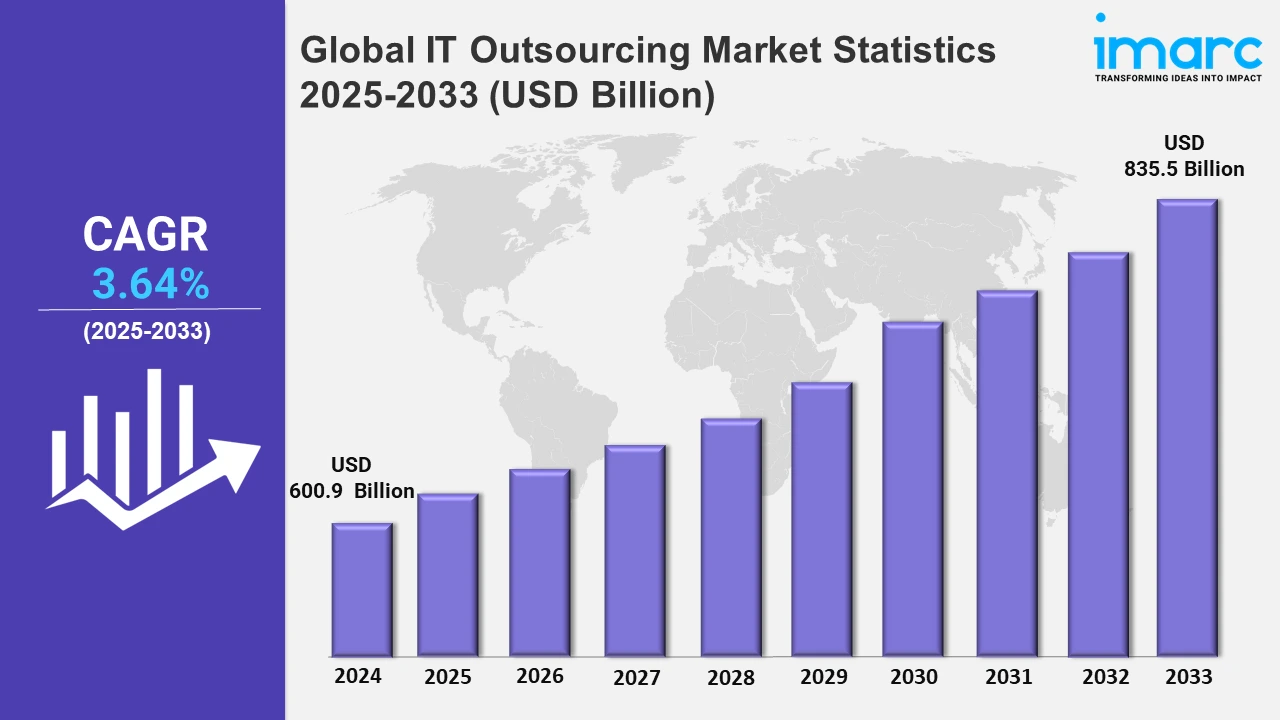

Global IT Outsourcing Market to Grow at 3.64% During 2025-2033, Reaching USD 835.5 Billion by 2033 - IMARC Group

Global IT Outsourcing Market Statistics, Outlook and Regional Analysis 2025-2033

The global IT outsourcing market size was valued at USD 600.9 Billion in 2024, and it is expected to reach USD 835.5 Billion by 2033, exhibiting a growth rate (CAGR) of 3.64% from 2025 to 2033.

To get more information on this market, Request Sample

As per the IMARC Group’s report, the global cybersecurity market reached USD 299.6 Billion in 2024. The frequency and sophistication of cyberattacks, such as ransomware, phishing, and data breaches, are increasing. Given that risk elements are on continuous change, many businesses prefer to outsource their threat detection and protection efforts to third parties. Providers of outsourcing services in the field of cybersecurity are quickly integrating new tools like remote vulnerability scanners, blockchain technology for securing data, and AI-based risk analysis and management technologies. Businesses can use these technologies through outsourcing instead of spending huge capital on purchase and running costs. Global enterprises must obey privacy policies of medical, commercial, and other types of data bases like the HIPAA, CCPA, or GDPR. Marketing agencies possess suitable competence to handle private data and put required level of IT security to cover the risks and requirements.

IT service providers, also known as managed services providers (MSPs), offer proactive monitoring, maintenance and support of the networks and infrastructure to ensure the smooth running of the systems and problems are resolved before causing any downtimes. The trend in organizations of reactive IT management is causing many businesses downtime which, in perspective, is too costly. Companies can manage IT costs through the diverse strategies offered by managed services, such as subscription-based plans, which are flexible and predictable. This cuts down the costs of outsourcing and training the in-house IT staff and eliminates the need for huge capital investments on IT assets. According to the IMARC Group’s report, the global managed services market is expected to reach USD 570.8 Billion by 2033.

Global IT Outsourcing Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounts for the largest market share on account of due to its advanced technological infrastructure, high adoption of digital transformation initiatives, and the presence of numerous global IT service providers.

