Global Ion Exchange Resins Market Size Anticipated to Reach USD 3.0 Billion by 2033 - IMARC Group

Global Ion Exchange Resins Market Statistics, Outlook and Regional Analysis 2025-2033

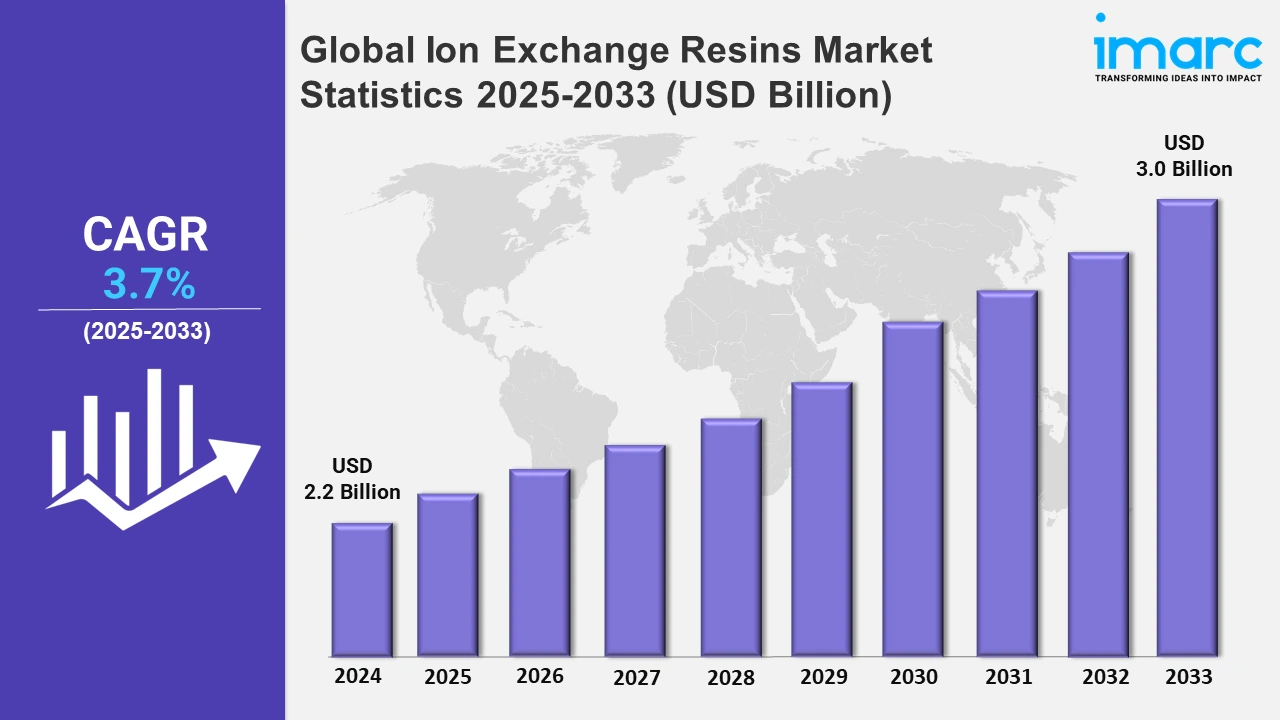

The global ion exchange resins market size was valued at USD 2.2 Billion in 2024, and it is expected to reach USD 3.0 Billion by 2033, exhibiting a growth rate (CAGR) of 3.7% from 2025 to 2033.

To get more information on this market, Request Sample

One primary trend significantly impacting the global market growth is the increasing use of ion exchange resins in water treatment, a response to rising concerns over notably escalating water pollution and scarcity. A research assessment published in Nature Communications in February 2024 found that water scarcity, influenced by nitrogen pollution, could triple in river basins by 2050. Over 2,000 sub-basins worldwide are affected, with water-scarce areas tripling due to pollution. By 2050, an estimated 3,061 sub-basins will experience scarcity, impacting an additional 40 million square kilometers and 3 billion people. Resultantly, various industries and governments worldwide are heavily investing in innovative water purification systems, magnifying the demand for ion exchange resins mainly because of their effectiveness in eliminating heavy metals and contaminants. The extension of industries in emerging regions has further accelerated growth with sectors like pharmaceuticals, chemical processing, and power generation, depending on ion exchange technology for resource filtration. Moreover, technological innovations in resin formulation have also facilitated the designing of more effective and resilient products that can endure extreme pressures and temperatures, improving their utility in demanding industrial processes.

