Driving Innovation: Saudi Arabia’s Tire Industry Driving Automotive Hub Vision

Tires are essential components of vehicles designed to provide traction, support, and absorb road shocks. Primarily made of rubber, tires consist of treads, belts, and sidewalls that work together to offer grip, stability, and durability. Modern tires come in various types – such as all-season, winter, and performance tires – each engineered for specific driving conditions. The two major tire categories are radial and bias tires, and they are available in different sizes to suit various vehicle types, including passenger cars, light commercial vehicles, medium and heavy commercial vehicles, two-wheelers, and off-road vehicles.

According to IMARC’s latest study, the Saudi Arabia tire market size reached 22.6 Million Units in 2023. Looking ahead, IMARC projects the market to grow to 25.5 Million Units by 2032, with a compound annual growth rate (CAGR) of 1.26% during 2024-2032. The expanding vehicle fleet, fueled by population growth and the country's Vision 2030 initiatives to diversify the economy, is a key contributor to the growth of the market. Increased urbanization and large-scale infrastructure projects are boosting demand for commercial vehicles, leading to higher tire consumption.

Moreover, the hot climate and rough terrain in the region result in more frequent tire replacements. The market also benefits from the rising demand for electric vehicles (EVs) and the growing focus on sustainability, which drives the need for specialized EV-compatible tires. The presence of global tire manufacturers and the expansion of aftersales services further support the market’s growth.

Latest Insights into the Saudi Arabia Tire Market: Trends and Developments

- In October 2024, Hankook Tire expanded its high-performance EV tire lineup in Saudi Arabia with the 'iON evo' and 'iON evo SUV' models. Available in 18, 20, and 21 inches, these tires are designed for a quiet, comfortable ride with improved fuel efficiency and extended mileage, catering to the growing needs of Saudi EV owners.

- In March 2024, Kumho Tire signed a 20-year technology export deal with Saudi Arabia's Black Arrow Tire Co. (Blatco). Under the agreement, Kumho will offer technological support to Blatco for producing passenger car tires in Saudi Arabia and the broader Middle East. Blatco, aligned with Saudi Arabia's Vision 2030, is building a 280,000-square-meter tire factory in the western industrial region, expected to be operational by 2027. The company aims to expand its mobility business through tire production and sales across the Middle East.

- In October 2023, Saudi Arabia's Public Investment Fund (PIF) and Pirelli Tyre SPA announced a US$ 550 Million joint venture to establish a tire manufacturing facility in Saudi Arabia, expected to start production in 2026. This facility will manufacture high-quality tires for both the Pirelli brand and a new local brand targeting regional markets, with a capacity of 3.5 Million Units annually.

