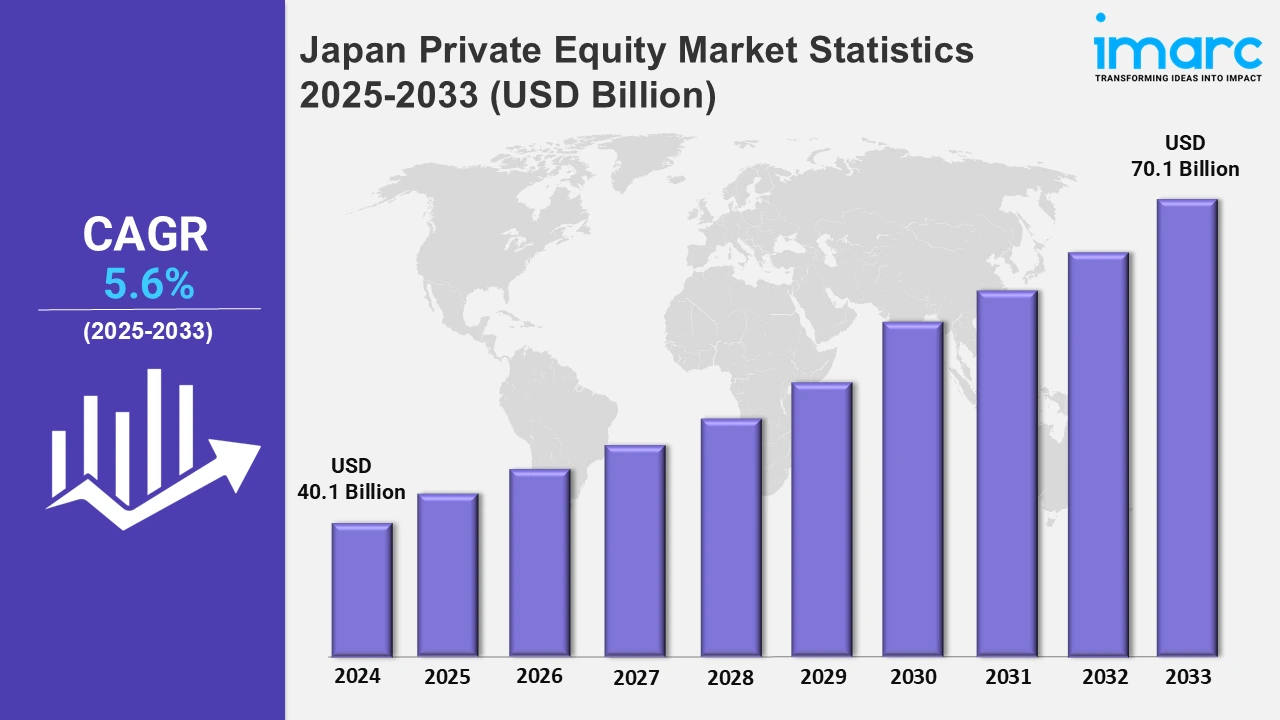

Japan Private Equity Market Expected to Reach USD 70.1 Billion by 2033 - IMARC Group

Japan Private Equity Market Statistics, Outlook and Regional Analysis 2025-2033

The Japan private equity market size was valued at USD 40.1 Billion in 2024, and it is expected to reach USD 70.1 Billion by 2033, exhibiting a growth rate (CAGR) of 5.6% from 2025 to 2033.

To get more information on this market, Request Sample

Private equity activity in Japan is mostly focused on pharmaceutical industry restructuring, with large investments in divestitures and acquisitions. This strategy represents a rising interest in unlocking value from non-core assets while improving operational efficiency in healthcare firms to satisfy changing market needs and capitalize on possibilities in Japan's aging population and new medication industries. For example, in January 2025, Mitsubishi Chemical Group named Bain Capital as the leading bidder for its pharmaceutical unit, Tanabe Mitsubishi Pharma, in a transaction valued at USD 3.2 Billion.

Moreover, private equity companies are progressively allocating resources to Asia Pacific, with a focus on prospects in Japan. This approach reflects rising confidence in industries such as technology, healthcare, and infrastructure, which is fueled by economic stability and expanding commercial prospects in major regional markets. For instance, in July 2024, Goldman Sachs revealed plans to raise USD 2 Billion for its inaugural private equity fund targeting the Asia Pacific region, with a primary emphasis on investments in Japan. Furthermore, renewable energy investments in the Japan private equity market have surged owing to the government's goal to achieve carbon neutrality by 2050. Investors are supporting initiatives that use solar, wind, and biomass technology to achieve these aims. Additionally, private equity-backed enterprises are extending their renewable energy portfolios to meet the growing demand for sustainable energy solutions. For example, Unison Capital's partnership with Kyudenko, a Kagoshima-based renewable energy company, has expanded solar and biomass projects across Kyushu. These programs have increased energy efficiency in the region while also encouraging sustainability. Kyudenko has also played an important role in the development of energy-efficient housing and infrastructure developments, reflecting Japan's overall trend toward environmentally friendly methods. This highlights the private equity sector's involvement in changing Japan's energy landscape while adhering to severe environmental regulations and profiting from profitable green technology.

