Japan Cell and Gene Therapy Market Expected to Reach USD 2,016 Million by 2033 - IMARC Group

Japan Cell and Gene Therapy Market Statistics, Outlook and Regional Analysis 2025-2033

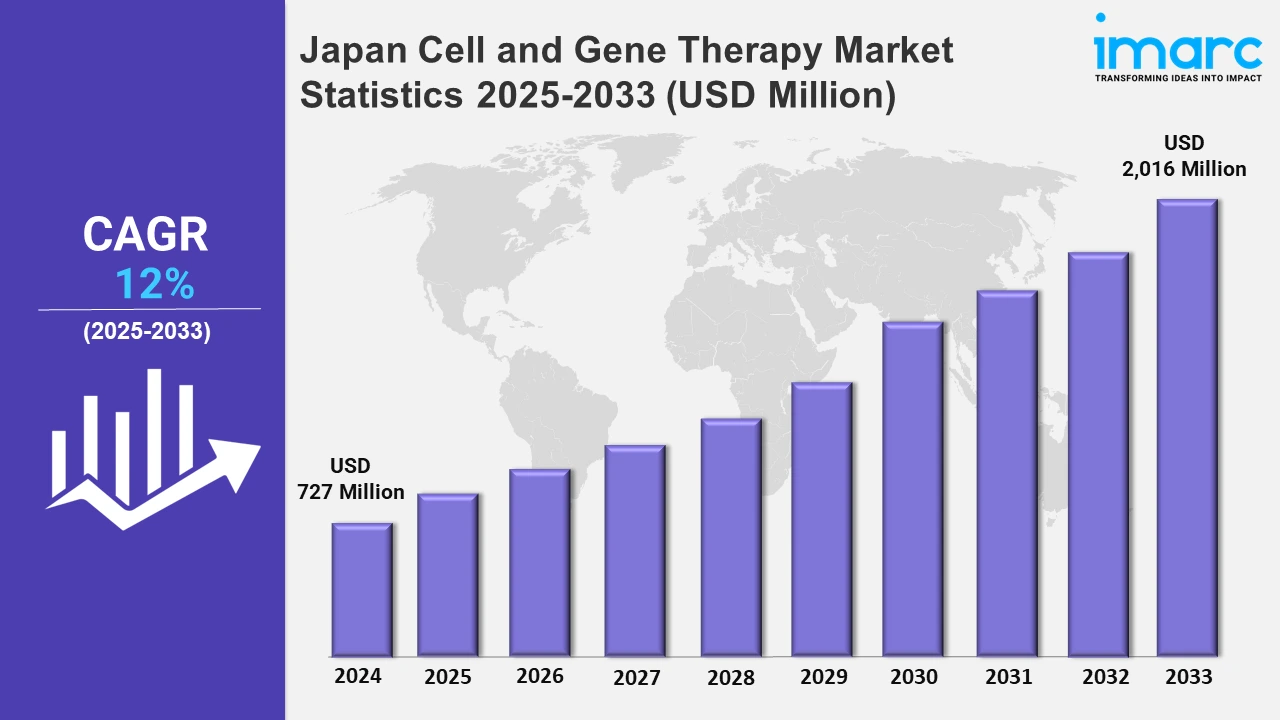

The Japan cell and gene therapy market size was valued at USD 727 Million in 2024, and it is expected to reach USD 2,016 Million by 2033, exhibiting a growth rate (CAGR) of 12% from 2025 to 2033.

To get more information on this market, Request Sample

The rising incidence of cancer in Japan is augmenting the country's overall healthcare sector. Approximately more than 95,000 cases of breast cancer were registered in 2023. As a result, the need for specialized treatment is on the surge. Additionally, gene-based therapies are in demand due to their potential to cure solid tumors, along with blood malignancies for patients with restricted therapeutic choices. The need for such developments is made even more urgent by Japan's aging population and the rising cancer rate. The cell and gene therapy industry in this country is experiencing growth with an emphasis on creating cures for corneal illnesses, such as bullous keratopathy. Concurrent with this, Japan has led the world in regenerative medicine, which has led to improvements in eye care and other fields.

In line with these trends, Vyznova, the first authorized cell treatment for corneal endothelium disease, specifically bullous keratopathy, was introduced by Aurion Biotech in Japan in September 2024. This significant achievement highlights the country's advances in cell-based therapies. Besides this, supportive government rules and rising biotechnology investments are also catalyzing the adoption of these treatments. Likewise, Abecma received a license in Japan in April 2024 for early access use in treating triple-class exposed relapsed and refractory multiple myeloma. With continued advancements, Japan is poised to expand the scope of cell and gene therapies, delivering solutions for various chronic and complex conditions. The convergence of regulatory support, innovation, and investment highlights Japan’s commitment to advancing its healthcare landscape through regenerative medicine.

Japan Cell and Gene Therapy Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. Instantaneous developments in genetics and biotechnology have solidified the method of cell and gene therapy, which has augmented market expansion.

Kanto Region Cell and Gene Therapy Market Trends:

In the Kanto region, the cell and gene therapy market is growing, with companies like Heartseed developing stem-cell treatments for heart failure. It acts as a center for clinical trials. Research on CBR-T therapy in Tokyo has shown assurance in the treatment of leukemia. Furthermore, the region's robust biotechnology ecosystem and strong government financing enable innovations in regenerative medicine and personalized medicines.