Case Study on Cost Model of Tire Manufacturing Plant

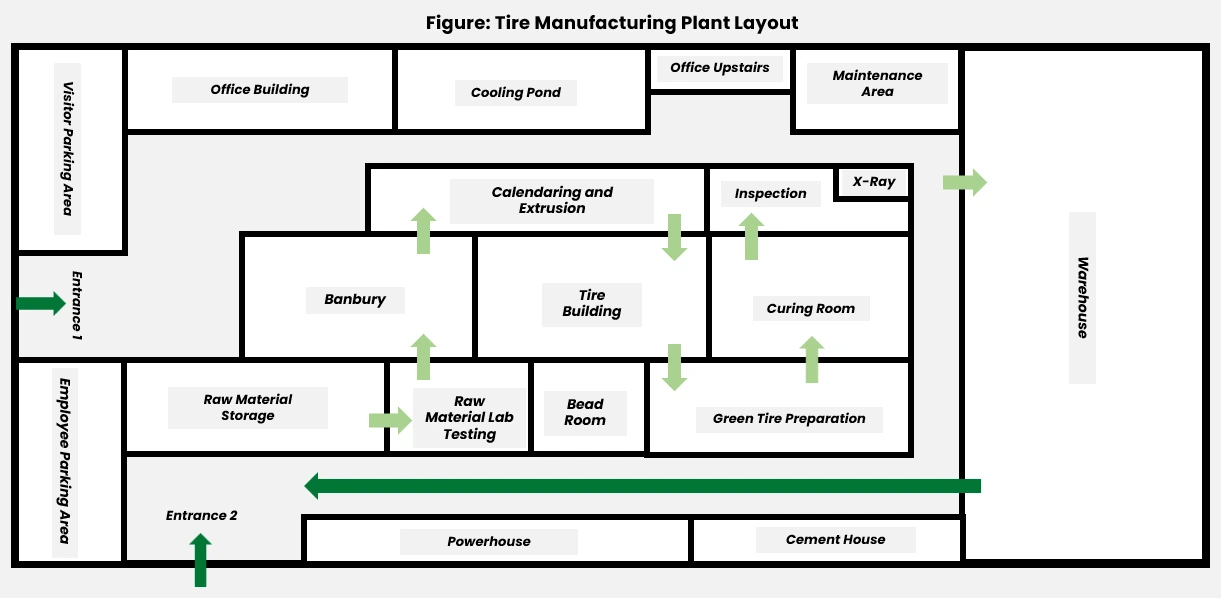

Objective: One of our clients reached out to us to conduct a feasibility study for setting up a large-scale tire manufacturing plant. We developed a comprehensive financial model for the setup and operation of a tire manufacturing plant in Saudi Arabia. The proposed plant is designed to have an annual production capacity of 2,500,000 passenger car tires and 500,000 truck and bus tires, covering an area of 240,000 square meters.

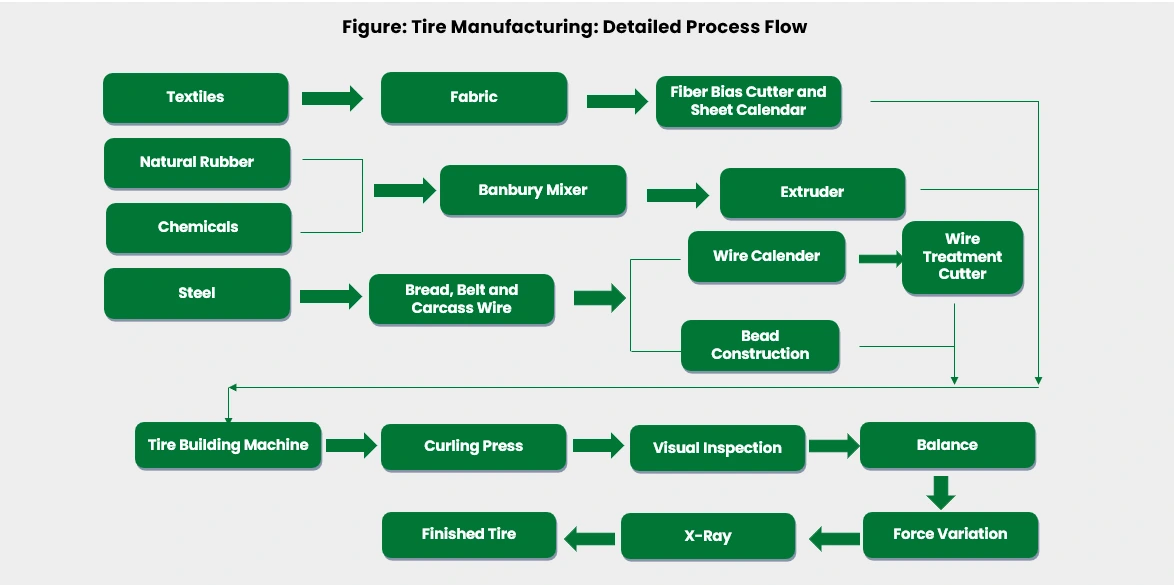

Manufacturing Process: The tire manufacturing process begins with a Banbury mixer that combines rubber stock, carbon black, and other chemicals to create a homogeneous material. After mixing, the rubber is shaped into flat strips using a drop mill. The calendaring operation further processes the rubber into uniform sheets while also coating fabrics and forcing rubber into fabric interstices. The extruder, or "tuber," shapes the rubber into tube-like components and large flat sections for tire treads. In the assembly phase, an automated tire assembly machine combines components like beads, plies, sidewalls, and treads into what’s known as a "green tire." This involves extensive handling of heavy rolls and the use of solvents to ensure adhesion, with safety measures in place to manage exposure. The green tires are then cured in a press using steam or heat, which transforms them into durable products. Finally, the finished tires undergo trimming, inspection, and packaging before being prepared for shipment. This comprehensive process ensures the production of high-quality tires suitable for various vehicles.

