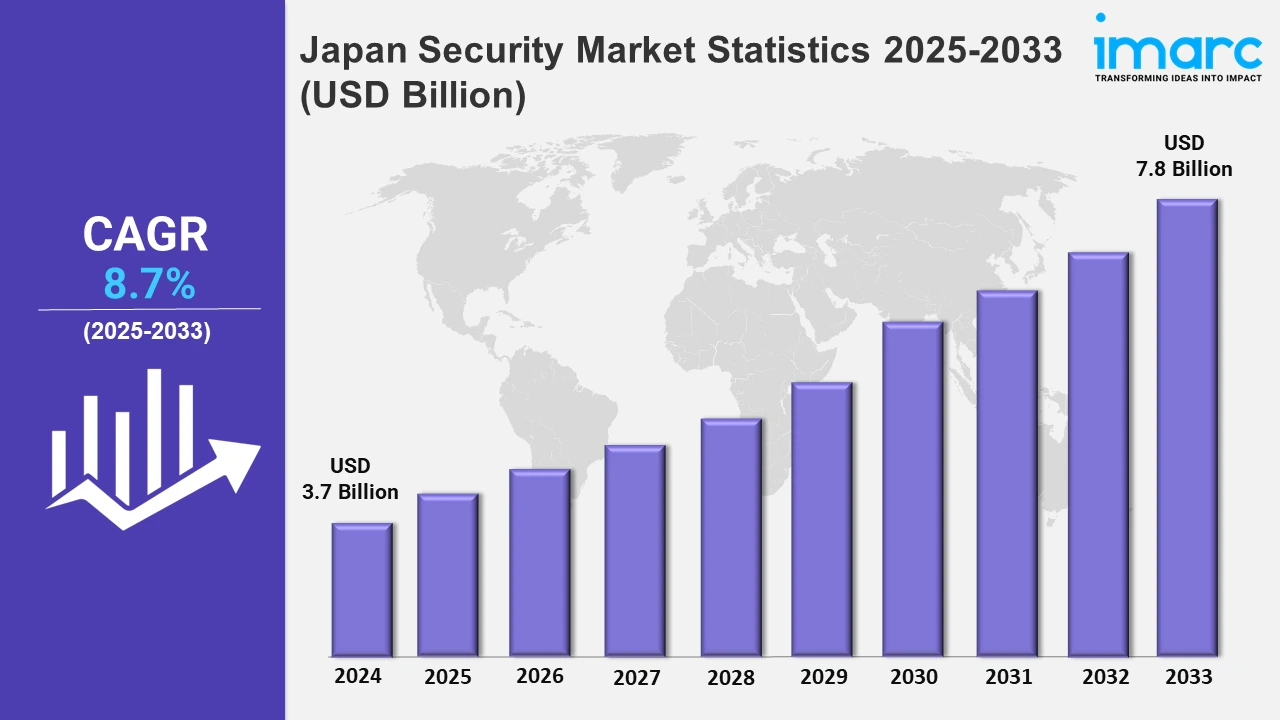

Japan Security Market Expected to Reach USD 7.8 Billion by 2033 - IMARC Group

Japan Security Market Statistics, Outlook and Regional Analysis 2025-2033

The Japan security market size was valued at USD 3.7 Billion in 2024, and it is expected to reach USD 7.8 Billion by 2033, exhibiting a growth rate (CAGR) of 8.7% from 2025 to 2033.

To get more information on this market, Request Sample

Collaborations in Japan's cybersecurity industry are centered on providing innovative application security solutions to combat the growing digital threats. These collaborations increase security in major industries by stressing innovation and resilience in protecting essential systems and data in an increasingly digitalized world. For example, in November 2024, DerSecur and TOYO Corporation announced a strategic partnership to launch the DerScanner application security solution in Japan. This collaboration aimed to enhance cybersecurity in key industries amid the rising digital threats. The platform showcased at EdgeTech+ 2024 underscores its importance in the evolving digital landscape.

Moreover, Japan is pushing its cyber defense tactics by establishing a consulting council to defend key infrastructure. Collaboration with industries such as railroads, power, and telecommunications improves risk-sharing procedures, hence enhancing cybersecurity resilience in the face of growing threats to national and industrial systems. For instance, in May 2024, Japan announced its plans to establish a consultative body to implement an active cyber defense system aimed at enhancing protections for critical infrastructure against cyberattacks. The initiative involved collaboration with key sectors like railways, electricity, and telecommunications to share cyber risk information. Furthermore, the Japan security industry providers are working on incorporating new technologies such as AI and IoT into surveillance and monitoring systems. This approach intends to improve efficiency, minimize response times, and increase public safety. Additionally, there is a rising need for customized solutions in essential infrastructure, such as airports, industries, and energy facilities, which creates income potential for manufacturers. Due to their accuracy and flexibility, end users are increasingly preferring advanced biometric systems and AI-powered security to traditional monitoring approaches. For example, NEC Corporation, a leader in Japan's security business, has installed AI-powered facial recognition systems at the Narita International Airport. These devices enhance passenger identification accuracy, speed boarding procedures, and increase overall airport security. Such advances show Japan's growing dependence on cutting-edge security technology to meet current issues in a variety of industries and position the country as a worldwide leader in security solutions.