Japan Private Equity Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto region, Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The elevating interest of domestic and foreign investors in promising investment opportunities in various regions of Japan is expanding the market.

Kanto Region Private Equity Market Trends:

In the Kanto region, private equity focuses on the healthcare industry due to Japan's aging population. MBK Partners made an investment in Tsukui Corporation, a Tokyo-based eldercare firm. This initiative expanded senior housing and daycare facilities throughout the region, addressing the rising demand for aged care. The company also implemented technical advancements, such as telemedicine solutions, which improved patient outcomes and operational efficiency, distinguishing it in the healthcare industry for private equity-backed expansion.

Kinki Region Private Equity Market Trends:

The Kinki region has emerged as a hub for culinary innovation. Marunouchi Capital helped Osaka's Ichimasa Kamaboko develop plant-based seafood products. This is consistent with the increased demand for sustainable and alternative proteins both domestically and abroad. The private equity investment allowed Ichimasa Kamaboko to increase manufacturing capacity, develop new products, and reach worldwide markets, establishing the firm as a leader in Japan's developing alternative food sector.

Central/Chubu Region Private Equity Market Trends:

Private equity is driving manufacturing developments in the Central/Chubu region. Advantage Partners invested in Yamazaki Mazak, based in Aichi, to help advance automation technology. This program upgraded precision machinery manufacturing lines by combining new robots and IoT capabilities. These renovations increased productivity, lowered prices, and helped Japan preserve its competitive advantage in manufacturing markets. This investment shows Central/Chubu's emphasis on technical excellence in the industrial sector.

Kyushu-Okinawa Region Private Equity Market Trends:

Kyushu-Okinawa's private equity strategy emphasizes on renewable energy. Unison Capital teamed up with Kyudenko in Kagoshima to expand solar and biomass projects. This investment increased green energy infrastructure, such as solar panel installations and biomass power generation, reducing the region's dependency on fossil fuels. Kyudenko also secured funding for energy-efficient housing programs. These initiatives highlight the rising interest in renewable energy projects in southern Japan.

Tohoku Region Private Equity Market Trends:

Private equity in Tohoku relies on regional development following the 2011 disaster. J-STAR invested in Miyagi-based Hokuetsu Housing to help increase disaster-resilient housing. This money enabled the development of stronger and more economical modular dwellings fitted to Tohoku's disaster-prone geography. By improving manufacturing capacities and distribution networks, the investment aided local employment development and established Hokuetsu as a vital actor in disaster recovery efforts.

Chugoku Region Private Equity Market Trends:

The Chugoku region is witnessing private equity engagement in logistics. Polaris Capital invested in Rikuun, a Hiroshima-based startup that specializes in last-mile deliveries. With the development of e-commerce, the investment helped modernize Rikuun's fleet and introduce digital tracking systems, resulting in increased operational efficiency. This strategic alliance also permitted network growth throughout western Japan, resulting in speedier and more dependable delivery services and strengthening Rikuun's position in Japan's logistics sector.

Hokkaido Region Private Equity Market Trends:

In Hokkaido, private equity promotes agricultural technology breakthroughs. Norinchukin Bank invested in Hokuren Agricultural Cooperative to incorporate smart agricultural technology. Precision irrigation, automated milking systems, and real-time crop monitoring contributed to increased production and sustainability in Hokkaido's agricultural business. The agreement also enhanced Hokuren's capacity to market premium dairy and produce both locally and internationally, strengthening Hokkaido's position as a pioneer in agricultural innovation.

Shikoku Region Private Equity Market Trends:

Shikoku's private equity seeks to promote sustainable aquaculture. Marunouchi Capital invested in Maruha Nichiro, based in Ehime, to promote ecologically friendly fish farming practices. The investment helped to enhance feed efficiency and waste management while strengthening production capacity for high-demand species such as yellowtail and sea breams. Maruha Nichiro used these resources to boost exports, establishing Shikoku as a key leader in sustainable aquaculture for international markets.

Top Companies Leading in the Japan Private Equity Industry

Some of the leading Japan private equity market companies have been included in the report. The report provides leading strategies for success, a competitive overview dashboard, and an evaluation quadrant for assessing company performance. For example, in December 2023, Japan Investment Corporation, in collaboration with a consortium, acquired Shinko Electric Industries, the chip-packaging unit of Fujitsu, for USD 4.7 Billion.

Japan Private Equity Market Segmentation Coverage

- Based on the fund type, the market has been classified into buyout, venture capital (VCs), real estate, infrastructure, and others. Buyout funds prioritize mature enterprises for operational improvement. Venture capitals (VCs) promote innovation by funding startups in technology and healthcare. Real estate leverage by investing in both commercial and residential buildings. Infrastructure funds target energy and transportation investments to promote sustainable growth.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 40.1 Billion |

| Market Forecast in 2033 | USD 70.1 Billion |

| Market Growth Rate 2025-2033 | 5.6% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Fund Types Covered | Buyout, Venture Capital (VCS), Real Estate, Infrastructure, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Private Equity Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)