Optimizing Battery Energy Storage System (BESS) Production: A Comprehensive Cost Analysis

-production_11zon.webp)

What is Battery Energy Storage System (BESS)?

Battery Energy Storage System (BESS) represents a power grid technology that stores electricity to enhance electric power grid reliability while increasing operational efficiency.

Key Applications Across Industries:

BESS permits battery recharging during periods of low demand or extra grid supply capacity. BESS provides three principal operational functionalities which include power grid stabilization during supply disruptions, control of energy supply variations, and integration of intermittent renewable generation from wind and solar resources.

What the Expert Says: Market Overview & Growth Drivers

According to an IMARC study, the global Battery Energy Storage System (BESS) market was valued at US$ 57.5 Billion in 2024, growing at a CAGR of 34.8% from 2019 to 2024. Looking ahead, the market is expected to grow at a CAGR of approximately 14.3% from 2025 to 2033, reaching a projected value of US$ 194.8 Billion by 2033.

The BESS market is experiencing significant growth driven by multiple factors. Renewable energy systems such as solar and wind require efficient energy storage as these resources produce irregular power output that impairs system stability. Advancements in battery technology deliver major benefits to BESS deployment as they advance energy density and safety while prolonging battery life and lowering costs. The need for methane emissions reduction and renewable energy adoption has surged the demand for BESS systems because they allow the effective utilization of clean energy. Supportive government policy measures and incentives for energy storage solutions drive market expansion through accelerated market growth. The rising need for backup power solutions due to frequent power outages and natural disasters is also contributing to market expansion.

Case Study on Cost Model of Battery Energy Storage System (BESS) Manufacturing Plant:

Objective

One of our clients has approached us to conduct a feasibility study for establishing a mid to large-scale Battery Energy Storage System (BESS) plant in the Houston, Texas (United States).

IMARC Approach: Comprehensive Financial Feasibility

We have developed a comprehensive financial model for the plant's setup and operations. The proposed facility of Battery Energy Storage System (BESS) is planned to have an installed capacity of 1 GWh per year.

