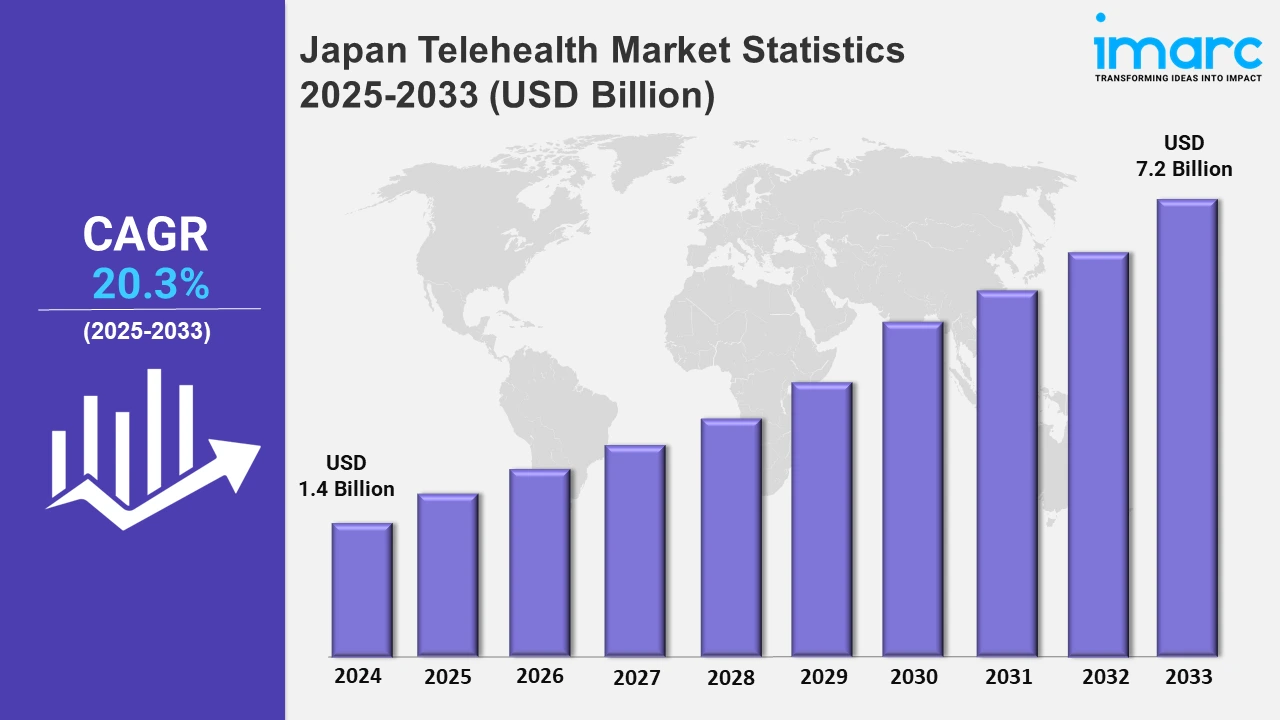

Japan Telehealth Market Expected to Reach USD 7.2 Billion by 2033 - IMARC Group

Japan Telehealth Market Statistics, Outlook and Regional Analysis 2025-2033

The Japan telehealth market size was valued at USD 1.4 Billion in 2024, and it is expected to reach USD 7.2 Billion by 2033, exhibiting a growth rate (CAGR) of 20.3% from 2025 to 2033.

To get more information on this market, Request Sample

Chronic disorders are becoming more common in Japan, which is driving the need for telehealth services across the country. Diabetes and other chronic diseases require ongoing care and frequent monitoring. In 2023, cancer cases in Japan reached 1,033,800. Breast cancer was the most common type of cancer among women, with approximately 97.3 thousand cases. Telehealth makes monitoring of these diseases easier by allowing patients to connect with doctors remotely and use devices to track their health from home. This reduces hospital visits and helps patients stay connected with their treatment plans.

Additionally, digital innovation is reshaping healthcare in Japan by making medication guidance more accessible and convenient. The increasing launch of new mobile applications allows patients to consult registered pharmacists remotely, thereby removing the need for physical visits to pharmacies. This approach also ensures greater accessibility, especially for those with mobility challenges. By integrating telemedicine with streamlined payment solutions, the initiative aims to enhance the patient experience and provide seamless healthcare services in an increasingly connected world. For instance, in June 2024, Infosys formed an alliance with Nihon Chouzai, a leading dispensing pharmacy chain in Japan, to improve access to healthcare services. As part of this effort, Infosys has created a mobile app called NiCOMS. This telemedicine platform allows patients to consult with registered pharmacists remotely, eliminating the need to visit a pharmacy in person. The collaboration also focuses on enhancing online medication guidance and payment options, making healthcare more accessible and convenient for people across Japan.

Japan Telehealth Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The increasing use of telehealth services to reduce the pressure on traditional healthcare facilities by enabling remote patient monitoring and virtual consultations is providing lucrative growth prospects for industry investors in Japan.

