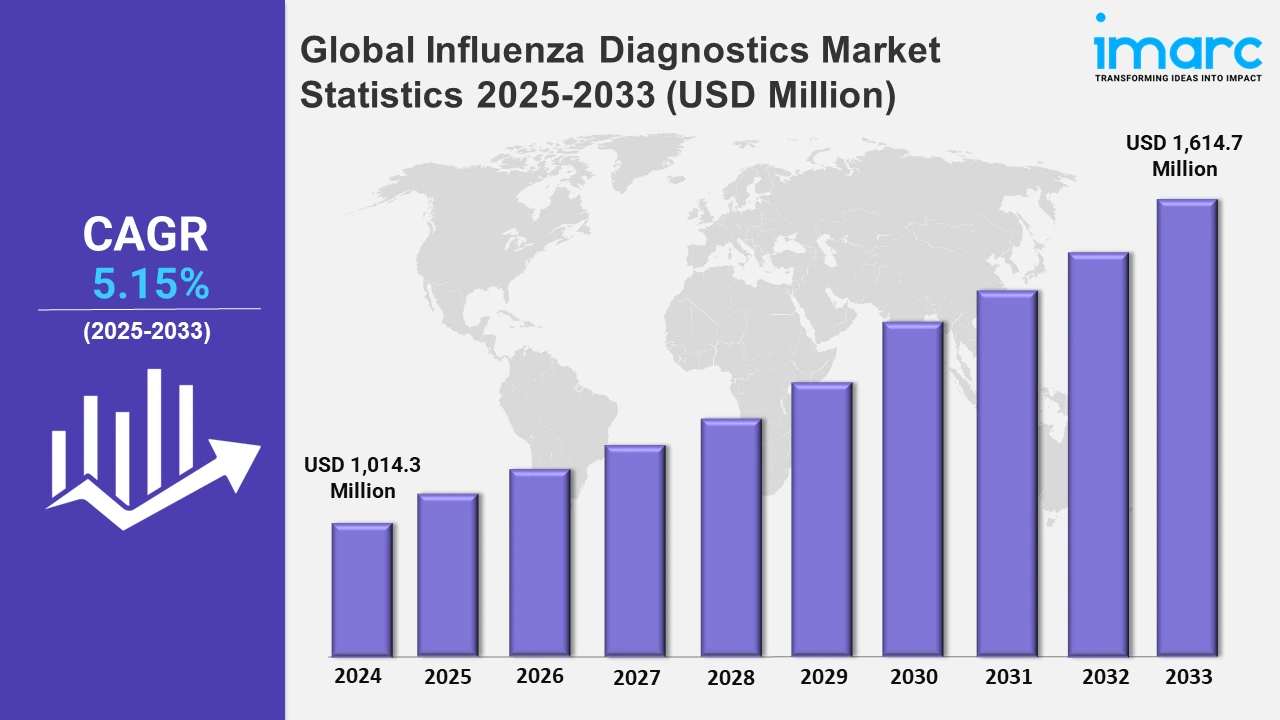

Global Influenza Diagnostics Market to Grow at 5.15% During 2025-2033, Reaching USD 1,614.7 Million by 2033

The global influenza diagnostics market size was valued at USD 1,014.3 Million in 2024, and it is expected to reach USD 1,614.7 Million by 2033, exhibiting a growth rate (CAGR) of 5.15% from 2025 to 2033.

