Global Industrial Gloves Market Expected to Reach USD 19.7 Billion by 2033 - IMARC Group

Global Industrial Gloves Market Statistics, Outlook and Regional Analysis 2025-2033

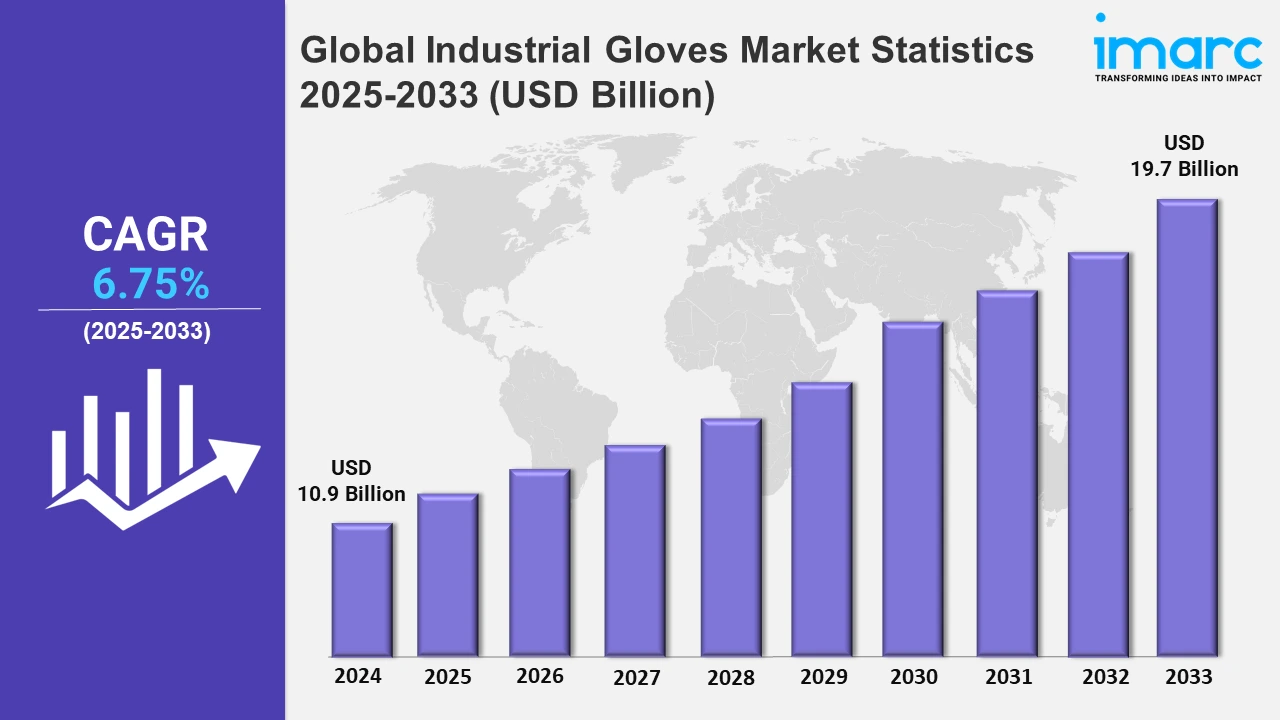

The global industrial gloves market size was valued at USD 10.9 Billion in 2024, and it is expected to reach USD 19.7 Billion by 2033, exhibiting a growth rate (CAGR) of 6.75% from 2025 to 2033.

To get more information on the this market, Request Sample

The rising emphasis on worker safety regulations and stringent workplace safety standards across industries is impelling the market growth. Governments worldwide have implemented regulations mandating the use of protective gear in sectors like manufacturing, healthcare, oil and gas, and construction. In September 2024, IRGMA announced its support for CDSCO's new guidelines for industrial gloves, advocating for the implementation of the Quality Control Order (QCO) to prevent substandard imports. Compliance with these standards necessitates high-quality industrial gloves that ensure worker protection against chemical, mechanical, and thermal hazards, which is creating a positive outlook for market expansion. In addition to this, the surging demand for gloves with specialized features, including cut resistance, puncture resistance, and chemical protection is supporting the market growth.

Besides this, the growing demand for sustainable and eco-friendly glove materials to cater to environmentally conscious consumers is propelling the market demand. