Japan Automotive Composites Market Expected to Reach USD 2.3 Billion by 2033 - IMARC Group

Japan Automotive Composites Market Statistics, Outlook and Regional Analysis 2025-2033

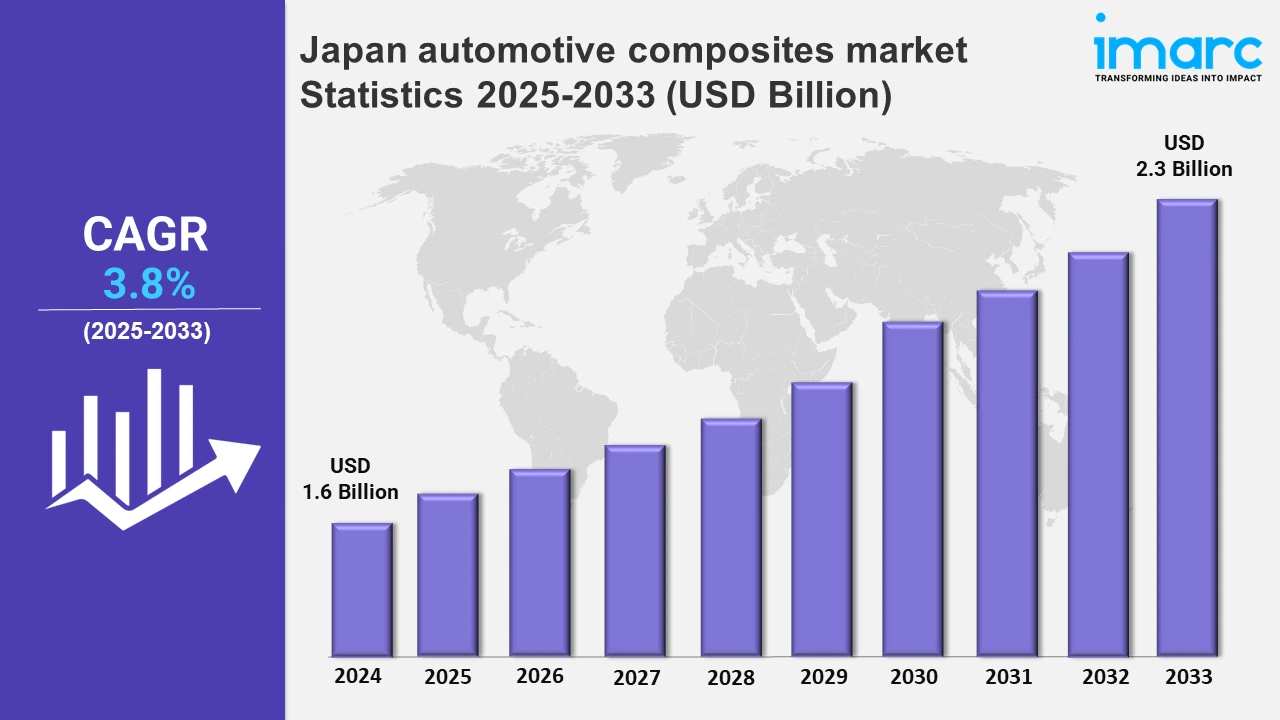

The Japan automotive composites market size was valued at USD 1.6 Billion in 2024, and it is expected to reach USD 2.3 Billion by 2033, exhibiting a growth rate (CAGR) of 3.8% from 2025 to 2033.

To get more information on this market, Request Sample

The growing emphasis on collaboration and integration reflects a push to advance electric vehicles and hybrid powertrains, leveraging expertise in battery development and lightweight materials to improve energy efficiency, sustainability, and competitiveness in the changing automotive market. For example, in December 2024, Honda and Nissan, both Japanese manufacturers, signed a memorandum of understanding to establish the world's third-largest automaker by sales. Nissan has years of expertise developing batteries, electric cars, and gas-electric hybrid powertrains, which might assist Honda in developing its EVs and next-generation hybrids.

Moreover, the automotive sector in Japan is putting more emphasis on foreign partnerships, particularly the integration of advanced parts for electric and hybrid automobiles. Such collaborations seek to foster innovation, improve efficiency, and facilitate the industry's transition to sustainable transportation solutions. For instance, in December 2024, Indian auto component maker Sona Comstar revealed its expansion strategy into Southeast markets, including Japan. The company is in active discussions with automakers across the country to supply components for electric and hybrid vehicles, indicating a growing interest in international collaborations within the automotive sector. Furthermore, the elevating inclination towards lightweight and durable materials that reduce carbon emissions and improve fuel economy is augmenting the market. Automakers are using advanced composites to fulfill tough environmental rules, including Corporate Average Fuel Economy (CAFE) norms. Additionally, the industry offers enormous revenue possibilities since customers prefer high-performance composites to traditional materials due to their better strength and lifespan. For example, Toyota Motor Corporation has been actively implementing carbon fiber-reinforced polymers (CFRP) into its hybrid and electric vehicles, including the Prius and Mirai, to enhance fuel economy and reduce total weight. This change to new materials is consistent with the worldwide trend of cleaner and safer automotive technology, establishing Japan as a leader in sustainable car manufacture. These efforts address the rising need for ecologically friendly mobility alternatives.

Japan Automotive Composites Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto region, Kansai/Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The growing demand for lightweight vehicles in various regions of Japan is propelling the market.

