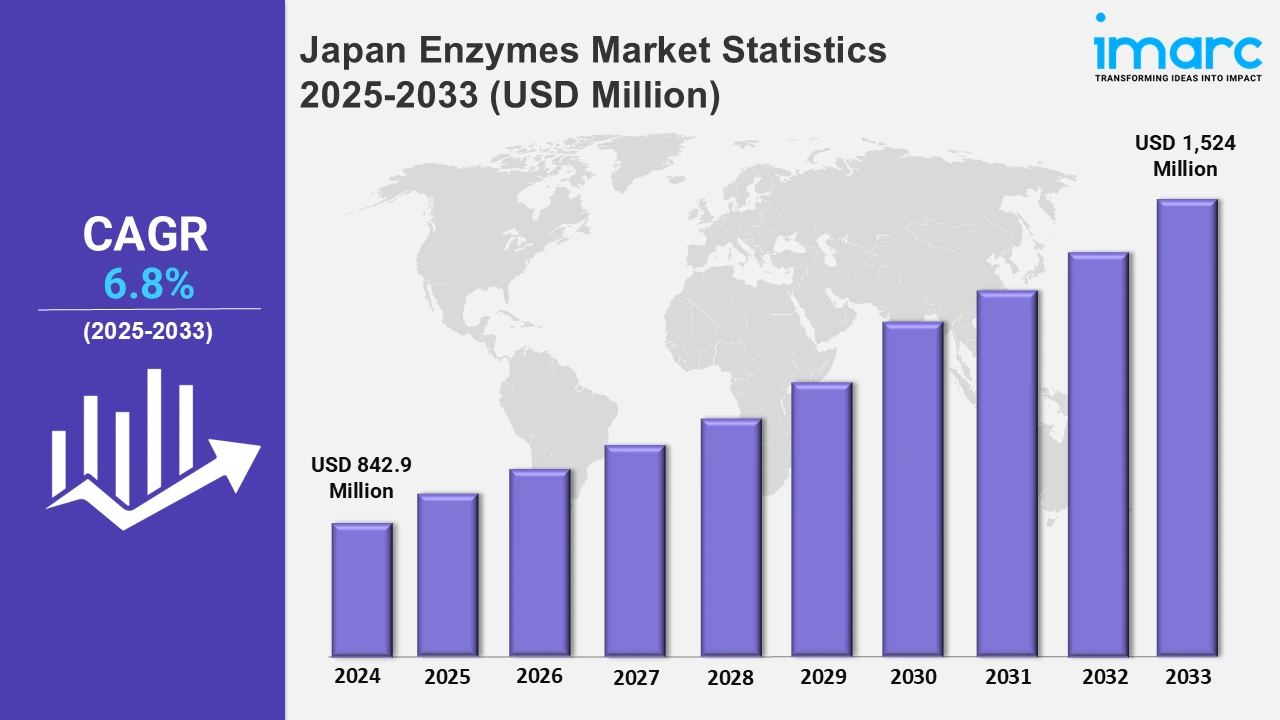

Japan Enzymes Market Expected to Reach USD 1,524 Million by 2033 - IMARC Group

Japan Enzymes Market Statistics, Outlook and Regional Analysis 2025-2033

The Japan enzymes market size was valued at USD 842.9 Million in 2024, and it is expected to reach USD 1,524 Million by 2033, exhibiting a growth rate (CAGR) of 6.8% from 2025 to 2033.

To get more information on this market, Request Sample

The market for enzymes in Japan is extending rapidly as the developments in targeted therapies are increasing. The growing emphasis on precision medicine, which strives to deliver treatments suited to individual patient needs, is a significant trend impacting this market. Also, factors such as the rising cases of chronic diseases, like autoimmune diseases and cardiovascular conditions, are further catalyzing the demand for enzyme-based treatments. They aimed at immune system modulation and cholesterol management to meet unmet medical demands. For instance, Otsuka proposed a new drug application in Japan for bempedoic acid in November 2024, a medication intended to treat hypercholesterolemia. This medication's method of action targets particular enzymatic pathways, thereby inhibiting the ATP citrate lyase enzyme, which represents a breakthrough in cholesterol balancing.

Aligned with these advances, in November 2024, Otsuka presented Lupkynis, an immunosuppressive medication used to treat lupus nephritis. The possibility of enzyme-targeted treatments for autoimmune disorders is highlighted by Lupkynis, which inhibits calcineurin. These improvements show how the pharmaceutical industry in Japan is using advanced strategies, impelling the enzyme sector ahead. Moreover, the growing emphasis on enzyme replacement therapies (ERTs) is another vital aspect pushing the market growth. ERTs offer expectancy for rare genetic disorders and chronic diseases where enzyme deficiencies play a key role. For example, Takeda's ADZYNMA was approved in March 2024 as the first recombinant ADAMT13 enzyme therapy for congenital thrombotic thrombocytopenic purpura. Besides this, an unmet need in enzyme replacement is addressed with this approval. The government's support of research and development projects, the growing use of advanced biotechnological tools, and healthcare practitioners' knowledge of enzyme therapies are all expected to fuel the Japan enzyme market's expansion.

Japan Enzymes Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. Advances in biotechnology and the growing demand for sustainable solutions across various industries are key driving factors in Japan's enzymes industry.

