Global Laminated Veneer Lumber Market Expected to Reach USD 6.9 Billion by 2033 - IMARC Group

Global Laminated Veneer Lumber Market Statistics, Outlook and Regional Analysis 2025-2033

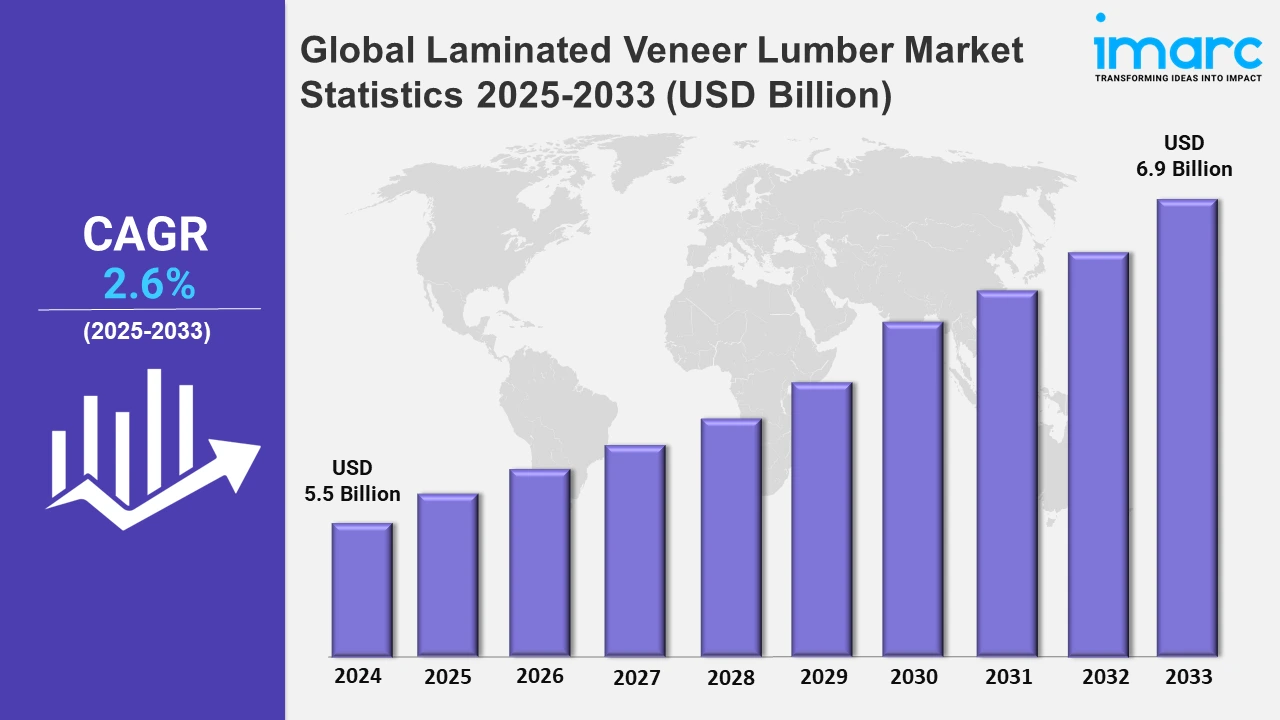

The global laminated veneer lumber market size was valued at USD 5.5 Billion in 2024, and it is expected to reach USD 6.9 Billion by 2033, exhibiting a growth rate (CAGR) of 2.6% from 2025 to 2033.

To get more information on this market, Request Sample

The market continues to place a greater emphasis on regional expansion and specialized leadership to improve market presence, with firms making strategic recruitment to drive growth and establish strong foundations in crucial geographical regions. For example, in June 2024, PWT, the developer of the world's first manufacturer-treated laminated veneer lumber (LVL), hired four new sales executives to accelerate national expansion. These business development managers would cover the Mid-Atlantic, Southwest, Southeast, and Northwest regions. With their knowledge, PWT hopes to broaden its reach and strengthen its position as a pioneer in the laminated veneer lumber industry.

Moreover, the escalating investment in sustainable building facilities, with a focus on environmentally friendly manufacturing processes and regional innovation, acts as a significant growth-inducing factor. Emerging activities in critical regions support Europe's transition to environmentally responsible and efficient building material manufacture. For instance, in February 2024, VMG Group, one of Central and Eastern Europe's major wood processing and furniture manufacturing firms, announced the launch of VMG Lignum Construction in Lithuania in collaboration with Hanner, Lithuania's leading real estate developer and Baltic Industrial Fund II. Furthermore, the laminated veneer lumber (LVL) industry is expanding rapidly, driven by its usage in infrastructure projects, which require high-performance materials. LVL's durability and adaptability make it an excellent choice for structural components such as beams, headers, and columns in both commercial and residential structures. Its capacity to withstand huge weights while being lightweight pushes its use in high-demand industries like bridges and industrial construction. For example, in Asia Pacific, Nelson Pine Industries improved LVL manufacturing to accommodate large-scale infrastructure projects in rapidly urbanizing countries like Southeast Asia. This development corresponds to the inflating need for low-cost, durable, and environmentally friendly materials for government-funded infrastructure projects such as affordable housing and urban transportation systems. Such projects reflect the region's growing dependence on engineered wood products to address building issues in an efficient and sustainable manner.

