Japan Drones Market Expected to Reach USD 4.9 Billion by 2033 - IMARC Group

Japan Drones Market Statistics, Outlook and Regional Analysis 2025-2033

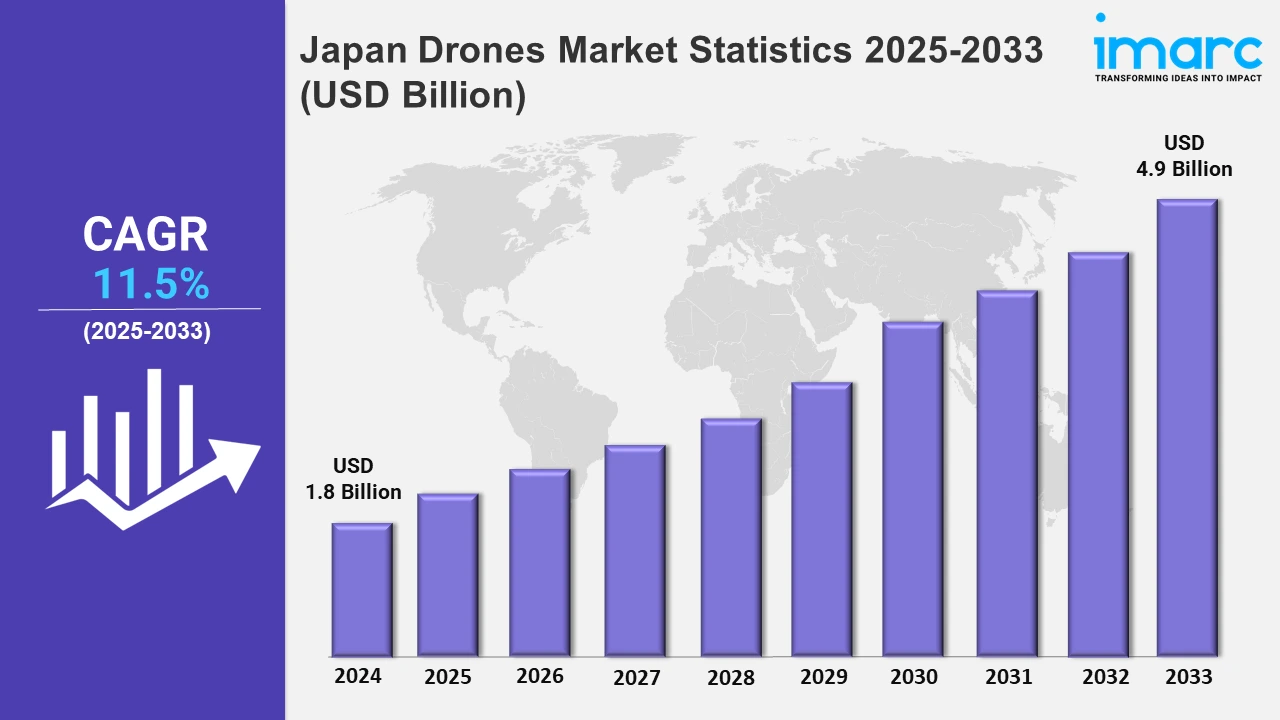

The Japan drones market size was valued at USD 1.8 Billion in 2024, and it is expected to reach USD 4.9 Billion by 2033, exhibiting a growth rate (CAGR) of 11.5% from 2025 to 2033.

To get more information on this market, Request Sample

The increasing demand for efficient logistics in rural and challenging terrains, enhanced disaster management capabilities, and innovations in defense and infrastructure applications are expanding the market in the country. The Japanese government’s active promotion of drone technology, including deregulated airspace for operations in rural areas and subsidies for innovative UAV solutions, is further bolstering the market. The integration of AI, advanced sensors, and modular designs is creating opportunities for drones to address complex issues across industries like construction, forestry, and defense. For instance, in August 2024, Tokyo-based JDrone dispatched a cargo drone service utilizing Yamaha FAZER R G2 and DJI Flycart 30 drones. They are well-suited for operations in mountainous regions, thereby providing critical assistance for disaster-relief missions with payload capacities of 55 kg and 35 to 45 kg.

Similarly, Japan’s Agency for Defense and Technology revealed its XLUUV submarine drone in May 2024. Developed by Mitsubishi Industries, this 10-meter-long unmanned underwater vehicle features modularity, advanced sonar systems, and autonomous operations lasting several weeks. This innovation marks a leap in maritime surveillance and defense capabilities, underlining Japan's focus on leveraging drones for strategic applications. Another development highlighting the integration of advanced technologies is Terra Drone’s approval of Kudan’s Lidar SLAM technology in June 2024. This enables precise 3D mapping for infrastructure assessment, under-bridge inspections, overhang measurement, etc. By reducing equipment costs and improving mapping accuracy, Terra Drone's solution represents a pivotal advancement in Japan’s UAV ecosystem, particularly in infrastructure management and urban planning.

Japan Drones Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The inflating focus on urban planning is elevating the market.

Kanto Region Drones Market Trends:

The Kanto region, including Tokyo, focuses on drones for urban logistics and smart city projects. Tokyo-based projects like the SkyHub initiative use drones for last-mile delivery in congested areas. This region emphasizes integrating drones into metropolitan infrastructure. This addresses urban challenges like traffic congestion and rapid parcel delivery demands fueled by rising e-commerce activities.