Japan Security Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto region, Kinki region, central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. These regions are necessitating novel security frameworks to protect critical assets and ensure public safety.

Kanto Region Security Market Trends:

Companies in the Kanto region, such as NEC Corporation and Fujitsu, are driving cybersecurity innovations in response to rising cyber threats. Tokyo-based companies are using AI-driven threat detection and enhanced data security solutions to ensure vital industries and organizations' operational continuity. This focus on cybersecurity is consistent with Kanto's status as Japan's economic and technical core.

Kinki Region Security Market Trends:

The Kinki region, supported by corporations like Panasonic and Omron, incorporates smart surveillance systems into urban infrastructure. Osaka is using AI-powered cameras and IoT devices to improve public safety, traffic monitoring, and crowd control for events such as the World Expo 2025. This shows Kinki's dedication to smart city initiatives.

Central/ Chubu Region Security Market Trends:

Toyota and Mitsubishi Electric have made significant investments in the security of industrial control systems in the central/ Chubu region. These enterprises are implementing advanced cybersecurity measures to fight against industrial espionage, ensure continuous production processes, and maintain the region's manufacturing competitiveness, which is critical to Japan's industrial base.

Kyushu-Okinawa Region Security Market Trends:

Kyushu-Okinawa is experiencing an increase in biometric security usage in the tourist sector, supported by corporations such as Hitachi and NEC. Airports and resorts use face recognition and fingerprint scanning technology to streamline services for foreign tourists while maintaining strong security requirements, which are critical for the region's developing tourism business.

Tohoku Region Security Market Trends:

Companies in Tohoku, like NTT Data and Toshiba, are improving catastrophe resilience by implementing modern communication networks and response systems. Post-disaster recovery operations now incorporate AI-powered warnings and strong monitoring systems, assuring public safety and readiness in this disaster-prone region.

Chugoku Region Security Market Trends:

Companies like Mitsubishi Heavy Industries support Chugoku's maritime security advancements. Ports improve surveillance systems with AI-powered monitoring to prevent smuggling and maintain secure marine operations, which are essential to the region's fishing and trading businesses along its large coastline.

Hokkaido Region Security Market Trends:

In Hokkaido, firms such as Rakuten and Fujitsu use IoT-based agricultural security systems to protect cattle and crops. These advances assist farmers in monitoring conditions, preventing theft, and ensuring the integrity of food production, all of which are critical to the economic stability of this agriculturally dependent region.

Shikoku Region Security Market Trends:

Shikoku specializes in renewable energy security, with businesses like Sharp and Kyocera developing cybersecurity for wind and solar farms. These solutions defend energy infrastructure from cyber-attacks, guaranteeing a consistent electricity supply that is critical for the region's growing renewable energy efforts.

Top Companies Leading in the Japan Security Industry

Some of the leading Japan security market companies have been included in the report. They use advanced technologies such as artificial intelligence, IoT, and cloud-based solutions to enhance their security portfolios. Strategic collaborations, partnerships, and mergers and acquisitions are common strategies to expand market reach and technological capabilities. For instance, in June 2024, Cisco announced the establishment of a Cybersecurity Center of Excellence in Tokyo to enhance Japan's digital resilience.

Japan Security Market Segmentation Coverage

- Based on the system, the market has been classified into access control systems, alarms and notification systems, intrusion detection systems, video surveillance systems, barrier systems, and others. Access control systems protect both physical and digital assets across various sectors. Alarms and notification systems ensure quick alerts in case of security breaches or emergencies. Intrusion detection systems detect and counteract unauthorized access attempts to secured environments. Video surveillance systems deliver continuous observation and visual validation of activities in various environments. Barrier systems offer physical deterrents and controlled access to sensitive locations.

- Based on the service, the market has been categorized into system integration and consulting, risk assessment and analysis, managed services, and maintenance and support. System integration and consulting services create customized security solutions that meet client needs. Risk assessment and analysis services offer organizations crucial insights into potential vulnerabilities and threats. Managed services provide organizations with comprehensive solutions for ongoing security management and monitoring. Maintenance and support services carry on the reliability and effectiveness of security systems in Japan.

- Based on the end user, the market has been divided into government, military and defense, transportation, commercial, industrial, and others. The government sector is a prominent end user driving demand for sophisticated security solutions tailored to protect national infrastructure and public services. The military and defense sector is vital to the security market, emphasizing the protection of national security assets and sensitive military information. The market in the transportation sector, encompassing airports, railway systems, ports, and highways, ensures nationwide access control, advanced surveillance, and effective risk mitigation solutions. In the commercial sector, it provides advanced surveillance and access control to safeguard assets and ensure customer safety. In the industrial sector, it delivers robust risk management and protection solutions to secure operations and enhance workplace safety.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 3.7 Billion |

| Market Forecast in 2033 | USD 7.8 Billion |

| Market Growth Rate 2025-2033 | 8.7% |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Systems Covered | Access Control Systems, Alarms and Notification Systems, Intrusion Detection Systems, Video Surveillance Systems, Barrier Systems, Others |

| Services Covered | System Integration and Consulting, Risk Assessment and Analysis, Managed Services, Maintenance and Support |

| End Users Covered | Government, Military and Defense, Transportation, Commercial, Industrial, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Security Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)