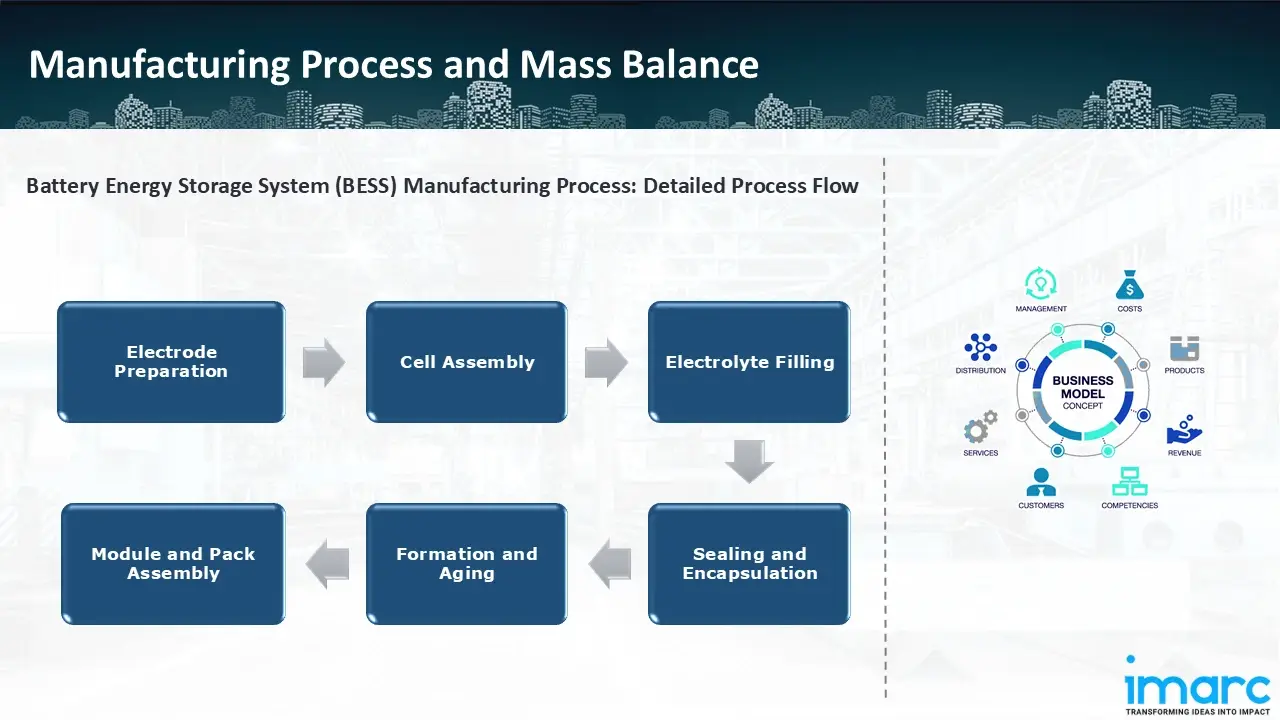

Manufacturing Process: Battery Energy Storage Systems (BESS) are manufactured by coating active materials onto metal foils to form cathodes and anodes. The drying process follows the electrode calendaring step to reach the desired product dimensions and material consistency. The next step is cell assembly, which entails placing the electrodes into protective cases after stacking or winding them with into the required cell design. In order to promote ion movement and guarantee steady electrochemical performance, the electrolyte filling stage adds a precisely measured quantity of electrolyte into the cells. Cells are sealed during the sealing and encapsulation stage to stop leaks and shield them from oxygen and moisture, improving longevity and safety. The production and aging process follows, where cells are charged and discharged under regulated settings to stabilize function and discover flaws. Individual cells are then arranged into modules and incorporated into battery packs with thermal and electrical control systems during the module and pack assembly process. This stage ensures scalability, safety, and compatibility with many applications, including grid storage and renewable energy integration. Rigorous quality checks at each step assure reliability, safety, and conformance to industry standards.

Get a Tailored Feasibility Report for Your Project Request Sample

Raw Material Required: The primary raw materials utilized in the Battery Energy Storage System (BESS) manufacturing plant include as lithium-ion battery cells, battery modules and battery management system, power conversion system, cooling and thermal management systems.

List of Machinery:

The following equipment was required for the proposed plant:

- Module Assembly Lines

- Welding Machines

- BMS Integration Equipment

- Inverter and Converter Assembly Lines

- Cooling System Manufacturing

- Environmental Test Chambers

- Electrical Test Equipment

- Material Handling Equipment (Forklifts, conveyors, and automated guided vehicles)

Techno-Commercial Parameter:

- Capital Investment (CapEx): Capital expenditure (CapEx) in a manufacturing plant includes various investments essential for its setup and long-term operations. It covers machinery and equipment costs, including procurement, installation, and commissioning. Civil works expenses involve land development, factory construction, and infrastructure setup. Utilities such as power, water supply, and HVAC systems are also significant. Additionally, material handling systems, automation, environmental compliance, and safety measures are key components. Other expenditures include IT infrastructure, security systems, and office essentials, ensuring operational efficiency and business growth.

