Japan Digital Transformation Market Expected to Reach USD 304.8 Billion by 2033 - IMARC Group

Japan Digital Transformation Market Statistics, Outlook and Regional Analysis 2025-2033

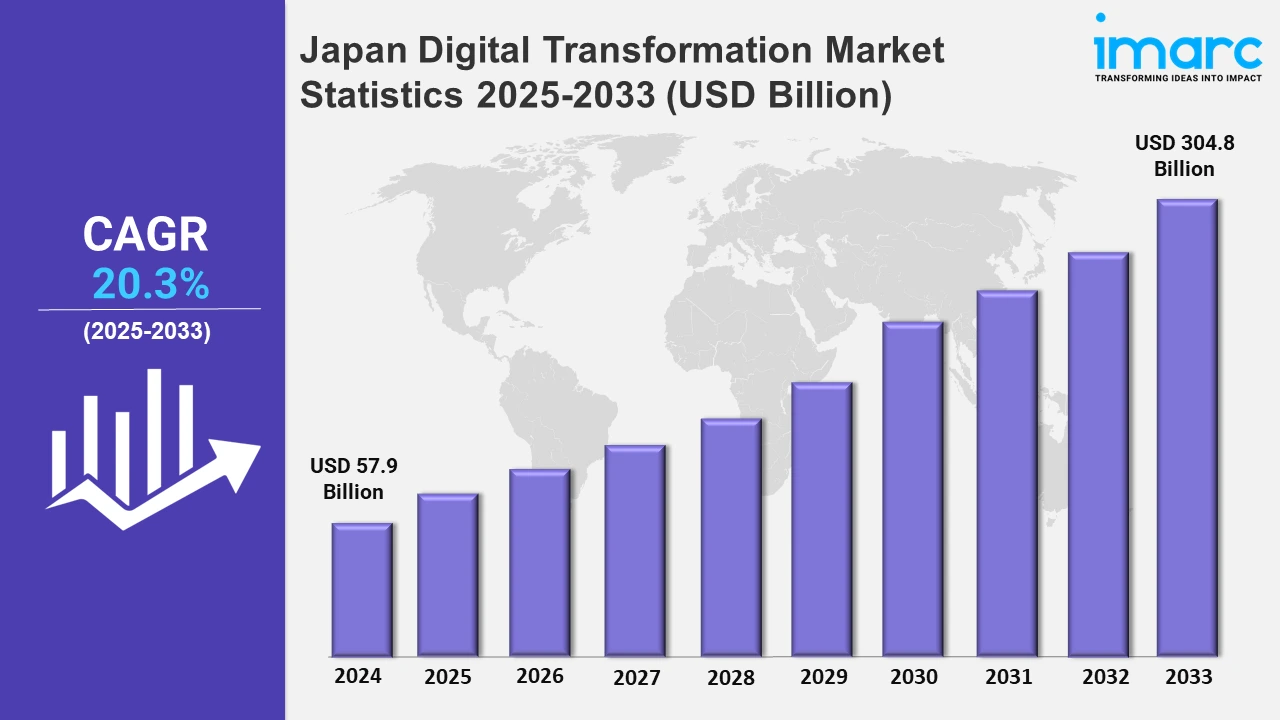

The Japan digital transformation market size was valued at USD 57.9 Billion in 2024, and it is expected to reach USD 304.8 Billion by 2033, exhibiting a growth rate (CAGR) of 20.3% from 2025 to 2033.

To get more information on this market, Request Sample

The growing adoption of novel technologies, government initiatives, partnerships, etc., are the factors accountable for boosting productivity and competitiveness in the digital transformation market in Japan. The country's emphasis on implementing edge computing, artificial intelligence, and IoT has stimulated innovations in manufacturing and healthcare industries, micro, small, and medium-sized businesses (MSMEs), and other applications. For instance, Japan’s commitment to developing smart cities and industry 4.0 standards has created benefits for technology providers and startups to thrive, addressing both local and international demands.

In line with these advancements, in August 2024, Stratus Technologies Japan collaborated with TQMO to launch a solution integrating Stratus ztC Edge and TQMO-XA software for real-time medical data management. This joint venture supports Japan's healthcare industry with operational reliability, thereby showcasing the role of advanced edge computing platforms. The increasing emphasis on cross-border collaborations and the demand for skilled workforces are driving bilateral initiatives between Japan and its neighboring countries. The country's employment shortages and aging population have prompted collaborations to draw in talent and technological expertise from developing nations. This is evident in the August 2024 launch of the Vietnam-Japan Digital Transformation Association in Tokyo. This initiative strengthened the IT revenue of Vietnam in Japan, targeting ¥1 Trillion by 2033. VADX Japan symbolizes a strategic alliance to address labor shortages and foster collaboration, further fueling the digital transformation market in Japan and the broader region.

Japan Digital Transformation Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The elevating need for novel security solutions and numerous digital platforms are expanding the market.

