From Pulp to Profit: Insights into India's Booming Tissue Paper Market

Tissue paper, made from both virgin and recycled pulp, has become an essential part of daily life for cleaning, dusting, wrapping, and personal use. The industry's expansion is driven by luxurious tissue products, ultra-absorbent paper towels, and rising prices. Favorable factors such as growth in the IT sector, tourism, and MNCs, along with shifts in lifestyle and attitudes towards hygiene, cleanliness, and freshness, have boosted tissue consumption. Institutions like hospitals, malls, office complexes, and F&B chains are major consumers. Government support for sustainable practices has further spurred growth. West and South India are projected to be the largest consumers of tissues due to high foreign tourist influx, growing urbanization, and a hot climate that increases demand for disposable tissues.

According to IMARC, the Indian tissue paper market reached a volume of 160 Thousand Tons in 2023, growing at a CAGR of 8.8% from 2018 to 2023. Looking ahead, the market is projected to reach 334 Thousand Tons by 2032, growing at a CAGR of 8.6% from 2024 to 2032. Several factors, such as the rising population and improved living standards, have led to increased demand for personal hygiene products like toilet paper and facial tissues in India. The growing number of supermarkets, hypermarkets, and convenience stores offering a variety of tissue brands, including private labels, has further boosted tissue sales. Additionally, the rise of e-commerce has increased tissue paper demand. Consumers are increasingly switching to eco-friendly products, driving the demand for sustainable tissue options.

Latest Insights into the India Tissue Market: Trends and Developments

- In October 2024, Supreme Paper announced its ambition to dominate the converted tissue products market in the Eastern region by installing a 50 TPD tissue production capacity. To further strengthen its market presence, the company also introduced its new tissue brand, SOFMAX.

- In June 2024, Krishna Tissues Pvt. Ltd. announced its plans to launch a state-of-the-art tissue paper plant with a production capacity of 50 tons per day, utilizing 100% virgin fiber. The plant is expected to commence operations by late 2025 or early 2026.

- In May 2024, Singapore’s APRIL Group, one of the world's largest fiber, pulp, and paper producers, acquired a controlling stake in Origami, India’s leading consumer tissue products company. This move marks APRIL's entry into India's fast-growing tissue and personal hygiene market.

- In February 2024, the Board of Andhra Paper approved the installation of a state-of-the-art tissue paper machine at its Kadiyam manufacturing facility in East Godavari, Andhra Pradesh. The machine will have a production capacity of 100 tons per day and will enable the company to expand its product portfolio by manufacturing various grades of tissue paper, including facial tissue, toilet tissue, napkins, and towel-grade tissue. The project involves a capital investment of up to INR 270 Crore.

- In December 2022, Gayatrishakti Tissue, a subsidiary of Gayatrishakti Paper & Boards Ltd., ordered an AHEAD 1.8 tissue machine from Toscotec for its mill in Vapi, Gujarat. This new line, set to start in 2024, marks the company's entry into the tissue market.

Case Study on Cost Model of Tissue Manufacturing Plant

Objective: One of our clients reached out to us to conduct a feasibility study for setting up a large-scale tissue paper manufacturing plant. We developed a comprehensive financial model for the setup and operation of the plant in India. The proposed facility is designed to have a production capacity of 50 tons of tissue paper per day, covering a land area of 12,140 square meters.