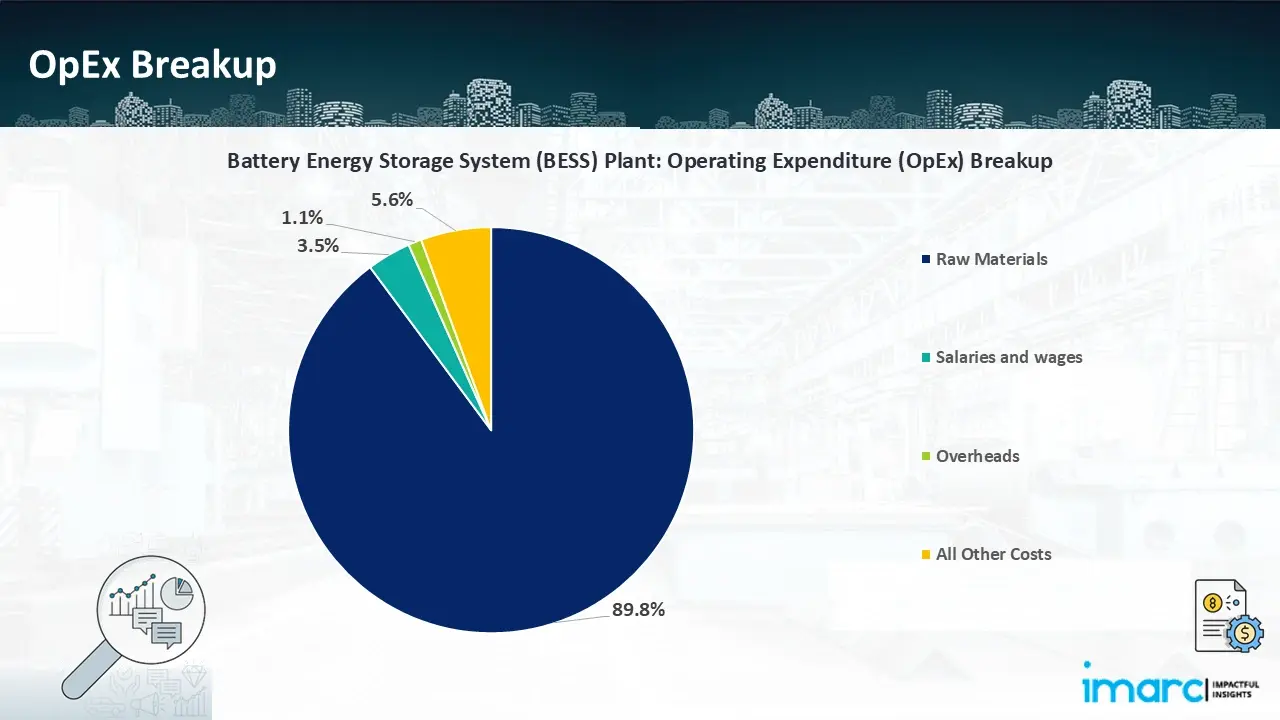

- Operating Expenditure (OpEx): Operating expenditure is the cost incurred to operate a manufacturing plant effectively. Opex in a manufacturing plant typically includes the cost of raw materials, utilities, depreciation, taxes, packing cost, transportation cost, and repairs and maintenance. The operating expenses are part of the cost structure of a manufacturing plant and have a significant effect on profitability and efficiency. Effective control of these costs is necessary for maintaining competitiveness and growth.

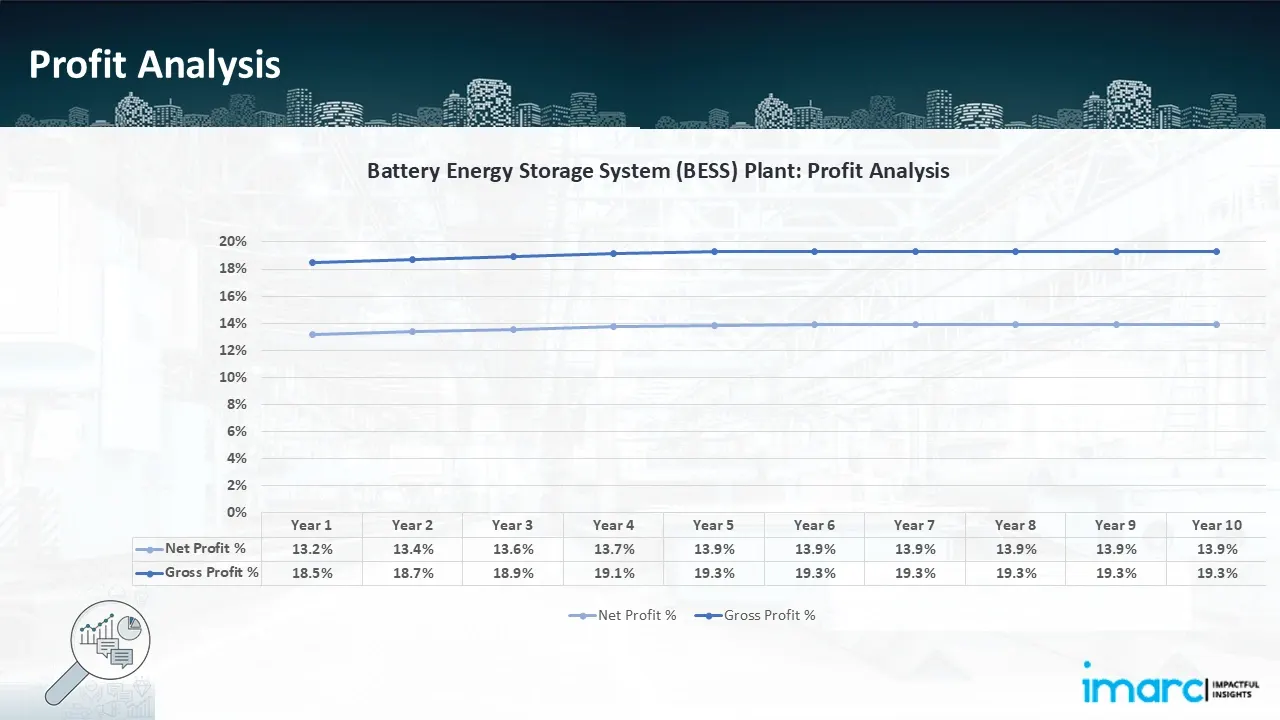

- Profitability Analysis Year on Year Basis: The proposed Battery Energy Storage System (BESS) plant, with an annual installed capacity of 1 GWh per year, achieved an impressive revenue of US$ 192.50 million in its first year. We assisted our client in developing a detailed cost model, which projects steady growth, with revenue rising till year 5 and then staying the same throughout Year 5 to Year 10. Gross profit margin improved from 18.5% to 19.3% throughout the years, and net profit went up from 13.2% to 13.9%, highlighting strong financial viability and profitability.

