Global K-Beauty Products Market Expected to Reach USD 31,818.4 Million by 2033 - IMARC Group

Global K-Beauty Products Market Statistics, Outlook and Regional Analysis 2025-2033

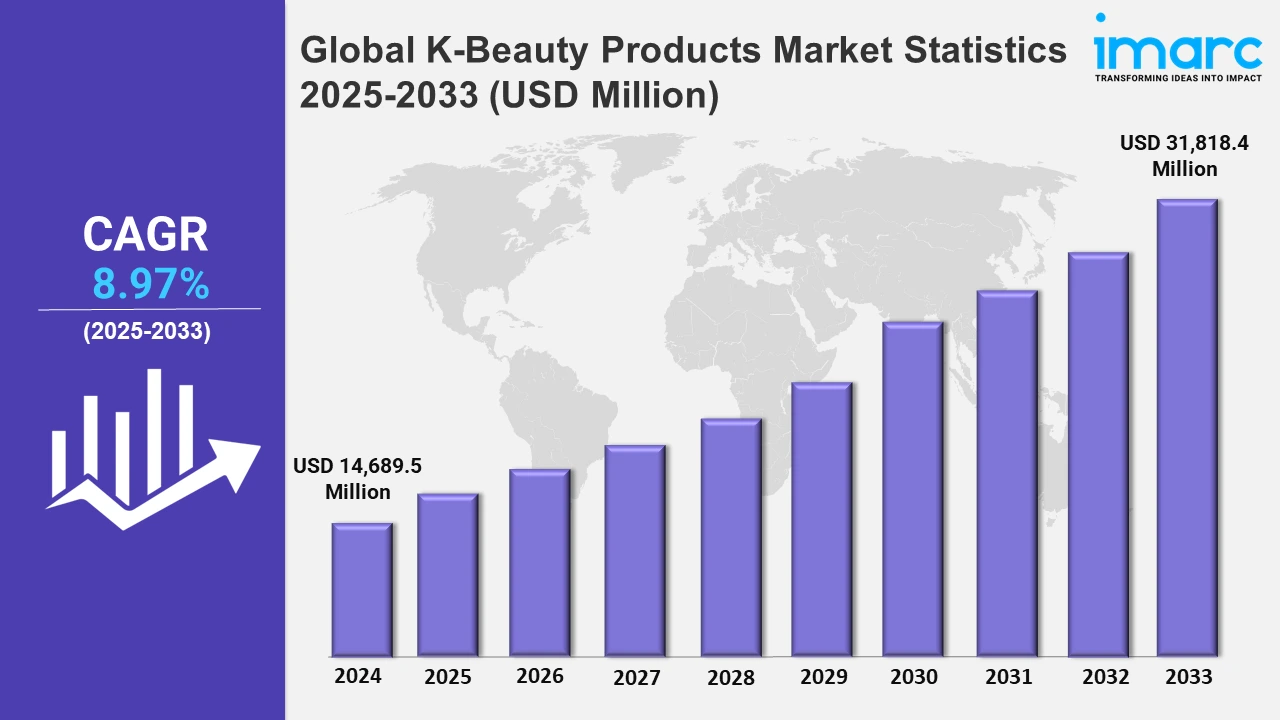

The global K-beauty products market size was valued at USD 14,689.5 Million in 2024, and it is expected to reach USD 31,818.4 Million by 2033, exhibiting a growth rate (CAGR) of 8.97% from 2025 to 2033.

To get more information on this market, Request Sample

The increasing awareness about the importance of skincare and the availability of targeted solutions for diverse skin concerns, such as anti-aging and hydration, represents one of the key factors impelling the market growth. Moreover, K-beauty is renowned for its innovative product formulations, such as snail mucin, fermented ingredients, and lightweight textures. These products often feature multi-functional benefits, addressing concerns like hydration, anti-aging, and brightening, making them appealing to diverse user groups. Brands are also focusing on developing versatile, easy-to-use products that cater to the demands of contemporary users. These innovations often combine multiple benefits, such as ultraviolet (UV) and hydration, in portable, user-friendly formats, appealing to individuals seeking effective skincare solutions that seamlessly fit into their busy daily routines. In 2024, KAHI Beauty launched the Airy Fit Sun Stick, a portable, lightweight sunscreen made for effortlessly applying and reapplying over makeup without leaving any residue. Blending UV protection and hydration, it suits hectic schedules and is essential in K-beauty. Its versatile design meets the increasing need for ease in skincare.

Apart from this, K-beauty products are known for offering high quality at relatively affordable prices. This cost-effectiveness has made them popular among younger users and those exploring premium skincare without high costs. In addition, leading companies are creating strategic alliances with prominent online shopping platforms to enhance product availability and grow their client base. Through utilizing the extensive reach and efficient logistics of these platforms, companies can present new skincare products to a wider audience. Furthermore, attributes such as fast shipping and unique products appeal to high-end buyers, leading to increased sales and market expansion. In 2024, Dr.Jart+ launched its popular Korean skincare items like the Cicapair™ Color Correcting Treatment and Ceramidin™ Cream on Amazon Premium Beauty store in the US, making them easily accessible. This first launch is aimed at a new demographic intrigued by K-beauty trends and innovative derma skincare. Prime members enjoy expedited, complimentary shipping for every purchase.

Global K-Beauty Products Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share owing to the strong presence of leading brands, high user demand for skincare innovations, and cultural influence promoting multi-step beauty routines.

