Global Insulin Pumps Market Expected to Reach USD 8.8 Billion by 2033 - IMARC Group

Global Insulin Pumps Market Statistics, Outlook and Regional Analysis 2025-2033

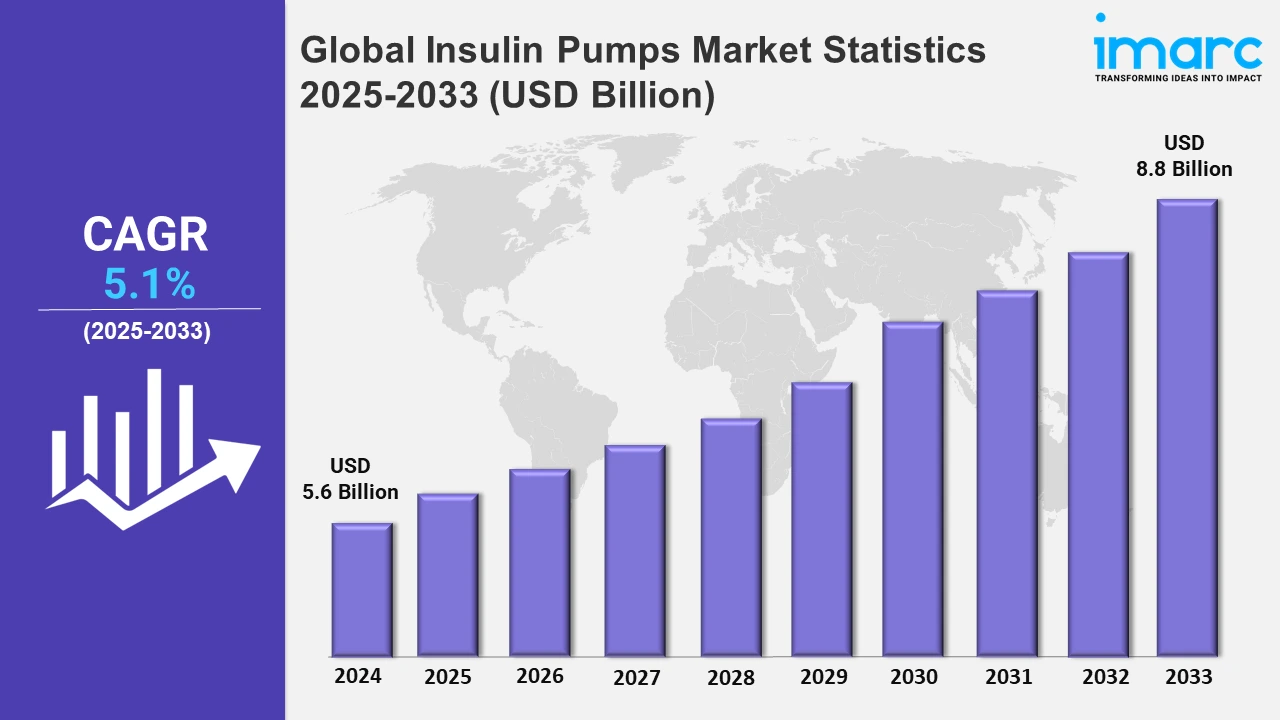

The global insulin pumps market size was valued at USD 5.6 Billion in 2024, and it is expected to reach USD 8.8 Billion by 2033, exhibiting a growth rate (CAGR) of 5.1% from 2025 to 2033.

To get more information on this market, Request Sample

Regulatory approvals for unique devices to control diabetes are propelling the growth of the market. FDA approvals for such insulin delivery devices indicate rising innovation, opening the way for more accessible, efficient, and patient-centered diabetes treatment options. For example, in September 2024, Modular Medical, Inc., an insulin delivery system technology company, announced receiving U.S. Food and Drug Administration (FDA) clearance to market and sell its MODD1 pumps in the U.S.

Moreover, the market is shifting toward smaller, automated devices that enhance glucose control. These developments are aimed at improving ease and precision, responding to the need for more user-friendly and effective diabetes treatment options for patients across the world. For instance, in October 2024, Luna Diabetes announced the commencement of a major investigation into Luna, the company's small and automated insulin delivery device. It is the world's smallest patch pump and is intended to change overnight glucose management. Furthermore, the industry is witnessing developments in smart technologies, with manufacturers incorporating artificial intelligence and Bluetooth connection for individualized diabetes care. These advancements improve user convenience and treatment precision, allowing wider worldwide adoption. Additionally, the increased need for replacement devices provides chances for income generation. As patients prefer compact and high-performance insulin pumps over older choices, the market shifts toward more contemporary and user-friendly solutions. For example, Insulet Corporation's Omnipod technology, which combines tubeless insulin administration with mobile app integration, has seen substantial growth in the Middle East. This technology meets the increased demand for easy solutions to treat patients with diabetes. Such advancements highlight the market's transition toward advanced and user-centric devices, which is driving higher adoption rates and enhancing diabetes treatment across several countries.

