Japan Tuna Market Expected to Reach USD 878.5 Million by 2033 - IMARC Group

Japan Tuna Market Statistics, Outlook and Regional Analysis 2025-2033

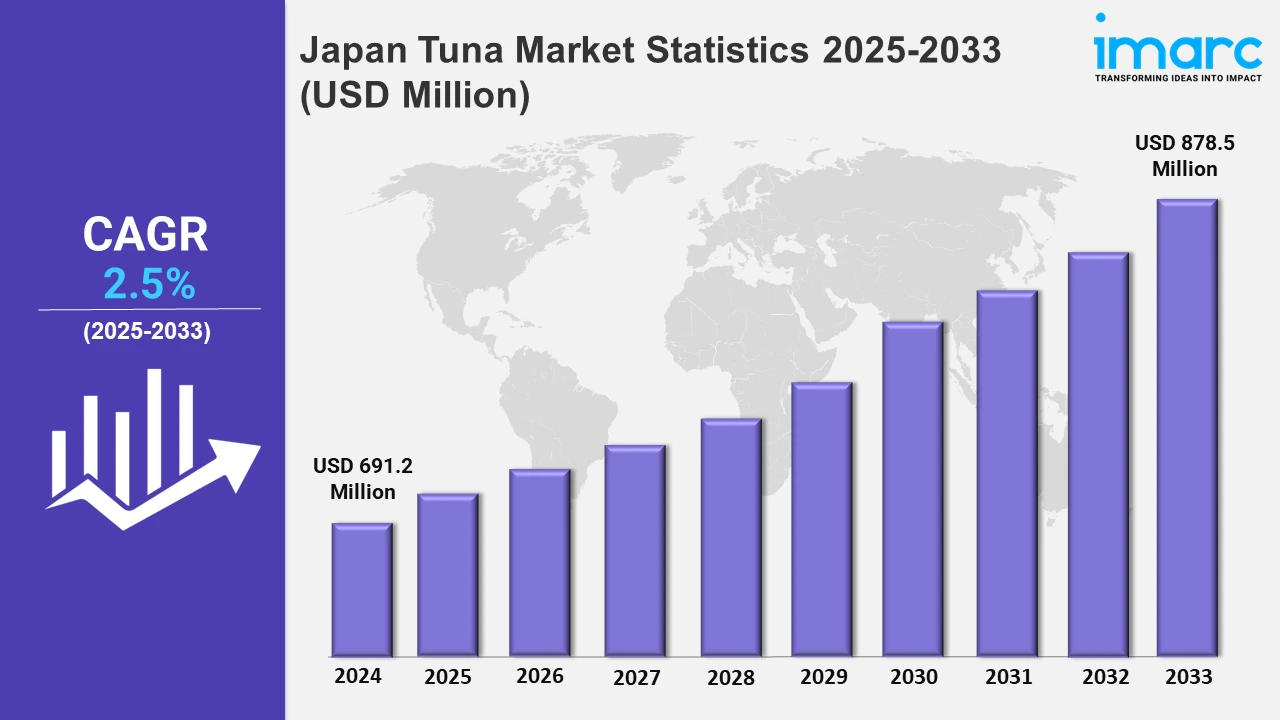

The Japan tuna market size was valued at USD 691.2 Million in 2024, and it is expected to reach USD 878.5 Million by 2033, exhibiting a growth rate (CAGR) of 2.5% from 2025 to 2033.

To get more information on this market, Request Sample

The Japanese fish business is broadening its worldwide reach through strategic acquisitions. Efforts to improve international operations center on utilizing expertise in tuna sourcing and product development to meet increased demand, particularly in places where sushi and seafood consumption is rising. For example, in July 2024, Sojitz, a Japanese trade firm, acquired Sushi Avenue Inc.'s takeaway sushi business, which operates over 300 grocery locations across the U.S. This strategic initiative intended to grow Sojitz's seafood business, especially in the tuna industry.

Moreover, the industry is advancing sustainability through collaborations that prioritize eco-friendly and socially responsible tuna fishing. Partnerships are fostering efforts to maintain tuna stocks while aligning with sustainability standards, ensuring long-term environmental and economic benefits for the tuna market in the country. For instance, in February 2024, the Global Tuna Alliance (GTA) revealed its first Japanese partner, Meiho Co., a fish processing firm in Shiogama City. This agreement represented a significant step forward for sustainable tuna practices in Japan, with the goal of promoting ecologically sustainable and socially responsible tuna fishing. Furthermore, Japan's tuna sector is developing to satisfy rising customer demand for high-quality and sustainable seafood choices. Producers are working on enhancing processing technologies and increasing distribution networks to serve both domestic and international markets. Additionally, the appeal of premium-grade tuna, particularly bluefin and bigeye, has increased due to its use in sushi and sashimi dishes. For example, Japanese corporations such as Maruha Nichiro and Nissui are investing in innovative freezing methods to keep tuna fresh for shipment. These inventions meet growing worldwide demand. The focus on sustainability is also driving initiatives to promote properly sourced tuna, safeguarding the industry's long-term survival while addressing consumer demand for ethically produced fish.