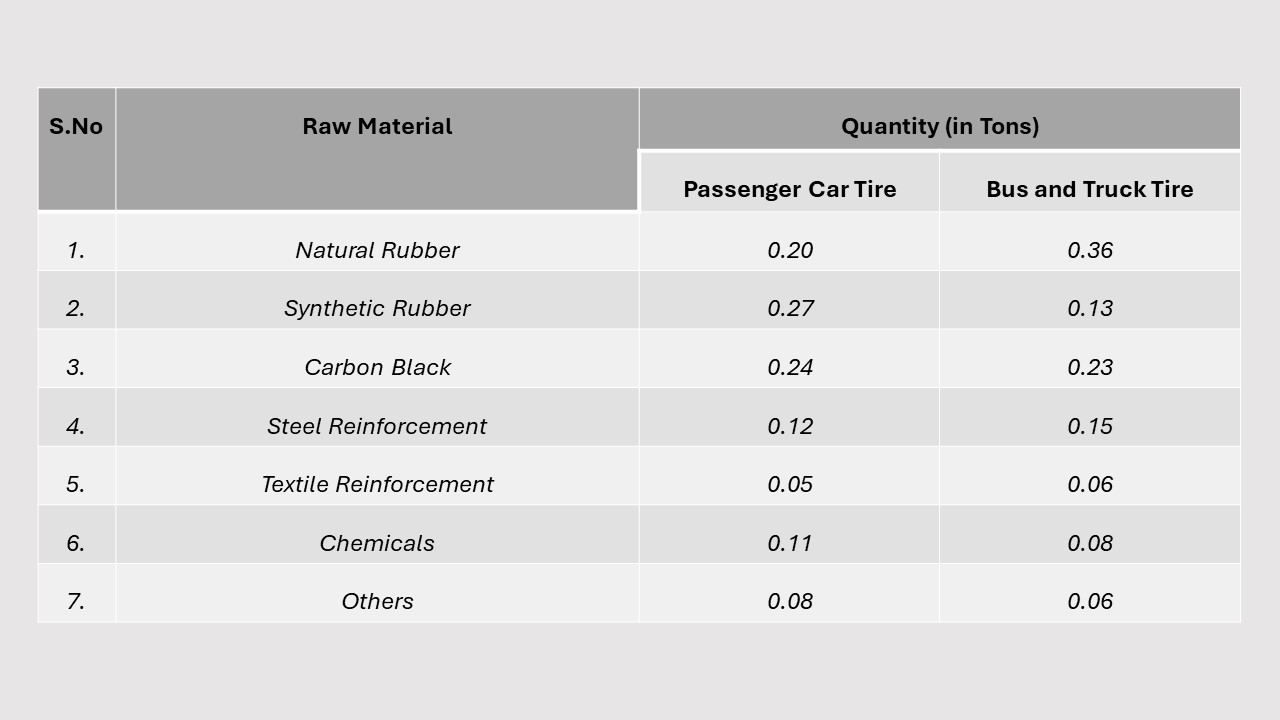

Mass Balance and Raw Materials Required: The primary raw materials utilized in the tire manufacturing plant include natural rubber, synthetic rubber, carbon black, steel reinforcement materials, textile reinforcement, chemicals, and other components. For a plant producing around 6,250 passenger car tires and 1,250 truck and bus tires per day, around 27.26 Tons of natural rubber, 21.65 Tons of synthetic rubber, 24.12 Tons of carbon black, 13.55 Tons of steel reinforcement component, 5.44 Tons of textile requirements, and 9.97 Tons of chemicals and 7.33 Tons of other raw materials would be required as feedstock per day.

