Japan Acetic Acid Market Expected to Reach USD 974.8 Million by 2033 - IMARC Group

Japan Acetic Acid Market Statistics, Outlook and Regional Analysis 2025-2033

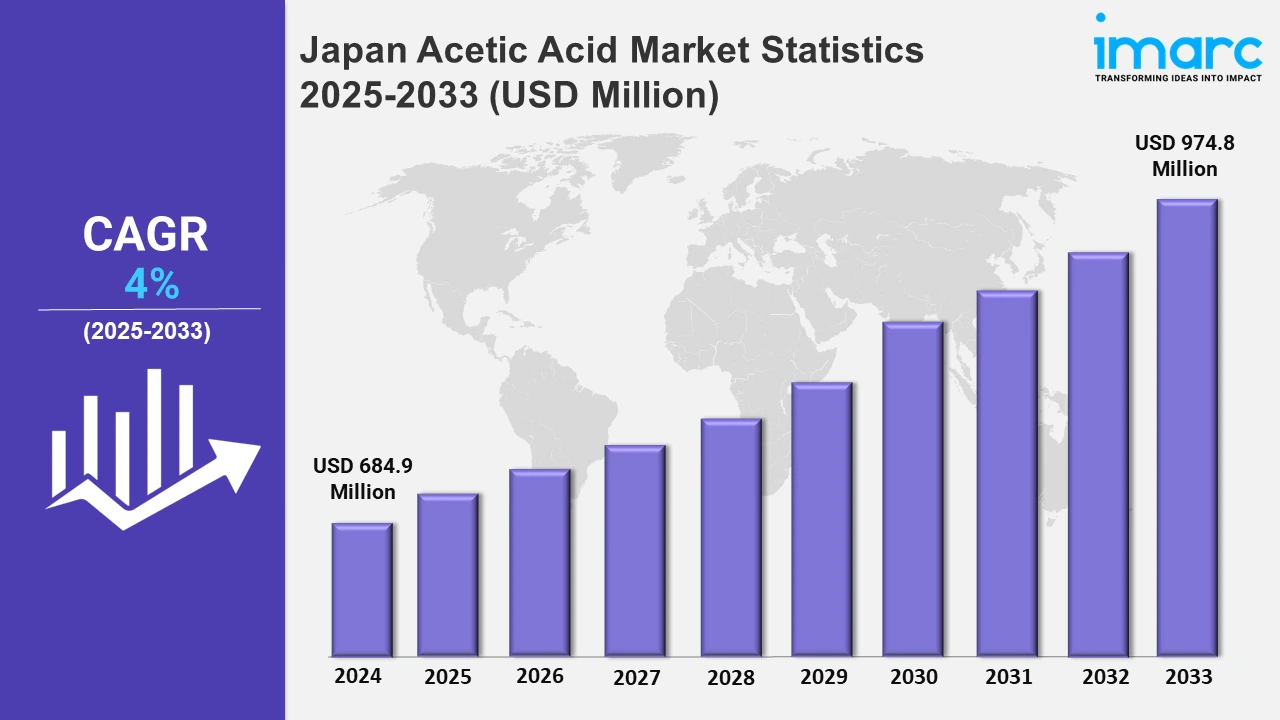

The Japan acetic acid market size was valued at USD 684.9 Million in 2024, and it is expected to reach USD 974.8 Million by 2033, exhibiting a growth rate (CAGR) of 4% from 2025 to 2033.

To get more information on this market, Request Sample

The market is backed by Japan's position as an economic leader, strong buying power, and a reputation for innovation, which drives developments in manufacturing technology and expands uses in a variety of industrial and chemical industries. For example, according to the World Economic Forum, Japan is the world's third-largest economy, accounting for about 7.86% of the overall economy. The International Monetary Fund (IMF) positions it as the fourth largest country in terms of purchasing power parity.

Moreover, Japanese manufacturers are prominent leaders in automotive coatings, owing to their excellent manufacturing capabilities. The country's strong vehicle output drives up demand for paints, coatings, and acetic acid, which are required for their production, bolstering its position in the sector. For instance, according to the Japan Paint Manufacturers' Association, key players produce 30% of all worldwide vehicle coatings, giving them the largest market share, ahead of European manufacturers at 25% and the U.S. at 19%. Furthermore, the market is witnessing strong demand from high-growth industries such as electronics, automotive, and pharmaceutical. Companies are working on improving manufacturing efficiency and following rigorous environmental laws, such as attaining the Japanese government's carbon neutrality targets by 2050. Additionally, producers are innovating to fulfill the rising need for improved acetic acid derivatives, which is driven by the need for environmentally friendly industrial applications. For example, Mitsubishi Chemical Corporation has enhanced its manufacturing capacity for high-purity acetic acid derivatives in Japan to meet the escalating demand from the electronics and pharmaceutical sectors. These compounds are required for the production of semiconductors and active pharmaceutical ingredients (APIs), both of which are crucial components of supply chains. Mitsubishi's initiatives illustrate Japanese companies' connection with trends in cleaner, high-performance, and environmentally friendly industrial solutions, ensuring the country's leadership in acetic acid production.