Kanto Region Digital Transformation Market Trends:

The Kanto region, which covers Tokyo, is at the forefront of Japan's efforts to undergo a digital transformation due to its concentration of multinational companies and startups. The government initiative of the smart city aims to incorporate AI and IoT into urban management, including real-time traffic monitoring. Moreover, corporations like Fujitsu enable cutting-edge technology like driverless cars, and deploying 5G networks. Tokyo's government offers incentives to promote digitalization in sectors, including e-commerce and banking, which is acting as a growth-inducing factor.

Kinki Region Digital Transformation Market Trends:

In the Kinki region, including Osaka, digital transformation emphasizes smart manufacturing and healthcare innovations. Osaka Prefecture supports the adoption of IoT and robotics in manufacturing hubs like Sakai, enhancing production efficiency. Panasonic’s development of smart appliances exemplifies the region's focus on integrating digital solutions. The Kansai Medical University leverages AI for early diagnosis, showcasing the area's dedication to healthcare transformation and smart industry applications.

Central/Chubu Region Digital Transformation Market Trends:

The Central/Chubu region emphasizes industrial digitalization for the automotive and aerospace sectors. In Nagoya, Toyota has adopted smart industrial technology and AI-driven automation. The area's manufacturers are using digital twins to maximize output. Concurrently, Nagoya City has implemented AI-powered disaster protection technologies, like real-time flood risk monitoring, demonstrating the region's emphasis on digital transformation in public safety and industry.

Kyushu-Okinawa Region Digital Transformation Market Trends:

Kyushu, including Fukuoka, focuses on agricultural and renewable energy transformation. Fukuoka-based startups like Green Earth Institute leverage AI to optimize farming yields. Okinawa has deployed blockchain technology for selling renewable energy to promote a decentralized energy demand. Besides this, these programs demonstrate the area's dedication to incorporating state-of-the-art technologies into environmentally friendly practices.

Tohoku Region Digital Transformation Market Trends:

Tohoku, including Sendai, emphasizes disaster resilience and smart agriculture in its digital transformation strategy. Sendai City deploys AI-driven disaster alert systems, reflecting its recovery efforts post-2011 tsunami. Precision agriculture using drones and IoT in Miyagi Prefecture is revolutionizing farming efficiency. These initiatives underscore Tohoku’s commitment to combining technology with community resilience and regional agricultural innovation.

Chugoku Region Digital Transformation Market Trends:

Chugoku emphasizes energy and transportation innovations in its digital efforts. Hiroshima City integrates IoT for optimizing public transport routes, reducing congestion. The Chugoku Electric Power Company uses AI to predict energy demand and enhance grid efficiency. These initiatives showcase the region’s focus on creating smart energy and transport systems, aligning with broader digital transformation goals.

Hokkaido Region Digital Transformation Market Trends:

The incorporation of IoT and AI into the agriculture and tourism industries is the primary focus of the Hokkaido region, which is contributing to the market growth. Also, the rising adoption of AI in Sapporo is improving the visitor experiences through tailored travel recommendations. In addition to this, drone technology is used for precision farming by agricultural cooperatives around Hokkaido. Furthermore, these advancements reflect the region's dual focus on sustainable agriculture and leveraging technology to boost its tourism-driven economy.

Shikoku Region Digital Transformation Market Trends:

Shikoku, particularly Kagawa Prefecture, prioritizes smart logistics and telemedicine. Kagawa’s logistics firms use IoT to track shipments and reduce operational costs. Telemedicine platforms are being developed in rural areas to offer enhanced healthcare access. The region's focus on addressing logistical and healthcare challenges through digital innovation reflects its unique approach to transformation within Japan’s broader tech landscape.

Top Companies Leading in the Japan Digital Transformation Industry

The report offers an in-depth analysis of Japan's digital transformation landscape, including market structure, leading player positioning, successful strategies, competitive dashboard, and company evaluation quadrant. It also features detailed profiles of key companies driving digital innovation in Japan, highlighting their strategies, technological advancements, and contributions to the country’s digital transformation initiatives.

Japan Digital Transformation Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into solution (analytics, cloud computing, mobility, social media, and others) and service (professional services, and integration and implementation). Solutions and services enable firms to streamline operations, enhance customer experiences, and drive innovation through advanced technologies like big data analytics.

- Based on the deployment mode, the market is categorized into cloud-based and on-premises. Cloud-based and on-premises digital transformation solutions offer flexibility, scalability, and security, i.e., catering to varied business needs and facilitating seamless integration of technologies across diverse environments.

- On the basis of the enterprise size, the market has been divided into large enterprises and small and medium-sized enterprises. Digital transformation empowers large enterprises with scalable solutions for complex operations. In contrast, small and medium-sized enterprises benefit from cost-effective tools to improve efficiency, agility, and competitive positioning.

- Based on the end use industry, the market is categorized into BFSI, manufacturing and retail, government, healthcare, IT and telecom, and others. Digital transformation drives innovation in these sectors, thereby enhancing efficiency, decision-making, and customer satisfaction through tailored technological solutions.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 57.9 Billion |

| Market Forecast in 2033 | USD 304.8 Billion |

| Market Growth Rate 2025-2033 | 20.3% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered |

|

| Deployment Modes Covered | Cloud-based, On-premises |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| End Use Industries Covered | BFSI, Manufacturing and Retail, Government, Healthcare, IT and Telecom, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Digital Transformation Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)