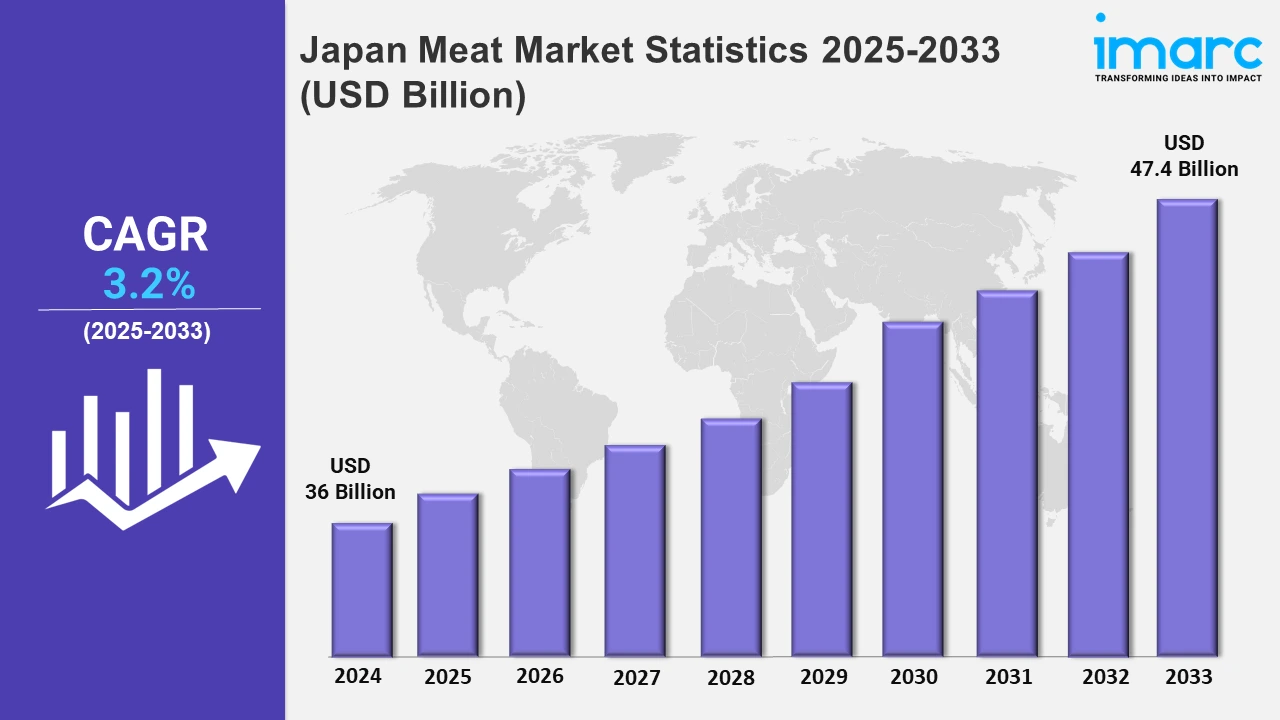

Japan Meat Market Expected to Reach USD 47.4 Billion by 2033 - IMARC Group

Japan Meat Market Statistics, Outlook and Regional Analysis 2025-2033

The Japan meat market size was valued at USD 36 Billion in 2024, and it is expected to reach USD 47.4 Billion by 2033, exhibiting a growth rate (CAGR) of 3.2% from 2025 to 2033.

To get more information on this market, Request Sample

The growing emphasis on sustainable food production, coupled with technological advancements in cellular agriculture and plant-based protein solutions, is driving significant innovations in Japan's meat market. The increasing awareness among individuals towards animal welfare standards, along with government and private sector support, has encouraged companies to explore alternative protein substitutes. For instance, Tokyo-based IntegriCulture introduced a cultivated meat starter kit featuring the Oxy-thru Cultivator bioreactor in November 2024. This kit, designed to simplify research and development activities, enhances cell densities and reduces production costs, fostering innovation in Japan’s cellular agriculture industry. Such initiatives underline the potential for technological solutions to revolutionize protein production and sustainability. Similarly, plant-based alternatives are gaining traction as a sustainable solution to meet Japan's evolving dietary demands. In March 2024, Azuma Foods launched "Future Fish," a vegan-certified seafood range under its Green Surf brand. This product line provides eco-friendly options for traditional dishes such as sushi, poke bowls, sashimi, etc. Companies like Azuma Foods are leveraging innovation to meet consumer demands for diverse and ethical food options while supporting environmental conservation efforts.

Building on these trends, cultured meat innovations are reshaping the market by offering cruelty-free and resource-efficient solutions. In November 2024, Vow launched "Forged Gras," a cultured quail foie gras, marking its entry into international markets. This product combines the rich flavors of Japanese quail with a fatty liver texture, showcasing a sustainable and ethical alternative to traditional foie gras. By redefining accessibility and addressing ethical concerns, the product highlights the transformative potential of cultured meat in creating high-quality and sustainable protein options.