To get more information on the this market, Request Sample

The global influenza diagnostics market is witnessing a stable expansion chiefly boosted by an amplified demand for rapid testing solutions and increasing innovations in diagnostic technologies. The magnifying investments for the designing of molecular diagnostic techniques, including reverse transcription-polymerase chain reaction (RT-PCR), has notably improved both speed and precision of influenza detection. For instance, in March 2024, Autonomous Medical Devices Incorporated (AMDI) received an investment of USD 5.2 million from the U.S. NIH RADx Tech initiative to advance its rapid point-of-care (POC) viral testing system. The funding supports the completion of a reverse transcription-polymerase chain reaction POC system and the development of the Fast PCR system’s initial test panel for detecting influenza A and B. Additionally, the rise in public awareness surrounding the importance of early and precise diagnosis, especially in the wake of pandemics, has accelerated the adoption of advanced diagnostic tools. Moreover, both healthcare organizations and governments are currently focusing on investing heavily in diagnostic infrastructure to boost pandemic preparedness, further accelerating the market growth. The integration of point-of-care testing devices in clinical settings and pharmacies is also facilitating greater accessibility and efficiency, supporting market growth.

Key trends impacting the market include the adoption of automated and user-friendly diagnostic platforms that enable healthcare providers to manage high testing volumes effectively. The incorporation of artificial intelligence and data analytics in diagnostic processes is streamlining test interpretation and operational workflows. Moreover, collaborations between diagnostic companies and technology providers are fostering the development of innovative solutions aimed at reducing turnaround times and enhancing diagnostic accuracy. For instance, in November 2024, Alveo Technologies launched its new Alveo Sense Avian Influenza Test for rapid, field-based detection of influenza A (avian flu) and announced a strategic partnership with Royal GD and x-OvO, leading diagnostics company, to support the market rollout of this new diagnostic solution across the European Union. Seasonal outbreaks and the continuous threat of emerging influenza strains are also spurring ongoing demand for effective diagnostic tools. Furthermore, as healthcare systems strive for rapid response capabilities, the market for influenza diagnostics remains well-positioned for sustained growth in the foreseeable future.

Global Influenza Diagnostics Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share due to advanced healthcare infrastructure, high testing adoption, and significant R&D investments.

North America Influenza Diagnostics Market Trends:

North America holds the leading position in the global influenza diagnostics market due to several critical factors. The region benefits from advanced healthcare infrastructure and strong government initiatives supporting early disease detection and control. In addition, high investment in research and development, coupled with the presence of key diagnostic companies, drives innovation in diagnostic technologies. Moreover, the region’s proactive approach to public health, supported by awareness campaigns and extensive testing protocols during flu seasons, bolsters market growth. Furthermore, the consistent rise in influenza cases fuels ongoing demand for rapid diagnostic solutions, reinforcing North America's leadership. For instance, according to the WHO, the 2023–2024 influenza season in the United States, spanning from October 1, 2023, to August 31, 2024, was moderately severe. Clinical laboratories conducted diagnostic tests on 3,910,204 respiratory specimens, of which 351,460 (9.0%) were positive for influenza. Of these, 69.2% were identified as influenza A (243,048 specimens), while 30.8% were influenza B (108,401 specimens). Resultantly, the demand for point-of-care diagnostic solutions and integration of advanced molecular testing is constantly bolstering, further fortifying North America's dominance in the influenza diagnostics market.

Asia-Pacific Influenza Diagnostics Market Trends:

The Asia Pacific region is experiencing notable expansion in the influenza diagnostics market chiefly due to enhancing accessibility to diagnostic technologies, elevating healthcare investments, and heightening awareness of early disease detection. Additionally, the magnifying population density and prevalent outbreaks foster the fueling demand for dependable diagnostic solutions across the region.

Europe Influenza Diagnostics Market Trends:

Europe's influenza diagnostics market is mainly bolstered by a robust healthcare system and beneficial government initiatives targeting the disease control. Moreover, the region's increasing emphasis on pandemic preparedness, combined with a reliable network of diagnostic centers, incentivizes constant innovations in diagnostic abilities and extensive utilization of rapid testing solutions.

Latin America Influenza Diagnostics Market Trends:

In Latin America, the influenza diagnostics market is growing primarily due to elevated efforts to improve diagnostic reach and enhancing healthcare infrastructure. Additionally, magnifying government campaigns to mitigate infectious disease outbreaks and endorse better public health awareness are significantly bolstering the utilization of modern diagnostic tools across numerous healthcare settings in the region.

