Global Insect Protein Market Expected to Reach USD 5,528.0 Million by 2033 - IMARC Group

Global Insect Protein Market Statistics, Outlook and Regional Analysis 2025-2033

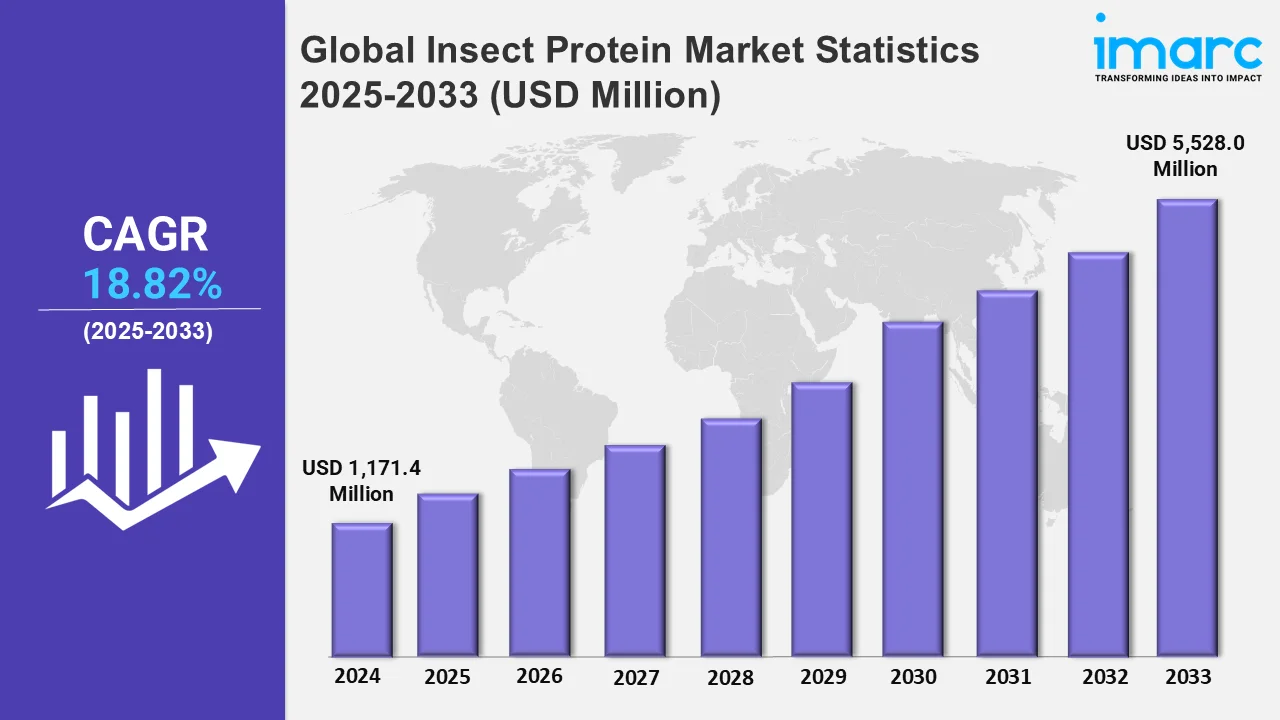

The global insect protein market size was valued at USD 1,171.4 Million in 2024, and it is expected to reach USD 5,528.0 Million by 2033, exhibiting a growth rate (CAGR) of 18.82% from 2025 to 2033.

To get more information on this market, Request Sample

The insect protein market is primarily driven by growing demand for sustainable protein sources amid increasing global food insecurity. Traditional animal-based proteins require extensive resources, leading to environmental degradation, while insects offer a more eco-friendly alternative. For instance, in February 2024, Vinh Hoan, the biggest producer of pangasius fish worldwide, and Entobel, a manufacturer of insect ingredients, extended their strategic alliance, which represents a major advancement in sustainable aquaculture methods. Insects have a high feed conversion ratio, producing more protein with fewer resources like water and land. As the global population expands and the demand for protein rises, insects present a viable solution. Moreover, insects are rich in essential amino acids, vitamins, and minerals, making them a nutritious option for animal feed, human consumption, and food processing, which, in turn, is contributing to the market growth.

Technological advancements in insect farming, coupled with greater awareness of sustainability, are also driving the insect protein market toward growth. For instance, in August 2024, The North American Insect Center's (NAIC) recent opening represents a turning point in the history of sustainable protein production. NRGene Canada, a division of Israel's NRGene Technologies Ltd., and Bühler, a prominent Swiss technological business, announced a partnership, which highlights a strategic commitment to expanding insect protein production, with a special focus on Black Soldier Fly (BSF) larvae. Insect farming is becoming more affordable as production methods improve, opening the door for large-scale enterprises. The adoption of insect-based goods is also influenced by shifting consumer tastes toward plant-based and alternative proteins. Insects are regarded as cheap, healthy, and natural ingredients for culinary items, cattle feed, and pet food. Additionally, governments and organizations are increasingly acknowledging the fact that insect protein might help with issues related to food security, which will increase research and investment and eventually speed up market expansion.