Conclusion & IMARC's Impact:

Our financial model for the Battery Energy Storage System (BESS) plant was meticulously designed to meet the client’s objectives. It provided a thorough analysis of production costs, including raw materials, manufacturing processes, capital expenditure, and operational expenses. Tailored to the specific requirement of setting up a Battery Energy Storage System (BESS) plant in Texas, United States, the model highlights key cost drivers and forecasts profitability, considering market trends, inflation, and potential fluctuations in raw material prices. This comprehensive financial model offers the client valuable insights for strategic decision-making, demonstrating our commitment to delivering precise, client-focused solutions that ensure the long-term success of large-scale manufacturing projects.

We designed the financial model of the Battery Energy Storage System (BESS) plant with scrupulous attention to match all client performance targets. The financial analysis measured expenses from all production aspects including materials and manufacturing operations alongside capital costs and business operating costs. Our BESS plant financial model specifically engineered for Texas, USA, showcases vital expense factors alongside profit projections through market trend research and raw material price variability and inflation adjustments. The extensive financial model provides critical decision-support data for long-term manufacturing success as part of our commitment to delivering exact client-centric solutions for large-scale industrial projects.

Latest News and Developments:

- In January 2025, The U.S. Department of Energy announced a US$1.2 Billion funding initiative to support renewable energy projects in Puerto Rico, including a US$585 Million loan guarantee for a 100-megawatt solar panel system with a 55-megawatt battery storage across four cities.

- In January 2025, Rolls-Royce and Polat Energy inked the largest battery energy storage system supply deal in Turkey to increase storage capacity at the Goktepe wind power station, which has a 132 MWh storage capacity.

- In September 2024, Reliance Power secured a contract from the Solar Energy Corporation of India to establish a 500 MW/1000 MWh battery energy storage system through e-Reverse Auction (eRA), marking a substantial step in India's renewable energy sector.

- In September 2024, Honeywell commissioned a microgrid BESS into service to distribute renewable energy, to aid in the decarbonisation of the Lakshadweep Islands in India.

- In December 2023, The Indian government approved a scheme to build a 4,000 MWh BESS with a budget of INR 3,760 crore, which is estimated to reduce carbon emissions by 1.3 Million metric tonnes per year.

Why Choose IMARC:

IMARC's Financial Model Expertise: Helping Our Clients Explore Industry Economics

IMARC is a global market research company that offers a wide range of services, including market entry and expansion, market entry and opportunity assessment, competitive intelligence and benchmarking, procurement research, pricing and cost research, regulatory approvals and licensing, factory setup, factory auditing, company incorporation, incubation services, recruitment services, and marketing and sales.

Brief List of Our Services: Market Entry and Expansion

- Market Entry and Opportunity Assessment

- Competitive Intelligence and Benchmarking

- Procurement Research

- Pricing and Cost Research

- Sourcing

- Distribution Partner Identification

- Contract Manufacturer Identification

- Regulatory Approvals, and Licensing

- Factory Setup

- Factory Auditing

- Company Incorporation

- Incubation Services

- Recruitment Services

- Marketing and Sales

Under our factory setup services, we assist our clients in exploring the feasibility of their plants by providing comprehensive financial modeling. Additionally, we offer end-to-end consultation for setting up a plant in India or abroad. Our financial modeling includes an analysis of capital expenditure (CapEx) required to establish the manufacturing facility, covering costs such as land acquisition, building infrastructure, purchasing high-tech production equipment, and installation. Furthermore, the layout and design of the factory significantly influence operational efficiency, energy consumption, and labor productivity, all of which impact long-term operational expenditure (OpEx). So, every parameter is covered in the analysis.

At IMARC, we leverage our comprehensive market research expertise to support companies in every aspect of their business journey, from market entry and expansion to operational efficiency and innovation. By integrating our factory setup services with our deep knowledge of industry dynamics, we empower our clients to not only establish manufacturing facilities but also strategically position themselves in highly competitive markets. Our financial modeling and end-to-end consultation services ensure that clients can explore the feasibility of their plant setups while also gaining insights into competitors' strategies, technological advancements, and regulatory landscapes. This holistic approach enables our clients to make informed decisions, optimize their operations, and align with sustainable practices, ultimately driving long-term success and growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104