Japan Gas Turbine Market Expected to Reach USD 2.6 Billion by 2033 - IMARC Group

Japan Gas Turbine Market Statistics, Outlook and Regional Analysis 2025-2033

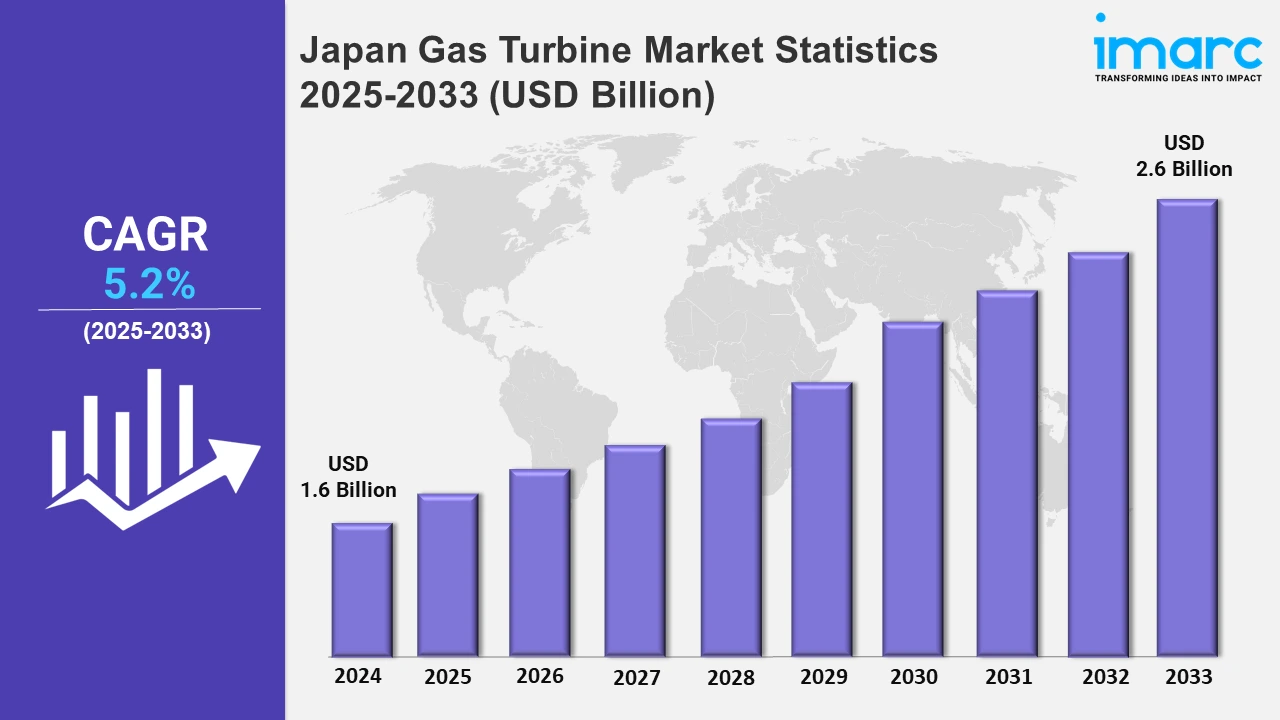

The Japan gas turbine market size was valued at USD 1.6 Billion in 2024, and it is expected to reach USD 2.6 Billion by 2033, exhibiting a growth rate (CAGR) of 5.2% from 2025 to 2033.

To get more information on this market, Request Sample

Japan continues to make efforts to develop ammonia-compatible gas turbine technology for power generation, with an emphasis on greener fuel sources. Collaborative engineering projects seek to enable efficient combustion of ammonia, hence promoting decarbonization and the transition to sustainable energy systems in the power industry. For example, in January 2024, GE Vernova's gas power business and IHI Corporation (IHI) signed an agreement for building a gas turbine combustor as a viable fuel option for generating power.

Moreover, Japan is expanding natural gas-fired power production through high-efficiency combined cycle facilities that incorporate cutting-edge technologies to provide greener energy alternatives. These projects demonstrate a commitment to updating energy infrastructure and achieving decarbonization targets through new gas turbine applications in power production. For instance, in July 2023, Mitsubishi Power signed a contract by Chiba-Sodegaura Power Co., Ltd for the construction of three gas turbines in Sodegaura City, Chiba Prefecture. Furthermore, the Japan gas turbine market is advancing due to a focus on efficiency and lower emissions. Additionally, there is rising demand for high-efficiency turbines in the power generation, transportation, and industrial sectors, creating considerable potential for market participants. For example, leading manufacturers, such as Mitsubishi Heavy Industries, are creating high-performance aero-derivative turbines that provide improved fuel economy and reduce carbon emissions. These turbines are increasingly being used in power plants and industrial activities throughout Japan, aligning with the government's aim of transitioning to a low-carbon economy. The need is also supported by energy companies such as JERA, which use modern turbines in their projects to fulfill increased electricity demand while adhering to environmental rules and sustainability requirements.

Japan Gas Turbine Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto region, Kansai/Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The elevating demand for electricity is positively driving the growth of the market.

