Optimizing Aluminium Cans Production: A Comprehensive Cost Analysis

What is Aluminium Cans?

Aluminium cans are common packaging solutions in the food, beverage, and industrial sectors because they are strong, lightweight, and highly recyclable.

Key Applications Across Industries:

They ensure product freshness by shielding contents from light, air, and pathogens thanks to their exceptional barrier qualities. Because of its limitless recyclability and little environmental impact, aluminium cans have become the favoured option as sustainability awareness has grown.

What the Expert Says: Market Overview & Growth Drivers

According to an IMARC study, the global aluminium cans market was valued at USD 55.4 Billion in 2024. The market is anticipated to expand at a compound annual growth rate of 2.8% between 2025 and 2033, with an estimated valuation of USD 70.9 Billion by the end of 2033.

Growing demand in recyclable and eco-friendly packaging is the main driving force in the aluminium cans market. Due to increasing environmental awareness, the customer and business worlds are moving away from single-use plastics toward utilizing aluminium cans because of their infinite recyclability and low carbon footprint. This appeal is realized through its lightweight, robust, and impenetrable characteristics by beverage, food, and personal care industries. Government policies have increased demand due to the encouragement of eco-friendly products, as well as growing acceptance of ready-to-drink beverages. Innovations in can design and production have also played a significant role in driving market growth.

Case Study on Cost Model of Aluminium Cans Manufacturing Plant:

Objective

One of our clients approached us to conduct a feasibility study for establishing a mid to large-scale aluminium cans manufacturing plant in Imbonini (South Africa).

IMARC Approach: Comprehensive Financial Feasibility

We developed a comprehensive financial model for the plant's setup and operations. The proposed facility is designed with an annual production capacity of 576,000 aluminium cans per day.

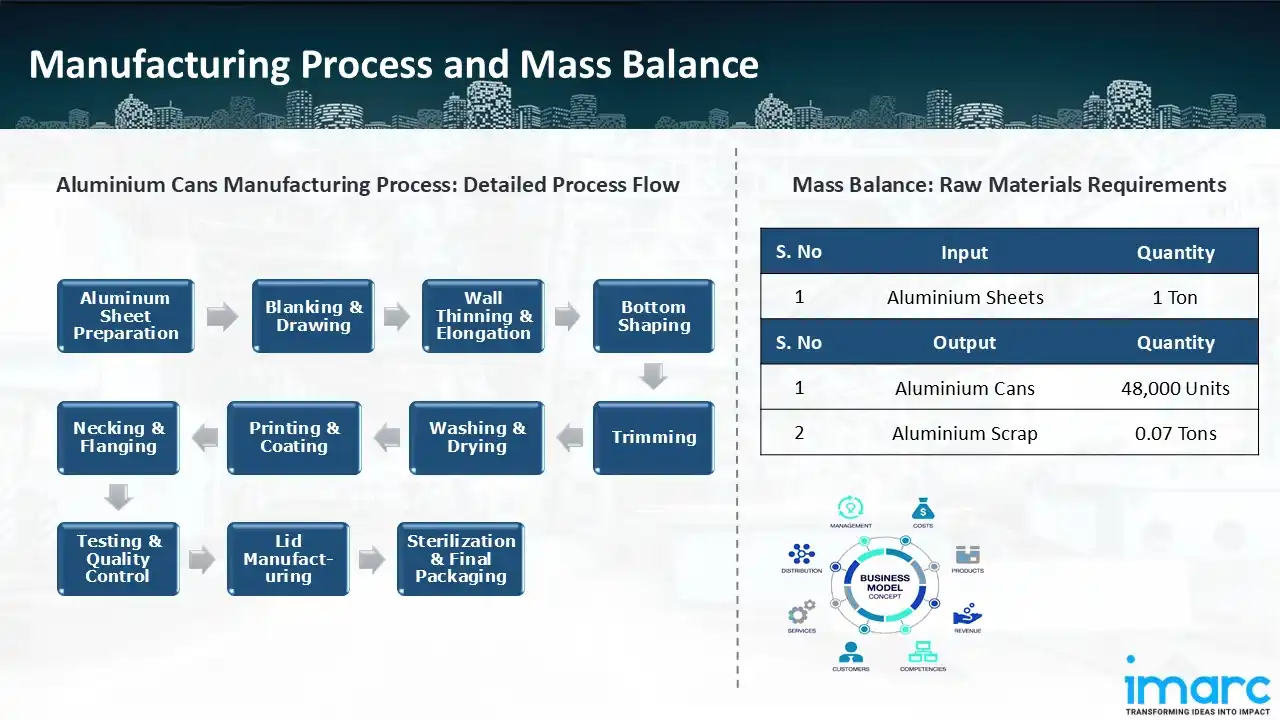

Manufacturing Process: The manufacturing process starts with coils of aluminium, which are first uncoiled, lubricated and then cut into aluminium circles or discs. The circular discs are then converted into shallow cups by using a press machine. The top of the cups is then trimmed off for making each can of same height. The scrap obtained after cutting and cupping process is removed and can be reused to make aluminium sheets again. Like can body manufacturing, the lids are cut from the aluminium sheet according to the can size, coated, dried and an easy-open tab is made on the lids. The cans are then cleaned, dried, printed, coated, filled and capped.

