Global Industrial Valves Market Expected to Reach USD 131.6 Billion by 2033 - IMARC Group

Global Industrial Valves Market Statistics, Outlook and Regional Analysis 2025-2033

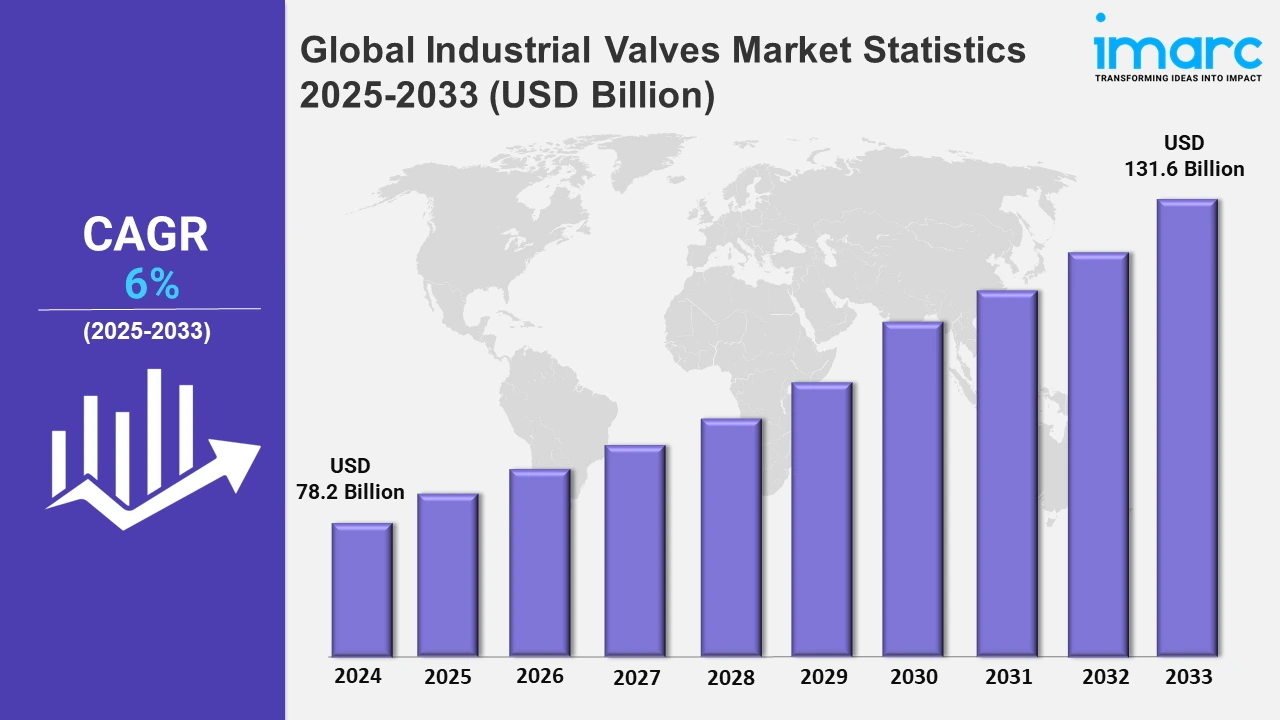

The global industrial valves market size was valued at USD 78.2 Billion in 2024, and it is expected to reach USD 131.6 Billion by 2033, exhibiting a growth rate (CAGR) of 6% from 2025 to 2033.

To get more information on this market, Request Sample

The global market is majorly driven by the growing demand for efficient flow control systems in oil and gas, water treatment, and chemical processing industries. In addition to this, the increasing adoption of automation in industrial operations for greater efficiency and safety is fueling the market. For instance, on September 4, 2024, ABB announced that it was selected by Vitens, the largest drinking water supplier in the Netherlands, for the development of a new process automation system designed to modernize around 200,000 input and output connections across 250 sites. These will improve operational performance, cybersecurity, and industry-standard compliance through the ABB Ability™ System 800xA® Distributed Control System, which will unify the operations of all the plants run by Vitens. This will ensure safety and efficiency in the industrial process, thereby providing an impetus to the market. Furthermore, the increasing focus on energy-efficient systems is encouraging the adoption of advanced industrial valves, thereby expanding the market. Additionally, the escalating number of infrastructural development projects, especially in emerging economies, is bolstering the demand for reliable valve systems. Moreover, the accelerating use of IoT-enabled valves that offer real-time monitoring and predictive maintenance is increasing operational reliability, which is broadening the market scope.

