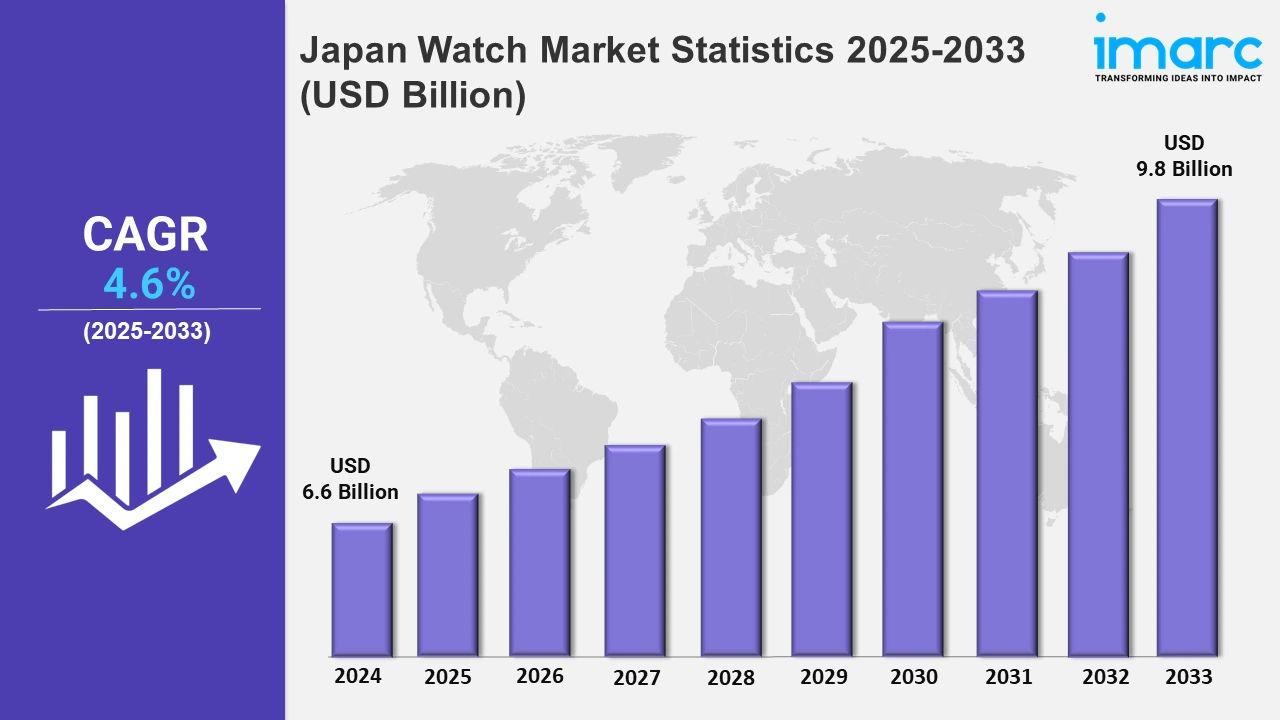

Japan Watch Market Expected to Reach USD 9.8 Billion by 2033 - IMARC Group

Japan Watch Market Statistics, Outlook and Regional Analysis 2025-2033

The Japan watch market size was valued at USD 6.6 Billion in 2024, and it is expected to reach USD 9.8 Billion by 2033, exhibiting a growth rate (CAGR) of 4.6% from 2025 to 2033.

To get more information on this market, Request Sample

The rising demand for compact, functional, and eco-friendly timepieces reflects shifting consumer preferences, especially among tech-savvy and environmentally conscious buyers in Japan. Major players in the market are focusing on enhancing their product offerings to align with these emerging trends. For instance, compact smartwatches and unique designs have become prominent in the market, appealing to younger demographics and collectors alike. For instance, in December 2023, Casio launched the CRW-001-1JR ring watch in Japan. This sleek and compact watch incorporates an LCD time display, dual time zones, a stopwatch, LED light alerts, and a two-year battery life, showcasing Casio's focus on functional and compact designs. Concurrent with this, consumers are increasingly drawn to high-end and aesthetically pleasing timepieces that combine artistry with precision engineering. A significant milestone was reached in November 2024, when Citizen launched the Caliber 0200 100th Anniversary watch to celebrate its century-long legacy. This 40mm stainless steel timepiece, featuring a white-gold bezel, iceberg-inspired dial, black diamond leather strap, and a high-precision automatic movement, exemplifies the growing demand for luxurious watches with unique designs and high craftsmanship in Japan. Such developments highlight the emphasis on premium branding and the fusion of tradition with innovation to cater to discerning customers.

Sustainability has emerged as a vital factor shaping the Japan watch market as brands recognize the importance of environmental responsibility. Eco-conscious consumers are seeking product variants that align with their values, which is prompting manufacturers to adopt sustainable practices. Reflecting this trend, in May 2024, Casio introduced the eco-friendly G-SHOCK G-5600SRF in Japan. This model features a recycled resin bezel, solar charging, and Surfrider Foundation branding, reinforcing the brand’s commitment to ocean conservation. With 200-meter water resistance, a stopwatch, and alarm functionality, this watch is not only practical but also symbolic of the increasing alignment of the watch industry with sustainability goals. These developments demonstrate how innovation and environmental stewardship are becoming intertwined in the market across the country.