Get a Tailored Feasibility Report for Your Project Request Sample

Mass Balance and Raw Material Required: Aluminium sheet is the major raw material required during the process; while printing inks, cleaning agents and coating materials are required in very small amounts. 1 Ton of aluminium sheet can produce 48,000 cans. Nearly 30g of printing ink would be required per 1,000 cans. Around 93% of the total aluminium sheet gets converted into aluminium cans, while the remaining 7% gets wasted and can be sold as aluminium scrap.

Li.st of Machinery:

The following equipment was required for the proposed plant:

- Cupping System consisting of Coil Downender, Coil Car, Single Decoiler, Coil Lubricator, Servo-feed

- Die-set for Can 204/202 330ml

- Bodymaker

- Trimmer

- Coolant Filter & Sump System (for 2 bodymakers)

- Can Washer, Washer Oven, Hot Water Boiler for 400 cpm

- Mass Bottom Rim Coater

- Decorator- with 8 colours and equipped with 8 inkers

- Outside Bake Oven (Pin Oven)

- "Inside Laquer Spray Machines including Pressure Control

- System on an integrated base"

- Internal Bake Oven (IBO) for 300bpm

- Necker including tooling sets and accessories for one bottle size

- Light Tester

- Internal Vision Inspection

- Label Inspection System

- "Palletizer/Pallet Conveying System/Strapper/Stretch Wrapper/Resort -Depalletizer"

- Can Conveying System/Line Controller

- Can Specific Parts Tooling System

- Can Scrap Handling System

- Scrap Bailer

- Bodymaker Mist Collection 1 Exhaust System for 2 bodymakers

- De-Ionised Water System

- Waste Water Treatment Plant

- Washer Chemical Control System

- Deco Mist Collection System

- Sheet Fedding Press System

- Pneumatic Press Tooling System

- Conveyer System Between Press and Curler

- Horizontal Single Head Big Curler System

- Connecting System Between Curler and Rotary Liner

- High Speed Rotary Liner

- Ends Stacker with Counter- type-1

- Pressing Machine

- Pressing Tab (3-Lane)

- Conversion Pressing Tool

- Belt Transmission System

- Mechanical Transmission System

- Oil Lubrication and Pneumatic System

- Ends Separator

- Tab Uncoiler Feeder

- Ends Stacker with Counter - type-2

Techno-Commercial Parameter:

- Capital Investment (CapEx): Capital expenditure (CapEx) in a manufacturing plant includes various investments essential for its setup and long-term operations. It covers machinery and equipment costs, including procurement, installation, and commissioning. Civil works expenses involve land development, factory construction, and infrastructure setup. Utilities such as power, water supply, and HVAC systems are also significant. Additionally, material handling systems, automation, environmental compliance, and safety measures are key components. Other expenditures include IT infrastructure, security systems, and office essentials, ensuring operational efficiency and business growth.