The market is also driven by the growing investments in oil and gas exploration activities and the modernization of existing infrastructure. For instance, on February 4, 2024, India's state-owned oil companies, which includes Oil and Natural Gas Corporation (ONGC) and Indian Oil Corporation (IOC), announced that they would invest around ₹1.2 lakh crores in the fiscal 2024-25 period. The investment is stated to be 5 per cent higher than the outlays made in the existing fiscal at ₹1.12 lakh crores while earmarked for oil exploration as well as gas finding projects, refinery expansions, and petrochemical developments plus pipeline infrastructure. Specifically, for its capital expenditures, the ONGC has allocated Rs. 30,800 crores and its foreign arm, ONGC Videsh Ltd (OVL), will spend Rs. 5,580 crores in abroad. Moreover, the tough regulatory norms for emissions control and operational safety are promoting high-performance valve systems in most industries in the region, thereby fostering growth in the market. Also, the increasing penetration of wind and solar-based renewable sources enhancing the demand for industrial valves in associated applications is thereby providing an impetus to the market. Additionally, the rising interest in water conservation and wastewater treatment in the United States is significantly contributing to the expansion of the market. Besides this, the ongoing innovation in valve manufacturing technology, for instance, through 3D printing or additive manufacturing, is providing lucrative growth opportunities in the market.

Global Industrial Valves Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of rapid industrialization, increasing demand for energy infrastructure, growing investments in oil and gas, power generation, water treatment, and the expanding manufacturing sector, which require efficient fluid control systems.

Asia-Pacific Industrial Valves Market Trends:

Asia- Pacific accounts for the largest regional market due to the rapidly industrializing, urbanizing economy and the increasing investment in the energy infrastructure of major economies, including China, India, and Japan. While the entire market has been dominated by China, its demand comes particularly from oil and gas, chemical, and water treatment sectors. Notably, on September 9, 2024, Neway Valve, a Chinese industrial manufacturer, became a bronze sponsor at the MSGBC Oil, Gas & Power 2024 conference in Dakar, showcasing its valve solutions for the oil and gas industry. With a client base including TotalEnergies and Shell, Neway Valve offers products like subsea and safety valves. The conference, highlighting opportunities in oil, gas, and power, will allow investors to explore new projects in West Africa’s hydrocarbon sector, where significant oil and gas reserves are awaiting extraction. . In India, the market growth is further driven by the accelerating infrastructural development projects such as Smart Cities and renewable energy initiatives. In addition to this, continuous technological advancements in valve manufacturing and the use of IoT-enabled technologies are increasing operational efficiency and reliability which in turn is fostering market growth.

North America Industrial Valves Market Trends:

The market in North America is driven primarily by escalating investments in shale oil exploration and pipeline projects across the United States. Meanwhile, stringent environmental regulations and modernization of industrial infrastructure are working in favor of high-performance valves. Increasing focus on water as well as wastewater management propels the growth of the market.

Europe Industrial Valves Market Trends:

The market for industrial valves in Europe is majorly driven by the strict regulatory focus on environmental sustainability and emissions control. Moreover, the rise in the modernization of aging industrial infrastructure and increased adoption of renewable energy solutions are supporting the demand for advanced valve systems.

Latin America Industrial Valves Market Trends:

The industrial valves market in Latin America is increasing due to the accelerating investment in oil and gas exploration. It is especially on the rise in Brazil and Mexico. Moreover, upgrading water treatment infrastructure and using automation technologies are also contributing to the growth of the market.

Middle East and Africa Industrial Valves Market Trends:

The market in the Middle East and Africa primarily operates based on the growing oil and gas industry, along with increasing water desalination projects. Moreover, efforts toward industrial diversification and investment in renewable energy infrastructure continue to expand market development in this region.

