Japan Tooling Market Expected to Reach USD 27.2 Billion by 2033 - IMARC Group

Japan Tooling Market Statistics, Outlook and Regional Analysis 2025-2033

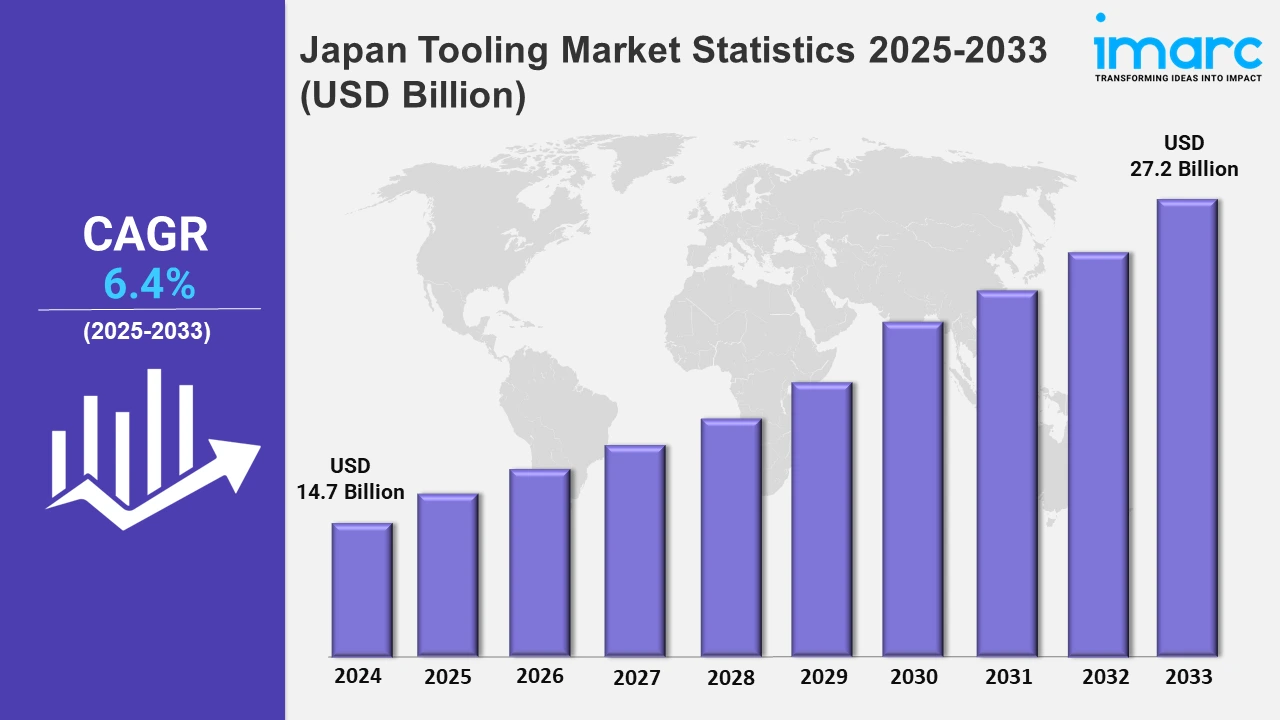

The Japan tooling market size was valued at USD 14.7 Billion in 2024, and it is expected to reach USD 27.2 Billion by 2033, exhibiting a growth rate (CAGR) of 6.4% from 2025 to 2033.

To get more information on this market, Request Sample

Innovative advancements and the growing demand for precise tools across a wide range of industries are driving the growth of the market. Additionally, the increasing focus on incorporating IoT and smart technologies into tooling systems to enable enhanced operational efficiency is acting as a growth-inducing factor. For instance, in April 2024, KTC launched nepros-ID, the first IoT-enabled tool series that integrates Xerafy's RF technology. These products are intended to improve FOD prevention, expedite inventory procedures, and redefine tooling criteria with scalable and affordable solutions tailored especially for MRO. In line with this, the tooling industry in Japan is also benefiting from innovations in material science and manufacturing techniques, particularly in sectors such as sports and automotive. Mizuno's introduction of the Pro 241, 243, and 245 irons in September 2023 exemplifies the application of cutting-edge technologies. These irons incorporate advancements like Hiroshima's grain flow forging, chromoly construction, tungsten weighting, and Coretech face technology.

Moreover, partnerships and investments are fueling the growth of the tooling industry in Japan. Companies are focusing on expanding their footprint and leveraging synergies to drive innovation in specialized tooling segments. For example, in May 2024, Mitsui acquired a 30% stake in Okamoto Machine Tool Works with an investment of ¥9.7 Billion. This strategic alliance was aimed at enhancing sales and fostering innovations in surface grinding and semiconductor wafer polishing tools. It aligned with Okamoto's vision of becoming a top-tier abrasive machine manufacturer, emphasizing the growing importance of precision tooling in high-tech industries.

