Japan Travel Retail Market Expected to Reach USD 31.6 Billion by 2033 - IMARC Group

Japan Travel Retail Market Statistics, Outlook and Regional Analysis 2025-2033

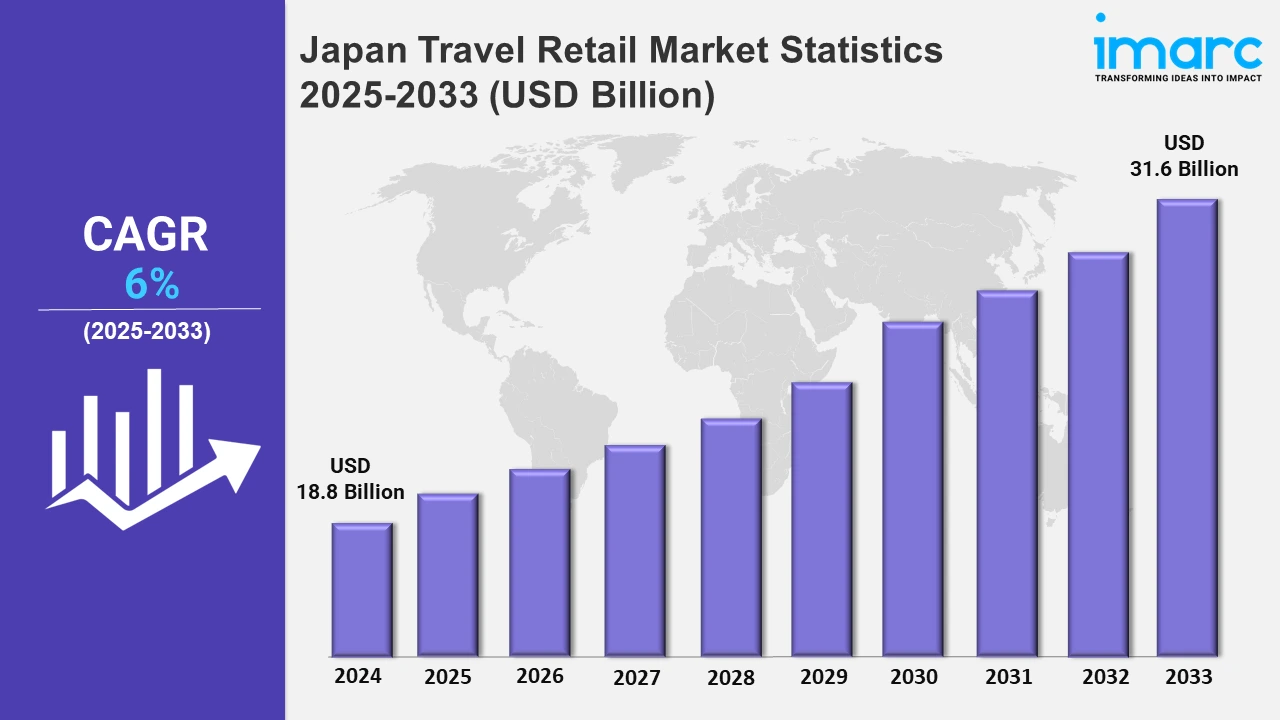

The Japan travel retail market size was valued at USD 18.8 Billion in 2024, and it is expected to reach USD 31.6 Billion by 2033, exhibiting a growth rate (CAGR) of 6% from 2025 to 2033.

To get more information on this market, Request Sample

The growing consumer demand for distinctive, premium goods and engaging shopping experiences is fueling the expansion of Japan's travel retail industry. Additionally, the emerging trend towards personalized and sustainable offerings, the resurgence of international travel, and the growing appeal of duty-free shopping are also augmenting the market. Collaborations between international companies and partners across the country have further improved the accessibility of premium goods and services. In order to take advantage of the growing travel retail market, luxury and beauty firms are progressively opening flagship locations and creative marketing initiatives. For example, Philip Morris International debuted its IQOS Iluma I line in March 2024 at key duty-free shopping destinations in Japan, such as the airports in Narita and Kansai. In addition to commemorating IQOS's tenth anniversary, this launch unveiled cutting-edge innovations like eco-friendly designs and bladeless induction technology. These developments showcased how consumers in the travel retail industry across Japan are increasingly choosing eco-friendly and technologically advanced products.

Similarly, in September 2024, Rituals Cosmetics, in partnership with the Bluebell Group, inaugurated its first flagship store in Japan's Aoyama district. The store blends Dutch craftsmanship with Japanese design, offering premium well-being products and reinforcing the commitment of the company to creating bespoke retail experiences. These developments underscore the importance of luxury and wellness brands in meeting the evolving expectations of international and domestic travelers. The focus on cultural and personalized experiences has also become a key driver in Japan’s travel retail market. Brands are leveraging this trend to introduce campaigns that celebrate local traditions while appealing to consumers. For example, in September 2024, Shiseido launched its first travel retail campaign, "From Shiseido With Love," in Japan. This initiative, featuring the Sense of Place collection, highlighted city-themed packaging, exclusive skincare sets, and culturally immersive shopping experiences. By aligning its campaign with Japan’s rich cultural heritage, Shiseido successfully enhanced its brand presence and tapped into the demand for unique and destination-specific products in the travel retail market. These developments highlight how Japan's travel retail market is evolving through innovation, cultural integration, and sustainability.

