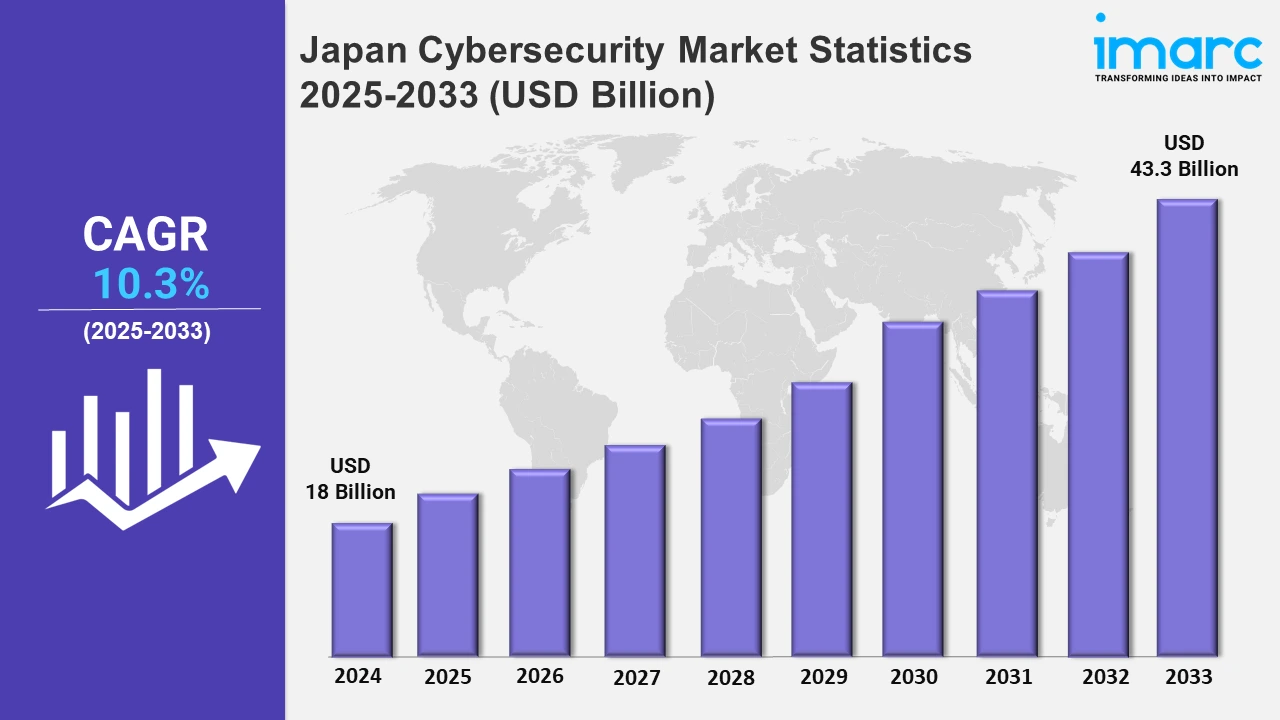

Japan Cybersecurity Market Expected to Reach USD 43.3 Billion by 2033 - IMARC Group

Japan Cybersecurity Market Statistics, Outlook and Regional Analysis 2025-2033

The Japan cybersecurity market size was valued at USD 18 Billion in 2024, and it is expected to reach USD 43.3 Billion by 2033, exhibiting a growth rate (CAGR) of 10.3% from 2025 to 2033.

To get more information on this market, Request Sample

There is a growing emphasis on improving cybersecurity as systematic data theft targeting national security and advanced technology prompts stronger preventive measures. For instance, in January 2025, Japan's National Police Agency identified over 200 cyberattacks by the Chinese hacking group MirrorFace. The attacks targeted national security and advanced technology, leading authorities to opt for stronger cybersecurity measures and outline the methods used in these systematic data theft attempts.

Moreover, an emphasis on specialized investment programs is encouraging cybersecurity innovation, fostering the development of advanced solutions, and improving the overall resilience of digital infrastructure across industries in response to changing threats in Japan's cybersecurity landscape. For example, in March 2024, Kanematsu Corporation, Kanematsu Electronics Ltd., and Global Security Experts Inc., in collaboration with WERU Investment Co., Ltd., announced the establishment of the "Nippon Cyber Security Fund 1 Investment Limited Partnership." This fund, launched in April 2024, is Japan's first to specialize in investing in security companies, aiming to bolster the nation's cybersecurity industry. Furthermore, Japan cybersecurity industry is expanding as a result of increased reliance on digital technology in industries such as automotive, energy, and finance. Companies are working on safeguarding vital systems while following laws, including the Cybersecurity Management Guidelines, which assure compliance. Additionally, they are investing in innovative solutions to combat emerging risks, such as ransomware and data breaches. For example, demand for automotive cybersecurity is increasing, with manufacturers, including Toyota and Nissan, incorporating sophisticated encryption and intrusion detection systems into connected automobiles. These advancements enable compliance with Japan's severe data privacy rules while also improving safety and performance. This approach not only meets changing consumer tastes but also creates a huge income potential for cybersecurity organizations targeting high-growth industries such as automotive, energy, and smart infrastructure.

Japan Cybersecurity Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto region, Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The rapid digitalization is elevating the demand for enhanced cybersecurity solutions.