Japan Acetic Acid Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto region, Kansai/Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The extensive usage of preservatives and flavor enhancers is elevating the market.

Kanto Region Acetic Acid Market Trends:

The pharmaceutical industry in the Kanto region, which includes Tokyo, places a high demand for acetic acid. Mitsubishi Chemical Corporation uses it to manufacture active pharmaceutical ingredients (APIs). This benefits the region's thriving healthcare industry, which is recognized for developing new treatments. The ongoing increase in pharmaceuticals, encouraged by the rising healthcare demands, guarantees that acetic acid remains an important component of the region's industrial operations.

Kansai/Kinki Region Acetic Acid Market Trends:

In the Kansai/Kinki region, including Osaka, acetic acid is frequently utilized in textile manufacturing. Daicel Corporation uses acetic acid to make cellulose acetate, which is necessary for producing high-quality textile fibers. The region's extensive textile manufacturing history and the need for high-quality textiles ensure that acetic acid remains important. This industry serves both domestic and foreign markets, bolstering the region's economic strength.

Central/Chubu Region Acetic Acid Market Trends:

Acetic acid consumption in the Central/Chubu region, which includes Nagoya, is driven by the major automobile sector. Toyota Tsusho utilizes acetic acid derivatives in their automotive paints and adhesives. These applications are critical for manufacturing long-lasting and efficient vehicles. The region's commitment to upgrading automotive technology and maintaining manufacturing excellence demonstrates the continued relevance of acetic acid in its industrial environment.

Kyushu-Okinawa Region Acetic Acid Market Trends:

Acetic acid is widely used in the electronics sector in Kyushu-Okinawa. Mitsubishi Gas Chemical Company uses it to make high-purity chemicals used in the production of semiconductors and electronic components. This strengthens the region's status as a hub for high-technology production. Acetic acid is crucial for sustaining high-quality production in the electronics industry, which is experiencing rising demand.

Tohoku Region Acetic Acid Market Trends:

The Tohoku region relies heavily on acetic acid for farming purposes. Acetic acid is used by companies such as Nihon Nohyaku Co., Ltd. to produce agrochemicals, which are crucial for crop protection and yield enhancement. This is consistent with the region's strong agricultural basis, where farming is a key component of the economy. The region's demand for acetic acid remains consistent due to the need for sustainable farming solutions.

Chugoku Region Acetic Acid Market Trends:

The shipbuilding sector drives the need for acetic acid in the Chugoku region. JFE Chemical Corporation employs acetic acid derivatives to provide anti-corrosive coatings for ships, which are critical for durability and safety. Acetic acid continues to play an important part in the region's marine building operations.

Hokkaido Region Acetic Acid Market Trends:

The food processing sector in Hokkaido mostly drives acetic acid consumption. The Hokuren Federation of Agricultural Cooperatives employs acetic acid as a preservative and taste enhancer in processed goods. This boosts the region's agricultural productivity and guarantees that optimal products reach the market. Acetic acid remains a key component in this region, owing to the rising emphasis on food safety and prolonged shelf life.

Shikoku Region Acetic Acid Market Trends:

Acetic acid is used extensively in the paper production industry in Shikoku. Daio Paper Corporation uses acetic acid to produce specialized sheets and help in the production process. This reflects the region's significant emphasis on high-quality paper manufacturing. As the need for environmentally friendly and long-lasting paper products rises, acetic acid remains an essential resource in the region's industrial infrastructure.

Top Companies Leading in the Japan Acetic Acid Industry

Some of the leading Japan acetic acid market companies have been included in the report. The report provides an in-depth competitive analysis, examining the market structure, the positioning of key players, leading strategies for success, a competitive overview dashboard, and an evaluation quadrant for assessing company performance.

Japan Acetic Acid Market Segmentation Coverage

- Based on the application, the market has been classified into VAM, PTA, anhydride, ethyl acetate, butyl acetate, and others. VAM is commonly used in adhesives and paints. PTA is essential in polyester manufacturing. Anhydride is used in medicines. Ethyl acetate acts as a solvent in coatings and adhesives, while butyl acetate is widely employed in paints and coatings, enhancing market demand.

- Based on the end use, the market has been categorized into plastics and polymers, food and beverage, inks, paints and coatings, chemicals, pharmaceuticals, and others. In plastics and polymers, acetic acid aids in producing PET and VAM. The food and beverage industry utilizes it as a preservative and flavoring agent. Inks benefit from its role as a solvent, while paints and coatings use it for enhanced performance. It supports the synthesis of specialty chemicals, including esters and acetic anhydride. Also, it is crucial for intermediates, active pharmaceutical ingredients (APIs), and chemical reagents in drug production.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 684.9 Million |

| Market Forecast in 2033 | USD 974.8 Million |

| Market Growth Rate 2025-2033 | 4% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | VAM, PTA, Anhydride, Ethyl Acetate, Butyl Acetate, Others |

| End Uses Covered | Plastics and Polymers, Food and Beverage, Inks, Paints and Coatings, Chemicals, Pharmaceuticals, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Acetic Acid Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)