Kinki Region Drones Market Trends:

The Kinki region, which includes Osaka, explores drones for industrial inspections and disaster response. Osaka-based Kansai Electric Power uses drones to inspect power lines, thereby reducing operational risks and costs. Additionally, Kobe's harbor facilities employ drones to monitor ship emissions and port security. This industrial hub leverages drones for maintenance and safety across energy, logistics, and maritime sectors, ensuring resilience in critical infrastructure operations.

Central/Chubu Region Drones Market Trends:

The Central/Chubu region, home to Nagoya, focuses on drones for manufacturing and precision agriculture. In Aichi Prefecture, Toyota’s R&D division explores drone use in automated assembly lines. Simultaneously, Nagano farmers deploy drones for pest control and crop monitoring. This region leverages its manufacturing capabilities to integrate drones into factory automation while advancing agricultural efficiency in rural areas.

Kyushu-Okinawa Region Drones Market Trends:

The Kyushu-Okinawa region emphasizes drones for remote connectivity and renewable energy monitoring. Okinawa's isolated islands benefit from drones transporting medical supplies, tested by Japan Airlines. In Kyushu, drones inspect offshore wind farms, such as those in Kitakyushu, ensuring renewable energy efficiency. This region prioritizes drones for addressing geographical challenges and supporting sustainable energy projects.

Tohoku Region Drones Market Trends:

The Tohoku region, known for reconstruction after the 2011 earthquake, uses drones for disaster monitoring and agriculture. In Fukushima, they also monitor radiation levels in nuclear-affected zones. Additionally, rice farmers in Miyagi Prefecture employ drones for efficient fertilization. Tohoku integrates UAVs for recovery, balancing disaster resilience with agricultural modernization.

Chugoku Region Drones Market Trends:

The Chugoku region, including Hiroshima, highlights drones in forestry and maritime logistics. In Shimane, drones assist in mapping and monitoring forest health, addressing deforestation concerns. Hiroshima’s shipping industry uses drones for vessel inspections, thereby reducing maintenance costs and time. This region’s focus on preserving natural resources and enhancing shipping operations demonstrates its adaptation of drone technology to meet environmental and industrial needs.

Hokkaido Region Drones Market Trends:

Hokkaido, Japan's northernmost island, utilizes drones for large-scale farming and snow-covered terrain monitoring. In Obihiro, they help manage vast potato farms by analyzing crop health and applying fertilizers. Additionally, drones equipped with thermal imaging support avalanche monitoring in ski resorts like Niseko. The region emphasizes managing its expansive agricultural areas and harsh winter conditions, enhancing both safety and productivity.

Shikoku Region Drones Market Trends:

Shikoku, known for its small-scale agriculture and fisheries, integrates drones for coastal monitoring and crop management. In Ehime Prefecture, they aid citrus farmers in precision spraying and monitoring. Coastal areas utilize drones to track fishery activities and detect illegal fishing. This region focuses on drones to enhance productivity in agriculture and protect marine ecosystems, reflecting its reliance on natural resources and local industries.

Top Companies Leading in the Japan Drones Industry

The report offers an in-depth evaluation of the competitive dynamics within Japan's drone market. It explores aspects such as market structure, strategic positioning of key players, leading strategies for success, a competitive overview, and a company assessment quadrant. Additionally, it includes detailed profiles of prominent companies, highlighting their business strategies, technological advancements, and market contributions.

Japan Drones Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into fixed-wing, rotary-wing, and hybrid. Drones are classified into fixed-wing for long flights, rotary-wing for versatile maneuvering, and hybrid designs for combining both features to optimize efficiency and adaptability for diverse applications.

- Based on the component, the market is categorized into hardware, software, and accessories. Drones integrate hardware for operation, software for navigation and data processing, and accessories like cameras or sensors to enhance functionality across different industries and use cases.

- On the basis of the payload, the market has been divided into <25 Kilograms, 25-170 Kilograms, and >170 Kilograms. Drones are categorized by weight, with below 25 kilograms for lightweight tasks, 25–170 kilograms for medium payloads, and above 170 kilograms for heavy-duty operations, including industrial and military uses.

- Based on the point of sale, the market is categorized into original equipment manufacturers (OEM) and aftermarket. The drone industry includes OEMs providing complete systems and aftermarket segments offering components, upgrades, and replacement parts tailored to enhance performance or extend service life.

- On the basis of the end use industry, the market has been divided into construction, agriculture, military and defense, law enforcement, logistics, media and entertainment, and others. Drones serve construction for mapping, agriculture for crop monitoring, military for surveillance, law enforcement for patrol, logistics for deliveries, and media for filming.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 4.9 Billion |

| Market Growth Rate 2025-2033 | 11.5% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed Wing, Rotary Wing, Hybrid |

| Components Covered | Hardware, Software, Accessories |

| Payloads Covered | <25 Kilograms, 25-170 Kilograms, >170 Kilograms |

| Point of Sales Covered | Original Equipment Manufacturers (OEM), Aftermarket |

| End Use Industries Covered | Construction, Agriculture, Military and Defense, Law Enforcement, Logistics, Media and Entertainment, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Drones Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)