Global IT Asset Disposition Market Expected to Reach USD 34.3 Billion by 2033 - IMARC Group

Global IT Asset Disposition Market Statistics, Outlook and Regional Analysis 2025-2033

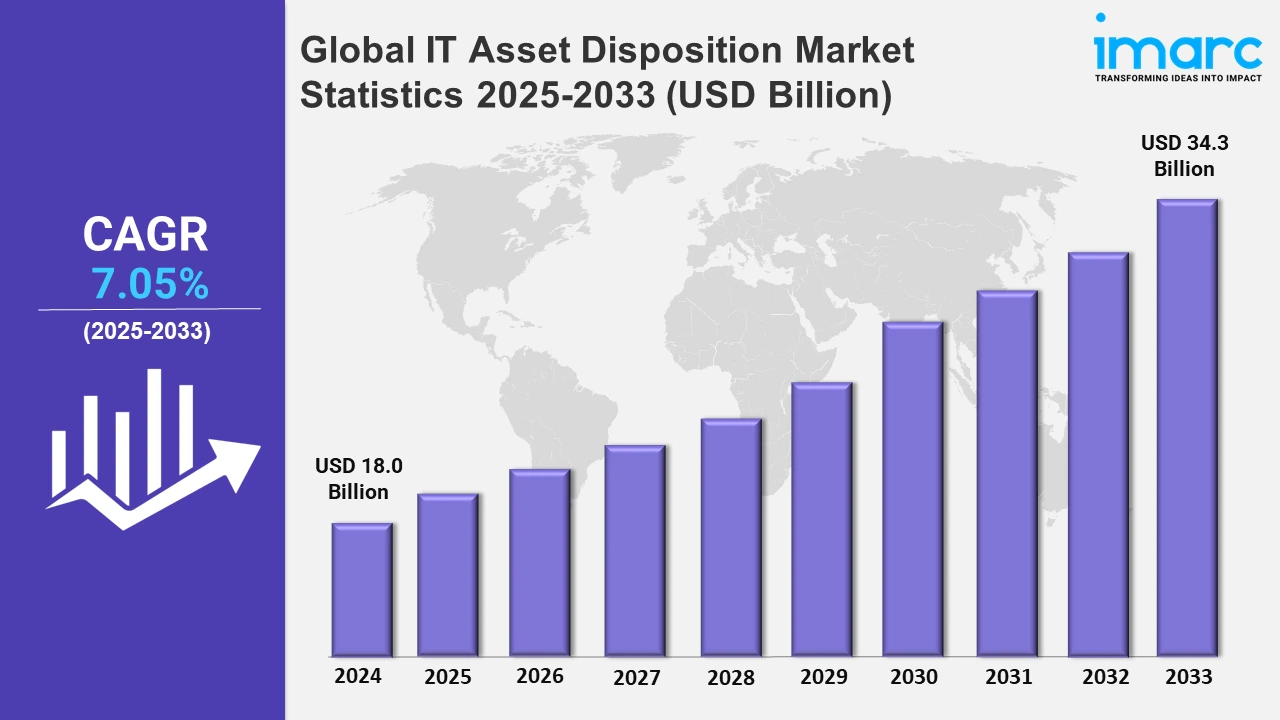

The global IT asset disposition market size was valued at USD 18.0 Billion in 2024, and it is expected to reach USD 34.3 Billion by 2033, exhibiting a growth rate (CAGR) of 7.05% from 2025 to 2033.

To get more information of this market, Request Sample

The development of the ITAD market is driven by various factors, such as increasing awareness about data security and compliance with strict government regulations, and the low environmental impact of e-waste. Companies tend to utilize ITAD services more often to protect confidential data, and at the same time, dispose of obsolete assets responsibly. As per the UN fourth Global E-waste Monitor (GEM) published on March 20th, 2024, the annual generation of e-waste is rising by 2.6 million tonnes every year and is expected to reach a volume of 82 million tonnes by 2030. This disturbing uptrend in the quantity of e-waste underlines the urgent requirement for effective recycling and asset recovery procedures. Additionally, in relation to ITAD, the introduction of corporate sustainability policies and the growth of cloud computing services creates a greater necessity for such services whereby the asset management’s lifecycle is managed in an accountable manner.