Japan Tuna Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto region, Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The increasing number of environmental organizations is stimulating the market across these regions.

Kanto Region Tuna Market Trends:

The Kanto region, which includes Tokyo's Toyosu Market, is key to Japan's tuna business. To accommodate the enormous demand for fresh and frozen tuna, large enterprises such as Maruha Nichiro offer a wide range of tuna species, including skipjack and bluefin. The region's robust infrastructure guarantees that restaurants and markets get high-quality sashimi and sushi, meeting the demands of Tokyo's thriving fish sector.

Kinki Region Tuna Market Trends:

In the Kinki region, which includes Osaka, fresh tuna is highly prized for local delicacies such as sushi and sashimi. To suit local demand, companies like Nissui offer quality tuna, including bluefin and bigeye. The Osaka Central Wholesale Market provides a steady supply of fresh tuna, preserving the region's reputation for high-quality fish utilized in traditional cuisine.

Central/Chubu Region Tuna Market Trends:

The Central/Chubu region takes advantage of its proximity to the Pacific Ocean and the Sea of Japan, which allows access to a variety of tuna species. Taiyo A&F works in this region with a focus on sustainable fishing and frozen tuna processing. Its yellowfin and albacore tuna supply benefits restaurants and merchants across Nagoya, assuring the price and quality of traditional meals.

Kyushu-Okinawa Region Tuna Market Trends:

The Kyushu-Okinawa region is known for tuna fishing and aquaculture due to its warm seas. Companies like Kyokuyo Co., Ltd. specialize in bluefin tuna aquaculture, assuring a consistent supply for both local and international markets. Okinawa and Fukuoka ports play important roles in transporting high-quality tuna for sushi, sashimi, and processed items, with a focus on sustainable fishing techniques.

Tohoku Region Tuna Market Trends:

The Tohoku region, especially Kesennuma, is well known for its high-quality bigeye and skipjack tuna catches. The companies in this region focus on sustainable fishing and frozen tuna exports. Fresh tuna is supplied to local markets, ensuring high standards for domestic and international buyers. Kesennuma remains a key location for tuna processing and trade, supporting the regional economy.

Chugoku Region Tuna Market Trends:

There are various tuna processing companies in the Chugoku region. Marusui Hiroshima is one of several companies that produce canned and packaged tuna to fulfill domestic and international demand. The firm works with local fishing cooperatives to acquire tuna, providing a consistent supply of value-added goods while also helping the region's fisheries sector.

Hokkaido Region Tuna Market Trends:

Hokkaido's plentiful seas are essential for migratory tuna fishing. Hokuyo Suisan, situated in Hakodate, specializes in frozen tuna processing, particularly bigeye and yellowfin tuna. The company's sustainable methods assure stable supply to domestic and international markets while upholding Hokkaido's strong environmental stance.

Shikoku Region Tuna Market Trends:

Shikoku's fishing communities are recognized for their traditional pole-and-line methods. Yamaki Co., located in Kochi, is a major producer of katsuobushi (dried skipjack). Its products are essential to Japanese cuisine, and its support for small-scale fishermen helps to preserve the region's cultural and economic fishing traditions.

Top Companies Leading in the Japan Tuna Industry

Some of the leading Japan tuna market companies have been included in the report. Competitive analysis, such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant, has been covered in the report.

Japan Tuna Market Segmentation Coverage

- Based on the species, the market has been classified into skipjack, yellowfin, albacore, bigeye, and bluefin. Skipjack tuna is an essential component in canned foods like katsuobushi. Yellowfin tuna is preferred as sashimi due to its mild taste. Albacore tuna is popular for canned foods. Bigeye tuna adds a rich taste to sushi. However, bluefin tuna is regarded for its buttery texture and high quality in sashimi.

- Based on the type, the market has been categorized into canned, frozen, and fresh. Canned tuna is popular because it is convenient and affordable, and it is frequently used in daily meals. Frozen tuna provides year-round availability and is often used in sashimi and sushi. Fresh tuna is preferred for its high quality and taste in traditional meals.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 691.2 Million |

| Market Forecast in 2033 | USD 878.5 Million |

| Market Growth Rate 2025-2033 | 2.5% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Species Covered | Skipjack, Yellowfin, Albacore, Bigeye, Bluefin |

| Types Covered | Canned, Frozen, Fresh |

| Regions Covered | Kanto Region, Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Tuna Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)