Japan LiDAR Market Expected to Reach USD 844.3 Million by 2033 - IMARC Group

Japan LiDAR Market Statistics, Outlook and Regional Analysis 2025-2033

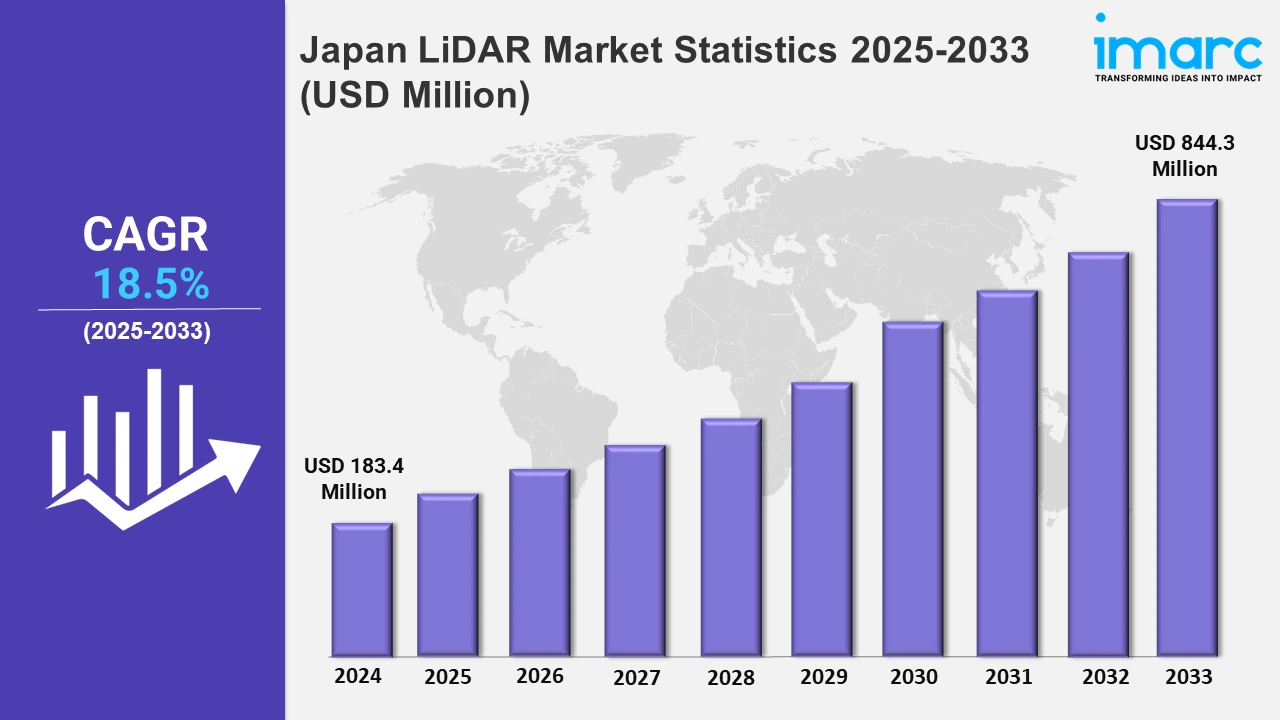

The Japan LiDAR market size was valued at USD 183.4 Million in 2024, and it is expected to reach USD 844.3 Million by 2033, exhibiting a growth rate (CAGR) of 18.5% from 2025 to 2033.

To get more information on this market, Request Sample

The Japan LiDAR market is witnessing growth driven by the elevating need for precision mapping and extensive applications in autonomous driving and industrial automation. The integration of LiDAR systems with cutting-edge innovations like artificial intelligence and machine learning has further enhanced their capabilities. This surge in demand is also supported by government initiatives to improve infrastructure and promote smart city projects, emphasizing the critical role of LiDAR in urban planning, transportation management, environmental monitoring, etc. In line with these trends, key players in the industry have introduced groundbreaking technologies that redefine LiDAR applications. In June 2024, Terra Drone combined Kudan’s Lidar SLAM technology, thereby allowing seamless airborne and ground measurements. This innovation enhances mapping accuracy and reduces equipment costs, thereby expanding LiDAR’s applicability in diverse sectors, including construction and agriculture.

Similarly, in January 2025, Kyocera launched the camera-LIDAR fusion sensor. With the world's highest laser irradiation density, it provides parallax-free and real-time object detection, revolutionizing long-distance precision in autonomous driving and industrial automation. These developments reflect the industry's focus on creating cost-effective, highly accurate, and versatile solutions to meet evolving market needs. The rise in the need for advanced sensing technologies in industrial automation, robotics, and environmental studies further propels the increasing adoption of LiDAR in Japan. Companies are leveraging LiDAR’s ability to provide detailed 3D spatial data for applications like warehouse automation, agricultural monitoring, and disaster management. Supporting this trend, in May 2024, Lumotive and Hokuyo introduced the YLM-10LX 3D lidar sensor for true solid-state beam steering. This breakthrough enhances 3D sensing precision, reliability, and adaptability, setting new benchmarks for industrial automation and service robotics applications. Such advancements underscore the transformative potential of LiDAR technology in driving innovation across multiple sectors in Japan.

Japan LiDAR Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. These regions focus on integrating sustainable strategies, which is stimulating the market.