Kanto Region Cybersecurity Market Trends:

The Kanto region, which includes Tokyo, leads in AI-based cybersecurity solutions. NEC Corporation focuses on AI-powered threat detection to safeguard essential industries such as banking and telecoms. With Tokyo being Japan's technological powerhouse, there is a high need for predictive analytics and automation to combat cyber threats. This emphasis on cutting-edge technology offers speedier reaction times and enhanced protection for enterprises in this region.

Kinki Region Cybersecurity Market Trends:

Osaka, at the center of the Kinki region, focuses on IoT cybersecurity. Companies like Panasonic work to secure connected devices, especially in smart homes and factories. With Osaka's industrial growth, the need to protect IoT systems from cyberattacks has increased. Panasonic’s focus on strengthening device security is helping address vulnerabilities and protect data in a region rapidly adopting digital transformation technologies.

Central/Chubu Region Cybersecurity Market Trends:

The Central/Chubu region, which includes Nagoya, is focusing on automotive cybersecurity, with corporations such as Toyota driving the effort. With the advent of connected and self-driving cars, there is a greater emphasis on secure vehicle-to-everything (V2X) communication. Local activities focus on safeguarding embedded systems to reduce hacking hazards in smart automobiles.

Kyushu-Okinawa Region Cybersecurity Market Trends:

Kyushu-Okinawa prioritizes cybersecurity for essential infrastructures like electricity. Kyuden Infocom, based in Fukuoka, specializes in cyber security for power grids and renewable energy systems. The region's need for renewable energy demands robust cybersecurity solutions to ensure continuous operations. Additionally, the region invests in educating local organizations about the importance of cybersecurity measures.

Tohoku Region Cybersecurity Market Trends:

Tohoku prioritizes cybersecurity in essential infrastructure and public services. For example, Tohoku Electric Power focuses on data security and system continuity. With the growing reliance on digital technology, there is a great emphasis on safe data recovery and sturdy systems to ensure continuous operation. Tohoku's strategy provides dependability and resilience against possible cyber threats to critical industries.

Chugoku Region Cybersecurity Market Trends:

The Chugoku region, centered around Hiroshima, emphasizes supply chain cybersecurity. Mazda leads efforts to secure manufacturing and logistics systems from cyber threats. As the region hosts supply chain networks, protecting against ransomware and data breaches is crucial. Mazda’s initiatives ensure smooth operations and enhance trust in the region’s manufacturing capabilities.

Hokkaido Region Cybersecurity Market Trends:

The Hokkaido region focuses on agricultural cybersecurity. Companies like Hokkaido System Science secure smart farming technologies, protecting IoT devices and agricultural data from cyberattacks. With the rise of precision farming, safeguarding digital tools is essential. Hokkaido’s commitment to securing these systems supports the agricultural sector’s growth while maintaining data integrity.

Shikoku Region Cybersecurity Market Trends:

Shikoku addresses cybersecurity needs for small businesses. NTT West, based in Ehime, provides affordable solutions tailored to local enterprises. As many small businesses lack advanced protection, Shikoku emphasizes simple and effective tools to combat cyber threats. This approach helps local businesses protect their data and operations in an increasingly digital environment.

Top Companies Leading in the Japan Cybersecurity Industry

Some of the leading Japan cybersecurity market companies have been included in the report. The report provides an in-depth competitive analysis, examining the market structure, the positioning of key players, leading strategies for success, a competitive overview dashboard, and an evaluation quadrant for assessing company performance.

Japan Cybersecurity Market Segmentation Coverage

- Based on the component, the market has been classified into solutions (identity and access management (IAM), infrastructure security, governance, risk and compliance, unified vulnerability management service offering, data security and privacy service offering, and others), and services (professional services and managed services). Solutions like firewalls, cloud security, and endpoint protection are used to prevent threats and ensure compliance. Consulting managed security and incident response services are available to help firms address vulnerabilities and assist them in facing the challenges of escalating cyber threats and digital transformation projects.

- Based on the deployment type, the market has been categorized into cloud-based and on-premises. Cloud-based solutions are preferred for scalability and remote access, which addresses the expanding cloud use. On-premises solutions are favored for sensitive data control in industries such as banking and government, as they provide compliance and strong security.

- Based on the user type, the market has been divided into large enterprises and small and medium enterprises. Large enterprises invest in advanced security solutions to support complex infrastructure and regulatory compliance. Small and medium enterprises (SMEs) use low-cost technologies to prevent increased cyberattacks and protect digital operations as they become more digitally integrated.

- Based on the industry vertical, the market is classified into IT and telecom, retail, BFSI, healthcare, defense/government, manufacturing, energy, and others. IT and telecom emphasize network security to ensure continuous operations, whereas retail uses solutions to safeguard e-commerce platforms and payment systems. The BFSI industry focuses on fraud prevention and compliance. Healthcare has strong processes to protect patient data. Defense/government prioritizes national security and data integrity. Manufacturing invests in safeguarding industrial control systems, while energy delivers grid security from cyber-attacks to essential infrastructure.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 18 Billion |

| Market Forecast in 2033 | USD 43.3 Billion |

| Market Growth Rate 2025-2033 | 10.3% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered |

|

| Deployment Types Covered | Cloud-based, On-premises |

| User Types Covered | Large Enterprises, Small and Medium Enterprises |

| Industry Verticals Covered | IT and Telecom, Retail, BFSI, Healthcare, Defense/Government, Manufacturing, Energy, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Cybersecurity Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)