Kanto Region Telehealth Market Trends:

The rising population across the Kanto region is driving the growth of the market. In addition, various key cities like Tokyo are introducing online consultation facilities. For example, LINE Healthcare Corporation launched a telemedicine service in the Greater Tokyo Area. The LINE app makes it easier for the patient to complete their entire medical explanation process.

Kinki Region Telehealth Market Trends:

The Kinki region focuses on telehealth for elderly care. Its aging population drives the need for remote monitoring platforms. Moreover, various companies across the region, like Medley Inc., offer special services to track chronic diseases. Community healthcare centers in Kinki actively promote telehealth, reducing hospital visits and easing caregiver burdens.

Central/Chubu Region Telehealth Market Trends:

The Chubu region is focusing on expanding its rural healthcare access. Moreover, various places like Nagano utilize remote platforms to connect people living in remote areas with medical experts. In addition to this, platforms like DoctorMate help in tackling chronic diseases through virtual consultations.

Kyushu-Okinawa Region Telehealth Market Trends:

The Kyushu-Okinawa region is prone to natural disasters like earthquakes. Telemedicine platforms in this region, like Holoeyes, help individuals during emergencies. Moreover, remote islands like Okinawa are dependent on telehealth for continuous care, which is not physically available in the region.

Tohoku Region Telehealth Market Trends:

Frequent hospital closure across the Tohoku region, especially in Fukushima due to natural disasters, is one of the key factors contributing to the market growth. Various platforms like Line Healthcare connect residents to medical experts virtually. Rural areas in Tohoku benefit greatly from telemedicine, which reduces travel times to distant hospitals and rebuilds trust in healthcare systems.

Chugoku Region Telehealth Market Trends:

Prefectures like Hiroshima use telemedicine to monitor factory workers’ well-being, which is stimulating the market growth in the Chugoku region. Industrial zones usually rely on healthcare apps for virtual check-ups, especially for respiratory issues. Moreover, telehealth initiatives across the Chugoku region target workforce well-being.

Hokkaido Region Telehealth Market Trends:

Hokkaido is tackling the challenges of its vast, sparsely populated areas by embracing telehealth solutions. The region has turned to telemedicine to support its agricultural communities, where access to healthcare can be limited. Services like MediBird provide support, offering video consultations and delivering medications directly to those in need.

Shikoku Region Telehealth Market Trends:

Shikoku promotes telehealth for the management of diseases, including hypertension and diabetes. Various places like Ehime deploy telemedicine to monitor patient's progress remotely. Platforms like CureApp aid in lifestyle modifications through virtual coaching.

Top Companies Leading in the Japan Telehealth Industry

The report also includes a detailed analysis of the market's competitive landscape. The study includes competition analysis on market structure, key player positioning, top winning tactics, competitive dashboard, and company evaluation quadrant. Additionally, full biographies of all important corporations have been supplied.

Japan Telehealth Market Segmentation Coverage

- On the basis of the component, the market has been bifurcated into software, hardware, and service. The software enables virtual consultations, remote monitoring, and digital health records. Moreover, hardware involves physical devices used for telehealth services like wearable devices. Besides this, services in telehealth include virtual consultations provided by healthcare professionals.

- Based on communication technology, the market has been bifurcated into video conferencing, mhealth solutions, and others. Video conferencing offers real-time, face-to-face calls between patients and healthcare providers. Moreover, mHealth solutions involve the use of smartphones and mobile apps to deliver healthcare services.

- On the basis of the hosting type, the market has been bifurcated into cloud-based and web-based, and on-premises. Cloud-based telehealth platforms store data on remote servers, which further enables easy access. Moreover, web-based telehealth solutions run directly from a web browser without the need for software downloads. Besides this, on-premises telehealth solutions involve installing software and hardware within the healthcare organization’s own infrastructure.

- Based on the application, the market has been bifurcated into teleconsultation and telementoring, medical education and training, teleradiology, telecardiology, tele-ICU, telepsychiatry, teledermatology, and others. Teleconsultation involves remote consultations using phone calls or messaging platforms. Moreover, telementoring connects experienced healthcare professionals with less experienced ones for guidance and knowledge sharing.

- On the basis of the end user, the market has been bifurcated into providers, patients, payers, and others. Providers are healthcare professionals who offer medical services to patients. Moreover, patients are the ones who receive healthcare services. Besides this, payers are entities responsible for covering the cost of healthcare services.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1.4 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Market Growth Rate 2025-2033 | 20.3% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Software, Hardware, Service |

| Communication Technologies Covered | Video Conferencing, mHealth Solutions, Others |

| Hosting Types Covered | Cloud-Based and Web-Based, On-Premises |

| Applications Covered | Teleconsultation and Telementoring, Medical Education and Training, Teleradiology, Telecardiology, Tele-ICU, Tele-Psychiatry, Tele-Dermatology, Others |

| End Users Covered | Providers, Patients, Payers, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Telehealth Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)