The market is expanding as organizations prioritize data security and regulatory compliance in the face of increasing cyber threats. In Q3 2024, the average weekly cyberattacks per organization accelerated to a record 1,876, reflecting a 75% increase from the same period in 2023 and a 15% rise from the prior quarter. This alarming growth underscores the critical need for secure data destruction and proper IT asset management. Businesses are adopting ITAD services to mitigate risks by ensuring the complete sanitization of decommissioned devices. Additionally, the push for sustainability and the rising volumes of e-waste from frequent IT upgrades further drive demand. ITAD solutions offer a secure and eco-friendly approach to managing end-of-life IT assets.

Global IT Asset Disposition Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest IT asset disposition market share, driven by stringent data security regulations, increasing e-waste generation, and a strong focus on sustainability. The presence of major ITAD providers and rapid technological advancements further boost the region’s leadership in this growing market.

North America IT Asset Disposition Market Trends:

The North American IT asset disposition (ITAD) market continues to grow, driven by increasing digitalization, stringent data security regulations, and rising awareness of environmental sustainability. Enterprises are prioritizing secure and efficient disposal of outdated IT equipment to prevent data breaches and comply with e-waste management laws. On January 10, 2024, Iron Mountain announced the acquisition of Regency Technologies, a prominent IT asset disposition (ITAD) services provider in the United States, enhancing its IT Asset Lifecycle Management (ALM) capabilities. This acquisition shows the market’s focus on innovation and value recovery, as companies seek sustainable solutions. With strong demand from sectors like IT, healthcare, and financial services, and advancements in asset recovery technologies, the region remains a global leader in ITAD adoption and growth.

Asia Pacific IT Asset Disposition Market Trends:

The Asia Pacific region continues to remain on the faster growth trajectory of the IT asset disposal market (ITAD), primarily driven by digital growth and the increasing penetration of advanced technologies across sectors. Countries such as China, India, and Japan are leading with the growth of the IT infrastructure alongside increasing e-waste concerns. Factors influencing the market include growing trends concerning data protection as well as environmental regulations pushing enterprises to avail of ITAD services. Additionally, the growing number of foreign companies in the region as well as the government’s efforts to increase e-waste recycling are also creating demand for ITAD solutions.

Europe IT Asset Disposition Market Trends:

Europe has also been witnessing a strong growth in IT asset disposition activities with most of the countries performing an increasing rate of ITAD adoption. While environmental laws, as well as GDPR data protection laws, play a role in ITAD uptake, several organizations in countries occupied in Germany, the UK, and France are more likely to engage ITAD services to not only meet compliance requirements but also, pursue their sustainability strategies. Attention on the circular economy has also escalated the demand for refurbishing and remarketing of IT assets. Moreover, the increasing trend of IT outsourcing and cloud adoption in various sectors is also proving to be a driver for the turnover of IT assets thus, enhancing the growth of the ITAD market in the region.

Latin America IT Asset Disposition Market Trends:

In Latin America, the market is expanding as awareness regarding data security and e-waste disposal becomes more relevant. Countries like Brazil, Mexico, and Argentina are embracing ITAD solutions due to the heightened IT expenditures and the urge for sustainable practices. The increase in digital transformation across industries as well as the regulatory measures related to electronic waste by the government authorities is supporting the growth of the market. Furthermore, the growing technological landscape of the region coupled with the influx of foreign IT firms into the region is creating a demand for the need for secure effective IT asset disposition services within the region.

Middle East and Africa IT Asset Disposition Market Trends:

The market in the Middle East and Africa is acquiring some momentum due to the growing IT infrastructure in the region together with the increased focus on data security. Countries like UAE, Saudi Arabia, and South Africa are seeing increased consumption of ITAD services with organizations placing a greater importance on secure data eradication and eco-friendly asset disposal practices. The increased investment in smart city initiatives along with the technological improvements across industries are also driving the turnover of IT assets. It is also seen that government initiatives advocating e-waste management coupled with the adoption of sustainable measures are further propelling the ITAD industry in the region.

