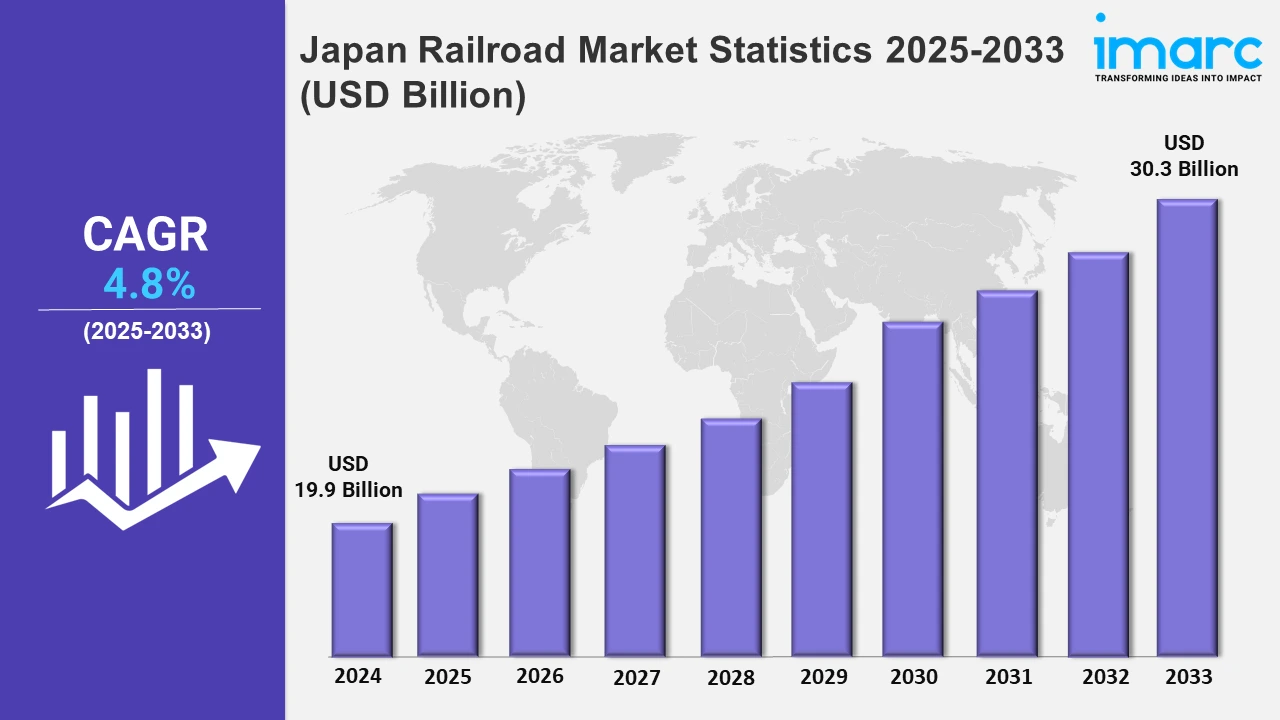

Japan Railroad Market Expected to Reach USD 30.3 Billion by 2033 - IMARC Group

Japan Railroad Market Statistics, Outlook and Regional Analysis 2025-2033

The Japan railroad market size was valued at USD 19.9 Billion in 2024, and it is expected to reach USD 30.3 Billion by 2033, exhibiting a growth rate (CAGR) of 4.8% from 2025 to 2033.

To get more information on this market, Request Sample

The inflating requirement of modernizing and improving the efficiency of foreign train networks is bolstering the market in the country. Collaborative initiatives are aimed at boosting infrastructure and commuter services, strengthening regional associations, demonstrating Japan's rail development leadership, etc. For example, in May 2024, the Japan International Cooperation Agency (JICA), along with Hankyu Corp. and Sumitomo Corp., entered into an agreement to maintain the Manila light rail transit system line 1.

Moreover, Japan continues to focus on developing more sustainable and robust supply networks, as well as incorporating innovative rail technology to increase efficiency and environmental effects. Collaboration with worldwide partners emphasizes the transportation system, highlighting rail's role in attaining sustainability and dependable logistical solutions. For instance, in May 2024, the European Union and Japan participated in the fifth High-Level Economic Dialogue (HLED), introducing an initiative aimed at creating transparent, resilient, and sustainable supply chains. Furthermore, the Japan railroad market is witnessing breakthroughs in sustainable rail technology as operators strive to satisfy severe environmental regulations, such as Japan's 2050 carbon neutrality goal. Rail operators are increasingly using energy-efficient electric and hybrid trains to reduce greenhouse gas emissions. Additionally, urban commuters choose high-speed and dependable trains over conventional forms of transportation due to awareness towards environmental sustainability and time efficiency. For example, JR East unveiled the ALFA-X Shinkansen prototype, which is designed to reach a speed of up to 360 kilometers per hour while featuring regenerative braking technologies and superior aerodynamics. These innovations not only improve operating efficiency but also correspond with the government's goal of lowering the transportation sector's carbon impact. As a result, manufacturers and operators are well-positioned to capitalize on the need for greener, safer, and quicker rail systems.

