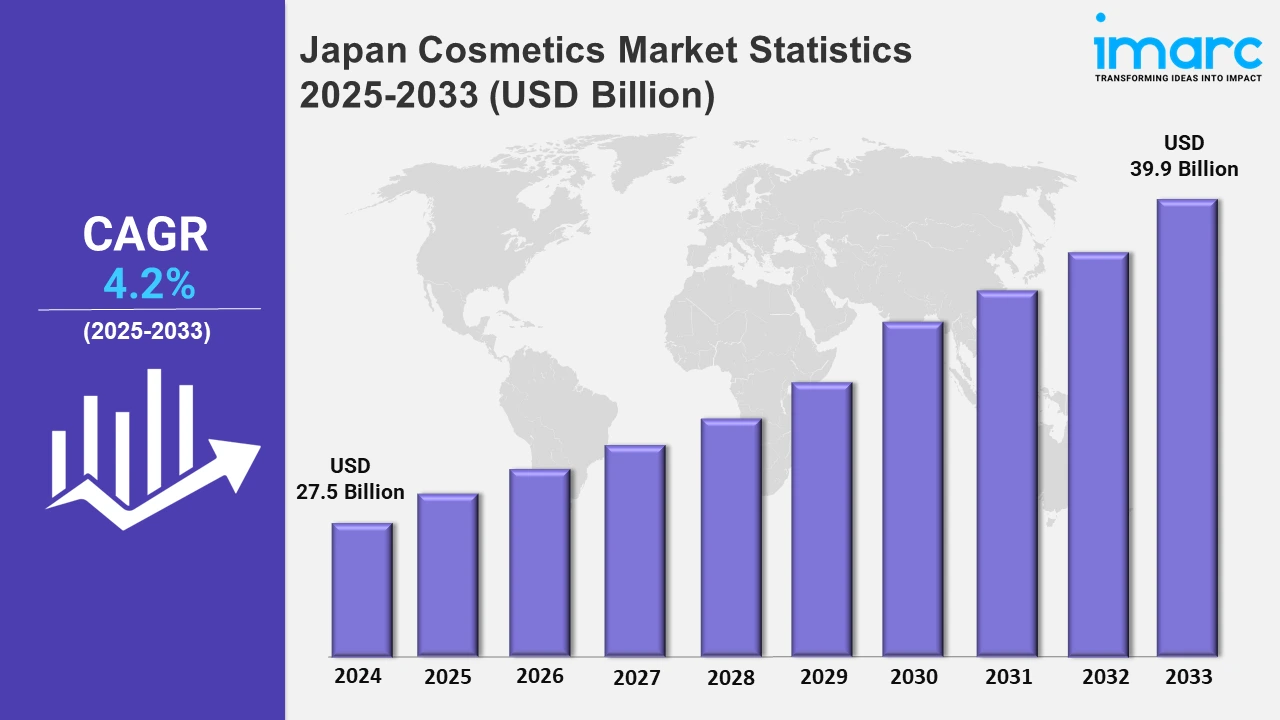

Japan Cosmetics Market Expected to Reach USD 39.9 Billion by 2033 - IMARC Group

Japan Cosmetics Market Statistics, Outlook and Regional Analysis 2025-2033

The Japan cosmetics market size was valued at USD 27.5 Billion in 2024, and it is expected to reach USD 39.9 Billion by 2033, exhibiting a growth rate (CAGR) of 4.2% from 2025 to 2033.

To get more information on this market, Request Sample

The market is expanding due to the inflating demand for innovative, high-quality skincare and beauty products. Japan, in particular, has emerged as a key player in this domain, driven by its advanced research, focus on natural ingredients, and unique cultural trends. The increasing influence of Korean skincare, known for its effective formulations and appealing packaging, has significantly shaped consumer preferences. For example, in August 2024, Estée Lauder re-launched its K-beauty brand Dr. Jart+ in Japan. This re-entry highlights the strategic pivot toward domestic retail partnerships with major outlets like Cosme and Matsumoto Kiyoshi. The growing interest in Korean skincare products such as Cica-based formulations aligns with a broader trend of consumers seeking dermatologically advanced solutions.

Furthermore, Japanese cosmetics brands are leveraging innovative marketing strategies and retail experiences to strengthen their position in the market. For instance, in July 2024, Kao Corporation introduced KATE's first flagship store in Shibuya, Tokyo. This store embodies the brand's "NO MORE RULES" ethos, blending digital and physical experiences to captivate modern consumers. Japan's focus on technology and consumer-centric designs positions it as a leader in this area, further driving growth in the cosmetics industry. In addition to this, brands across the country are also expanding their influence in international markets, recognizing the rising demand for traditional skincare solutions in regions like India. In September 2024, Japanese brand ILEM JAPAN launched its largest wellness and skincare store in Chennai's Palladium Mall. This initiative showcased the brand's traditional skincare offerings through live demonstrations, targeting the cosmetics and wellness market. The increasing preference for authentic and natural products in emerging economies like India provides lucrative opportunities for Japanese brands to expand their footprint and meet diverse consumer needs.

Japan Cosmetics Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The elevating focus of individuals on wellness is bolstering the market.