North America IT Outsourcing Market Trends:

The market for IT outsourcing is dominated by North America due to its strong technological environment and extensive use of cutting-edge technologies like cybersecurity, cloud computing, and artificial intelligence (AI). Many multinational IT service companies that dominate the outsourcing market are based in the region. High IT investments by businesses across all industries and an emphasis on innovation and digital transformation is impelling the market growth. Market expansion is also aided by the growing popularity of remote work and the increasing focus on data security and legal compliance. The region's adoption of edge computing, especially in the United States, is accelerated by the presence of tech-savvy enterprises and consumers. The IMARC Group’s report shows that the United States edge computing market is projected to exhibit a growth rate (CAGR) of 25.7% during 2024-2032.

Asia-Pacific IT Outsourcing Market Trends:

Due to its abundance of highly qualified IT workers, affordable labor prices, and developing technology capabilities, Asia Pacific is a fast-rising market for IT outsourcing. Prominent outsourcing hotspots include China, India, and the Philippines, which provide proficiency in business process management, software development, and customer services. Government programs promoting the growth of IT infrastructure and digital transformation are also offering a favorable market outlook.

Europe IT Outsourcing Market Trends:

Because of the region's linguistic, cultural, and time zone compatibility, Europe is an established but developing market for IT outsourcing, with a significant emphasis on nearshoring. Poland, Romania, and Ukraine are becoming popular outsourcing locations because they provide competent and reasonably priced IT personnel. Due to strict data protection regulations and an increasing demand for cybersecurity services, Western Europe, including Germany and the UK, has the highest demand for outsourcing.

Latin America IT Outsourcing Market Trends:

Because of its close proximity and comparable time zones, Latin America is a growing market for IT outsourcing and offers North American businesses the benefit of nearshoring. Due to their expanding skill pools and reasonably priced services, nations like Brazil, Mexico, and Colombia are becoming more well-known as outsourcing hubs. The region's capabilities in fields like software development and digital transformation are improving as a result of rising investments in IT infrastructure and education.

Middle East and Africa IT Outsourcing Market Trends:

Rapid digitalization and government programs to encourage IT innovations are making the Middle East and Africa (MEA) a prominent region in the IT outsourcing business. With their affordable services and multilingual workforce, nations like South Africa, Egypt, and the United Arab Emirates are emerging as regional outsourcing hotspots. Growing investments in IT infrastructure, especially in cybersecurity and cloud computing, is positively influencing the market.

Top Companies Leading in the IT Outsourcing Industry

Some of the leading IT outsourcing market companies include Accenture plc, Capgemini SE, Dell Technologies Inc., DXC Technology Company, Fujitsu Limited, International Business Machines Corporation, Nippon Telegraph and Telephone Corporation, Specialist Computer Centres (SCC), Wipro Limited, among many others. In January 2024, Accenture plc finalized the acquisition of Navisite, a digital transformation and managed services company. This acquisition will strengthen and expand Accenture's application and infrastructure managed services capabilities, allowing clients across North America to update their IT for the artificial intelligence (AI) era.

Global IT Outsourcing Market Segmentation Coverage

- On the basis of the service model, the market has been categorized into software as a service (SaaS), platform as a service (PaaS), and infrastructure as a service (IaaS), wherein software as a service (SaaS) represents the leading segment. SaaS solutions are preferred by businesses because they eliminate the need for expensive hardware, lower maintenance costs, and offer the flexibility to scale resources as needed. SaaS solutions also improve productivity and teamwork by providing smooth updates and tool integration. The demand for SaaS is further fueled by the expanding use of cloud computing and the requirement for remote work solutions. SaaS is essential to contemporary corporate operations, as demonstrated by important applications like customer relationship management (CRM), enterprise resource planning (ERP), and productivity solutions.

- Based on the organization size, the market has been bifurcated into small and medium-sized enterprises and large enterprises. SMEs rely on IT outsourcing to access cost-effective expertise, scalable solutions, and advanced technologies that would otherwise be difficult to manage in-house. On the other hand, large enterprises leverage IT outsourcing to streamline operations, ensure global scalability, and focus on strategic initiatives while outsourcing routine IT tasks and infrastructure management.

- On the basis of the end user, the market has been divided into BFSI, healthcare, media and telecommunications, retail and e-commerce, manufacturing, and others. Among these, BFSI accounts for the majority of the market share. BFSI businesses use IT outsourcing to cut expenses, improve cybersecurity, and deploy cutting-edge technology like blockchain for safe transactions and AI-driven fraud detection. The demand for outsourcing is also fueled by the necessity of digital transformation, which includes online financial services and mobile banking apps. In order to stay in accordance with the industry's strict regulations, outsourcing expertise is also required.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 600.9 Billion |

| Market Forecast in 2033 | USD 835.5 Billion |

| Market Growth Rate 2025-2033 | 3.64% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Service Models Covered | Software as a Service (SaaS), Platform as a Service (PaaS), Infrastructure as a Service (IaaS) |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| End Users Covered | BFSI, Healthcare, Media and Telecommunications, Retail and E-commerce, Manufacturing, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Accenture plc, Capgemini SE, Dell Technologies Inc., DXC Technology Company, Fujitsu Limited, International Business Machines Corporation, Nippon Telegraph and Telephone Corporation, Specialist Computer Centres (SCC), Wipro Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on IT Outsourcing Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)