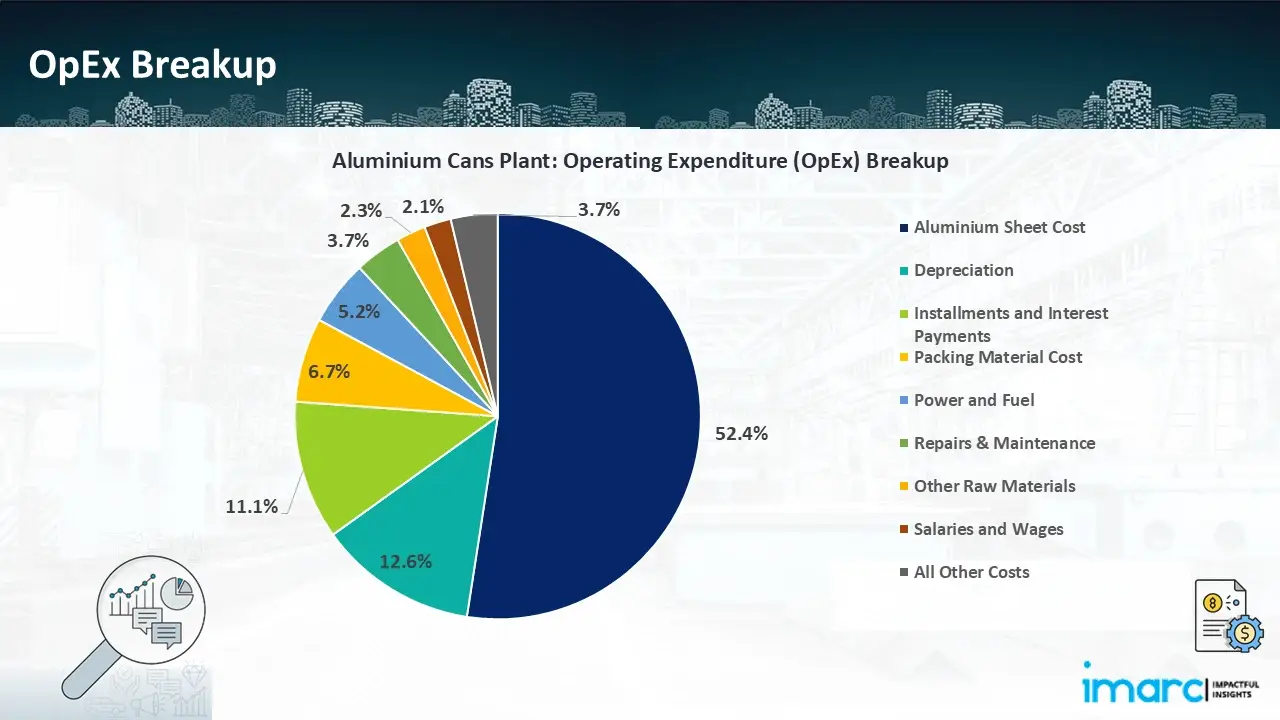

- Operating Expenditure (OpEx): Operating expenditure is the cost incurred to operate a manufacturing plant effectively. OpEx in a manufacturing plant typically includes the cost of raw materials, utilities, depreciation, taxes, packing cost, transportation cost, and repairs and maintenance. The operating expenses are part of the cost structure of a manufacturing plant and have a significant effect on profitability and efficiency. Effective control of these costs is necessary for maintaining competitiveness and growth.

