Japan Mattress Market Expected to Reach USD 1.9 Billion by 2033 - IMARC Group

Japan Mattress Market Statistics, Outlook and Regional Analysis 2025-2033

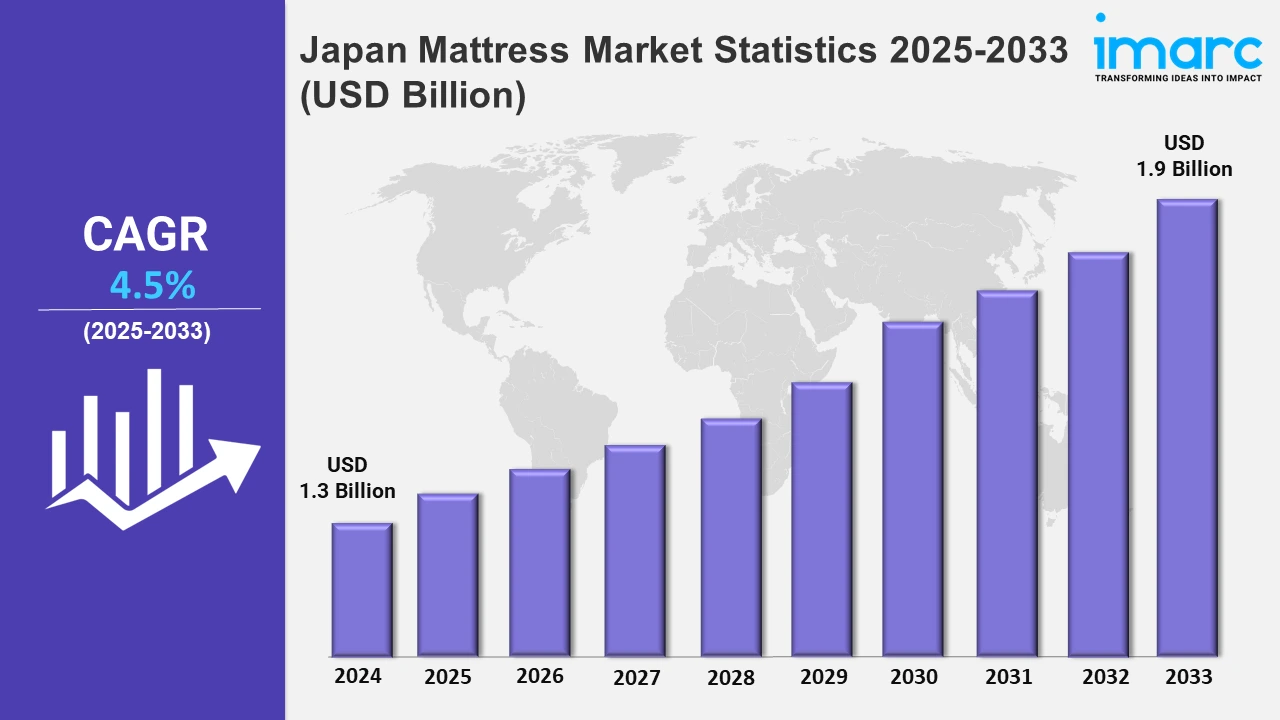

The Japan mattress market size was valued at USD 1.3 Billion in 2024, and it is expected to reach USD 1.9 Billion by 2033, exhibiting a growth rate (CAGR) of 4.5% from 2025 to 2033.

To get more information on this market, Request Sample

The increasing focus on durability, innovations, and sustainability is creating new business opportunities in the market across the country. Companies are focusing on circular economy projects and eco-friendly product designs as consumers are becoming more environmentally conscious. Apart from this, the quality and durability of mattresses are improved by advancements in materials and manufacturing technologies. For example, in September 2023, Paramount Bed, Mitsui Chemicals, and Rever initiated a chemical recycling program to reduce the growing waste and disposal costs of polyurethane mattresses. This project aimed to lower carbon emissions levels and create a circular economy with the support of Japan's Ministry of the Environment. Along with this, companies across Japan are using international platforms to showcase their creative and eco-conscious products. A leading mattress manufacturer in the country, Airweave, supplied more than 16,000 athletes with bedding options for the 2024 Summer Olympics in Paris by introducing their sustainable and customized variants. Concurrently, the company's expanded partnership with Milano Cortina showcases its commitment to innovation while solidifying its market presence.

These developments underline the increasing demand for products that cater to both performance and environmental considerations in the Japan mattress industry. In line with these trends, quality assurance and product durability have become critical factors for manufacturers in the country to remain competitive. To support this, China's SKYLINE Instruments shipped its upgraded mattress fatigue tester (model T07I) to Japan in September 2024. This advanced testing equipment enables producers to perform accelerated performance simulations, thereby improving mattress longevity and quality. The collaboration also represented a pivotal step in enhancing product standards, reflecting the broader drive within the industry to address consumer expectations for high-quality, sustainable, and durable mattresses.

Japan Mattress Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. As per the market report, the Kanto region exhibited a clear dominance in the market, as there is a rising emphasis on multifunctional furniture.

Kanto Region Mattress Market Trends:

The Kanto region is dominating the market owing to the demand for high-quality and durable mattresses. Urban lifestyles in cities like Tokyo emphasize comfort and functionality, favoring memory foam and hybrid designs. Companies like Nishikawa promote ergonomic mattresses tailored to office workers facing long hours. A rising trend includes the elevating adoption of sustainable materials, reflecting the increasing number of eco-conscious consumers across the region. For example, Saitama-based retailers have noted a spike in organic mattress sales, addressing health and environmental concerns.