Middle East and Africa Influenza Diagnostics Market Trends:

The MEA region's influenza diagnostics market is gradually progressing, spurred by growing investments in healthcare modernization and enhanced disease surveillance. Challenges remain due to uneven access to healthcare, but targeted efforts and partnerships aimed at strengthening diagnostic capabilities are supporting market development and expanding service coverage in the region.

Top Companies Leading in the Influenza Diagnostics Industry

Some of the leading influenza diagnostics market companies include Abbott Laboratories, Becton Dickinson and Company, Cepheid (Danaher Corporation), Coris BioConcept, DiaSorin S.p.A., F. Hoffmann-La Roche Ltd, Hologic, Inc., Meridian Bioscience Inc., Qiagen N.V, QuidelOrtho Corporation, SEKISUI Diagnostics, Siemens Healthcare Diagnostics GmbH, Thermo Fisher Scientific Inc., among many others. In March 2024, Sekisui Diagnostics LLC, a prominent medical diagnostics company, announced the receival of EUA clearance for its OSOM Flu SARS-CoV-2 Combo Test, approved for use in both home testing and professional environments. This lateral flow immunochromatographic assay is developed for rapid in vitro detection and differentiation of influenza A and B nucleoprotein antigens, as well as the SARS-CoV-2 nucleocapsid antigen.

Global Influenza Diagnostics Market Segmentation Coverage

- On the basis of the product, the market has been categorized into test kit and reagents, instruments, and others, wherein test kit and reagents represent the leading segment. This dominance is attributed to their essential role in enabling rapid, accurate detection of influenza, supporting timely treatment. Furthermore, high adoption rates in both clinical and point-of-care settings highlight their critical importance for efficient disease diagnosis and management.

- Based on the test type, the market is classified into molecular diagnostic tests (polymerase chain reaction, isothermal nucleic acid amplification tests, and other molecular tests) and traditional diagnostic tests (rapid influenza diagnostic tests, viral culture tests, direct fluorescent antibody test, and serological tests), amongst which traditional diagnostic test dominates the market. Their extensive use stems from their established accuracy and reliability in laboratory settings. These tests, including viral culture and immunoassays, continue to be preferred for their dependable performance in confirming influenza infections and guiding clinical decisions.

- On the basis of the type of flu, the market has been divided into type A flu, type B flu, and type C flu. Among these, type A flu accounts for the majority of the market share. This is due to its higher prevalence and potential for more severe outbreaks, driving consistent demand for diagnostic solutions. Moreover, surveillance and testing for Type A flu are prioritized by healthcare providers to mitigate its impact and enhance public health response strategies.

- Based on the end user, the market is segregated into hospitals, diagnostic laboratories, and others, amongst which hospitals dominate the market. Their significant share is driven by high patient volume and the need for accurate, timely diagnostics to manage treatment efficiently. Hospitals often invest in advanced diagnostic technologies to support comprehensive influenza detection and patient care, solidifying their role as key users in this market.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1,014.3 Million |

| Market Forecast in 2033 | USD 1,614.7 Million |

| Market Growth Rate 2025-2033 | 5.15% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Test Kit and Reagents, Instruments, Others |

| Test Types Covered |

|

| Types of Flu Covered | Type A Flu, Type B Flu, Type C Flu |

| End Users Covered | Hospitals, Diagnostic Laboratories, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, Becton Dickinson and Company, Cepheid (Danaher Corporation), Coris BioConcept, DiaSorin S.p.A., F. Hoffmann-La Roche Ltd, Hologic, Inc., Meridian Bioscience Inc., Qiagen N.V, QuidelOrtho Corporation, SEKISUI Diagnostics, Siemens Healthcare Diagnostics GmbH, Thermo Fisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Influenza Diagnostics Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)