North America K-Beauty Products Market Trends:

The North American K-Beauty market is expanding, driven by the influence of beauty influencers and social media platforms promoting innovative products. Individuals in this region appreciate the effectiveness and affordability of K-beauty formulations, particularly those featuring unique natural ingredients. The multi-step skincare approach is gaining traction, reflecting a shift towards comprehensive self-care routines. Accessibility through online channels and specialty stores supports market penetration and enhances user engagement.

Asia-Pacific K-Beauty Products Market Trends:

The Asia Pacific region leads the K-beauty products market due to its strong cultural affinity for innovative skincare routines and advanced beauty formulations. The region benefits from the widespread popularity of K-beauty products owing to their affordability, effectiveness, and alignment with user preferences for natural ingredients. The growing digital landscape supports brand visibility and accessibility is making products readily available to a diverse user base. Furthermore, leading companies are expanding their portfolio to cater to evolving user preferences. For instance, in 2024, Tira from Reliance Retail introduced the high-end Korean skincare label Mixsoon in India, providing popular items such as Mixsoon Bean Essence through both online and physical stores. This decision is in line with Tira's plan to widen its range with beauty brands from around the world.

Europe K-Beauty Products Market Trends:

Europe is a rapidly growing market for K-beauty products, driven by increasing user interest in unique and effective beauty solutions. The focus on clean, sustainable, and cruelty-free products resonates well with people, aligning with regional preferences for ethical beauty. The rise of e-commerce and social media is increasing product awareness and accessibility, fostering a strong connection between K-beauty brands and their audience. Moreover, the market benefits from a sophisticated demand for high-quality, luxurious skincare products.

Latin America K-Beauty Products Market Trends:

Latin America is emerging as a promising market for K-beauty products, driven by the growing awareness about skincare trends and the appeal of Korean innovation. The region's expanding middle-class population is adopting premium beauty products, supported by improved access through e-commerce platforms. Individuals are attracted to the novelty and efficacy of K-beauty formulations, particularly those tailored for hydration and anti-aging. The emphasis on affordability and variety further supports the market growth.

Middle East and Africa K-Beauty Products Market Trends:

The Middle East and Africa region is witnessing rising demand for K-Beauty products, especially within the premium skincare segment. Individuals are drawn to products that emphasize luxury and innovation, aligning with regional preferences for high-quality beauty solutions. The growing beauty-conscious population and increasing focus on skincare routines are offering a favorable market outlook. Enhanced availability through online channels and the introduction of region-specific formulations are encouraging the adoption of K-beauty products.

Top Companies Leading in the K-Beauty Products Industry

Some of the leading K-beauty products market companies include Able C & C Ltd., Adwin Korea Corporation, Amorepacific Corporation, CLIO COSMETICS Co. Ltd., Cosrx Inc., LG H&H Co. Ltd. (LG Coproration), The Crème Shop Inc., The Face Shop Inc., and Tonymoly Co. Ltd, among many others. In 2024, Able C & C Ltd. revealed its plan to enhance its presence in the beauty market of China by expanding online and forming partnerships with important opinion leaders (KOLs). This strategy resulted in a notable rise in sales, with a 51% increase compared to the previous year during the 6.18 Shopping Festival, primarily due to popular items such as Missha's M Perfect Cover BB Cream.

Global K-Beauty Products Market Segmentation Coverage

- On the basis of the product type, the market has been categorized into sheet masks, cleansers, moisturizers, makeup, and others, wherein sheet masks represent the leading segment. Sheet masks dominate the market owing to their convenience, affordability, and immediate skincare benefits. Their popularity is driven by innovative formulations, including ingredients like hyaluronic acid, snail mucin, and vitamin C, which cater to diverse skin concerns. Widely marketed as a must-have in multi-step skincare routines, sheet masks are gaining a loyal user base worldwide, particularly in regions where skincare trends heavily influence purchasing behaviors.

- Based on the distribution channel, the market is classified into online retail, supermarket/hypermarket, and specialty/monobrand stores, amongst which specialty/monobrand dominate the market. [60-70 words for the leading segment] Specialty and monobrand stores lead the market, offering an exclusive and immersive shopping experience tailored to the brand’s identity. These stores provide expert consultations, personalized product recommendations, and access to the latest product launches, enhancing client loyalty. The ability to experience products firsthand and engage with trained staff appeals to individuals seeking high-quality and authentic K-Beauty solutions, making this distribution channel the preferred choice.

- On the basis of the end user, the market has been bifurcated into male and female. Among these, female accounts for the majority of the market share. Females represent the largest segment, driven by a growing focus on skincare and beauty routines. The demand is driven by innovative products tailored to women's diverse skin types and concerns, such as anti-aging, hydration, and brightening. Additionally, effective marketing strategies, including social media campaigns and influencer endorsements, resonate strongly with female users, further solidifying their dominance in the market.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 14,689.5 Million |

| Market Forecast in 2033 | USD 31,818.4 Million |

| Market Growth Rate 2025-2033 | 8.97% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sheet Masks, Cleansers, Moisturizers, Makeup, Others |

| Distribution Channels Covered | Online Retail, Supermarket/Hypermarket, Specialty/Monobrand Stores |

| End Users Covered | Male, Female |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Able C & C Ltd., Adwin Korea Corporation, Amorepacific Corporation, CLIO COSMETICS Co. Ltd., Cosrx Inc., LG H&H Co. Ltd. (LG Coproration), The Crème Shop Inc., The Face Shop Inc., Tonymoly Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)