Kinki Region Mattress Market Trends:

The Kinki region, with Osaka and Kyoto as key areas, combines modern and traditional preferences. Younger buyers in Osaka opt for compact and customizable Western-style mattresses to suit smaller living spaces. Traditional beds remain popular among older generations, especially in Kyoto. Retailers in Kobe have introduced temperature-regulating foam mattresses, catering to the region’s humid summers. This dual demand highlights Kinki’s cultural diversity influencing mattress trends.

Central/Chubu Region Mattress Market Trends:

Central/Chubu region, centered around Nagoya, values affordability and practicality in mattresses. Middle-class families often seek long-lasting and budget-friendly options. Aichi-based manufacturers produce innovative cooling mattresses to combat the area's humid climate, appealing to cost-conscious buyers. Local brands emphasize breathable fabrics, increasing sales among working-class households. In Gifu Prefecture, rural areas still see steady demand for futon mattresses, reflecting a blend of tradition and modernity within the region.

Kyushu-Okinawa Region Mattress Market Trends:

In Kyushu and Okinawa, the warm and humid climate drives demand for cooling and moisture-resistant mattresses. Retailers in Fukuoka report increasing interest in mattresses made with bamboo charcoal and gel-infused foam for better airflow. Okinawa’s expanding tourism sector boosts luxury mattress sales for high-end resorts. For instance, a Naha-based store noted a 25% rise in hotel-grade mattresses, addressing the growing need for guest comfort in tropical environments.

Tohoku Region Mattress Market Trends:

Tohoku’s cold climate shapes preferences for insulated mattresses offering warmth. Wool and thermal-layer mattresses are popular for homes in regions like Sendai, where winters are harsh. Local brands focus on heat-retaining materials, boosting sales among rural communities. A Morioka-based retailer saw significant interest in heated mattress pads, addressing consumer needs during snowy seasons. This trend reflects Tohoku’s prioritization of comfort and practicality in bedding choices.

Chugoku Region Mattress Market Trends:

With an aging population, the Chugoku region sees a rising demand for orthopedic mattresses. Residents in Hiroshima favor products designed for back support and joint relief. Adjustable firmness options are increasingly popular, catering to elderly consumers. Retailers in Okayama highlight growth in sales of pressure-relief foam mattresses, often recommended by healthcare providers. These trends underscore the region’s focus on health and wellness in addressing demographic challenges.

Hokkaido Region Mattress Market Trends:

Hokkaido’s extreme winters influence the demand for mattresses with superior thermal properties. Residents in Sapporo prefer materials like latex and wool, which offer both insulation and hypoallergenic benefits. Retailers also report interest in mattresses with antimicrobial features due to the dampness associated with snowmelt seasons. A local brand in Asahikawa developed thermal foam mattresses, catering to Hokkaido’s unique need for warmth and allergy prevention.

Shikoku Region Mattress Market Trends:

Shikoku’s rural setting maintains a preference for futons but shows growing interest in Western-style mattresses. Younger consumers in cities like Matsuyama are driving the demand for hybrid mattresses with enhanced lumbar support. Eco-friendly varieties made from natural latex and organic cotton are gaining immense popularity among environmentally conscious consumers. For example, a local store in Kochi saw a 15% increase in sales of sustainable mattresses, reflecting shifting sleep habits in the region.

Top Companies Leading in the Japan Mattress Industry

The report offers an in-depth analysis of the Japan mattress market, covering market structure, key player positioning, winning strategies, and a competitive dashboard. It includes a company evaluation quadrant and detailed profiles of major players, providing valuable insights into the competitive landscape and strategic approaches shaping the industry.

Japan Mattress Market Segmentation Coverage

- On the basis of the product, the market has been bifurcated into innerspring mattresses, memory foam mattresses, latex mattresses, and others, wherein innerspring mattresses represent the most preferred segment. Innerspring mattresses offer robust support with coiled layers, catering to individuals seeking a traditional yet reliable sleep solution.

- On the basis of the distribution channel, the market is categorized into online distribution and offline distribution, amongst which offline distribution dominates the market. Offline distribution for mattresses allows customers to experience products firsthand, driving trust and enabling informed purchasing through tactile interactions in physical retail environments.

- On the basis of size, the market has been divided into twin or single size, twin XL size, full or double size, queen size, king size mattress, and others. Among these, queen size exhibits a clear dominance in the market. Queen-size mattresses provide an ideal balance of space and versatility, suiting both individuals and couples.

- Based on the application, the market has been bifurcated into domestic and commercial, wherein domestic dominates the market. Domestic mattress production emphasizes on quality control, supports local economies, and reduces delivery times, appealing to customers prioritizing quick, reliable, and ethically sourced options.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1.3 Billion |

| Market Forecast in 2033 | USD 1.9 Billion |

| Market Growth Rate 2025-2033 | 4.5% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Innerspring Mattresses, Memory Foam Mattresses, Latex Mattresses, Others |

| Distribution Channels Covered | Online Distribution, Offline Distribution |

| Size Covered | Twin or Single Size, Twin XL Size, Full or Double Size, Queen Size, King Size Mattress, Others |

| Applications Covered | Domestic, Commercial |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Mattress Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)