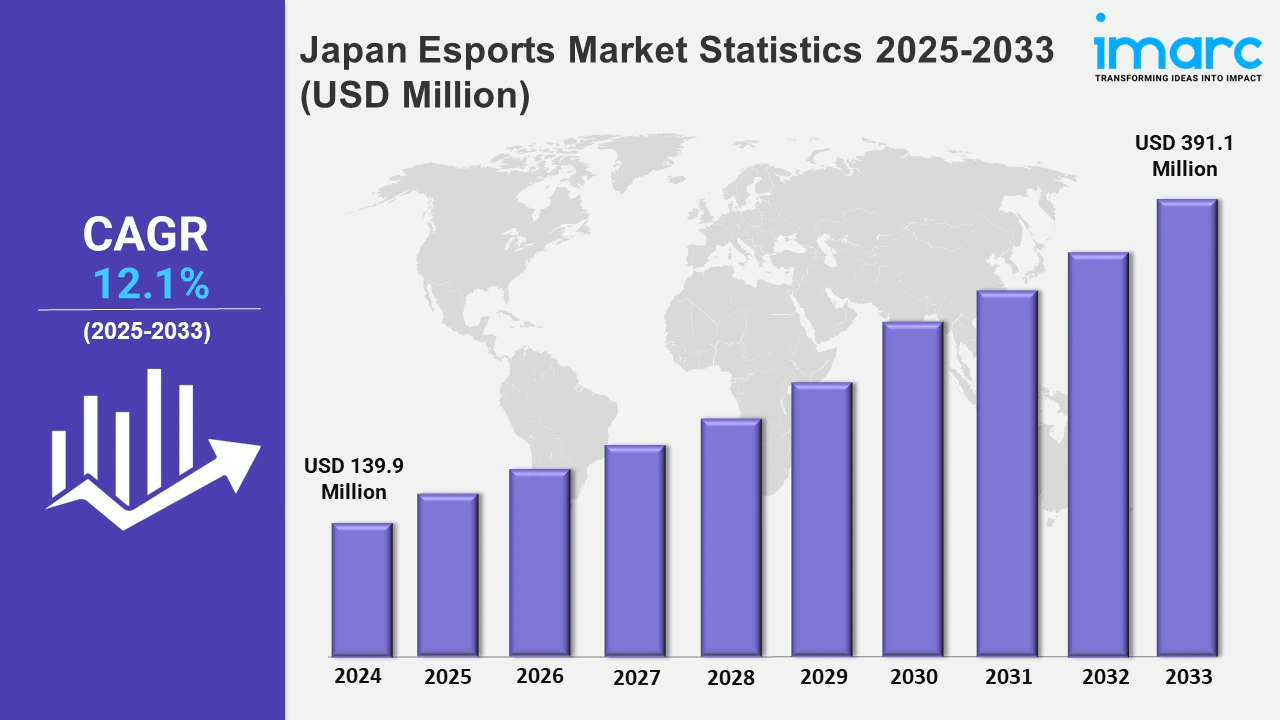

Japan Esports Market Expected to Reach USD 391.1 Million by 2033 - IMARC Group

Japan Esports Market Statistics, Outlook and Regional Analysis 2025-2033

The Japan esports market size was valued at USD 139.9 Million in 2024, and it is expected to reach USD 391.1 Million by 2033, exhibiting a growth rate (CAGR) of 12.1% from 2025 to 2033.

To get more information on this market, Request Sample

The rise of esports-focused living spaces is transforming unused properties in Japan into immersive gaming hubs. These modern facilities cater to gamers by providing high-tech environments designed for skill development and competitive play. Beyond creating a unique lifestyle experience, the initiative seeks to elevate esports' cultural presence. By repurposing vacant homes and apartments, this concept merges technology, entertainment, and community revitalization, reflecting a growing demand for specialized spaces tailored to digital enthusiasts. For example, in January 2025, TFOA formed an alliance with Broad Enterprise, an Osaka-based property renovator and high-speed internet provider, to transform Japan's vacant houses and apartments into high-tech gaming facilities to attract esports players and avid gamers. The project also aims to increase the visibility of esports in Japan and help revitalize local communities, further escalating the market growth.

Another popular trend in Japan's esports industry is the rapid growth of professional esports leagues and competitions. Well-known video games such as Street Fighter and Valorant allow for the formation of structured championships. In addition to exhibiting outstanding talent, these events attract large crowds due to live venues and internet broadcast platforms. Sponsors and advertisers have made major investments in esports as it has grown in prominence as a spectator sport. For example, in March 2024, Riot Games, which has a strong presence in Japan, announced plans to change the League of Legends (LoL) esports business model with the goal of increasing sustainability by lowering reliance on sponsorships. The modifications include fixed team stipends, revenue sharing from digital content, and a Global Revenue Pool (GRP). Furthermore, these championships have been ingrained in Japan's cultural and entertainment sectors, attracting both domestic and international interest.