Japan Travel Retail Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The increasing focus on tailored consumer experiences and high-value product offerings ensures that Japan remains a key player in the travel retail industry.

Kanto Region Travel Retail Market Trends:

The Kanto region, home to Tokyo, thrives in travel retail due to high tourist inflow. Duty-free outlets in Narita International Airport and luxury brands cater to affluent international travelers. Popular local souvenirs include Tokyo Banana and Asakusa sweets. Japan's urban hubs like Yokohama further bolster sales of electronic goods and cosmetics, appealing to Chinese and Southeast Asian tourists and solidifying Kanto's dominance in Japan's travel retail market.

Kansai/Kinki Region Travel Retail Market Trends:

In Kansai, Osaka and Kyoto's historical and cultural allure drive retail demand. Kansai International Airport hosts diverse duty-free shops offering premium sake, matcha products, and regional delicacies like Yatsuhashi sweets. Tourists from Taiwan and Hong Kong significantly contribute to purchases, particularly traditional crafts. Nara's tourism and Kobe's luxury brand outlets add diversity, making Kansai a pivotal region for heritage-linked retail and high-end goods.

Central/ Chubu Region Travel Retail Market Trends:

Chubu's retail centers in Nagoya benefit from its strategic location between Tokyo and Osaka. Tourists frequently visit Chubu Centrair International Airport, purchasing Nagoya's famed hitsumabushi (eel rice) and local ceramics. The region attracts Asian and European travelers, drawn to the Shirakawa-go UNESCO site. Traditional crafts like Mino washi paper are retail highlights. Chubu’s balance of modernity and tradition underpins its growing travel retail market.

Kyushu-Okinawa Region Travel Retail Market Trends:

The Kyushu-Okinawa region offers a unique blend of tropical and cultural retail experiences. Okinawa’s Naha Airport duty-free shops attract South Korean and Chinese tourists purchasing Awamori liquor and Ryukyu glass. In Kyushu, Fukuoka's bustling Hakata Station enhances local product visibility, such as Hakata ramen kits. The region’s proximity to Asia and distinct regional goods contribute to its thriving travel retail sector.

Tohoku Region Travel Retail Market Trends:

Tohoku’s retail market leverages its scenic landscapes and seasonal attractions. Sendai Airport duty-free shops focus on regional specialties like Zunda mochi and local sake from Akita. The 2011 recovery efforts have also encouraged tourism, drawing visitors from Taiwan and Europe. Matsushima Bay’s proximity boosts souvenir sales, especially handcrafted wooden toys. Tohoku’s cultural and natural treasures form the backbone of its retail success.

Chugoku Region Travel Retail Market Trends:

The Chugoku region, encompassing Hiroshima, sees thriving retail markets focused on peace tourism. Hiroshima Airport features duty-free outlets offering oyster delicacies. Tourists from the U.S. and Australia often purchase Hiroshima-themed souvenirs. Okayama’s peaches and regional denim attract niche buyers. Chugoku’s mix of historical resonance and unique regional products appeals to culturally inclined shoppers, enriching its travel retail landscape.

Hokkaido Region Travel Retail Market Trends:

Hokkaido’s travel retail thrives on its nature-driven tourism. New Chitose Airport’s duty-free shops sell premium dairy products like Shiroi Koibito chocolates and regional wines. Visitors from China and South Korea dominate consumer demographics. Sapporo's snow festival boosts sales of winter gear and artisanal crafts. Hokkaido’s distinct appeal lies in its outdoor lifestyle offerings, merging natural beauty with specialty products in the retail market.

Shikoku Region Travel Retail Market Trends:

Shikoku’s travel retail is niche yet vibrant, centered around pilgrimage and rural charm. Takamatsu Airport’s duty-free offerings include udon noodle sets and citrus products like Yuzu. International tourists from Southeast Asia, especially Singapore, are drawn to the region’s tranquility. Regional crafts like Awa washi paper and local sake from Kochi find strong demand. Shikoku’s blend of spirituality and exclusivity makes its retail market unique.

Top Companies Leading in the Japan Travel Retail Industry

The report offers an in-depth evaluation of the competitive dynamics in the Japan travel retail market. It examines market structure, key player positions, leading strategies, competitive insights, and company rankings. Additionally, it includes comprehensive profiles of prominent companies, highlighting their roles and contributions within the industry.

Japan Travel Retail Market Segmentation Coverage

- On the basis of the product type, the market has been bifurcated into beauty and personal care, wine and spirits, tobacco, food and confectionary, fashion accessories and hard luxury, and others. Travel retail thrives on diverse product categories, catering to travelers with duty-free beauty products, premium wines, spirits, exclusive tobacco, gourmet confectionery, luxury fashion, and high-end accessories.

- Based on the distribution channel, the market is categorized into airports, airlines, ferries, and others. Travel retail operates through airports, onboard airlines, ferries, and various transit hubs, offering convenient access to exclusive, duty-free goods tailored to enhance the travel experience and capitalize on international passenger traffic.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 18.8 Billion |

| Market Forecast in 2033 | USD 31.6 Billion |

| Market Growth Rate 2025-2033 | 6% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Beauty and Personal Care, Wine and Spirits, Tobacco, Food and Confectionary, Fashion Accessories and Hard Luxury, Others |

| Distribution Channels Covered | Airports, Airlines, Ferries, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Travel Retail Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)