Global Ion Exchange Membrane Market Expected to Reach USD 1,401.3 Million by 2033 - IMARC Group

Global Ion Exchange Membrane Market Statistics, Outlook and Regional Analysis 2025-2033

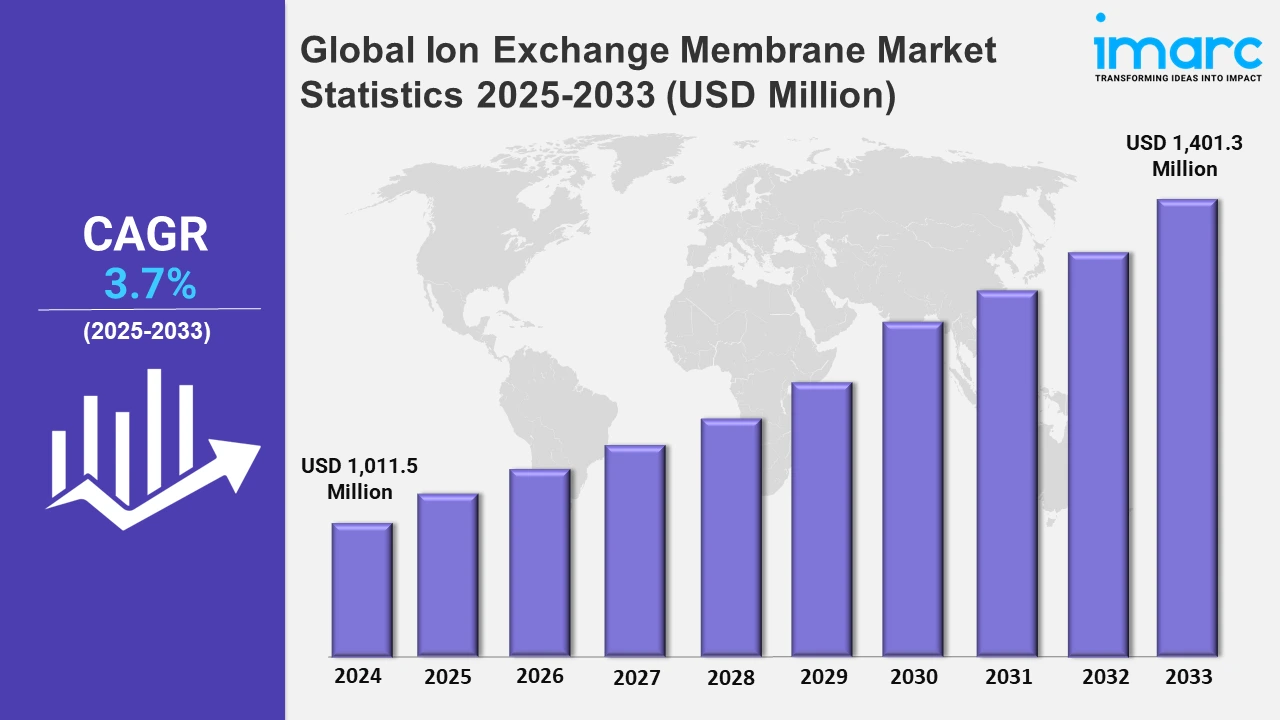

The global ion exchange membrane market size was valued at USD 1,011.5 Million in 2024, and it is expected to reach USD 1,401.3 Million by 2033, exhibiting a growth rate (CAGR) of 3.7% from 2025 to 2033.

To get more information on this market, Request Sample

New ion-exchange membrane technologies are being developed to enhance efficiency and durability in industrial applications, such as salt electrolysis, hence enabling advances in chemical manufacturing processes and contributing to more sustainable industrial practices. For example, in June 2023, AGC ENGINEERING Co. Ltd, a world-leading manufacturer of glass, chemicals, and high-tech materials, announced the launch of a new FORBLUE FLEMION ion-exchange membrane, manufactured and sold for use in salt electrolysis plants.