Kanto Region Automotive Composites Market Trends:

The Kanto region, which includes Tokyo, is committed to sustainable vehicle solutions. Nissan Motor Co., headquartered in Yokohama, utilizes carbon fiber-reinforced polymers (CFRP) in electric cars such as the Nissan Leaf. This strategy decreases vehicle weight, improves energy efficiency, and increases driving range while meeting Japan's carbon neutrality goals. The region's innovation-driven focus makes it a hub for environmentally friendly vehicle improvements.

Kansai/Kinki Region Automotive Composites Market Trends:

The Kansai/Kinki region, which includes Osaka, is an important location for advanced material research in the automobile industry. Toray Industries, located in Osaka, manufactures high-strength carbon fibers, which are widely utilized in lightweight automotive components. These composites are essential for increasing fuel efficiency and performance, especially in hybrid and electric vehicles. Kansai/Kinki's materials science expertise places it as a leader in automotive composite innovation.

Central/Chubu Region Automotive Composites Market Trends:

The Central/Chubu region, centered on Nagoya, is a manufacturing powerhouse, with Toyota Motor Corporation leading the way. Toyota uses glass fiber composites for external vehicle parts to balance durability, weight reduction, and cost-effectiveness. This technique is consistent with the region's emphasis on creating high-performance, dependable automobiles on a wide scale. Central/Chubu's automotive sector relies heavily on innovation and collaboration with material suppliers.

Kyushu-Okinawa Region Automotive Composites Market Trends:

The Kyushu-Okinawa region, notably Fukuoka, is well-known for its use of thermoplastic composites in automobile interiors. Companies such as Daihatsu Motor Kyushu use lightweight and recyclable materials to design appealing and practical automobile interiors. This invention promotes both sustainability and cost-effectiveness. With a developing automotive sector, Kyushu has emerged as a key participant in offering environmentally friendly solutions for contemporary automobiles.

Tohoku Region Automotive Composites Market Trends:

Bio-based composites are gaining popularity in the Tohoku region, which has its center in Sendai, owing to collaboration between industry and research organizations. For example, Tohoku University collaborates with vehicle manufacturers to produce renewable materials like natural fiber-reinforced polymers that decrease environmental impact while maintaining performance. Additionally, Japan U-Pica Company, which operates in the region, promotes the development of environmentally friendly resins. These initiatives establish Tohoku as a pioneer in green automobile innovation.

Chugoku Region Automotive Composites Market Trends:

The Chugoku region specializes in resin transfer molding (RTM), which produces lightweight and complicated composite parts required for high-performance vehicles. Mazda Motor Corporation, situated in Hiroshima, uses RTM to manufacture components for vehicles such as the Mazda MX-5. This technology assures accuracy, minimizes material waste, and improves structural efficiency. The region's focus on modern manufacturing technologies is consistent with the automobile industry's need for sustainable and performance-driven improvements.

Hokkaido Region Automotive Composites Market Trends:

Hokkaido's severe winters have fueled the development of cold-resistant composites. Companies like Sumitomo Bakelite Co., Ltd. and research institutes like Hokkaido University work together to develop materials that preserve structural integrity and performance in severe temperatures. These breakthroughs are critical for assuring vehicle durability in cold areas, making Hokkaido an ideal location for specialist composite developments.

Shikoku Region Automotive Composites Market Trends:

Shikoku is known for its use of hand layup processes to create unique car components. DaikyoNishikawa Corporation, which operates in the region, specializes in making high-quality, specialized composite parts for niche markets. In addition, Shikoku Research Institute works on material innovation to improve the endurance and performance of these components. This emphasis on artisanal skill and innovation underscores Shikoku's distinctive contribution to the automotive composites market.

Top Companies Leading in the Japan Automotive Composites Industry

Some of the players have been encompassed in the report. Nippon Seiki Co., Ltd. and HKS Co., Ltd., in December 2024, launched enhanced product variants for EVs. Moreover, Mitsubishi Chemical Group introduced a ceramic matrix composite in February 2024 that can withstand high temperatures. Apart from this, Toray Industries, Inc., offers chemical recycling methods.

Japan Automotive Composites Market Segmentation Coverage

- Based on the production type, the market has been classified into hand layup, resin transfer molding, vacuum infusion processing, injection molding, and compression molding. Hand layup is preferred for custom and low-volume components. Resin transfer molding produces precise and lightweight parts in moderate volumes. Vacuum infusion processing is used for complex geometries with increased strength. Injection molding allows for high-speed mass production of intricate parts, and compression molding efficiently produces durable and high-strength components for large-scale applications.

- Based on the material type, the market has been categorized into thermoset polymer, thermoplastic polymer, carbon fiber, glass fiber, and others. Thermoset polymers have become known for their strength and heat resistance. Thermoplastic polymers are recyclable and lightweight. Carbon fiber is valued for its excellent strength-to-weight ratio in high-performance vehicles, while glass fiber offers cost-effective reinforcement for structural and non-structural elements.

- Based on the application, the market has been divided into structural assembly, power train components, interior, exterior, and others. The structural assembly improves vehicle strength and weight reduction. Powertrain components enhance both efficiency and heat resistance. Interior applications provide lightweight, aesthetically pleasing, and ergonomic designs, while exterior components provide durability, aerodynamics, and flexibility in design.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1.6 Billion |

| Market Forecast in 2033 | USD 2.3 Billion |

| Market Growth Rate 2025-2033 | 3.8% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Production Types Covered | Hand Layup, Resin Transfer Molding, Vacuum Infusion Processing, Injection Molding, Compression Molding |

| Material Types Covered | Thermoset Polymer, Thermoplastic Polymer, Carbon Fiber, Glass Fiber, Others |

| Applications Covered | Structural Assembly, Power Train Components, Interior, Exterior, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Automotive Composites Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)