Another major driver for the ion exchange resins market is the amplifying requirement of the compound in the pharmaceutical sector, where they are leveraged in drug purification and formulation methods. Their capability to methodically seize and release selected ions has made them requisite in the production of ultra-pure water for pharmaceutical applications. In addition, the global inclination towards sustainability is prompting the utilization of environmentally friendly and recyclable resins, addressing the stringent environmental policies. For instance, in May 2024, Veolia Water Technologies unveiled its first ion exchange regeneration plant in China that will recycle used ion exchange resins to incentivize sustainability and resource optimization. Furthermore, the food and beverage sector also foster the market expansion, utilizing ion exchange resins for applications including sugar purification and demineralization. As industries seek more efficient solutions for resource management and regulatory compliance, the ion exchange resins market is positioned for continued expansion, supported by ongoing innovations and increasing demand from multiple sectors.

Global Ion Exchange Resins Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Asia-Pacific, Europe, Latin America, and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share due to rapid industrialization, growing water treatment needs, and expanding chemical and pharmaceutical sectors.

Asia Pacific Ion Exchange Resins Market Trends:

Asia-Pacific has emerged as the dominant region in the global ion exchange resins market primarily because of accelerating urbanization and industrialization, especially in countries such as Japan, China, and India. For instance, as per industry reports, it is estimated that by 2036, 600 million people in India, i.e., 40% of the total population, will dwell in urban areas. Moreover, the region's resilient expansion in key sectors, including power generation, chemical processing, and water treatment, bolsters significant need for ion exchange resins. In addition, growing environmental concerns and strict water quality protocols in these countries have resulted in an escalated investment in innovative water purification technologies. The growing food and beverage and pharmaceutical sectors further foster the market expansion, as they demand ultra-pure water and tailored processes where ion exchange resins play a crucial role.

North America Ion Exchange Resins Market Trends:

North America’s ion exchange resins market benefits from established industrial infrastructure and stringent environmental regulations. High demand for water treatment solutions in the U.S. and Canada, driven by industrial and municipal needs, supports market growth. Moreover, the pharmaceutical sector's requirement for high-purity water also bolsters the region’s market position.

Europe Ion Exchange Resins Market Trends:

The European market for ion exchange resins is chiefly driven by stringent water quality policies and sustainability projects. Major sectors, such as chemical processing, food and beverage, and pharmaceuticals, deploy ion exchange technology for purification purposes. Heavy investments in innovative and environmentally friendly resin technologies further improve market expansion in the region.

Latin America Ion Exchange Resins Market Trends:

In Latin America, escalating industrial advancement and urbanization are major factors boosting the requirement for ion exchange resins. Countries such as Mexico and Brazil are actively investing in water treatment plants to mitigate water quality and scarcity issues, bolstering the market growth. Additionally, the region’s growing food and beverage industry also contributes to the market expansion.

Middle East and Africa Ion Exchange Resins Market Trends:

The ion exchange resins market in MEA is expanding due to the region’s need for efficient water treatment solutions amid water scarcity challenges. Industrial growth and investments in oil and gas processing are significant drivers impacting the market growth. Furthermore, governments’ focus on sustainable practices and desalination projects supports the market’s development.

Top Companies Leading in the Ion Exchange Resins Industry

Some of the leading ion exchange resins market companies include Lanxess, Mitsubishi Chemical Holdings, The Dow Chemical Company, Purolite, Thermax Ltd., Ion Exchange (India) Ltd., Resintech Inc., Novasep Holding S.A.S., Samyang Corporation, Jiangsu Suqing Water Treatment Engineering Group Company Ltd., among many others. In October 2024, Mitsubishi Chemical Holdings announced plans to strategically expand its production capacity for ion exchange resins, which are typically designed for ultrapure water production. The upgraded facilities are expected to go into operation in the second quarter of 2026.

Global Ion Exchange Resins Market Segmentation Coverage

- On the basis of the type, the market has been categorized into cationic resins, anionic resins, and others, wherein cationic resins represent the leading segment. This is attributed to their extensive utilization in water purification and treatment methodologies. Their capability to efficiently eliminate positively charged contaminants, including hardness ions and heavy metals, establishes them as an indispensable component in industrial and municipal water treatments applications. Moreover, the integral role of cationic resins in chemical processing further strengthens their market dominance.

- Based on the application, the market is segregated into demineralization and water softening, food and beverage, mining and metallurgy, and others. Demineralization and water softening are major applications bolstering the global ion exchange resins market growth, as they guarantee superior water purity for both municipal and industrial applications. In the food and beverage sector, these resins support demineralization and purification processes. Additionally, mining and metallurgy rely on ion exchange resins for efficient metal recovery and impurity removal, boosting overall market demand.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 2.2 Billion |

| Market Forecast in 2033 | USD 3.0 Billion |

| Market Growth Rate 2025-2033 | 3.7% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Cationic Resins, Anionic Resins, Others |

| Applications Covered | Demineralization and Water Softening, Food and Beverage, Mining and Metallurgy, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Lanxess, Mitsubishi Chemical Holdings, The Dow Chemical Company, Purolite, Thermax Ltd., Ion Exchange (India) Ltd., Resintech Inc., Novasep Holding S.A.S., Samyang Corporation, Jiangsu Suqing Water Treatment Engineering Group Company Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)