Moreover, new advances in hydrogen generation include anion exchange membrane (AEM) electrolyzer systems, which broaden technology portfolios beyond standard alkaline and PEM counterparts. This move helps to meet growing worldwide hydrogen demand by increasing efficiency and diversifying the applications for ion exchange membranes, eventually promoting sustainable energy solutions. For instance, in September 2024, Hygreen Energy, a global electrolyzer manufacturer, announced the introduction of its first-ever anion exchange membrane electrolyzer system. It broadens the company's product portfolio beyond its flagship alkaline and PEM electrolyzers to meet the diverse needs in hydrogen production worldwide. Furthermore, manufacturers of ion exchange membranes are extending their product lines to meet increasing demand in industrial and environmental applications. A significant focus is on enhancing sustainability and adhering to tighter environmental standards. Companies are creating improved membranes with increased chemical resistance, selectivity, and efficiency. The market also anticipates major opportunities in water treatment, energy storage, and separation processes. The shift to renewable energy sources, such as hydrogen fuel cells, drives up demand for high-performance ion exchange membranes. For example, in Asia Pacific, leading companies, such as Asahi Kasei and AGC Engineering, are developing ion exchange membranes for wastewater treatment and energy applications. These developments address the region's severe environmental rules as well as its large industrial output. Their innovations assist companies in meeting regulatory standards, lowering operating costs, and promoting environmentally friendly operations, hence encouraging market growth across numerous sectors.

Global Ion Exchange Membrane Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest ion exchange membrane market share, on account of the elevating demand for ion exchange membranes to treat various kidney-related diseases among individuals.

North America Ion Exchange Membrane Market Trends:

Rising investment in water treatment infrastructure is promoting the usage of ion exchange membranes for more effective water management in North America. For example, the U.S. WIFIA program funds projects use these membranes for advanced desalination and wastewater treatment.

Europe Ion Exchange Membrane Market Trends:

Europe’s goals for sustainable energy are driving the usage of ion exchange membranes in hydrogen fuel cells. Siemens Energy incorporates these membranes into their electrolyzer in Germany, increasing hydrogen production and facilitating the transition to renewable energy.

Asia Pacific Ion Exchange Membrane Market Trends:

In Asia Pacific, stricter environmental restrictions are boosting the usage of membranes to treat industrial wastewater, thereby exhibiting dominance in the regional market. For instance, China's stricter discharge rules have prompted enterprises to use ion exchange membranes for effective pollution removal, in accordance with regulatory requirements.

Latin America Ion Exchange Membrane Market Trends:

The mining industry's expansion has boosted membrane applications for metal recovery in Latin America. Codelco in Chile employs ion exchange membranes in hydrometallurgical operations to increase metal extraction and sustainability.

Middle East and Africa Ion Exchange Membrane Market Trends:

Desalination improvements rely on membrane technology to produce water efficiently in the Middle East and Africa region. For example, Saudi Arabia's SWCC uses ion exchange membranes in large-scale desalination facilities to address rising freshwater demand.

Top Companies Leading in the Ion Exchange Membrane Industry

Some of the leading ion exchange membrane market companies include 3M Company, AGC ENGINEERING Co. Ltd, Asahi Kasei Corporation, Dioxide Materials, Dow Inc., DuPont de Nemours Inc., Fujifilm Holdings Corporation, General Electric Company, Lanxess AG, Merck KGaA, ResinTech Inc., Saltworks Technologies Inc., and Toray Industries Inc., among many others. For example, in September 2024, Asahi Kasei Corporation launched new services for membrane process chlor-alkali electrolysis with R2, following an acquisition and joint study. It also opened a Houston office in November 2024 to enhance its global presence.

Global Ion Exchange Membrane Market Segmentation Coverage

- On the basis of the charge, the market has been bifurcated into cation, anion, amphoteric, bipolar, and mosaic, wherein anion represents the most preferred segment as it resists alkali, oxidation, and chlorine and functions as diffusion dialysis for acid recovery.

- Based on the material, the market is categorized into hydrocarbon membrane, perfluorocarbon membrane, inorganic membrane, composite membrane, and partially halogenated membrane, amongst which inorganic membrane dominates the market. It provides resilience to high temperatures and wetting-drying cycles across organic membranes.

- On the basis of the structure, the market has been divided into heterogeneous membrane and homogenous membrane. Among these, the homogenous membrane exhibits a clear dominance in the market, on account of the increasing use of homogeneous membranes to remove high sulfate concentrations from water.

- Based on the application, the market is bifurcated into electrodialysis, electrolysis, chromatographic separation, desalination, wastewater treatment, and radioactive liquid waste treatment, wherein electrolysis dominates the market due to the increasing utilization in chemical processing, chloralkali and hydrogen production, and metal extraction.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1,011.5 Million |

| Market Forecast in 2033 | USD 1,401.3 Million |

| Market Growth Rate (2025-2033) | 3.7% |

| Units | Million USD |

| Segment Coverage | Charge, Material, Structure, Application, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, AGC ENGINEERING Co. Ltd, Asahi Kasei Corporation, Dioxide Materials, Dow Inc., DuPont de Nemours Inc., Fujifilm Holdings Corporation, General Electric Company, Lanxess AG, Merck KGaA, ResinTech Inc., Saltworks Technologies Inc. and Toray Industries Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)