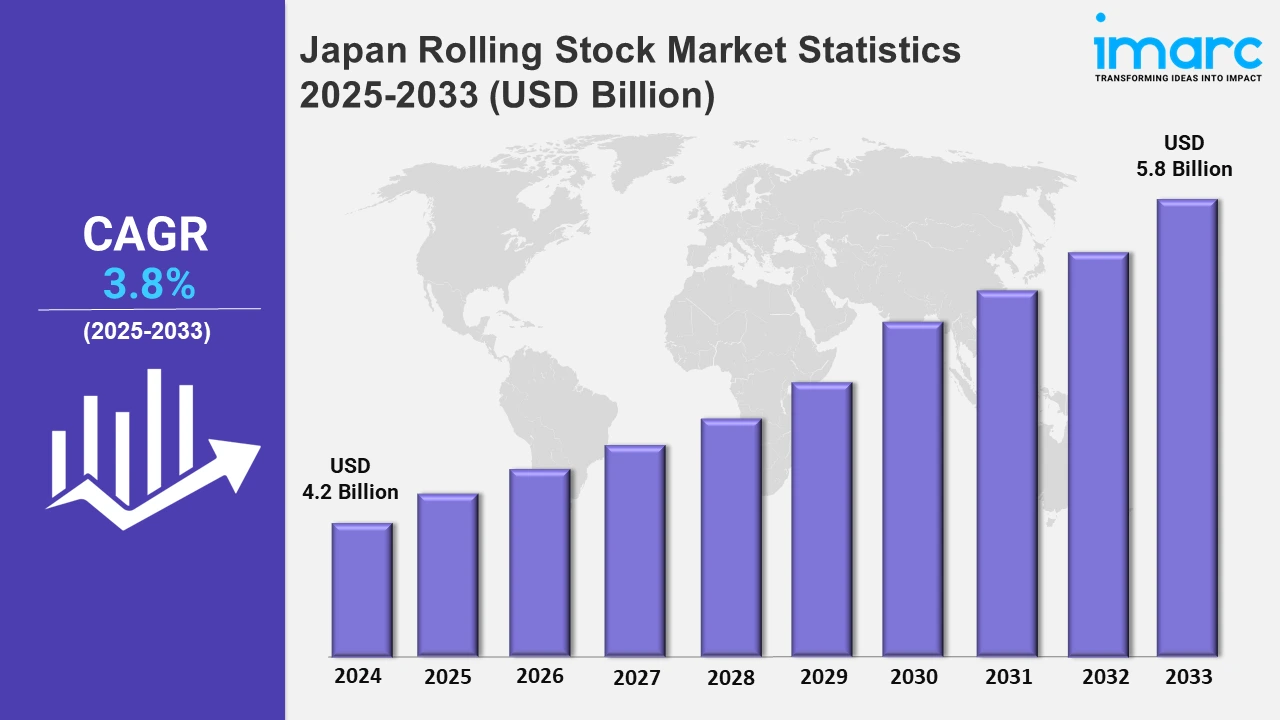

Japan Rolling Stock Market Expected to Reach USD 5.8 Billion by 2033 - IMARC Group

Japan Rolling Stock Market Statistics, Outlook and Regional Analysis 2025-2033

The Japan rolling stock market size was valued at USD 4.2 Billion in 2024, and it is expected to reach USD 5.8 Billion by 2033, exhibiting a growth rate (CAGR) of 3.8% from 2025 to 2033.

To get more information on this market, Request Sample

The increasing investments in eco-friendly rail systems and enhancements in passenger comfort are among the key factors influencing the growth of the market in the country. The focus on reducing CO2 emissions levels and enhancing operational efficiency aligns with the push towards greener transportation solutions. For instance, Tobu Railway's introduction of Hitachi Rail's Series N100 SPACIA X trains in July 2023 highlighted this trend. These trains connect Tokyo with Nikko and Kinugawa Onsen while offering up to 41% reduced CO2 emissions. With 212 seats, including premium and suite options, these trains provide an elevated travel experience. The development of JR East's E8 EMU by Kawasaki Rail and Hitachi Rail in March 2024 on the 403 km Tokyo–Shinjo line also exemplifies this shift. The seven-car trains, set to replace the E3 fleet by 2026, feature 355 seats and active suspension, enabling speeds of up to 300 km/h. Such developments cater to the rising need for faster and more efficient rail systems, meeting both passenger and operational requirements. Moreover, these initiatives contribute to the broader adoption of high-speed rail networks, thereby strengthening Japan's position as a leader in rail technology.

Furthermore, the efforts to standardize and enhance the compatibility of rolling stock with existing railway infrastructure are catalyzing the market across the country. Japan's leadership in revising the IEC 62427 international standard in December 2024 underscored this commitment. Developed by RTRI and the International Electrotechnical Commission, the update ensured that electromagnetic compatibility between rolling stock and train detection systems is neutral and widely accepted. This revision not only bolsters the integration of advanced technologies into rail systems but also ensures seamless interoperability across diverse regions. Such proactive measures are anticipated to drive growth in the rolling stock market, which is positioning Japan as a pioneer in sustainable and technologically advanced rail solutions.