Global Insect Protein Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe accounted for the largest market share owing to sustainability goals, regulatory support, rising consumer demand for alternative proteins, and environmental concerns.

North America Insect Protein Market Trends:

In North America, rising demand for alternative protein sources due to health and environmental concerns drives market growth. Technological advancements, investment in insect farming, and increased consumer awareness of sustainable food systems contribute to the popularity of insect protein for both human and animal consumption.

Asia-Pacific Insect Protein Market Trends:

In Asia Pacific, rapid population growth and increasing demand for sustainable protein sources drive the insect protein market. Rising environmental awareness, food security concerns, and government support for alternative protein sources contribute to the region's adoption of insect-based proteins, particularly in animal feed and human consumption.

Europe Insect Protein Market Trends:

The market for insect protein in Europe is driven by a significant emphasis on sustainability, circular economies, and lowering carbon footprints. The use of insect proteins in food items and animal feed is encouraged by regulatory developments, customer demand for more environmentally friendly, alternative proteins, and the popularity of plant-based diets. For instance, in April 2024, HiProMine, a Polish company that produces insect-based proteins, opened its facilities and finished building the second phase of its new Genetic Center. The development occurs as the company prepares to start production operations on an industrial scale. Based in Robakowo, western Poland, the institution specializes in insect breeding and genetics. HiProMine is expanding its capabilities to become a major supplier of proteins to the pet food business in Europe.

Latin America Insect Protein Market Trends:

The growing demand for animal feed, increased food instability, and expanding awareness of sustainable agricultural methods are the main factors propelling the insect protein market in Latin America. The extensive agricultural sector in the area is looking for more affordable, alternative sources of protein for cattle, which is encouraging the use of insect-based proteins.

Middle East and Africa Insect Protein Market Trends:

The market for insect protein is being driven by issues with food security, rapid population increase, and water shortages in the Middle East and Africa. In these resource-constrained areas, insect farming offers a cost-effective and environmentally responsible protein substitute for animal and human consumption, providing a sustainable answer to these problems.

Top Companies Leading in the Insect Protein Industry

Some of the leading insect protein market companies include Aspire Food Group, Chapul LLC, Entomo Farms, EnviroFlight LLC (Darling Ingredients), Goterra, Hexafly, InnovaFeed SAS, Jimini's, nextProtein, Protenga, Protix B.V., etc., among many others.

In February 2024, Innovafeed launched its new brand Hilucia, redesigning its offer of the complete range of high-quality ingredients for animal and plant nutrition. Hilucia represents the combination of the unique upcycling capabilities of the Hermetia illucens larvae with cutting-edge technology developed by Innovafeed’s teams and has a significantly low environmental impact.

Global Insect Protein Market Segmentation Coverage

- On the basis of the source, the market has been categorized into coleoptera, lepidoptera, hymenoptera, orthoptera, hemiptera, diptera, and others. Beetles (Coleoptera) are commonly cultivated for animal feed because of their high protein content and excellent conversion efficiency. For sustainable protein sources, moths and butterflies (Lepidoptera) are perfect because they are high in protein and vital nutrients. Because of their high nutritional content, ants and bees (Hymenoptera) are being more and more widely used in feed and human food products. The usage of crickets (Orthoptera) in food and feed applications is growing due to their ease of cultivation and high protein production. Bugs like plant bugs (Hemiptera) provide a sustainable and nutrient-dense protein source, popular for animal feed. Flies (Diptera) are farmed at scale due to their rapid growth, high protein content, and efficiency in waste conversion.

- Based on the distribution channel, the market is classified into offline and online, amongst which offline dominates the market. Because of the requirement for individualized contacts, product education, and establishing consumer confidence, offline channels account for the largest portion of the insect protein market. For product specifics and quality assurance, many buyers—particularly in the food and feed industries—prefer direct consultations and are more inclined to meet in person with reputable suppliers.

- On the basis of the application, the market has been divided into animal nutrition (aqua feed, poultry feed, and others), food and beverages, pharmaceutical and supplements, and personal care and cosmetics. Among these, animal nutrition accounts for the majority of the market share. Animal nutrition holds the largest share of the insect protein market due to the growing demand for sustainable, cost-effective feed alternatives. Insect protein is rich in essential amino acids, making it an ideal ingredient for livestock, poultry, and aquaculture feed, offering a nutritious and environmentally friendly option to traditional feed sources.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1,171.4 Million |

| Market Forecast in 2033 | USD 5,528.0 Million |

| Market Growth Rate 2025-2033 | 18.82% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Coleoptera, Lepidoptera, Hymenoptera, Orthoptera, Hemiptera, Diptera, Others |

| Distribution Channels Covered | Offline, Online |

| Applications Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aspire Food Group, Chapul LLC, Entomo Farms, EnviroFlight LLC (Darling Ingredients), Goterra, Hexafly, InnovaFeed SAS, Jimini's, nextProtein, Protenga, Protix B.V., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Insect Protein Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)