for the largest market share. Solvent-based adhesives offer fast curing times, making them particularly advantageous in high-speed production processes such as flexible packaging and labeling, thereby boosting their adoption.

- On the basis of the application, the market has been divided into packaging, automotive and transportation, and others. Among these, packaging represented the largest segment owing to the increasing consumer preference for convenient and visually appealing packaging solutions.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 3.4 Billion |

| Market Forecast in 2033 | USD 5.9 Billion |

| Market Growth Rate 2025-2033 | 6.05% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Resins Covered | Acrylic, Polyurethane, Others |

| Technologies Covered | Solvent-based, Water-based, Others |

| Applications Covered | Packaging, Automotive and Transportation, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Ashland Global Specialty Chemicals Inc., Bostik SA (Arkema S.A), Coim Group, DIC Corporation, Dow Inc., DuPont de Nemours Inc., Evonik Industries AG, Flint Group, H.B. Fuller Company, Henkel AG & Co. KGaA, L.D. Davis Industries Inc., Sika AG, Vimasco Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)