Japan Meat Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. Key players across these regions are focusing on improving preservation techniques, thereby propelling the market.

Kanto Region Meat Market Trends:

Kanto, with Tokyo as its hub, leans on pork consumption due to its affordability. Tonkatsu, a breaded pork cutlet, gains prominence on menus across Tokyo and Saitama. Pork gyudon (rice bowls) also cater to busy urbanites. The market has seen growth in premium cuts, reflecting the rising disposable income levels. Specialty stores in Chiba offer locally sourced pork, thereby catering to high-end consumers preferring traceability and quality assurance.

Kinki Region Meat Market Trends:

In Kansai/Kinki region, home to Osaka and Kyoto, beef is the centerpiece of cuisine. Kobe beef, from Hyogo Prefecture, symbolizes premium Japanese meat. The region's love for yakiniku (grilled beef) drives a thriving restaurant culture. Kansai’s sukiyaki, a sweet soy-based beef hotpot, remains a winter favorite. Osaka leads in innovations like the introduction of beef kushikatsu (skewers). Kobe beef’s international recognition also boosts tourism-driven meat sales.

Central/Chubu Region Meat Market Trends:

Chicken wings (tebasaki) from Nagoya have a nationwide fanbase, thereby driving poultry demand in the region. Gifu’s Hida beef competes with other premium meats, emphasizing techniques, including marbling. Aichi Prefecture balances poultry and beef in its markets. Growing interest in free-range and hormone-free chicken expands opportunities for regional farmers, focusing on ethical and sustainable practices.

Kyushu-Okinawa Region Meat Market Trends:

Kyushu-Okinawa has deep ties to pork due to Okinawan heritage, where every part of the pig is used. Okinawa’s rafute (braised pork belly) highlights this tradition. Kagoshima, renowned for Berkshire pigs, produces tender and juicy pork. Rising tourism in Okinawa is also boosting the demand for unique pork dishes, particularly among international visitors.

Tohoku Region Meat Market Trends:

Tohoku, known for its cold climate, enjoys beef tongue (gyutan) as a specialty in Sendai, Miyagi Prefecture. The unique preparation, including grilling and seasoning, attracts culinary tourism. Local wagyu, such as Iwate’s Maesawa beef, emphasizes superior quality. Tohoku also balances pork and chicken demand, with locally sourced meats preferred. Meat producers in Akita are innovating with preserved meats, targeting urban markets beyond the region.

Chugoku Region Meat Market Trends:

Chugoku blends pork and beef preferences, with Hiroshima highlighting pork in okonomiyaki (savory pancakes). Hiroshima’s proximity to the Seto Inland Sea encourages meat pairings with seafood. The region is witnessing a shift towards lean meats as health consciousness among individuals grows. Specialty pork cuts are gaining popularity in Okayama’s fine dining.

Hokkaido Region Meat Market Trends:

Hokkaido’s distinct preference for mutton rises. Jingisukan, rarely popular in other regions, symbolizes Hokkaido's food culture. Sapporo restaurants specialize in farm-to-table mutton, emphasizing local sourcing. Beef and pork consumption are secondary but supported by Hokkaido’s dairy farming. The region’s harsh winters drive demand for hearty and protein-rich meals like stews and grilled meat.

Shikoku Region Meat Market Trends:

Shikoku values poultry, with Tokushima’s Awa Odori chicken leading local demand. Known for its tenderness and rich flavor, Awa Odori features in festivals and upscale dining. Kagawa’s udon dishes often pair with chicken toppings. Beef from Ehime Prefecture is gaining popularity. Regional chefs experiment with traditional cooking, balancing the demand for both traditional and fusion dishes in an evolving market landscape.

Top Companies Leading in the Japan Meat Industry

The report analyzes the competitive dynamics of Japan's meat industry, highlighting market structure, key player positioning, winning strategies, and a competitive dashboard. It includes a company evaluation quadrant and detailed profiles of leading firms, offering insights into their strategies and roles within the market.

Japan Meat Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into raw and processed. Raw meat includes fresh cuts like steaks and chops, while processed meat refers to products like sausages, bacon, or cured meats prepared for extended shelf life.

- Based on the product, the market has been categorized into chicken, beef, pork, mutton, and others. These categories offer diverse flavors, nutritional profiles, and culinary applications for varied consumer preferences and cultural cuisines.

- On the basis of the distribution channel, the market has been divided into supermarkets and hypermarkets, departmental stores, specialty stores, online stores, and others. Meat is available through supermarkets, hypermarkets, departmental stores, specialty butcher shops, online platforms, and other outlets, catering to convenience, quality, and accessibility for diverse customer needs.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 36 Billion |

| Market Forecast in 2033 | USD 47.4 Billion |

| Market Growth Rate 2025-2033 | 3.2% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Raw, Processed |

| Products Covered | Chicken, Beef, Pork, Mutton, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/Chubu Region, Kyushu/Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Meat Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)