Table: Mass Balance: Raw Materials Required for the Production of 1 Ton of Passenger Car Tires and 1 Ton of Bus and Truck Tires

Plant Layout:

List of Machinery:

The following equipment is required for the proposed plant:

- Vertical Rubber Cutter

- Mixing Mill Machine

- Hoist Machine

- Open Mixing Mill

- Rubber Extruder

- Tire Tread Cooling Line

- Tire Building Machine

- Bear Wire Winding Machine

- Roll Rubber Calendar Line

- Horizontal Bias Cutter

- Tire Vulcanizing

- Tire Expanding Machine

- Tire Packing Machine

Techno-Commercial Parameters:

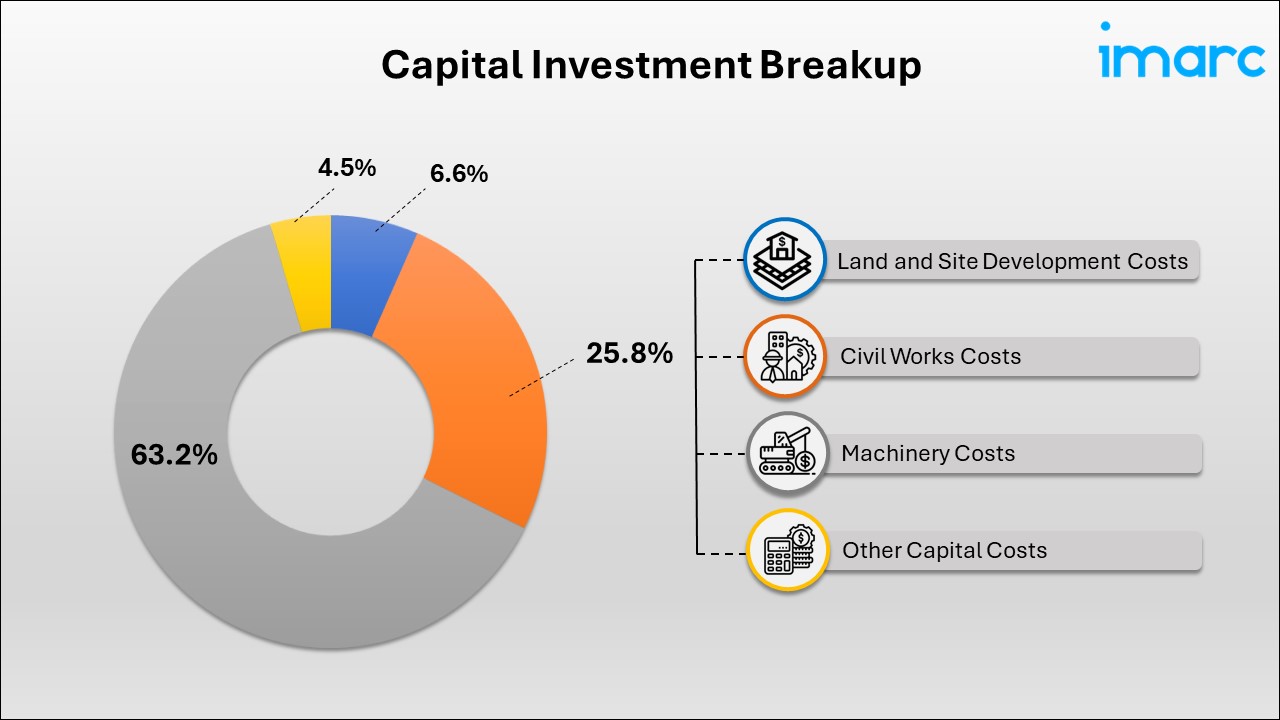

- Breakup by Capital Investment: The total capital cost for establishing the proposed plant is approximately US$ 220 Million. Machinery costs comprise 63.2% of the total capital costs for the tire production plant. The civil work for the tire manufacturing plant includes site preparation, excavation, and construction of the main facility and support structures. Key infrastructure like roadways, drainage, and utility connections is developed, focusing on sustainability and compliance with safety standards to ensure efficient operations.