Kansai/Kinki Region Cell and Gene Therapy Market Trends:

In the Kansai/ Kinki region, the cell and gene therapy sector is expanding, driven by its leadership in iPs cell research, with Osaka University developing the first treatments for conditions, including macular degeneration. In addition to this, local programs such as the Kansai Life Science Cluster ensure the region's competitiveness in precision medicine and innovative medicines by encouraging cooperation between academia and business.

Central/Chubu Region Cell and Gene Therapy Market Trends:

Nagoya drives the Chubu region’s market with its focus on innovative delivery systems for gene therapy. RaQualia Pharma, a Nagoya-based company, concentrates on extending pharmaceutical pipelines to treat neurological conditions. Research partnerships with Nagoya University aim to enhance the efficiency of viral vectors used in therapies. This blend of industrial expertise and cutting-edge biotech research fuels the region's advancements.

Kyushu-Okinawa Region Cell and Gene Therapy Market Trends:

The Kyushu-Okinawa region specializes in metabolic and neurodegenerative illnesses. With Fukuoka at its center, Kyushu University is well-known for its genome-editing studies that target ALS and Parkinson's illness. Okinawa’s medical tourism complements these initiatives, attracting international collaborations in stem cell therapies. Regional government funding supports startups that specialize in cell and gene therapy, solidifying the region's role in Japan’s biotech industry.

Tohoku Region Cell and Gene Therapy Market Trends:

Innovative studies on the use of iPS cells to treat spinal cord injury are performed by Tohoku University. Beyond that, the area's resiliency has stimulated biomanufacturing investments following restoration, assisting in the development of treatments. Local policies encourage collaborations between universities and biotech firms, making Tohoku a growing hub for innovation in the sector.

Chugoku Region Cell and Gene Therapy Market Trends:

The Chugoku region, represented by Okayama, specializes in cell-based cardiovascular therapy. Okayama University collaborates with biotech companies to work and develop unique ischemic heart disease treatments. Furthermore, the region's importance in regenerative medicine is underscored by its focus on therapeutic solutions and precise drug delivery. Supportive local funding schemes and academic excellence have positioned the Chugoku region as an emerging center for medical innovation.

Hokkaido Region Cell and Gene Therapy Market Trends:

Sapporo in Hokkaido leads in developing tools to support cell and gene therapy research. Goryo Chemical’s fluorescent probes have gained recognition for their role in enhancing live-cell imaging and drug development. Hokkaido University contributes to advancements in gene-editing technology, particularly for precision medicine. The region’s integration of biotech innovations into agriculture and healthcare reflects its multidisciplinary approach.

Shikoku Region Cell and Gene Therapy Market Trends:

Tokushima in Shikoku is gaining attention for its focus on oncology research. Delta-Fly Pharma, headquartered here, develops next-generation cancer therapies, including gene-targeted treatments. Local initiatives support startups focusing on rare and advanced cancer solutions. Collaboration between academia and biotech firms ensures a steady flow of innovation, making Shikoku a niche player in Japan’s cell and gene therapy market.

Top Companies Leading in the Japan Cell and Gene Therapy Industry

The Japan cell and gene therapy market is dynamic, with key players like Takeda Pharmaceutical, Astellas Pharma, and Fujifilm Cellular Dynamics driving innovation alongside firms such as Novartis and Gilead Sciences. Strong collaboration between academia, businesses, and research institutes, supported by favorable regulations, fosters growth. Domestic companies leverage local expertise, while international firms expand through partnerships. Increasing clinical trials and a robust therapy pipeline further accelerate competition and market advancement.

Japan Cell and Gene Therapy Market Segmentation Coverage

- On the basis of the therapy type, the market has been bifurcated into cell therapy (stem cell and non-stem cell) and gene therapy. Cell therapy is a medical approach that uses live cells to repair, replace, or regenerate damaged tissues and organs. Moreover, gene therapy involves altering the genetic material within a person’s cells to treat or prevent disease.

- Based on the indication, the market has been bifurcated into cardiovascular disease, oncology disorder, genetic disorder, infectious disease, neurological disorder, and others. Heart disease is one of the leading causes of death. Advanced cancer therapies, like CAR-T cell treatments and oncolytic viruses, are extensively adopted for the treatment of these disorders.

- On the basis of the delivery mode, the market has been bifurcated into in-vivo and ex-vivo. In-vivo therapy delivers cells directly into the patient’s body, where they treat the condition. While ex-vivo therapy removes cells from the patient’s body, modifying them in a laboratory, and then reintroducing them into the patient to achieve therapeutic effects.

- Based on the end user, the market has been bifurcated into hospitals, cancer care centers, pharmaceutical and biotechnology companies, and others. Hospitals play a crucial role in the administration of cell and gene therapies, serving as hubs for patient care and clinical trials. Moreover, cancer care centers are at the forefront of applying cell and gene therapies to combat oncology disorders.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 727 Million |

| Market Forecast in 2033 | USD 2,016 Million |

| Market Growth Rate 2025-2033 | 12% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Therapy Types Covered |

|

| Indications Covered | Cardiovascular Disease, Oncology Disorder, Genetic Disorder, Infectious Disease, Neurological Disorder, Others |

| Delivery Modes Covered | In-Vivo, Ex-Vivo |

| End Users Covered | Hospitals, Cancer Care Centers, Pharmaceutical and Biotechnology Companies, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Cell and Gene Therapy Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)