Japan Esports Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The growing professional tournaments are augmenting the market.

Kanto Region Esports Market Trends:

The rising number of esports events across the Kanto region is expanding the overall market. One of the major examples is Akihabara, which is also known as an electric town located near Tokyo that hosts gaming cafes. Moreover, the growing gaming culture across the region through expos like the Tokyo Game Show is propelling the growth of the market.

Kinki Region Esports Market Trends:

Osaka in the Kinki region is developing specialized education games, focusing on tools like UEFN. Amazing Inc. has announced that Osaka e-Games Advanced Academy will host Japan's first specialized training in Unreal Editor for Fortnite (UEFN) in April 2025. These initiatives aim to equip students with practical skills required within popular gaming platforms, further propelling the growth of esports in the Kinki region.

Central/Chubu Region Esports Market Trends:

The escalating focus on integrating esports into education in the Chubu region is acting as one of the major growth-inducing factors. In this area, schools are also launching esports programs. For example, Nagoya University has launched an esports course. Moreover, the rising penetration of creating a career pathway through esports is driving the growth of the market in the Central/Chubu region.

Kyushu-Okinawa Region Esports Market Trends:

There has been a significant increase in esports tourism across the Kyushu and Okinawa regions. Various events like the Fukuoka esports championship attract fans from across Japan. Okinawa utilizes its tropical attractions in organizing esports-themed travel packages. Moreover, the region’s relaxed vibe makes it attractive for younger audiences. This strategy uniquely combines esports with local tourism development.

Tohoku Region Esports Market Trends:

The Tohoku region drives esports market growth by using gaming to bring life back to rural areas. Sendai City hosts esports tournaments to attract young people and visitors. These events create excitement and bring new energy to places that often feel quiet. Local governments and businesses also invest in gaming centers and training programs, giving young players a reason to stay or move to the area.

Chugoku Region Esports Market Trends:

The increasing popularity of gaming events across the Chugoku region is propelling the growth of the market. For example, in November 2024, Enecom, Inc. launched the Hiroshima eSports Corporate Exchange Games at the Kamiyacho Chaleo Central Square. These events showcased how esports can foster collaboration and support local development.

Hokkaido Region Esports Market Trends:

Winter gaming festivals in Hokkaido attract many visitors, thereby offering a combination of esports and outdoor activities like skiing. Sapporo, one of the main cities in the region, also hosts various regional tournaments and expos, which is further acting as a prominent growth-inducing factor.

Shikoku Region Esports Market Trends:

Shikoku is building a niche as a development hub for indie esports games. Local game developers collaborate with small gaming events to promote their creations. Cities like Takamatsu support startups and creative projects, making Shikoku an incubator for innovation. It allows for tight-knit gaming communities to thrive.

Top Companies Leading in the Japan Esports Industry

Prominent organizations mark the competitive landscape of the Japan esports market. Major gaming companies drive innovations and sponsorships, making them prominent participants. For example, in October 2024, Konami announced six releases that gained extensive traction in the country. They include Suikoden I&II HD Remaster, Metal Gear Solid Delta: Yu-Gi-Oh! Early Days Collection, Snake Eater, and two Silent Hill titles.

Japan Esports Market Segmentation Coverage

- On the basis of the revenue model, the market has been bifurcated into media rights, advertising and sponsorships, merchandise and tickets, and others. Media rights allow broadcasters and other media companies to broadcast the tournaments. Moreover, advertising and sponsorships are important revenue streams in the esports industry. Brands collaborate with organizations to promote their products or services to targeted audiences. Furthermore, merchandise and ticket sales include direct revenue for esports events and teams.

- Based on the platform, the market has been bifurcated into PC-based esports, consoles-based esports, and mobile and tablets. PC-based esports are one of the most popular forms of gaming. It offers high-performance gaming with special equipment, further driving the segment's growth. Additionally, console-based esports involve gaming on systems. Apart from this, mobile and tablets are gaining immense popularity due to the growing usage of smartphones and tablets.

- On the basis of the games, the market has been bifurcated into multiplayer online battle arena (MOBA), player vs players (PvP), first-person shooters (FPS), and real-time strategy (RTS). MOBA team-based strategy games in which players control a single character and work with teammates to destroy the enemy's base. Additionally, PvP involves playing against each other. This does not involve any opponent. Real-time strategy (RTS) games comprise strategic thinking, which is gaining traction in the country.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 139.9 Million |

| Market Forecast in 2033 | USD 391.1 Million |

| Market Growth Rate 2025-2033 | 12.1% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Revenue Models Covered | Media Rights, Advertising and Sponsorships, Merchandise and Tickets, Others |

| Platforms Covered | PC-based Esports, Consoles-based Esports, Mobile and Tablets |

| Games Covered | Multiplayer Online Battle Arena (MOBA), Player vs Players (PvP), First Person Shooters (FPS), Real Time Strategy (RTS) |

| Regions Covered | Kanto Region, Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Esports Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)