Japan Whiskey Market Expected to Reach USD 7.3 Billion by 2033 - IMARC Group

Japan Whiskey Market Statistics, Outlook and Regional Analysis 2025-2033

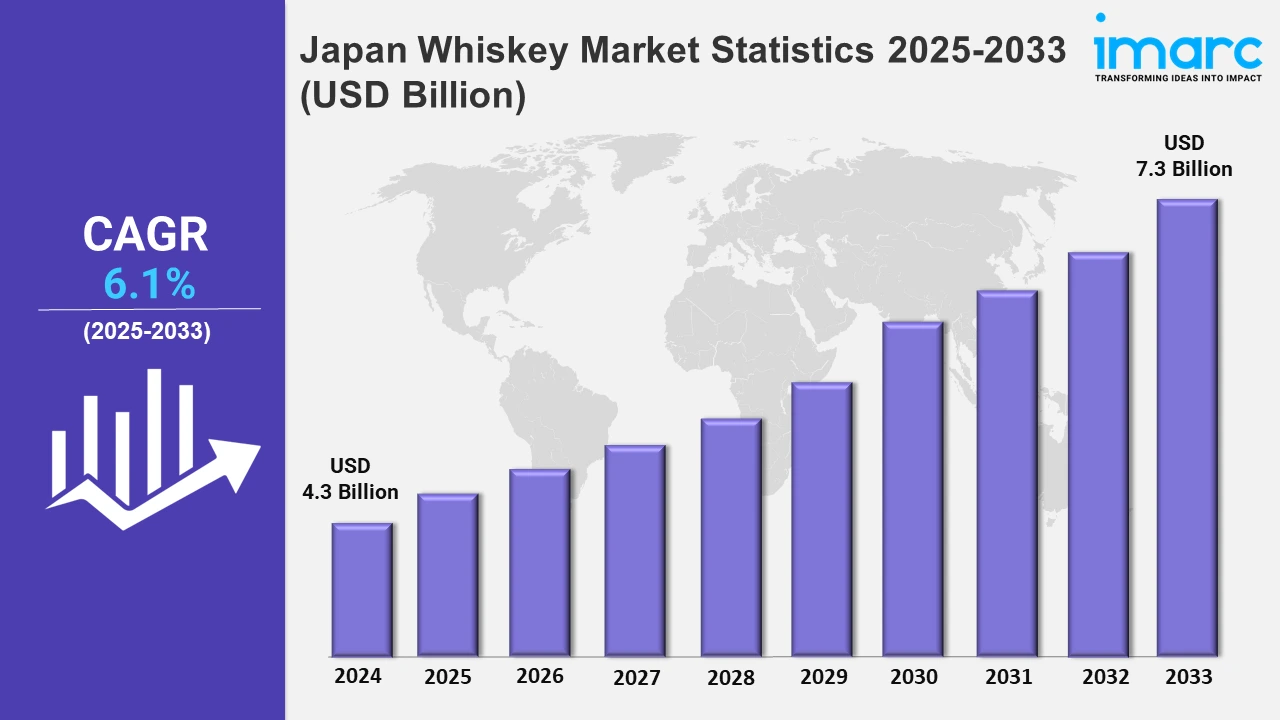

The Japan whiskey market size was valued at USD 4.3 Billion in 2024, and it is expected to reach USD 7.3 Billion by 2033, exhibiting a growth rate (CAGR) of 6.1% from 2025 to 2033.

To get more information on this market, Request Sample

A desire for luxury and exclusivity supports the premiumization trend in the Japan whiskey market. In addition, consumers are increasingly drawn to premium items like limited-edition releases, which represent refinement and elegant taste. For example, in October 2024, Suntory debuted Hibiki 40-Year-Old, its oldest blended whisky made from whiskies from Yamazaki, Hakushu, and Chita distilleries. Limited to 400 bottles, it boasts complex smells and flavors that highlight Japanese history. The inflating popularity of exquisite craftsmanship and distinct flavor profiles of whiskey makes it especially appealing to connoisseurs and collectors willing to pay a premium for superior quality.

Moreover, collaborations and partnerships are transforming the market across the country by enabling innovations. Distilleries are collaborating with international brands, luxury venues, and well-known experts to improve product offerings and attract a wider range of consumers. In September 2024, Nikka Whisky partnered with Park Hyatt Niseko Hanazono Hotel to provide guests with exclusive whisky-tasting experiences. Such collaborations frequently result in the creation of limited-edition whiskies that incorporate unique production techniques or cultural features from both sides. Besides this, as consumers want more ecologically friendly products, whisky makers in Japan are incorporating sustainable techniques into their production processes. Distilleries are implementing green production practices, such as using renewable energy sources. For example, in April 2024, Suntory Spirits set a world record in whisky production by successfully executing a direct-fired distillation trial using 100% hydrogen at its Yamazaki Distillery. This milestone represented considerable progress in decarbonizing whiskey production while maintaining quality, as the new spirits are comparable to those made with regular natural gas. Packaging developments such as recyclable materials and simple designs seek to reduce waste while keeping a premium appeal.

Japan Whiskey Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The growing popularity of high-end spirits among younger and affluent consumers is fueling the product demand across these regions as they seek unique and sophisticated beverage options that reflect Japanese tradition and innovation.