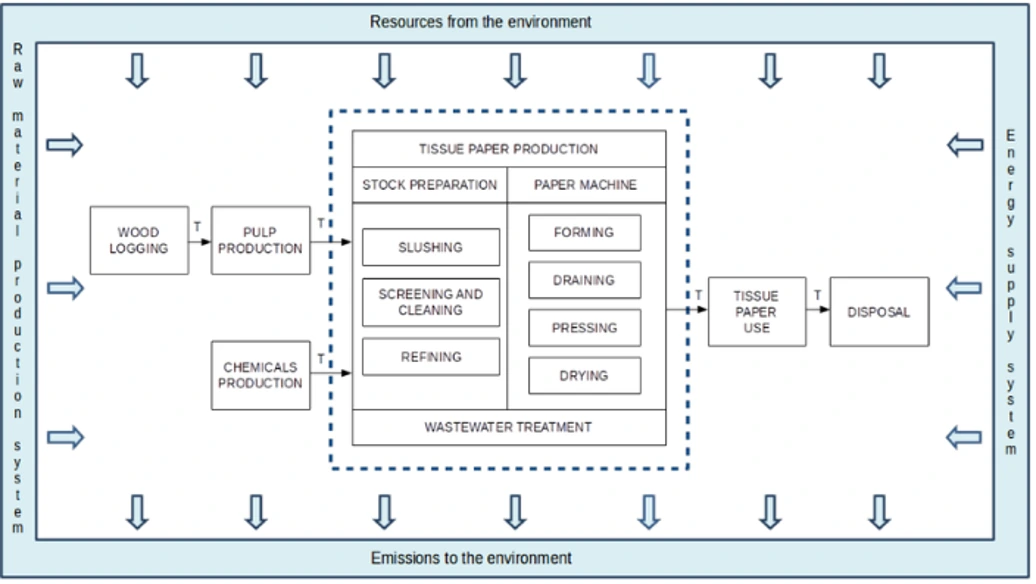

Manufacturing Process: Tissue paper production begins with wood logging, where trees are selected for sustainability and processed into logs. These logs are debarked, chipped, and chemically treated during pulp production to break down lignin and create wood pulp. Chemicals like fixing agents and dyes are added to achieve desired properties. The pulp undergoes stock preparation, starting with fiber slushing to form a watery fiber suspension, followed by screening and cleaning to remove impurities and refining to enhance fiber properties for better tissue strength and quality. The pulp is then fed into a paper machine, where the process includes forming the tissue web, draining excess water, pressing to remove moisture, and drying using steam to achieve the required dryness and texture. The tissue is further smoothed and compacted through calendaring during the finishing stage. Large tissue rolls are converted into smaller products through cutting, embossing, folding, and stacking. Finally, the tissues are packaged and branded for distribution.

Figure: Tissue Paper Manufacturing Process: Detailed Process Flow

Mass Balance and Raw Material Required: The primary raw materials utilized in the tissue manufacturing plant include hardwood, softwood, white liquor, caustic soda, coal, industrial oxygen, dry and wet strength resin, softener, and other components.

Table: Mass Balance: Raw Materials Required for 1 Ton of Tissue Paper Jumbo Roll Manufacturing

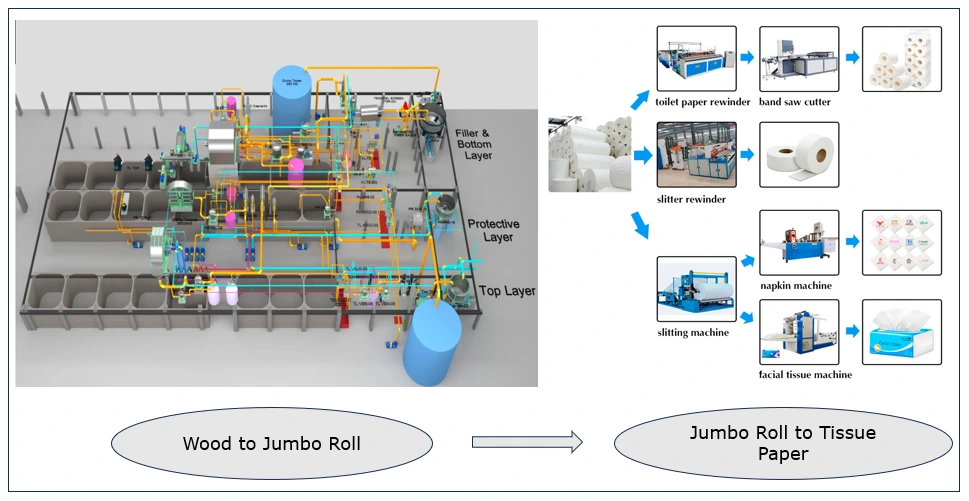

Plant Layout:

Figure: Tissue Paper Manufacturing: Plant Layout

List of Machinery:

The following equipment was required for the proposed plant:

- Pulping Equipment (Virgin Paper + Recycled Paper)