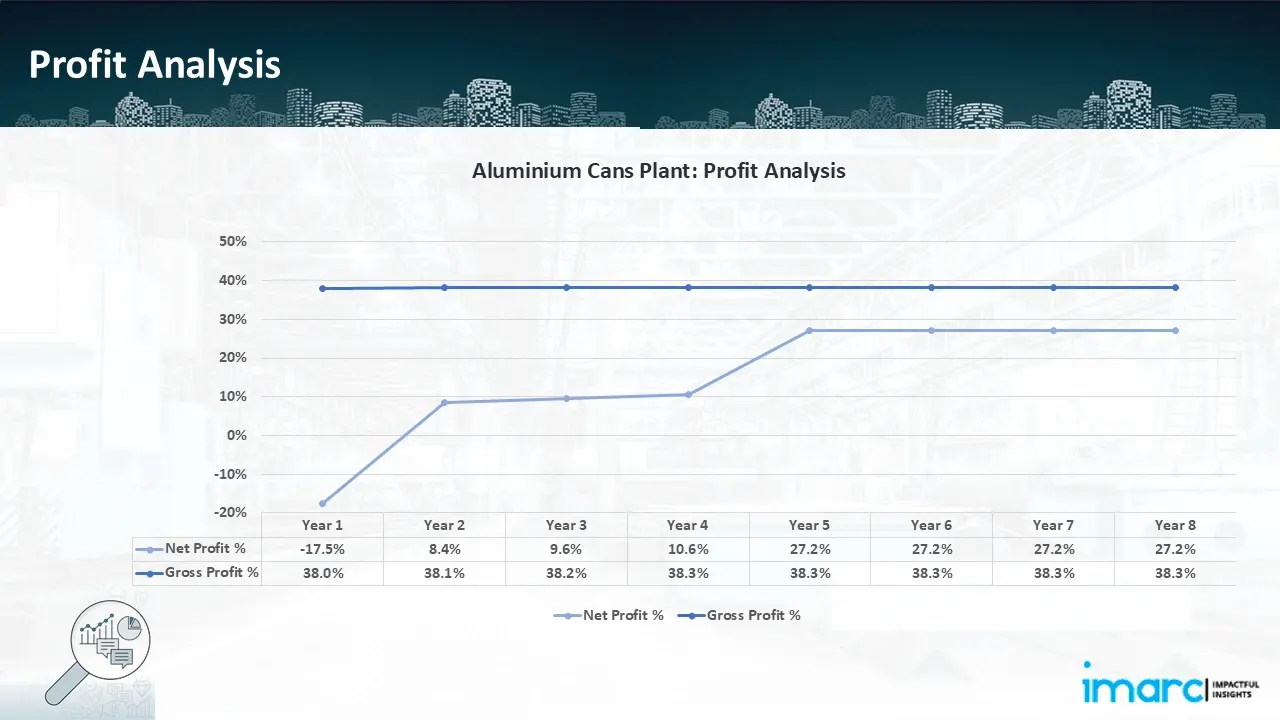

- Profitability Analysis Year on Year Basis: The proposed aluminium cans plant, with a capacity of 576,000 aluminium cans per day, achieved an impressive revenue of US$ 13.1 million in its first year. We assisted our client in developing a detailed cost model, which projects steady growth, with revenue rising throughout the projected period. Moreover, gross profit margins improve from 38.0% to 38.3% by year 8, and net earnings rise from a negative of 17.5% to a positive of 27.2%, highlighting strong financial viability and profitability.

Conclusion & IMARC's Impact:

Our financial model for the aluminium cans manufacturing plant was meticulously designed to meet the client’s objectives. It offered a detailed analysis of production costs, covering raw materials, manufacturing processes, capital expenditures, and operational costs. Tailored to the specific requirement of producing 576,000 aluminium cans per day, the model highlights key cost drivers and forecasts profitability, considering market trends, inflation, and potential fluctuations in raw material prices. This detailed financial model provides the client with valuable insights for strategic decision-making, reflecting our dedication to delivering accurate, client-centered solutions that support the long-term success of large-scale manufacturing projects.

Latest News and Developments:

- In December 2024, the United States' recycling rate for aluminium beverage cans has decreased recently due to ageing recycling infrastructure and a lax attitude to recycling regulations, according to the most recent data from the Aluminium Association and the Can Manufacturers Institute (CMI).

- In August 2024, the Brazilian Association of Aluminium Can Manufacturers reports that the country's aluminium can sector is expected to grow by 5% by 2024. This notable increase is the result of increased beverage consumption and can sales due to the prolonged hot season and advantageous macroeconomic conditions.

- In September 2023, according to a recent study on aluminium can recycling, by 2030, efficient worldwide recycling of used beverage cans might save 60 Million tonnes of CO2e annually. The study, commissioned by the International Aluminium Institute, received co-funding from Emirates Global Aluminium, Crown Holdings, the Australian Aluminium Council, and Novelis.

Why Choose IMARC:

IMARC's Financial Model Expertise: Helping Our Clients Explore Industry Economics

IMARC is a global market research company that offers a wide range of services, including market entry and expansion, market entry and opportunity assessment, competitive intelligence and benchmarking, procurement research, pricing and cost research, regulatory approvals and licensing, factory setup, factory auditing, company incorporation, incubation services, recruitment services, and marketing and sales.

Brief List of Our Services: Market Entry and Expansion

- Market Entry and Opportunity Assessment

- Competitive Intelligence and Benchmarking

- Procurement Research

- Pricing and Cost Research

- Sourcing

- Distribution Partner Identification

- Contract Manufacturer Identification

- Regulatory Approvals, and Licensing

- Factory Setup

- Factory Auditing

- Company Incorporation

- Incubation Services

- Recruitment Services

- Marketing and Sales

Under our factory setup services, we assist our clients in exploring the feasibility of their plants by providing comprehensive financial modeling. Additionally, we offer end-to-end consultation for setting up a plant in India or abroad. Our financial modeling includes an analysis of capital expenditure (CapEx) required to establish the manufacturing facility, covering costs such as land acquisition, building infrastructure, purchasing high-tech production equipment, and installation. Furthermore, the layout and design of the factory significantly influence operational efficiency, energy consumption, and labor productivity, all of which impact long-term operational expenditure (OpEx). So, every parameter is covered in the analysis.

At IMARC, we leverage our comprehensive market research expertise to support companies in every aspect of their business journey, from market entry and expansion to operational efficiency and innovation. By integrating our factory setup services with our deep knowledge of industry dynamics, we empower our clients to not only establish manufacturing facilities but also strategically position themselves in highly competitive markets. Our financial modeling and end-to-end consultation services ensure that clients can explore the feasibility of their plant setups while also gaining insights into competitors' strategies, technological advancements, and regulatory landscapes. This holistic approach enables our clients to make informed decisions, optimize their operations, and align with sustainable practices, ultimately driving long-term success and growth.