Global Industrial Hemp Market Expected to Reach USD 20.9 Billion by 2033 - IMARC Group

Global Industrial Hemp Market Statistics, Outlook and Regional Analysis 2025-2033

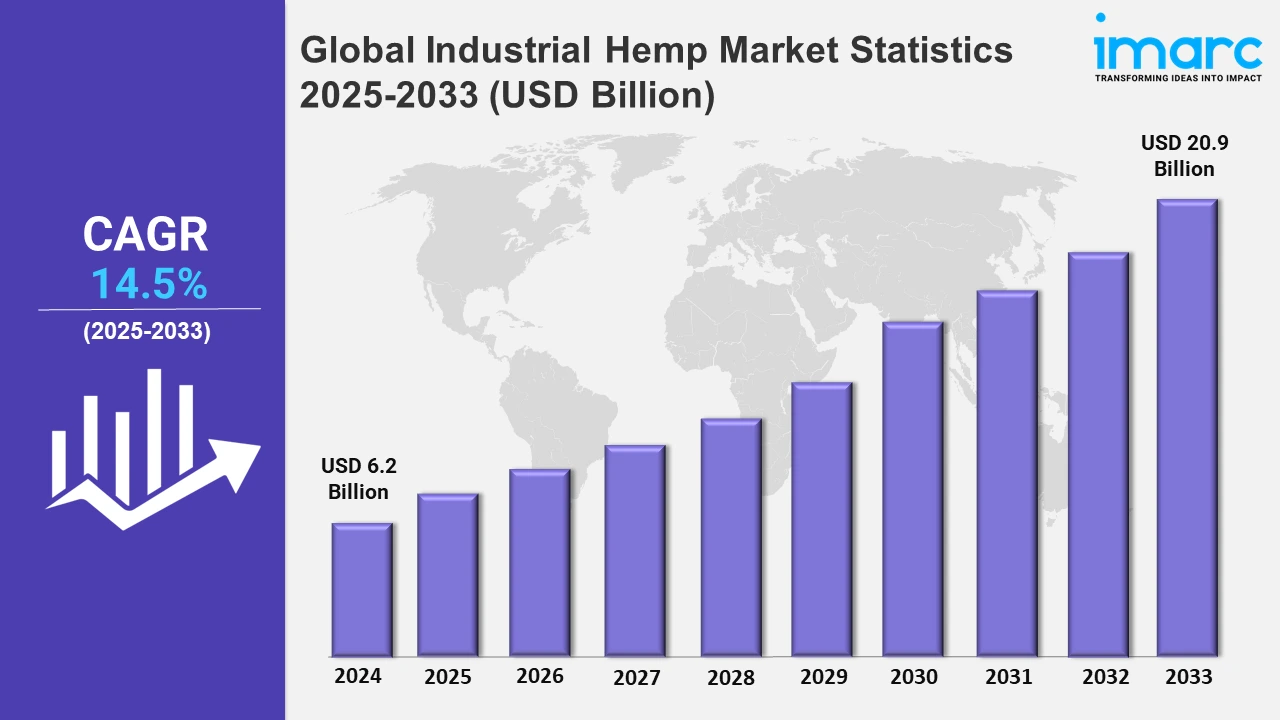

The global industrial hemp market size was valued at USD 6.2 Billion in 2024, and it is expected to reach USD 20.9 Billion by 2033, exhibiting a growth rate (CAGR) of 14.5% from 2025 to 2033.

To get more information of this market, Request Sample

The global market is primarily driven by the increasing demand for eco-friendly and sustainable raw materials in the textile industry as hemp fibers offer high durability, breathability, and biodegradability. Furthermore, the expanding cosmetics industry is leveraging hemp-derived ingredients in skincare and haircare products for their anti-inflammatory and moisturizing properties. The rising preference for plant-based and organic products in the food and beverage sector is also fueling the demand for hemp seeds and oil, which are rich in nutrients, such as omega-3 fatty acids, proteins, and vitamins. The expansion of construction sector is providing an impetus to the market as adopting hempcrete obtained from hemp hurds and lime helps in promoting sustainable building practices. The introduction of innovative biochar products by various companies is further creating a positive market outlook towards sustainability in the AgTech sector. For instance, on 25th June 2024, Hempalta Corp., a newly public AgTech Company, announced the launch of a new biochar product derived from industrial hemp, expanding its product line to include sustainable items like animal bedding, pet litter, and garden mulch. Through this, the company aims to leverage the high carbon sequestration aspect of industrial hemp to help hemp farmers monetize carbon removal credits on the voluntary carbon market, thus contributing to climate change mitigation and offering environmentally beneficial products.

Besides, the numerous collaborations between key players in fostering market growth. In October 2024, Honeywell and SGP Bioenergy collaborated to develop new technology that allows plant material, including industrial hemp, to be used for biochemical production on a larger scale. The collaboration supports Honeywell's focus on the energy transition and aims to reduce reliance on fossil fuels without affecting the food chain. Additionally, the nutraceutical and pharmaceutical industries are extensively utilizing hemp-derived cannabidiol (CBD) for its potential health benefits in managing anxiety, chronic pain, and epilepsy which, in turn, is contributing to the growth of the market. In addition to this, the rising use of hemp fibers, which offer higher yield and lower environmental in paper and industry is another key factor influencing the market growth. Moreover, the growing emphasis on reducing carbon emissions has led to the adoption of hemp-based bioplastics and biofuels as sustainable alternatives to conventional petroleum-based products. Besides, governments worldwide are introducing favorable policies and subsidies to support hemp farming, thereby augmenting the growth of the market.

