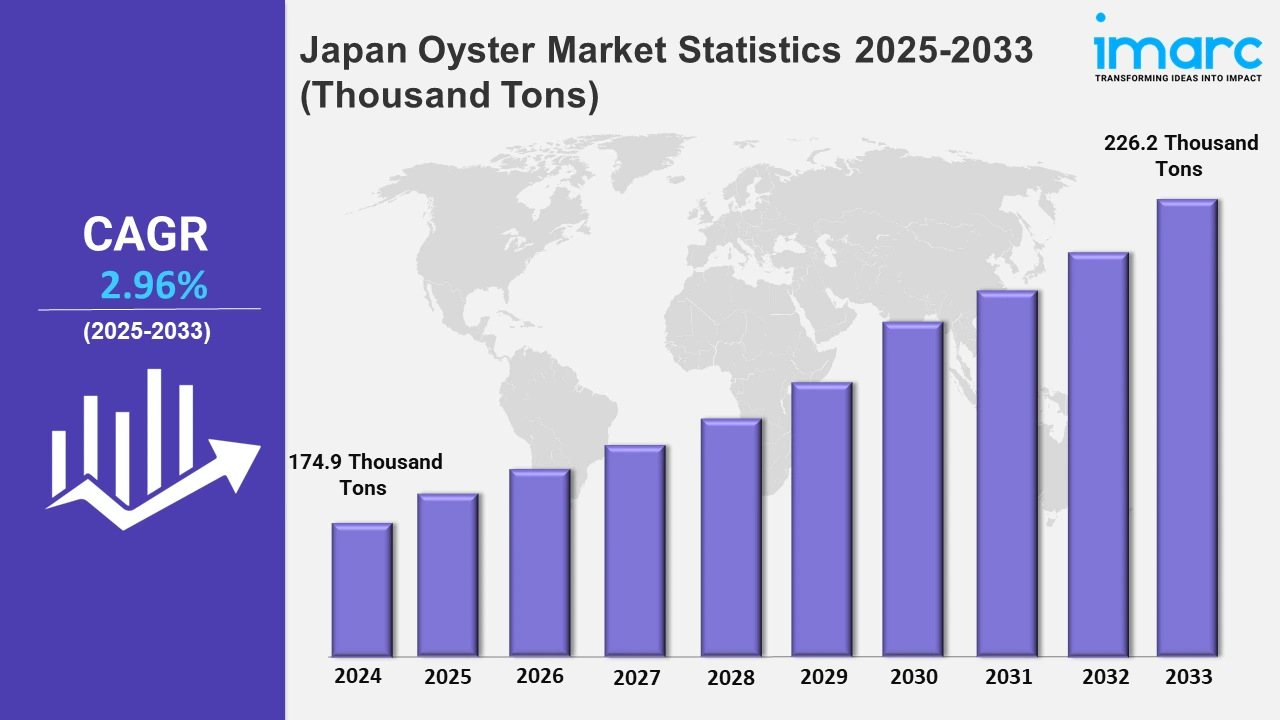

Japan Oyster Market Expected to Reach 226.2 Thousand Tons by 2033 - IMARC Group

Japan Oyster Market Statistics, Outlook and Regional Analysis 2025-2033

The Japan oyster market size reached 174.9 Thousand Tons in 2024, and it is expected to reach 226.2 Thousand Tons by 2033, exhibiting a growth rate (CAGR) of 2.96% from 2025 to 2033.

To get more information on this market, Request Sample

The Japan oyster market is witnessing significant growth, driven by advancements in aquaculture technology, the increasing consumer preference for premium seafood, and a rise in culinary innovation. The use of deep ocean water for land-based aquaculture has opened up new possibilities for the industry. For instance, in August 2023, General Oyster Inc., through its subsidiary GO Farm Co., Ltd., introduced the world's first land-based life-cycle aquaculture for oysters on Kume Island, Okinawa. This pioneering initiative under the "8th Sea Oyster 2.0" brand ensured mass production of Norovirus-free oysters, catering to the growing demand for safe and sustainably produced seafood in commercial markets. Additionally, consumer interest in premium and regionally branded oysters has become a driving factor. Restaurants and culinary events are emphasizing these high-quality products to attract seafood enthusiasts. In October 2024, Kora Corporation announced the "Oyster Fair," held nationwide across 139 Akakara restaurants from November to December. This event celebrated Hiroshima's renowned oysters. These initiatives highlight the increasing prominence of Japan's oyster regions and the growing demand for experiential dining that revolves around local seafood.

Moreover, innovations in oyster-based dining concepts are further propelling the market growth. Japanese culinary traditions are being creatively merged with international influences to attract attention. For example, in April 2024, the Tapasu Oyster Gastro Bar was launched, blending the country's culinary traditions with Spanish tapas culture. This establishment showcased premium Japanese oysters in fresh and cooked forms, accompanied by curated beverages, offering diners a distinctive experience. Such ventures not only promote Japan's oyster market but also position the country as a leader in oyster culinary innovation on the stage.

Japan Oyster Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. According to the report, the Kanto region accounts for the majority of the total share in the market, driven by high demand in urban centers like Tokyo.