Japan Tooling Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The rising number of reshoring manufacturing activities is expanding the market in these regions.

Kanto Region Tooling Market Trends:

The Kanto region, encompassing Tokyo, is a major hub for automotive and electronics manufacturing. This drives demand for high-precision tooling solutions to support mass production. For instance, in Kanagawa Prefecture, companies require advanced dies and molds for efficient production lines. The region's emphasis on innovation fosters the adoption of cutting-edge tooling technologies to maintain competitive advantage.

Kinki Region Tooling Market Trends:

In the Kinki region, which includes Osaka, the tooling market is shaped by a diverse industrial base. This diversity necessitates a wide range of tooling solutions, from forging tools to specialized jigs. In Hyogo Prefecture, for example, local manufacturers invest in custom tooling to enhance production efficiency and product quality, reflecting the region's commitment to industrial excellence.

Central/Chubu Region Tooling Market Trends:

The Chubu region, home to Aichi Prefecture, is renowned for its automotive industry. This dominance leads to a significant demand for durable and high-performance tooling, such as machine tools and gauges, essential for vehicle manufacturing. Companies in this area focus on precision engineering to meet stringent requirements, driving the growth of the market.

Kyushu-Okinawa Region Tooling Market Trends:

In the Kyushu-Okinawa region, including Fukuoka Prefecture, the market is positively influenced by the expanding electronics and semiconductor industries. The need for miniaturization and precision in electronic components propels the demand for specialized micro-tooling solutions. Manufacturers invest in advanced tooling to achieve the high accuracy required for semiconductor fabrication, supporting the region's technological advancements.

Tohoku Region Tooling Market Trends:

The Tohoku region, encompassing Miyagi Prefecture, is experiencing growth in renewable energy projects, particularly wind power. This development increases the demand for large-scale tooling. Local manufacturers are adapting by investing in tooling capable of handling the fabrication of sizable and complex parts essential for renewable energy infrastructure.

Chugoku Region Tooling Market Trends:

In the Chugoku region, which includes Hiroshima Prefecture, the shipbuilding industry significantly influences the market. The construction of large vessels requires specialized heavy-duty tooling for metal forming and assembly. Manufacturers in this area focus on acquiring robust tooling solutions to meet the demands of shipbuilding, thereby contributing to the region's economic vitality.

Hokkaido Region Tooling Market Trends:

Hokkaido's tooling market is shaped by its agricultural machinery manufacturing sector. The production of equipment suited for large-scale farming operations necessitates durable and efficient tooling. Companies in the region invest in tooling that enhances the durability and performance of agricultural machinery.

Shikoku Region Tooling Market Trends:

In the Shikoku region, including Kagawa Prefecture, the tooling market is influenced by the chemical processing industry. The production of chemical equipment requires corrosion-resistant tooling materials to withstand harsh processing environments. Manufacturers prioritize tooling solutions that ensure longevity and safety in chemical production facilities, reflecting the region's industrial needs.

Top Companies Leading in the Japan Tooling Industry

The report offers an in-depth review of the competitive landscape in Japan's tooling market, covering market structure, key player positioning, leading strategies, competitive dashboards, and company evaluation quadrants.

Japan Tooling Market Segmentation Coverage

- On the basis of the product type, the market has been bifurcated into dies and molds, forging, jigs and fixtures, machines, tools, and gauges. These essential tooling components enable precision shaping, assembly, machining, and measurement, forming the backbone of manufacturing across diverse industries.

- Based on the material type, the market is categorized into stainless steel, iron, aluminum, and others. These materials are fundamental in tooling for their durability, machinability, and versatility, tailored to meet varying manufacturing requirements and industry demands.

- On the basis of the end use industry, the market has been divided into automotive, electronics and electrical, aerospace, marine, and defense, plastics industry, construction and mining, and others. Tooling supports critical operations in these sectors, enabling efficiency, precision, and innovation in product development and large-scale production.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 14.7 Billion |

| Market Forecast in 2033 | USD 27.2 Billion |

| Market Growth Rate 2025-2033 | 6.4% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Dies and Molds, Forging, Jigs and Fixtures, Machines Tools, Gauges |

| Material Types Covered | Stainless Steel, Iron, Aluminum, Others |

| End Use Industries Covered | Automotive, Electronics and Electrical, Aerospace, Marine, and Defense, Plastics Industry, Construction and Mining, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Tooling Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)