Kanto Region LiDAR Market Trends:

The Kanto region, home to Tokyo and Yokohama, leads Japan's LiDAR adoption due to advanced infrastructure and autonomous vehicle testing. Tokyo's 2024 autonomous bus trials use LiDAR for precision mapping and obstacle detection. Companies like Mitsubishi Electric focus on urban applications, including smart city initiatives. For example, Chiba Prefecture integrates LiDAR in flood prediction systems, enhancing disaster management and improving response times in this highly urbanized region.

Kinki Region LiDAR Market Trends:

Kinki region, including Osaka and Kyoto, emphasizes industrial and heritage applications of LiDAR. Kyoto Prefecture uses LiDAR to preserve UNESCO heritage sites like Kiyomizu-dera digitally. Osaka integrates LiDAR in smart logistics hubs for automation and safety in warehouses. These trends highlight the region’s focus on preserving cultural assets while fostering industry innovation, positioning Kansai as a hub for diverse LiDAR technologies.

Central/Chubu Region LiDAR Market Trends:

The Central/Chubu region, with Nagoya as its hub, sees LiDAR adoption in automotive manufacturing and seismic monitoring. Toyota City, the headquarters of Toyota Motors, uses LiDAR in the R&D of autonomous vehicles. Additionally, LiDAR supports earthquake preparedness programs by mapping fault lines in Gifu Prefecture. These initiatives underscore Chubu’s dual focus on automotive innovation and disaster resilience, making it a key player in Japan’s LiDAR market.

Kyushu-Okinawa Region LiDAR Market Trends:

Kyushu and Okinawa prioritize LiDAR in renewable energy and coastal management. Okinawa Prefecture employs LiDAR to map coral reefs and monitor erosion, aiding marine conservation. Meanwhile, Fukuoka leverages LiDAR in offshore wind energy projects, optimizing turbine placement and efficiency. The region’s focus on environmental sustainability and clean energy positions it as a leader in leveraging LiDAR for ecological and industrial benefits.

Tohoku Region LiDAR Market Trends:

In Tohoku, LiDAR is essential for post-disaster reconstruction and agricultural innovation. Miyagi Prefecture uses LiDAR to assess tsunami-damaged areas and plan resilient infrastructure. In Akita, LiDAR-based precision farming improves crop yields by analyzing soil and terrain. These applications reflect Tohoku’s focus on leveraging LiDAR for recovery and enhancing productivity in agriculture, supporting the region’s economic revitalization.

Chugoku Region LiDAR Market Trends:

The Chugoku region, including Hiroshima, applies LiDAR to optimize port operations and logistics. Hiroshima Prefecture uses LiDAR in port automation to enhance safety and streamline cargo handling. LiDAR also supports landslide risk assessments in mountainous areas like Yamaguchi. These efforts highlight the region’s dual focus on improving transportation efficiency and mitigating natural disaster risks using LiDAR technologies.

Hokkaido Region LiDAR Market Trends:

Hokkaido, Japan’s northernmost island, uses LiDAR in forestry and snow management. The prefecture employs LiDAR to map forests for sustainable logging practices and wildlife monitoring. Sapporo integrates LiDAR in smart snow removal systems, enhancing urban mobility during harsh winters. These initiatives reflect Hokkaido’s focus on environmental conservation and infrastructure optimization in response to its unique climatic and geographic challenges.

Shikoku Region LiDAR Market Trends:

In Shikoku, LiDAR supports bridge maintenance and flood prevention. Ehime Prefecture uses LiDAR to monitor the Seto Inland Sea bridges for structural health. Additionally, Kagawa Prefecture employs LiDAR for flood risk mapping, improving early warning systems. These applications highlight Shikoku’s focus on enhancing infrastructure durability and mitigating climate-related risks, leveraging LiDAR to address its geographical and environmental vulnerabilities.

Top Companies Leading in the Japan LiDAR Industry

The report offers an in-depth analysis of the competitive landscape in Japan's LiDAR market. It examines market structure, key player positioning, leading strategies, competitive dashboards, and a company evaluation quadrant. Additionally, comprehensive profiles of major companies operating in the LiDAR sector are included, providing insights into their strategies, innovations, and market performance.

Japan LiDAR Market Segmentation Coverage

- On the basis of the installation type, the market has been bifurcated into airborne and terrestrial. Airborne and terrestrial LiDAR systems provide precise topographic data, with airborne systems capturing large-scale terrain details and terrestrial systems offering high-resolution insights for ground-level applications.

- Based on the component, the market is categorized into laser scanners, navigation systems, global positioning systems, and others. LiDAR systems integrate these technologies to achieve accurate spatial mapping, ensuring precise data collection for diverse applications like surveying and monitoring.

- On the basis of the application, the market has been divided into corridor mapping, engineering, environment, exploration, ADAS, and others. LiDAR supports these applications to deliver detailed spatial data critical for infrastructure planning, ecological assessments, and advanced vehicular systems.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 183.4 Million |

| Market Forecast in 2033 | USD 844.3 Million |

| Market Growth Rate 2025-2033 | 18.5% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Installation Types Covered | Airborne, Terrestrial |

| Components Covered | Laser Scanners, Navigation Systems, Global Positioning Systems, Others |

| Applications Covered | Corridor Mapping, Engineering, Environment, Exploration, ADAS, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on LiDAR Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)