Japan Railroad Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto region, Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The need for reliable and convenient transportation options to connect cities with their suburbs and nearby areas is augmenting the market.

Kanto Region Railroad Market Trends:

The Kanto region supports smart urban transit, with JR East using AI-powered train schedules to improve efficiency throughout Tokyo and the neighboring areas. The Yamanote Line demonstrates this trend. Furthermore, commercial operators such as Odakyu Electric Railway have introduced double-decker express trains to meet increased passenger demand between suburban centers like Kanagawa and central Tokyo.

Kinki Region Railroad Market Trends:

Luxury tourism trains are becoming increasingly popular in the Kinki region. JR West's Twilight Express Mizukaze offers picturesque routes linking Osaka, Kyoto, and Himeji, with a focus on high-end tourists. This is consistent with regional initiatives to promote historic and cultural assets. Private operators, like Kintetsu Railway, offer luxury amenities such as gourmet dining carriages to attract both local and foreign visitors.

Central/Chubu Region Railroad Market Trends:

The Central/Chubu region prioritizes industrial freight rail due to Nagoya's status as a manufacturing powerhouse. JR Freight collaborates with Toyota to provide efficient shipping of automobile components between production sites and export facilities. Furthermore, efficient cargo-tracking technologies expedite logistics, enabling just-in-time delivery for industries in Chubu, setting it apart from passenger-focused districts.

Kyushu-Okinawa Region Railroad Market Trends:

The Kyushu-Okinawa region favors rail-based regional redevelopment. JR Kyushu operates trains that connect rural hot spring areas to metropolitan areas like Fukuoka. This technique benefits local economies by encouraging tourists. Unlike other places, the Okinawa Monorail addresses the issues of island-specific rail systems while improving transportation in Okinawa's metropolitan centers.

Tohoku Region Railroad Market Trends:

The Tohoku region specializes in seasonal tourism with themed trains. JR East's Resort Shirakami train entices travelers with panoramic views. Seasonal offers such as cherry blossom viewing excursions distinguish it, promoting the region's distinct landscapes while rehabilitating post-disaster areas such as Fukushima and Sendai.

Chugoku Region Railroad Market Trends:

The Chugoku region encourages urban-rural connection, with JR West establishing local lines like the Geibi Line to connect Hiroshima's outskirts to metropolitan centers. These efforts improve everyday transportation for rural communities. Unlike tourism-centric approaches, Chugoku's emphasis on workforce transit promotes economic inclusion by facilitating employment access for citizens in rural places.

Hokkaido Region Railroad Market Trends:

Hokkaido stands significant for its agricultural freight train. JR Freight works with dairy farmers to carry fresh milk and processed commodities from Sapporo to markets on Honshu. Unlike other regions that prioritize passenger service, Hokkaido's emphasis on perishables delivery benefits local agriculture and assures timely deliveries even in harsh winter conditions.

Shikoku Region Railroad Market Trends:

Shikoku revolves around regional festivals and rail integration. JR Shikoku combines train services with events like the Awa Odori Festival in Tokushima, providing specific routes and schedules. Special trains adorned with festival themes promote cultural tourism and community interaction, setting Shikoku's rail initiatives apart from those of bigger, more industrialized regions.

Top Companies Leading in the Japan Railroad Industry

Some of the leading Japan railroad market companies have been included in the report. The report provides an in-depth competitive analysis, examining the market structure, the positioning of key players, leading strategies for success, a competitive overview dashboard, and an evaluation quadrant for assessing company performance.

Japan Railroad Market Segmentation Coverage

- Based on the type, the market has been classified into rail freight and passenger rail. Rail freight helps companies through bulk transport and intermodal logistics, guaranteeing supply chain stability in a market that values sustainability and technological innovation. Passenger rail encompasses urban, intercity, and high-speed networks that provide efficient transportation in heavily populated regions.

- Based on the distance, the market has been categorized into long-distance and short-distance. Long-distance rail, such as the Shinkansen and intercity trains, offers rapid and comfortable travel. Short-distance rail, which includes urban transportation and regional lines, provides efficient daily commutes in highly populated regions while maintaining constant connectivity and reliability.

- Based on the end use, the market has been divided into mining, construction, agriculture, and others. Mining utilizes efficient transport for bulk minerals and raw materials. Construction relies on trains for heavy equipment and material logistics. Besides this, agriculture depends on them for fresh produce and products being delivered on time.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 19.9 Billion |

| Market Forecast in 2033 | USD 30.3 Billion |

| Market Growth Rate 2025-2033 | 4.8% |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Rail Freight, Passenger Rail |

| Distances Covered | Long Distance, Short Distance |

| End Uses Covered | Mining, Construction, Agriculture, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Railroad Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)