- High-strength hydraulic pulper

- Vibrating Screen

- Upflow pressure

- Rinsing machine

- Double disc grinding

- Low-concentration slag remover

- Pulp pool pusher

- Pulp pump

- White water pump

- Motor switch gear for pulp-making equipment

- Auxiliary machine consumables for jumbo roll machine

- Vacuum pump

- Air compressor

- Air pocket

- High-pressure water pump

- Dispersant mixer

- Tapered iron

- Woolen cloth (700g)

- Formed mesh

- Doctor blade

- Motor switchgear

- Sewage Treatment Machinery

- Sewage pump

- Stirring pot

- Fiber recycling machine

- Sewage pump

- Horizontal dissolved air flotation machine

- Air compressor

- Sludge pump

- Plate and frame filter press

- Flocculation tank

- Sewage pump

- Other Equipment

- Net Parts

- Round net cage

- Net groove

- Couch roller

- Suction box

- Guide roller

- Activities spray pipe

- Washing Section

- Suction box

- Guide roller

- Expand roller

- Electric tensioner

- Activities spray pipe

- Low-pressure water pipe

- Washing tank

- Frame

- Drying part

- Dryer

- Breathing hood

- Guide roller

- Holding roller

- Suction box

- Pneumatic scrap

- Adjuster (Manual type)

- Box frame

- Walkway railing

- Paper rolling section

- Roll paper cylinder

- Paper pressing roller

- Box frame

- Roll paper shaft

- Net Parts

Techno-Commercial Parameter:

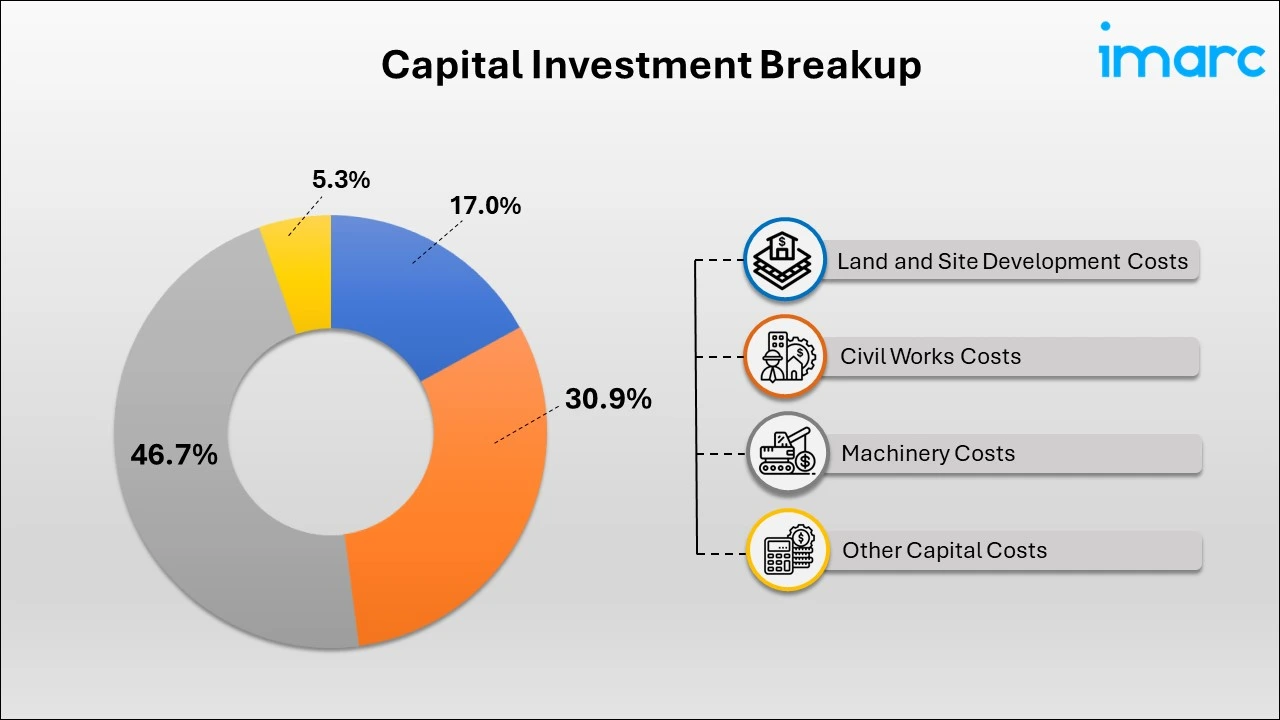

- Breakup by Capital Investment: The total capital cost for establishing the proposed plant is approximately INR 23.6 Crore. Machinery costs comprise 46.7% of the total capital costs for the tissue production plant. The civil work for a tissue manufacturing plant in India involves constructing a robust foundation, production halls, warehouses, utility buildings, and administrative offices. It includes site preparation, drainage systems, power infrastructure, and space for equipment like paper machines and drying units, ensuring compliance with local building codes and environmental standards.