Kanto Region Oyster Market Trends:

The Kanto region leads the overall market, as it is a hub for premium oyster imports and culinary innovations. The market emphasizes fresh and high-quality oysters sourced locally and internationally. Urban dining trends, such as oyster bars, are thriving. For instance, restaurants in Yokohama have introduced seasonal menus featuring Pacific oysters from Iwate Prefecture. The region's affluent population and dining culture contribute to the growing demand for sustainable oyster products.

Kinki Region Oyster Market Trends:

The Kinki region, including Osaka and Kyoto, highlights oyster-based delicacies with a focus on traditional and fusion cuisine. Oysters from Hyogo Prefecture, especially from Ako City, are consumed for their robust flavor and size. Kansai's renowned street food scene also integrates grilled oysters during regional festivals, boosting consumption. Increased collaborations between seafood suppliers and culinary establishments have further elevated the popularity of oysters in local markets.

Central/Chubu Region Oyster Market Trends:

In the Central/Chubu region, including Nagoya, the oyster market thrives on regional specialties and tourism-driven consumption. Oysters from Mie Prefecture, particularly Ise Bay, are sought after for their delicate taste and nutrient-rich cultivation waters. Local oyster festivals, such as the Toba Oyster Festival, attract visitors, enhancing regional demand. The area's proximity to major urban centers and tourist spots ensures a steady market for fresh and processed oysters.

Kyushu-Okinawa Region Oyster Market Trends:

Kyushu and Okinawa focus on innovative oyster farming and culinary tourism. Kumamoto Prefecture leads in producing small, creamy oysters ideal for half-shell serving. Okinawa's pioneering land-based aquaculture, as seen with the "8th Sea Oyster 2.0" from Kume Island, boosts safety and quality. The region leverages its reputation as a tropical destination, offering unique oyster dining experiences alongside other seafood, attracting both locals and international tourists.

Tohoku Region Oyster Market Trends:

Tohoku, particularly Miyagi Prefecture, is a leader in oyster exports and farming advancements. Ishinomaki Bay is renowned for cultivating large, flavorful oysters using floating rack methods. In addition to this, significant investments in sustainable aquaculture have revitalized the industry. Miyagi oysters are highly prized in domestic and international markets, with annual oyster festivals drawing attention to the region’s commitment to quality and innovation.

Chugoku Region Oyster Market Trends:

The Chugoku region, home to Hiroshima Prefecture, dominates Japan's oyster production. Hiroshima Bay oysters account for over half of the country's total supply, known for their plump texture and umami flavor. Initiatives such as the "Oyster Fair" by Kora Corporation spotlight these premium oysters. The region's emphasis on eco-friendly farming practices and advanced aquaculture techniques reinforces its position as a market leader.

Hokkaido Region Oyster Market Trends:

Hokkaido focuses on cold-water oyster farming, yielding high-quality varieties with a briny and creamy flavor. Akkeshi oysters are a notable example, harvested year-round due to the cold climate. The region's pristine waters and sustainable practices enhance the appeal of its oysters. Hokkaido's seafood markets, such as the Sapporo Nijo Market, showcase these premium products, attracting culinary tourists and boosting local consumption.

Shikoku Region Oyster Market Trends:

Shikoku emphasizes on small-scale and high-quality oyster farming, with Kagawa Prefecture leading production. Oysters from the Seto Inland Sea are known for their clean taste and medium size. The region promotes oyster tourism through events like the Takamatsu Oyster Festival, highlighting fresh and grilled oyster dishes. Shikoku’s focus on artisanal farming and culinary experiences caters to a niche.

Top Companies Leading in the Japan Oyster Industry

The report presents an in-depth analysis of the Japan oyster market's competitive landscape, highlighting market structure, key player positions, leading strategies, and a competitive dashboard. It includes a company evaluation quadrant and detailed profiles of major players, offering valuable insights into the market dynamics and strategies shaping the industry's growth and competitiveness.

Japan Oyster Market Segmentation Coverage

- On the basis of the oyster type, the market has been bifurcated into cupped oyster, Pacific cupped oyster, American cupped oyster, penguin wing oyster, and others, wherein cupped oyster represents the most preferred segment. It is known for its distinctively curved shells, making it a favorite in seafood cuisine.

- Based on the end user, the market is categorized into foodservice and retail (supermarkets and hypermarkets, convenience stores, specialty outlets, online channels, and others), amongst which retail dominates the market. The retail market for oysters has expanded significantly, offering fresh, sustainably sourced options to consumers, making these delicacies more accessible in supermarkets, specialty stores, and online platforms.

- On the basis of the form, the market has been divided into fresh, frozen, canned, and others. Among these, fresh exhibits a clear dominance in the market. Fresh oysters, harvested and promptly delivered, are celebrated for their delicate taste and vibrant texture, ensuring an exceptional culinary experience for seafood enthusiasts worldwide.

| Report Features | Details |

|---|---|

| Market Size in 2024 | 174.9 Thousand Tons |

| Market Forecast in 2033 | 226.2 Thousand Tons |

| Market Growth Rate 2025-2033 | 2.96% |

| Units | Thousand Tons |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Oyster Type Covered | Cupped Oyster, Pacific Cupped Oyster, American Cupped Oyster, Penguin Wing Oyster, Others |

| End Users Covered |

|

| Forms Covered | Fresh, Frozen, Canned, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Oyster Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)