Kanto Region Gas Turbine Market Trends:

The Kanto region prioritizes the upgrade of gas-fired power facilities to address rising energy demand. For example, JERA's new 0.78 GW unit at Chiba's Goi gas-fired power plant began operations in August 2024. This plant, powered by modern General Electric turbines, achieves 64% efficiency while replacing older and less efficient units. It meets rising electricity demand at peak times, demonstrating the region's commitment to updating power-producing infrastructure.

Kansai/Kinki Region Gas Turbine Market Trends:

The Kansai/Kinki region promotes energy efficiency through technical advancements in gas turbines. Mitsubishi Heavy Industries has facilities in Kobe and Takasago that specialize in high-performance turbines. Its cutting-edge gas turbines are integrated into regional power networks, providing increased efficiency and lower emissions. This reflects the region's emphasis on sustainable energy techniques, which maintain a balance between industrial expansion and environmental stewardship.

Central/Chubu Region Gas Turbine Market Trends:

The Chubu region emphasizes efficiency and pollution reduction in its energy infrastructure. For example, Chubu Electric Power Co. invests in gas turbine upgrades to comply with Japanese environmental standards. These retrofits enhance operating efficiency while also meeting residential and industrial energy requirements. The developments assure a steady power supply across the region's major urban and industrial areas, demonstrating a strong commitment to sustainable energy solutions.

Kyushu-Okinawa Region Gas Turbine Market Trends:

The Kyushu-Okinawa region is focused on developing reliable and clean energy systems that employ advanced gas turbines. For instance, Kyushu Electric Power improves turbine technologies in its gas-fired power plants, minimizing environmental effects. This maintains a consistent power supply for both the mainland and Okinawa's islands, meeting the region's various energy needs.

Tohoku Region Gas Turbine Market Trends:

The Tohoku region is enhancing its energy infrastructure to fulfill expanding demand on a sustainable basis. Tohoku Electric Power Co. has been improving the efficiency and dependability of its gas turbines. Recent upgrades to its power plants have focused on lowering emissions and providing a reliable energy supply to enterprises and inhabitants, demonstrating the region's dedication to energy efficiency and resilience in the face of changing energy problems.

Chugoku Region Gas Turbine Market Trends:

The Chugoku region targets updating turbine systems to maintain operational dependability. For example, Chugoku Electric Power Co. updates its gas-fired power stations to satisfy changing energy demands while lowering emissions. This endeavor benefits the regional industry and people by assuring a reliable energy supply while maintaining environmental goals.

Hokkaido Region Gas Turbine Market Trends:

To meet extreme climatic conditions, the Hokkaido region blends renewable energy with gas turbines. For example, Hokkaido Electric Power Co. uses hybrid systems that combine gas turbines and renewables to ensure a consistent electricity supply. This system offers dependability throughout harsh winters, meeting both industrial and residential demands while encouraging environmentally friendly practices.

Shikoku Region Gas Turbine Market Trends:

The Shikoku region favors gas turbine efficiency to provide energy stability. For instance, Shikoku Electric Power Co. adjusts its turbines to increase power output and cost-effectiveness. These initiatives supply continuous electricity to local enterprises and families, maintaining dependability in the region's relatively small but critical energy market.

Top Companies Leading in the Japan Gas Turbine Industry

Some of the leading Japan gas turbine market companies have been included in the report. The report provides an in-depth competitive analysis, examining the market structure, the positioning of key players, leading strategies for success, a competitive overview dashboard, and an evaluation quadrant for assessing company performance.

Japan Gas Turbine Market Segmentation Coverage

- Based on the technology, the market has been classified into combined cycle gas turbine and open cycle gas turbine. Combined cycle gas turbines are increasingly being used in power generation because of their great efficiency and low emissions. Open-cycle gas turbines provide flexibility by enabling peak load control and quick startup to handle variable energy demands efficiently.

- Based on the design type, the market has been categorized into heavy-duty (frame) type and aero-derivative type. Heavy-duty (frame) type is commonly utilized for power production in utilities and large enterprises due to its long life and high output. The aero-derivative type, known for its efficiency and flexibility, is used in small power plants, transportation, and oil and gas applications.

- Based on the rated capacity, the market has been divided into above 300 MW, 120-300 MW, 40-120 MW, and less than 40 MW. Large-scale power plants employ turbines above 300 MW to handle high energy needs efficiently. The 120-300 MW sector serves midsize industrial activities. Turbines in the 40-120 MW range are ideal for smaller facilities, while those less than 40 MW meet localized power demands with flexibility and cost-effectiveness.

- Based on the end user, the market is classified into power generation, mobility, oil and gas, and others. Power generation is a critical application for providing dependable electricity to utilities and industrial operations. Mobility utilizes turbines for aerospace and marine propulsion, with an emphasis on efficiency and performance. The oil and gas industry relies on turbines to power energy-intensive activities such as extraction, refining, and pipeline compression, providing consistent results.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1.6 Billion |

| Market Forecast in 2033 | USD 2.6 Billion |

| Market Growth Rate 2025-2033 | 5.2% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Combined Cycle Gas Turbine, Open Cycle Gas Turbine |

| Design Types Covered | Heavy Duty (Frame) Type, Aeroderivative Type |

| Rated Capacities Covered | Above 300 MW, 120-300 MW, 40-120 MW, Less Than 40 MW |

| End Users Covered | Power Generation, Mobility, Oil and Gas, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Gas Turbine Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)