Global Laminated Veneer Lumber Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa. According to the report, North America accounted for the largest laminated veneer lumber market share due to the elevating number of new residential housing projects, particularly in the U.S.

North America Laminated Veneer Lumber Market Trends:

North America holds the largest share of the market owing to the widespread sustainable building practices. Weyerhaeuser's focus on green-certified engineered wood products, such as LVL, highlights this trend. Builders prefer renewable resources to reduce environmental effects and promote growth. Investments in green building, like Boise Cascade's 2024 expansion in Alabama, demonstrate the region's dedication to sustainable wood product manufacture.

Europe Laminated Veneer Lumber Market Trends:

The market in Europe prioritizes innovative production processes to improve product strength and adaptability. Stora Enso's 2019 automation investment at its Varkaus, Finland mill shows this trend. European countries are focusing on high-performance LVL for cross-laminated timber (CLT) constructions, which allows for lightweight yet durable construction options. The demand for new wood-based solutions aligns with the region's emphasis on technical innovation and resource efficiency.

Asia Pacific Laminated Veneer Lumber Market Trends:

Asia Pacific is experiencing rapid urbanization, boosting LVL demand for infrastructure projects. In 2023, Nelson Pine Industries increased LVL manufacturing in Malaysia to accommodate the growing demand for construction materials. The region's increasing middle class drives housing demand, while governments engage in large-scale initiatives, such as India's affordable housing projects, making LVL a common choice for low-cost and high-strength structural purposes.

Latin America Laminated Veneer Lumber Market Trends:

The growth of agricultural infrastructure encourages the use of LVL for long-lasting construction components in Latin America. Companies such as Roseburg Forest Products are exploring opportunities in countries like Brazil for LVL usage in barns and warehouses. Latin American economies, which have major agricultural sectors, demand strong and moisture-resistant materials for construction, increasing LVL acceptance in non-residential building projects and enhancing its position in rural development programs.

Middle East and Africa Laminated Veneer Lumber Market Trends:

The Middle East and Africa region supports cost-effective choices for housing, utilizing LVL for speedy and economical construction. In South Africa, LVL is rapidly being utilized in modular and affordable housing projects to overcome urban housing shortages. Furthermore, programs such as Saudi Arabia's Vision 2030 promote sustainable construction materials, establishing LVL as a viable choice for long-lasting, lightweight, and environmentally friendly building applications.

Top Companies Leading in the Laminated Veneer Lumber Industry

Some of the leading laminated veneer lumber market companies include Boise Cascade, Metsä Wood, Murphy Plywood, Nelson Pine Industries Limited, PWT, Roseburg Forest Products, STEICO SE, Ultralam, VMG Lignum, Wesbeam Pty Ltd, West Fraser Timber Co., Weyerhaeuser Company, among many others. For example, in January 2024, Boise Cascade Company announced investment plans of about USD 140 Million over the next two years in its Alabama and Louisiana facilities to support its engineered wood products (EWP) growth strategy.

Global Laminated Veneer Lumber Market Segmentation Coverage

- Based on the residential and commercial application, the market has been classified into residential and commercial, wherein residential leads the market. The growing usage of LVL as a supporting structure in roofs, walls, and floors is acting as a significant growth-inducing factor.

- Based on the new construction and replacement sector, the market has been categorized into new construction and replacement, amongst which new construction dominates the market. This is primarily driven by the expanding application of LVL in beams, purlins, lintels, formwork, and truss chords.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 5.5 Billion |

| Market Forecast in 2033 | USD 6.9 Billion |

| Market Growth Rate 2025-2033 | 2.6% |

| Units | Million Cubic Meters, Billion USD |

| Segment Coverage | Residential and Commercial Application, New Construction and Replacement Sector, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Boise Cascade, Metsä Wood, Murphy Plywood, Nelson Pine Industries Limited, PWT, Roseburg Forest Products, STEICO SE, Ultralam, VMG Lignum, Wesbeam Pty Ltd, West Fraser Timber Co., Weyerhaeuser Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Laminated Veneer Lumber Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)