Top Companies Leading in the IT Asset Disposition Industry

Some of the leading IT asset disposition market companies include Apto Solutions Inc, Cascade Asset Management, CDW Corporation, CompuCom Systems Inc, Dell Technologies Inc, DMD Systems Recovery Inc., Ingram Micro, Iron Mountain Incorporated, LifeSpan International Inc, Sims Limited, TES (SK Ecoplant Co Ltd), etc. On November 7, 2024, DMD Systems Recovery Inc., a prominent Reuse First IT Asset Disposition (ITAD) services provider, announced its acquisition of Basket Materials, a Bay Area-based ITAD company recognized for its focus on sustainability and innovative solutions. This strategic acquisition enhances DMD’s foothold in Northern California, allowing the company to better serve the Bay Area’s rapidly expanding tech industry and data center operations. By integrating Basket Materials’ expertise, DMD aims to deliver more comprehensive and efficient ITAD services, reinforcing its commitment to supporting environmentally responsible and technologically advanced asset recovery solutions in the region.

Global IT Asset Disposition Market Segmentation Coverage

- On the basis of the service, the market has been bifurcated into de-manufacturing and recycling, remarketing and value recovery, data destruction/data sanitation, logistics management and reverse logistics, and others, wherein data destruction/data sanitation represent the most preferred segment. This is primarily due to growing concerns over data security and strict regulations that call for proper disposal of sensitive information. As cyber threats continue to increase, businesses will focus on secure data sanitation in order to avoid data breaches and comply with privacy laws. Moreover, the use of cloud services and decommissioning of IT assets also require the service. BFSI and healthcare are critical industries that heavily depend on safe protection of confidential customer data.

- Based on the asset type, the market is categorized into computers and laptops, servers, mobile devices, storage devices, and others, amongst which computers and laptops dominate the market. This is primarily driven by the rapid obsolescence of technology, resulting in frequent upgrades by organizations and individuals. As businesses adopt remote and hybrid working models, the turnover rate of laptops and desktops has surged. Furthermore, environmental concerns and government initiatives promoting e-waste recycling are pushing companies to adopt IT asset disposition services.

- On the basis of the enterprise size, the market has been divided into small and medium-sized enterprise and large enterprise. Among these, large enterprise dominates the market due to their extensive IT infrastructures and high asset turnover rates. Large organizations often replace IT equipment regularly to maintain operational efficiency and adhere to industry standards. Additionally, strict compliance requirements for data protection and environmental responsibility drive these enterprises to utilize professional IT asset disposition services.

- Based on the industry vertical, the market is categorized into BFSI, IT and telecom, education, healthcare, manufacturing, media and entertainment, and others, amongst which IT and telecom dominate the market due to the sector’s reliance on advanced technology and frequent hardware upgrades to remain competitive. The industry generates significant volumes of obsolete IT equipment, necessitating efficient and secure disposal methods. Moreover, stringent regulations regarding data security and sustainability compliance in the IT sector further fuel the demand for IT asset disposition services.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 18.0 Billion |

| Market Forecast in 2033 | USD 34.3 Billion |

| Market Growth Rate 2025-2033 | 7.05% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | De-Manufacturing and Recycling, Remarketing and Value Recovery, Data Destruction/Data Sanitation, Logistics Management and Reverse Logistics, Others |

| Asset Types Covered | Computers and Laptops, Servers, Mobile Devices, Storage Devices, Others |

| Enterprise Sizes Covered | Small and Medium-sized Enterprise, Large Enterprise |

| Industry Verticals Covered | BFSI, IT and Telecom, Education, Healthcare, Manufacturing, Media and Entertainment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Apto Solutions Inc, Cascade Asset Management, CDW Corporation, CompuCom Systems Inc, Dell Technologies Inc, DMD Systems Recovery Inc., Ingram Micro, Iron Mountain Incorporated, LifeSpan International Inc, Sims Limited, TES (SK Ecoplant Co Ltd), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on IT Asset Disposition Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)