Japan Watch Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The wide presence of retail outlets is augmenting the market in these regions.

Kanto Region Watch Market Trends:

The focus of the Tokyo-centered Kanto region on luxury and high-end timepieces is propelling the market. This industry is dominated by brands like Patek Philippe and Rolex, which appeal to collectors and wealthy people. Significant-end watch stores are well-known in Tokyo's Ginza district, thereby indicating a significant demand for luxury timepieces. Moreover, Swiss products are also becoming more popular in countries like Kanagawa, where affluent professionals place a premium on classic style and resale value.

Kansai/Kinki Region Watch Market Trends:

In the Kansai region, including Osaka, consumers display a preference for traditional Japanese watchmakers like Seiko and Orient. This area values heritage and craftsmanship, with many opting for mechanical watches that align with the cultural appreciation of artisanal quality. Kyoto, known for its historic roots, is a notable example where vintage and limited-edition Japanese timepieces often gain popularity among residents and tourists seeking authenticity.

Central/Chubu Region Watch Market Trends:

The industrial and business-oriented economy of the Chubu region makes it a center for robust and useful timepieces. Casio’s G-Shock series thrives here because of its durability and technological characteristics, which meet the demands of engineers and factory workers. Aichi Prefecture stands out as a key area where professionals seek reliable timepieces for daily wear, blending style with practicality in high-demand occupations.

Kyushu-Okinawa Region Watch Market Trends:

Kyushu and Okinawa regions are marked by their younger demographic, fueling a rising demand for smartwatches like the Apple Watch. Tech-savvy consumers in Fukuoka, for instance, prefer multifunctional devices that combine fitness tracking, communication, and style. The region’s relaxed yet modern lifestyle supports wearable technology trends, making it a lucrative market for brands integrating digital features with sleek designs.

Tohoku Region Watch Market Trends:

The Tohoku region, encompassing Sendai, features a strong inclination towards simple, easy-to-read watches due to its aging population. Citizen’s eco-drive series, with its solar-powered technology and classic aesthetics, resonates well in counties like Miyagi. Consumers in Tohoku value reliability and minimal maintenance, leading to steady sales of practical models that cater to both retirees and professionals alike.

Chugoku Region Watch Market Trends:

The Chugoku region, with Hiroshima as its focal point, shows a balanced demand for traditional and contemporary watches. Orient’s versatile collections, which combine classic designs with modern functionalities, are well-received. Hiroshima’s consumer base appreciates affordable elegance, making it a prime market for mid-range brands that cater to both casual and formal settings. This reflects a trend towards understated luxury.

Hokkaido Region Watch Market Trends:

Hokkaido, known for its outdoor activities and cold climate, leans towards rugged sports watches. Suunto and Garmin are popular brands in Sapporo, offering GPS functionality and weather resistance, catering to adventure enthusiasts and hikers. Watches designed for outdoor use align with the region’s active lifestyle, providing durability and performance in extreme conditions. This market reflects a practical approach to timepieces suited for challenging environments.

Shikoku Region Watch Market Trends:

The Shikoku region, including Matsuyama, prioritizes affordability and reliability. Timex and Casio lead this region, offering budget-friendly yet dependable watches for everyday use. Residents in counties such as Ehime often choose durable models that meet daily needs without excessive cost. The emphasis is on functional timepieces with basic features, making Shikoku a stronghold for brands targeting value-conscious consumers.

Top Companies Leading in the Japan Watch Industry

The Japan watch market sees leading brands leveraging their expertise and heritage to maintain a competitive edge. In order to fulfill the changing preferences and demands of tech-savvy consumers, companies are focusing on innovation by fusing traditional craftsmanship with cutting-edge technology, implementing sustainable practices, improving energy-efficient designs, and developing wristwatch functions.

Japan Watch Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into quartz and mechanical. Among these, quartz dominates the market segmentation. Japan is renowned for pioneering quartz watches with precision and affordability while maintaining excellence in mechanical craftsmanship, catering to diverse preferences in timekeeping technology.

- On the basis of the price range, the market is categorized into low-range, mid-range, and luxury. According to the report, the low-range represented the largest segment. Low-range watches provide functional designs with affordability, thereby balancing quality and price with stylish features.

- On the basis of the distribution channel, the market has been divided into online retail stores and offline retail stores. Offline retail stores dominate the market as they offer personalized service and an authentic shopping experience.

- Based on the end user, the market is categorized into men, women, and unisex. Men dominate the segment. Watches designed for men often feature bold and masculine aesthetics. Technological innovations, craftsmanship, and brand prestige play a major role in men's watches in Japan.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 6.6 Billion |

| Market Forecast in 2033 | USD 9.8 Billion |

| Market Growth Rate 2025-2033 | 4.6% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Quartz, Mechanical |

| Price Ranges Covered | Low-Range, Mid-Range, Luxury |

| Distribution Channels Covered | Online Retail Stores, Offline Retail Stores |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | Kanto, Kinki, Central/ Chubu, Kyushu-Okinawa,Tohoku, Chugoku, Hokkaido, Shikoku, Kanto, Central/ Chubu, Kyushu-Okinawa, Tohoku, Chugoku, Hokkaido, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Watch Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)