Global Industrial Hemp Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of favorable cultivation conditions, cost-efficient production, rising government support, and escalating demand for hemp-based products.

Asia-Pacific Industrial Hemp Market Trends:

Asia Pacific dominates the industrial hemp market due to its favorable climatic conditions for hemp cultivation and its long-standing agricultural tradition. Major producers, such as China and India leverage extensive farmlands, cost-effective labor, and robust supply chains to boost production. Increasing government support and legalization in countries like Australia and Thailand further drive market expansion. Additionally, the region’s rising demand for hemp-based textiles, food products, and bioplastics positions Asia Pacific as a global leader in industrial hemp. On July 10, 2024, Wandarra, an ag-tech firm in Townsville, North Queensland, and PAPACKS, a sustainable packaging leader from Cologne, Germany, announced a strategic partnership. This collaboration aims to revolutionize the packaging industry in Australia and the Asia-Pacific by utilizing industrial hemp as a sustainable fiber source. The initiative seeks to reduce plastic waste and promote environmental sustainability through innovative hemp-based packaging solutions.

North America Industrial Hemp Market Trends:

North America is essential in industrial hemp market owing to plants legalization, increasing popularity of hemp CBD products, and escalating usage in meals, cloth, and bioplastics. Hemp planting has also been increased due to the U.S Farm Bill and the market expands further with support in R&D and other sustainable alternatives.

Europe Industrial Hemp Market Trends:

Europe has favorable market conditions for industrial hemp's application as oeko-tex textiles, bioplastics, or even nutraceuticals are witnessing growing demand. The dominant regional policies supporting sustainable agriculture practices and steadily growing demand for hempcrete increase the regional expansion. In terms of production, France and Germany are among the top countries, due to their cutting-edge processing technology and growing public education about the ecological properties of hemp.

Latin America Industrial Hemp Market Trends:

Latin America hemp industrial market is on an expansion trajectory due to growing legalization, favorable weather conditions, and increased emphasis on diversification within the agricultural sectors. Countries like Uruguay and Colombia are using hemp as the head industry for export purposes such as food and cosmetics. With regard to the economic advantages and greenness of hemp, its popularity is spreading rapidly and further boosts growth in the region’s market.

Middle East and Africa Industrial Hemp Market Trends:

The Middle East and Africa are witnessing gradual growth in the industrial hemp market, driven by increasing legalization and demand for sustainable solutions in textiles and bioplastics. Countries with emerging hemp cultivation industries benefit from rising investments and interest in hemp’s potential for boosting soil health and agricultural productivity.

Top Companies Leading in the Industrial Hemp Industry

Some of the leading industrial hemp market companies include Aurora Cannabis Inc., Blue Sky Hemp Ventures Ltd., Ecofibre Limited, Fresh Hemp Foods Ltd., Hemp Inc, HempFlax Group B.V., Hempro International GmbH, Ind Hemp, LLC, MH medical hemp GmbH, Panda Biotech, LLC, Parkland Industrial Hemp Growers Co-op. Ltd., South Hemp, Valley Bio Limited, etc. among many others. On September 25, 2024, Ecofibre Limited announced a three-year agreement to supply its NEOLAST yarns to Under Armour's designated knitting mills. This partnership underscores Ecofibre's commitment to advancing industrial hemp applications in performance fabrics, offering sustainable alternatives to traditional elastane.

Global Industrial Hemp Market Segmentation Coverage

- On the basis of the type, the market has been categorized into hemp seed, hemp oil, hemp fiber, and others, wherein hemp seed represent the leading segment. Hemp seeds dominate the industrial hemp market due to their versatility and high nutritional value. Rich in proteins, omega-3 fatty acids, and antioxidants, they are widely used in dietary supplements, snacks, and oil production. The rising health-conscious population and growing demand for plant-based, organic foods have further bolstered this segment's growth.

- Based on the source, the market is classified into conventional and organic, amongst which conventional dominates the market.The conventional segment leads the industrial hemp market as it caters to large-scale production demands at lower costs. Compared to organic farming, conventional methods rely on established agricultural practices, ensuring higher yields and consistent quality. The widespread use of conventional hemp across industries like textiles, construction, and bioplastics reinforces its dominant position in the market.

- On the basis of the application, the market has been divided into food and beverages, textiles, personal care products, pharmaceuticals, and others. Among these, food, and beverages accounts for the majority of the market share. The food and beverages segment holds the largest share in the industrial hemp market, driven by increasing consumer preference for nutrient-rich, plant-based products. Hemp seeds and oils are incorporated into health bars, dairy alternatives, and beverages, offering high protein content and essential nutrients. The growing awareness of hemp’s dietary benefits supports the segment's expansion.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 6.2 Billion |

| Market Forecast in 2033 | USD 20.9 Billion |

| Market Growth Rate 2025-2033 | 14.5% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Hemp Seed, Hemp Oil, Hemp Fiber, Others |

| Sources Covered | Conventional, Organic |

| Applications Covered | Food And Beverages, Textiles, Personal Care Products, Pharmaceuticals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aurora Cannabis Inc., Blue Sky Hemp Ventures Ltd., Ecofibre Limited, Fresh Hemp Foods Ltd., Hemp Inc, HempFlax Group B.V., Hempro International GmbH, Ind Hemp, LLC, MH medical hemp GmbH, Panda Biotech, LLC, Parkland Industrial Hemp Growers Co-op. Ltd., South Hemp, Valley Bio Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Industrial Hemp Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)