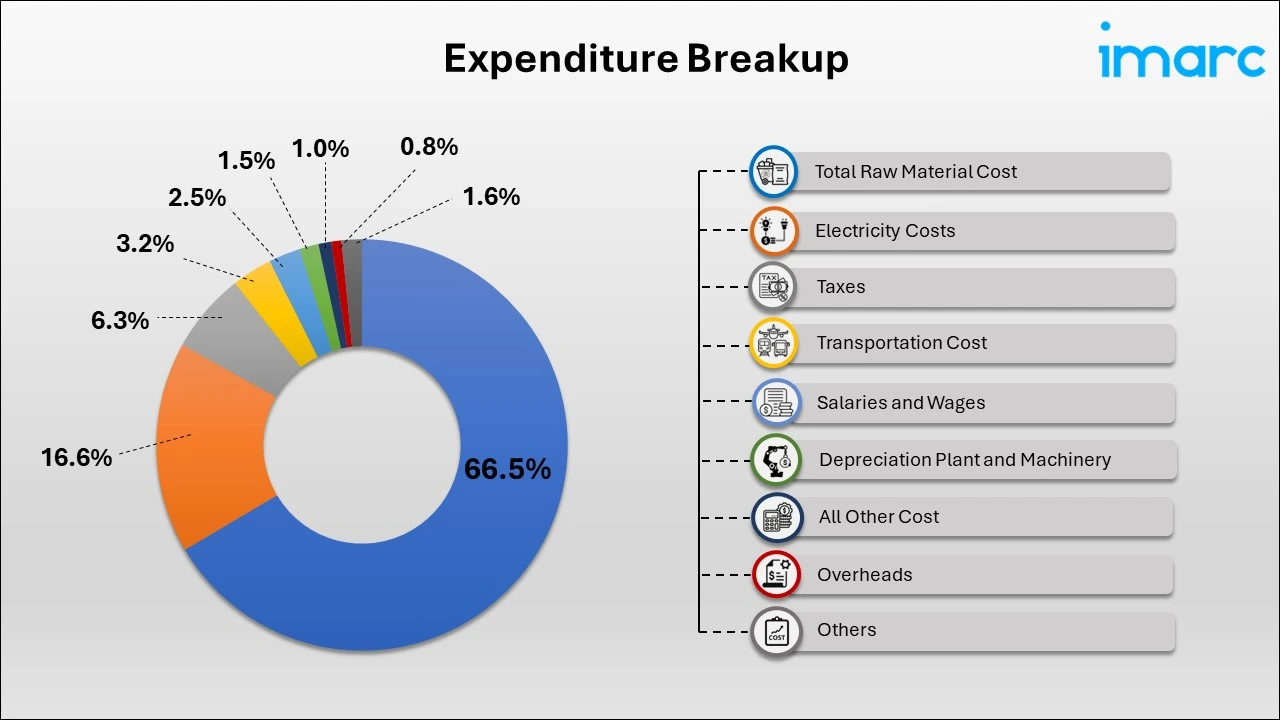

- Breakup by Expenditure: In a tissue paper manufacturing plant, the raw material cost for the first year of operations is projected at INR 58.50 Crore. This estimate encompasses the cost of all primary inputs required for production, such as wood pulp, chemicals, and other necessary materials. However, it is anticipated that by the fifth year of operation, the raw material cost will rise by 21.4% compared to the first year. This increase reflects anticipated inflation, market fluctuations, and potential rises in the cost of key raw materials, driven by factors such as supply chain disruptions, market demand, and changes in global economic conditions.