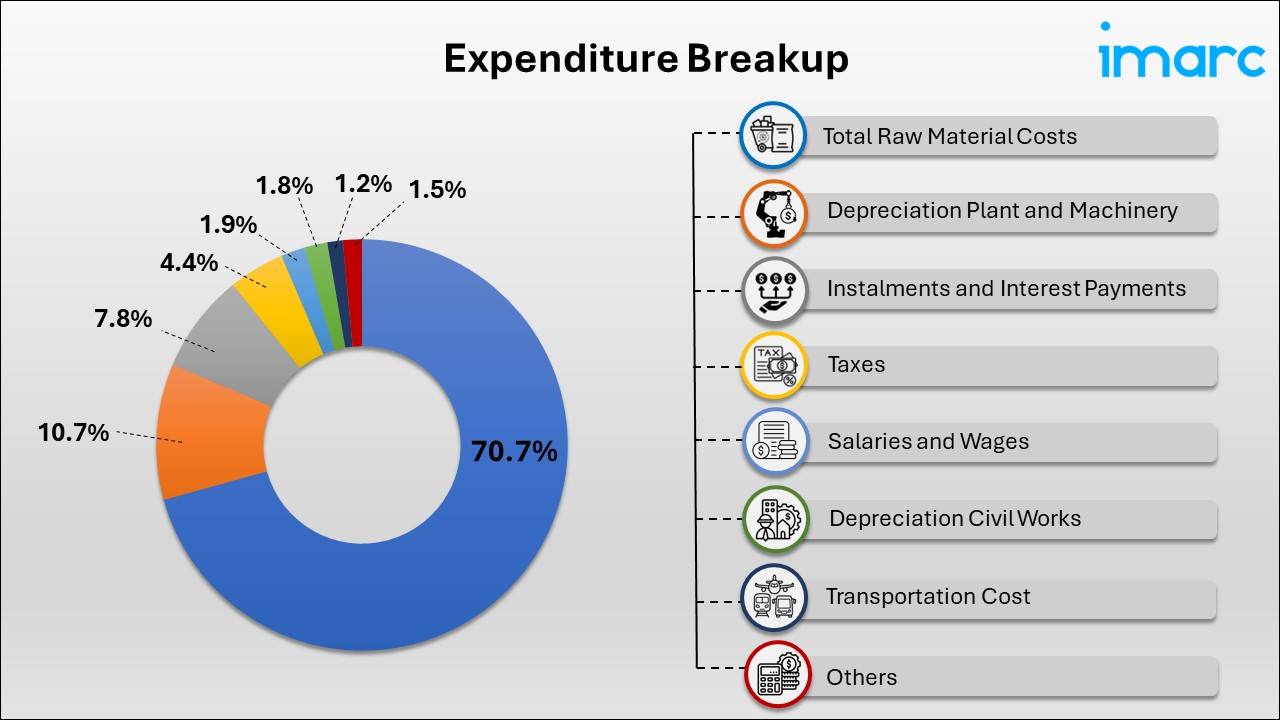

- Breakup by Expenditure: Raw materials account for the largest share of total expenditures, at 70.7%. This is followed by the depreciation of the plant and machinery, installment payments and interest payments, taxes, salaries and wages, depreciation of civil works, transportation costs, and various other expenses. Other expenses include transportation charges, utility costs, repair and maintenance, depreciation of civil works, depreciation of miscellaneous fixed assets, and other costs. Overall expenditures are expected to increase by 23.2% in the fifth year of operation compared to the first year.

- Profitability Analysis Year-on-Year Basis

(All values are in US$ Million, except % ages)

Conclusion

Our financial model for the tire manufacturing plant was meticulously developed to meet the client’s objectives, providing an in-depth analysis of production costs, including raw materials, manufacturing, capital expenditure, and operational expenses. By addressing the specific requirements of producing 2,500,000 passenger car tires and 500,000 truck and bus tires annually, we successfully identified key cost drivers and projected profitability, considering market trends, inflation, and potential fluctuations in raw material prices. This comprehensive financial model equipped the client with valuable insights for strategic decision-making, demonstrating our commitment to delivering high-quality, client-focused solutions that ensure the long-term success of large-scale manufacturing ventures.

IMARC's Financial Model Expertise: Helping Our Clients Explore Industry Economics

IMARC is a global market research firm that provides an extensive range of services, including market entry and expansion strategies, opportunity assessments, competitive intelligence, procurement research, pricing and cost analysis, regulatory approvals, factory setup and audits, company incorporation, incubation, recruitment, and marketing and sales support.

At IMARC, we leverage our deep market research expertise to guide businesses through every phase of their journey, from entering new markets to optimizing operations and driving innovation. Our factory setup services, combined with our knowledge of industry trends, enable clients to establish manufacturing facilities and gain a strategic foothold in competitive markets. With our financial modeling and comprehensive consultation, we help clients assess the feasibility of plant setups while offering insights into competitors, technology, and regulatory frameworks. This holistic approach allows our clients to make well-informed decisions, streamline operations, and adopt sustainable practices, fostering long-term success and growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104