Kanto Region Enzymes Market Trends:

The pharmaceutical companies are focusing on the Kanto region, which includes Tokyo. The need for proteolytic enzymes has increased because of advances in enzyme-based pharmaceutical compositions. Companies such as Daiichi Sankyo in Tokyo have embraced enzymes for biocatalysis in drug synthesis, thereby lowering production duration and prices. The region also makes investments in food enzymes, especially amylases, due to the expanding processed food business and the desire to extend food shelf life.

Kansai/Kinki Region Enzymes Market Trends:

Home to Osaka and Kobe, the Kansai region emphasizes on industrial enzymes for textiles and brewing. Amylase and protease usage in sake production is prominent, exemplified by companies like Takara Bio in Kyoto. The region’s textile industry leverages cellulases for eco-friendly processing. Kansai’s focus on sustainability drives enzyme demand, particularly for industrial applications that align with reduced chemical usage and energy-efficient manufacturing processes.

Central/Chubu Region Enzymes Market Trends:

Enzymes are utilized in the manufacturing of automotive components in the Central/Chubu region. Moreover, bio-lubricant formulations include enzymes such as lipases to reduce their influence on the environment. Additionally, Chubu’s thriving food sector sees significant use of pectinases for juice clarification. Companies such as Toyobo, based in Shizuoka, contribute to the regional enzyme market by developing innovative enzyme solutions for industrial and food applications.

Kyushu-Okinawa Region Enzymes Market Trends:

In the Kyushu-Okinawa region, enzymes support the agriculture and aquaculture industries. Okinawa leverages proteases for fish feed formulations, thereby enhancing nutrient absorption. Kyushu’s rich soil supports enzyme-based biofertilizers, which aids in reducing reliance on chemical inputs. Companies like Kyushu BioTech in Fukuoka focus on producing enzymes for sustainable agricultural practices, making the region a leader in enzyme applications for primary industries.

Tohoku Region Enzymes Market Trends:

Tohoku, known for its agricultural prominence, sees a high demand for enzymes like cellulases in biomass processing for bioenergy. In addition, pectinases are used in Aomori Prefecture to produce fruit juice, which is a local specialty. Also, Tohoku companies are inventing enzyme-based technologies to turn agricultural trash into bioethanol to grow investments in renewable energy, thereby enabling the region to achieve its sustainability objectives and energy independence.

Chugoku Region Enzymes Market Trends:

The Chugoku region, including Hiroshima, integrates enzymes in its chemical and textile sectors. Cellulases are utilized in denim manufacturing for eco-friendly finishes, with Kurashiki being a key textile hub. The region’s key industry players incorporate oxidoreductases for green chemical synthesis. Hiroshima-based research centers focus on developing tailored enzymes for industrial use, positioning Chugoku as a growing player in the enzyme market for sustainable manufacturing.

Hokkaido Region Enzymes Market Trends:

The strong dairy sector in the Hokkaido region drives the need for enzymes, especially lactases, for lactose-free products. Rennet enzymes for cheese manufacturing are another segment of interest for Sapporo-based companies, which serve local and foreign markets. Moreover, scientists are examining enzymes that are highly active at low temperatures because of the region's frigid environment, which can help sectors like dairy processing and brewing.

Shikoku Region Enzymes Market Trends:

Shikoku region emphasizes enzyme applications in pulp and paper processing. Xylanases are employed to enhance pulp bleaching, reducing chemical usage. Ehime Prefecture, a key player, has companies like Oji Holdings implementing these enzymes to improve environmental outcomes. The region also sees enzyme applications in citrus processing, with pectinases used for juice clarification and essential oil extraction, leveraging Shikoku's status as a major citrus producer.

Top Companies Leading in the Japan Enzymes Industry

Some of the leading enzymes market companies include Amano Enzyme Inc., Nagase & Co. Ltd., and Novozymes A/S., among many others. The inflating demand for eco-friendly agricultural procedures is driving innovation in enzyme-based pesticide development. For example, Tokyo University researchers identified XccOpgD in August 2024, a novel enzyme important for pathogenic bacterial activity.

Japan Enzymes Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into protease, carbohydrase, lipase, polymerase and nuclease, and others. Enzymes act on proteins, carbohydrates, fats, nucleic acids, and polymers, facilitating digestion, energy release, and synthesis essential for biological processes and industrial applications.

- Based on the source, the market is categorized into microorganisms, plants, and animals. They produce enzymes to act on other biomolecules, ensuring efficient digestion, metabolism, and biosynthesis critical for growth, energy, and survival.

- On the basis of the reaction type, the market has been divided into hydrolase, oxidoreductase, transferase, lyase, and others. These reactions perform hydrolysis, oxidation-reduction, transfer, or cleavage essential for metabolic pathways and industrial processes.

- Based on the application, the market is categorized into food and beverages, household care, bioenergy, pharmaceutical and biotechnology, feed, and others. Enzymes play a vital role across industries, like food and beverages, as they aid in production and preservation. In household care, they enhance cleaning products. In bioenergy, these enzymes improve biofuel production. In pharmaceuticals and biotechnology, they accelerate drug development.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 842.9 Million |

| Market Forecast in 2033 | USD 1,524 Million |

| Market Growth Rate 2025-2033 | 6.8% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Protease, Carbohydrase, Lipase, Polymerase and Nuclease, Others |

| Sources Covered | Microorganisms, Plants, Animals |

| Reaction Types Covered | Hydrolase, Oxidoreductase, Transferase, Lyase, Others |

| Applications Covered | Food and Beverages, Household Care, Bioenergy, Pharmaceutical and Biotechnology, Feed, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Companies Covered | Amano Enzyme Inc., Nagase & Co. Ltd., Novozymes A/S, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Enzymes Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)