Global Insulin Pumps Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa. According to the report, North America accounted for the largest insulin pumps market share due to a high incidence rate of diabetes, especially type 1 diabetes.

North America Insulin Pumps Market Trends:

North America holds the largest share of the market. Advancements in technologies like artificial pancreas systems and Bluetooth-enabled devices are augmenting the growth of the market. Companies such as Medtronic developed the MiniMed 780G in 2021, which has automated glucose monitoring and insulin administration to improve diabetes control. Besides this, the region's emphasis on innovation and high patient acceptance rates is another growth-inducing factor.

Europe Insulin Pumps Market Trends:

Insulin pumps are becoming increasingly common in Europe for managing diabetes at a very young age. With an increase in instances of Type 1 diabetes in children, devices designed for younger patients are gaining popularity. For example, Roche addressed this by launching Accu-Chek Insight for children. Government healthcare programs and reimbursement regulations boost insulin pumps utilization throughout the region.

Asia Pacific Insulin Pumps Market Trends:

In Asia Pacific, there is widespread usage of insulin pumps being driven by improved diabetes management awareness and better healthcare infrastructure. For example, due to initiatives by organizations like JDRF, there has been an increase in the number of patients in India who are using insulin pumps. Companies, including Ypsomed, have also extended their regional operations, increasing accessibility and cost.

Latin America Insulin Pumps Market Trends:

The industry is growing as manufacturers focus on cost and accessibility to meet economic concerns in Latin America. For example, Medtronic has collaborated with healthcare professionals in Brazil and Mexico to sell its MiniMed insulin pumps, allowing more access. Similarly, Roche promotes its Accu-Chek systems through instructional programs. These activities complement government programs aimed at reducing diabetes prevalence and promoting broader usage of improved insulin delivery systems throughout the region.

Middle East and Africa Insulin Pumps Market Trends:

The market in the Middle East and Africa region continues to expand as innovative and user-friendly solutions are being developed. For example, Insulet Corporation has introduced the tubeless Omnipod insulin pumps in several Middle Eastern nations. This technology provides a simple solution for diabetes care, helping to meet the region's growing diabetes prevalence. Such innovations increase patient accessibility, improving health outcomes across various healthcare settings.

Top Companies Leading in the Insulin Pumps Industry

Some of the leading insulin pumps market companies include CeQur SA, F. Hoffmann-La Roche AG, Jiangsu Delfu medical device Co., Ltd., Medtronic plc, Medzer LLC, MicroPort Scientific Corporation, Micro-Tech Medical, Inc., SOOIL Developments Co., Ltd., Terumo Corporation, Ypsomed AG, among many others. For example, in March 2024, Medtronic plc announced that it had received approval from the FDA for the Evolut FX+ transcatheter aortic valve replacement (TAVR) system.

Global Insulin Pumps Market Segmentation Coverage

- Based on the product type, the market has been segmented into insulin pumps (tethered pumps and disposable/patch insulin pumps) and insulin pumps supplies and accessories (infusion set insertion devices and insulin reservoirs/cartridges), wherein insulin pumps lead the market owing to the introduction of new types of insulin pumps. Tethered pumps employ a catheter attached to an external device to provide continuous subcutaneous insulin infusion. Disposable or patch insulin pumps, on the other hand, are tiny wearable devices that cling directly to the skin.

- Based on the distribution channel, the market is divided into hospital pharmacy, retail pharmacy, online sales, diabetes clinics/ centers, and others, wherein hospital pharmacy dominates the market. Hospital pharmacy plays an important role in ensuring the effective integration and application of this technology in patient care.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 5.6 Billion |

| Market Forecast in 2033 | USD 8.8 Billion |

| Market Growth Rate 2025-2033 | 5.1% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Hospital Pharmacy, Retail Pharmacy, Online Sales, Diabetes Clinics/ Centers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | CeQur SA, F. Hoffmann-La Roche AG, Jiangsu Delfu medical device Co., Ltd., Medtronic plc, Medzer LLC, MicroPort Scientific Corporation, Micro-Tech Medical, Inc., SOOIL Developments Co., Ltd., Terumo Corporation, Ypsomed AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Insulin Pumps Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)