Kanto Region Cosmetics Market Trends:

The Kanto region, including Tokyo, is gaining prominence in the Japan cosmetics market with the growing preference for premium skincare products. Local consumers prioritize anti-aging and brightening solutions, driven by the urban lifestyle's skin stresses. Tokyo-based Shiseido leads with research-backed offerings like its Ultimune serum. The region’s high population density and retail hubs, such as Ginza, boost demand for flagship stores and experiential shopping, enhancing brand visibility.

Kinki Region Cosmetics Market Trends:

In the Kinki region, encompassing Osaka, Kyoto, and Kobe, the demand for traditional and natural cosmetics is notable. For example, brands like Yojiya leverage Kyoto’s legacy with green tea-infused skincare. The region also thrives on tourism, with Osaka’s Namba district seeing a surge in duty-free beauty stores catering to foreign visitors, especially from China.

Central/Chubu Region Cosmetics Market Trends:

The Central/Chubu region, including Nagoya, emphasizes practical and high-quality cosmetics suited for professionals in the automotive and industrial hubs. Long-lasting makeup, such as Kanebo’s Kate products, appeals to working women balancing long hours. Local consumer behavior also favors accessible yet effective products found in drugstores like Matsumoto Kiyoshi. Nagoya’s location as a logistics hub ensures efficient distribution, further boosting market accessibility across the region.

Kyushu-Okinawa Region Cosmetics Market Trends:

Kyushu’s tropical climate influences the demand for UV protection and lightweight skincare products. Okinawa-based brands capitalize on the region’s marine resources with products containing coral and sea minerals. Tourists, especially from South Korea, drive the market for souvenir-friendly cosmetics. The popularity of Fukuoka’s Hakata Station as a retail hotspot amplifies brand reach, especially for sunblock and hydrating cosmetics tailored for humid conditions.

Tohoku Region Cosmetics Market Trends:

The Tohoku region, including Sendai, emphasizes hydrating and rejuvenating skincare due to the area’s cold, dry winters. Local brands, such as Tsubaki-no-Kaori, use regional resources like camellia oil to craft moisturizing products. Consumers value affordability, and department stores like Sendai’s S-PAL offer a range of mid-priced options. The market benefits from regional pride, with local ingredients enhancing product appeal within the eco-conscious demographic.

Chugoku Region Cosmetics Market Trends:

Chugoku, home to Hiroshima, highlights the use of unique local resources in cosmetics. Hiroshima’s oyster shells, rich in minerals, are used in skincare like Tokiwa Pharmaceutical's products. Consumers lean towards gentle and hypoallergenic formulations catering to sensitive skin. The region’s aging population drives demand for anti-aging creams and serums. With Hiroshima being a peace tourism hub, international visitors boost sales of locally inspired skincare products.

Hokkaido Region Cosmetics Market Trends:

Hokkaido’s extreme winters create demand for heavy moisturizers and skin-repairing cosmetics. Brands like Sapporo-based Arctic Fox utilize milk and lavender from Hokkaido farms for ultra-hydrating formulations. The region’s commitment to sustainability is reflected in eco-friendly packaging and production. Consumers appreciate homegrown products available at venues such as Sapporo Station, making Hokkaido a growing hub for ethically produced, winter-specific skincare.

Shikoku Region Cosmetics Market Trends:

Shikoku’s rural charm shapes its cosmetics market, with an emphasis on traditional ingredients like yuzu and sake. Kagawa’s yuzu-based cosmetics, such as those by Yuzu Kobo, are popular for their brightening and toning effects. Local festivals, including the Awa Odori in Tokushima, fuel demand for long-lasting makeup. Shikoku’s artisanal approach appeals to niche consumers seeking unique formulations rooted in Japanese traditions.

Top Companies Leading in the Japan Cosmetics Industry

The research provides a thorough competitive analysis of the cosmetics market in Japan with segments like market structure, key player positioning, winning strategies, competitive dashboards, and business evaluation. It contains detailed summaries of significant corporations, emphasizing their strategic endeavors, including new product introductions and joint ventures, that are intended to bolster their market position and increase their market share.

Japan Cosmetics Market Segmentation Coverage

- On the basis of the product type, the market has been bifurcated into skin and sun care products, hair care products, deodorants and fragrances, makeup and color cosmetics, and others. These products offer innovative formulations addressing diverse beauty needs and enhancing personal care routines through improved functionality and aesthetic appeal.

- Based on the category, the market is categorized into conventional and organic. Cosmetics now cater to varied preferences, offering conventional formulations alongside organic products crafted from natural ingredients. This appeals to environmentally conscious consumers and those seeking minimal chemical exposure in their beauty routines.

- On the basis of gender, the market has been divided into men, women, and unisex. The cosmetics industry addresses gender-specific demands with tailored products for men and women alongside versatile unisex offerings that bridge preferences and promote inclusivity across personal care and grooming categories.

- Based on the distribution channel, the market is categorized into supermarkets and hypermarkets, specialty stores, pharmacies, online stores, and others. These channels ensure convenience and cater to evolving consumer shopping preferences in an increasingly digital marketplace.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 27.5 Billion |

| Market Forecast in 2033 | USD 39.9 Billion |

| Market Growth Rate 2025-2033 | 4.2% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Skin and Sun Care Products, Hair Care Products, Deodorants and Fragrances, Makeup and Color Cosmetics, Others |

| Categories Covered | Conventional, Organic |

| Genders Covered | Men, Women, Unisex |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Pharmacies, Online Stores, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Cosmetics Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)