Top Companies Leading in the Industrial Valves Industry

Some of the leading industrial valves market companies include Alfa Laval, Bray International, Crane Company, Curtiss-Wright Corporation, Emerson Electric Co., Flowserve Corporation, IDEX India, IMI Process Automation, KITZ Corporation, KLINGER Group, SLB, Spirax Sarco Limited, Valmet, Walworth, among many others. Notably, on August 13, 2024, Flowserve Corporation announced its agreement to acquire MOGAS Industries for USD 290 Million, with an additional earnout of up to USD15 Million. MOGAS, a manufacturer of isolation valves, generated approximately USD 200 Million in revenue and has a large installed base, which is expected to strengthen Flowserve’s aftermarket opportunities. The acquisition will also double Flowserve's exposure to the mining and mineral extraction sectors. The transaction is anticipated to close in the last quarter of 2024, subject to regulatory agreement and customary closing factors.

Global Industrial Valves Market Segmentation Coverage

- On the basis of product type, the market has been categorized into gate valve, globe valve, butterfly valve, ball valve, check valve, plug valve, and others, wherein ball valve represents the leading segment in the valve market due to their efficiency in on-off isolation applications. Their simple design, with a spherical closure element, ensures a tight seal and low resistance to flow, making them ideal for controlling fluids under high pressure and temperature. In industries such as oil and gas, ball valves are favored for their ability to withstand demanding conditions, offering reliability, ease of maintenance, and longevity, which makes them a go-to choose in critical systems.

- Based on the functionality, the market is classified into on-off/isolation valves, control valves, amongst which on-off/isolation valves dominate the market. These valves are designed to fully isolate sections of pipelines, providing safety and operational control. The robust design and easy operation of on-off/isolation valves render them indispensable in oil and gas, power, and chemical industries, where system shutdowns and flow control are essential for both operational safety and efficiency. Their widespread use drives their dominance in the market.

- Based on material, the market has been divided into steel, cast iron, alloy based, and others. Among these, steel contributes the most to the market as it has better strength and durability and is resistant to corrosion to use in high-pressure environments at high temperatures. Steels are widely used in several industries like oil and gas, water treatment, power generation, where the purpose of using steel valves can ensure safe and efficient conveyance of fluids and gas. Their resistance to wear and tear and the ability to withstand harsh chemicals and temperatures contributes to their widespread preference in industrial applications..

- Based on size, the market is segregated into upto 1”, 1”-6”, 7”-25”, 26”-50”, and 51” and above. The largest market share comes from valves in the range of 1"-6". This is as they tend to be versatile and often used in a wide variety of areas, such as oil and gas, water treatment, or chemical processing. They enable the best flow control or pressure regulation and cost-effectiveness for medium scale operating conditions, making them standard for both standard and severe service operating conditions in industrial environments.

- Based on the end-use industries, the market is segregated into oil and gas, power, pharmaceutical, water and wastewater treatment, chemical, food and beverage, and others. Oil and gas take the lead as valves are crucial in the exploration, production, refining, and transportation processes of oil and gas operations where liquids and gases are regulated. The valves must provide high performance, reliability, and durability for the extreme conditions that occur in this sector. Therefore, this demand for safety, control, and efficiency in fluid handling makes oil and gas dominate the overall industrial valves market.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 78.2 Billion |

| Market Forecast in 2033 | USD 131.6 Billion |

| Market Growth Rate 2025-2033 | 6% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Gate Valve, Globe Valve, Butterfly Valve, Ball Valve, Check Valve, Plug Valve, Others |

| Functionalities Covered | On-Off/Isolation Valves, Control Valves |

| Materials Covered | Steel, Cast Iron, Alloy Based, Others |

| Sizes Covered | Upto 1”, 1”-6”, 7”-25”, 26”-50”, 51” and Above |

| End Use Industries Covered | Oil and Gas, Power, Pharmaceutical, Water and Wastewater Treatment, Chemical, Food and Beverage, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alfa Laval, Bray International, Crane Company, Curtiss-Wright Corporation, Emerson Electric Co., Flowserve Corporation, IDEX India, IMI Process Automation, KITZ Corporation, KLINGER Group, SLB, Spirax Sarco Limited, Valmet, Walworth, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Industrial Valves Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)