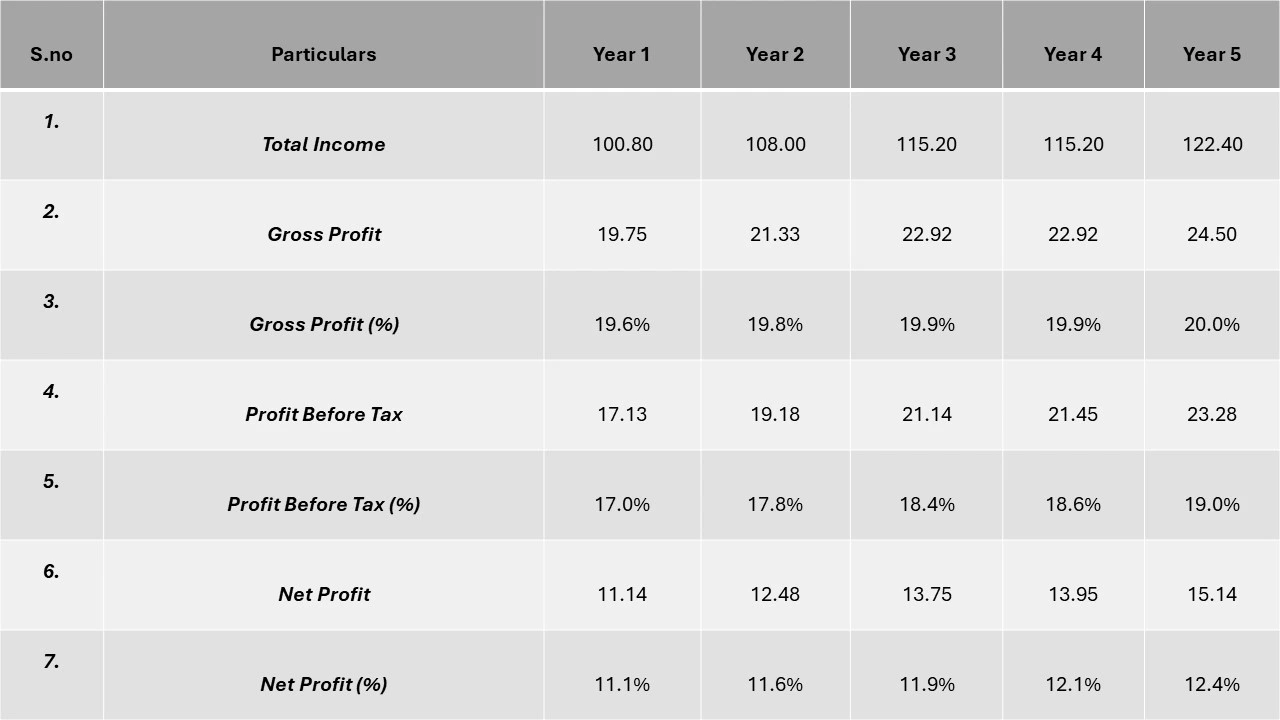

- Profitability Analysis Year on Year Basis

(All values are in INR Crore, except % ages)

Conclusion

Our financial model for the tissue paper manufacturing plant was carefully designed to align with the client’s objectives. It provides a comprehensive analysis of production costs, encompassing raw materials, manufacturing processes, capital expenditure, and operational expenses. Focused on the specific requirement of producing 50 tons of tissue paper per day, the model identifies key cost drivers and forecasts profitability while accounting for market trends, inflation, and potential fluctuations in raw material prices. This detailed financial model offers the client critical insights for strategic decision-making, underscoring our commitment to delivering precise, client-centric solutions that support the long-term success of large-scale manufacturing projects.

IMARC's Financial Model Expertise: Helping Our Clients Explore Industry Economics

At IMARC, we combine deep industry expertise with advanced financial modeling to empower clients to make well-informed decisions on market entry and operational strategies. By integrating competitive intelligence, regulatory analysis, and cost research, we help clients strategically position their manufacturing facilities in competitive markets. Our financial models go beyond cost projections, offering valuable insights into industry trends, competitor strategies, and emerging technologies. This holistic approach enables clients to plan sustainable, efficient, and profitable operations while adhering to industry standards and regulations. With IMARC's expertise, businesses can optimize their plant setup decisions, control costs effectively, and drive long-term growth through strategic, data-driven insights.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104