Kanto Region Whiskey Market Trends:

The Kanto area has a dense population and bustling nightlife. High-end pubs and restaurants have a considerable impact on whiskey consumption. The region's cosmopolitan demographic encourages the demand for both international and homegrown products. Retail shops and internet platforms thrive here because of the city's convenience and accessibility. Whiskey tourism and events, such as tastings and festivals, intensify the market's rapid rise in Kanto.

Kinki Region Whiskey Market Trends:

The Kinki region, which includes Osaka and Kyoto, is a notable whiskey industry encouraged by its cultural value, and booming hospitality industry. Kyoto's rich whiskey history, including famous distilleries like Yamazaki, drives regional demand. Whiskey highballs are popular in bars and izakaya. The region's robust economy fosters the expansion of super premium and collectible whiskey sales. The Kinki region has a strong consumer base for both local and foreign brands, making it an ideal location for whiskey marketing initiatives.

Central/ Chubu Region Whiskey Market Trends:

The Chubu region, known for cities such as Nagoya, has a prominent whiskey market stimulated by the rising disposable income and the expanding tourism industry. The city's location as a business hub increases demand for quality whiskey for corporate gifts and celebratory parties. The region's acceptance of craftsmanship aligns with the popularity of both Japanese and worldwide premium whiskey brands, assuring consistent growth.

Kyushu-Okinawa Region Whiskey Market Trends:

The Kyushu-Okinawa region's growing whiskey sector is influenced by its distinct culture and changing drinking preferences. Okinawa's tropical climate encourages lighter whiskey-based beverages like highballs. Restaurants and izakaya contribute to on-trade sales while small liquor stores specialize in unique and affordable options. Tourism considerably enhances whiskey sales, since visitors frequently seek regional exclusives and rarities. This region is also seeing an increase in demand for whiskey pairings with local cuisine and culturally themed beverages.

Tohoku Region Whiskey Market Trends:

The Tohoku region, popular for its beautiful landscapes, has a small but rising whiskey sector backed by local enthusiasm for spirits. During the colder months, the region's cold environment pairs well with neat whiskey and warm cocktails. Also, tourism plays an important role, with visitors looking for Japanese whiskey as mementos. Tohoku's admiration for craftsmanship and distinct flavor characteristics is consistent with the growing popularity of domestic premium whiskey brands in the region.

Chugoku Region Whiskey Market Trends:

The Chugoku region, which includes Hiroshima, is a continuously developing industry because of its regional tourism. Restaurants and bars contribute significantly to on-trade sales by serving whiskey in a variety of formats, from highballs to special tastings. Local liquor stores cater to customers looking for quality selections and collectibles. Chugoku's expanding urbanization and the growing number of whiskey-themed events drive up demand for whiskey brands.

Hokkaido Region Whiskey Market Trends:

Hokkaido's mild climate and natural beauty attract tourism, which further supports the whiskey industry. Moreover, the region's penetration of rich flavors aligns with premium whiskey sales. Also, on-trade consumption centers around bars, while local merchants focus on domestic brands and low-cost options. The booming tourism economy in the region also promotes whiskey sales, as visitors frequently seek out regional specialties.

Shikoku Region Whiskey Market Trends:

The Shikoku region has a developing whiskey industry driven by a mix of local and tourist demand. Additionally, liquor stores and supermarkets cater to regular customers, while premium options are popular among whiskey experts. The region's cultural festivals boost whiskey sales as visitors seek out local retailers for Japanese brands.

Top Companies Leading in the Japan Whiskey Industry

The competitive landscape of the Japan whiskey market is marked by prominent organizations which dominate the region. Key players across the country are expanding internationally, with new distilleries and product ranges emerging. Additionally, strategic collaborations and the production of exclusive tasting experiences help to differentiate brands. The competition intensifies as new entrants challenge established businesses, creating a dynamic climate that fosters product innovation.

Japan Whiskey Market Segmentation Coverage

- On the basis of the product type, the market has been bifurcated into American whiskey, Irish whiskey, scotch whiskey, Canadian whiskey, and others. Japanese consumers are fond of American whiskey based on its distinct sweetness and notes of caramel that goes well with local cuisine. Scotch whiskey is made from cereals and water. It is available in two types, namely malt and grain whiskey. The emerging popularity of consuming affordable drinks in the country drives the demand for Canadian whiskey.

- Based on the quality, the market is categorized into premium, high-end premium, and super premium. Premium whiskey is attractive to individuals seeking for affordable option. The booming trend of whiskey highballs has boosted the demand for premium products. Moreover, high-end premium whiskeys cater to consumers who value flavors. This segment includes international brands like Macallan. Besides this, super premium whiskey represents luxury. This segment includes rare and aged whiskey from Japanese and international brands.

- On the basis of the distribution channel, the market has been divided into off-trade (supermarkets and hypermarkets, discount stores, online stores, and others) and on-trade (restaurants and bars, liquor stores, and others). Off-trade channels, including supermarkets, cater to budget-conscious consumers seeking convenience and a variety of domestic and international brands. The rising number of bars and restaurants in the country is acting as a major growth-inducing factor. The inflating popularity of high-end curated cocktails propels the on-trade channel.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 4.3 Billion |

| Market Forecast in 2033 | USD 7.3 Billion |

| Market Growth Rate 2025-2033 | 6.1% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | American Whiskey, Irish Whiskey, Scotch Whiskey, Canadian Whiskey, Others |

| Qualities Covered | Premium, High-End Premium, Super Premium |

| Distribution Channels Covered |

|

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Whiskey Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)