Japan Rolling Stock Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The rising preference for efficient and reliable transportation solutions is fueling the market across these regions.

Kanto Region Rolling Stock Market Trends:

The Kanto region is prioritizing the modernization of its urban rail systems to manage the rising passenger demands. This effort includes introducing advanced rolling stock with features such as regenerative braking and energy-efficient designs. For example, Tokyo Metro has deployed the 17000 series trains on the Yurakucho Line, enhancing acceleration and reducing maintenance costs. These developments aim to provide smoother and faster commutes, which is vital for a densely populated and high-demand area like Tokyo.

Kansai/Kinki Region Rolling Stock Market Trends:

In the Kansai/Kinki region, the focus is on enhancing intercity connectivity through new rail technologies. The deployment of JR West’s 271 series trains for limited express services between Osaka and Kansai International Airport reflects this trend. These trains improve access for tourists and residents alike, featuring luggage spaces and enhanced ride stability. Such upgrades strengthen the region’s role as a key transportation hub in western Japan.

Central/Chubu Region Rolling Stock Market Trends:

The Central/Chubu region, centered around Nagoya, emphasizes high-speed rail innovations. The Chuo Shinkansen maglev project, which will link Tokyo and Nagoya by 2027, demonstrates this. The maglev system reduces travel time to just 40 minutes, which fosters economic ties and convenience.

Kyushu-Okinawa Region Rolling Stock Market Trends:

The market in the Kyushu-Okinawa region is boosted due to the expanding tourism industry and through strategic rail investments. The Nishi Kyushu Shinkansen, operational since 2023, exemplifies this focus by reducing travel times between Takeo-Onsen and Nagasaki. The train promotes regional attractions, including Nagasaki’s historical sites. Enhanced convenience for domestic and international travelers showcases the region’s commitment to fostering tourism-driven economic growth while modernizing local infrastructure.

Tohoku Region Rolling Stock Market Trends:

Tohoku emphasizes developing disaster-resilient rail systems to ensure reliable and safe transportation in challenging conditions. JR East’s E5 series Shinkansen, serving major cities like Sendai, incorporates advanced seismic detection systems and automatic braking technology. These innovations enhance safety and maintain operational continuity during natural events. The region’s rail upgrades also strengthen connectivity and stimulate economic growth, setting a high standard for safety-focused infrastructure in Japan’s railway network.

Chugoku Region Rolling Stock Market Trends:

The Chugoku region is investing in community-focused rail enhancements. JR West’s introduction of the 227 series trains on local routes, such as the San'in Main Line, highlights this trend. These trains offer barrier-free access for elderly passengers and energy-efficient designs to reduce operational costs. By improving mobility and convenience for rural areas, the region aims to sustain transportation accessibility while adapting to demographic shifts.

Hokkaido Region Rolling Stock Market Trends:

Hokkaido emphasizes rolling stock capable of functioning in extreme winter conditions. JR Hokkaido’s H100 series hybrid trains feature snow-resistant technologies, ensuring uninterrupted service despite heavy snowfall. Routes like the Hakodate Line benefit from these advancements, which include improved snowplows and advanced heating systems. By addressing its unique climatic challenges, Hokkaido ensures year-round transportation reliability, supporting both residents and the region’s seasonal tourism industry.

Shikoku Region Rolling Stock Market Trends:

Shikoku enhances regional rail experiences to attract tourists and improve local mobility. The introduction of JR Shikoku’s 2700 series trains on the Yosan Line represents these efforts. These trains boost tourism as they are designed with tilting mechanisms for speed on curvy tracks and panoramic windows for scenic views. By modernizing its limited express services, Shikoku fosters regional development while preserving the island's natural and cultural appeal.

Top Companies Leading in the Japan Rolling Stock Industry

The report offers an in-depth competitive analysis of Japan's rolling stock market, highlighting market structure, key player positioning, winning strategies, and a comprehensive competitive dashboard. It also features a company evaluation quadrant and detailed profiles of major industry players, providing insights into their performance, strategies, and contributions to the market's growth and development.

Japan Rolling Stock Market Segmentation Coverage

- On the basis of the product type, the market has been bifurcated into diesel locomotive, electric locomotive, and others. Diesel and electric locomotives, along with other specialized rolling stock types, are crucial for powering trains, offering versatility and efficiency in freight and passenger transport across various rail networks.

- Based on the locomotive technology, the market is categorized into conventional locomotive, turbocharge locomotive, and maglev. Conventional locomotives, turbocharged models, and advanced maglev systems represent diverse rolling stock technologies, meeting the needs of traditional rail services, high-performance operations, and magnetically levitated transport solutions.

- On the basis of the application, the market has been divided into passenger coach and freight wagon. Passenger coaches and freight wagons form integral parts of rolling stock, designed to accommodate travelers comfortably and transport goods efficiently, ensuring the seamless functioning of both commercial and public railway systems.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 5.8 Billion |

| Market Growth Rate 2025-2033 | 3.8% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Diesel Locomotive, Electric Locomotive, Others |

| Locomotive Technologies Covered | Conventional Locomotive, Turbocharge Locomotive, Maglev |

| Applications Covered | Passenger Coach, Freight Wagon |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Rolling Stock Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)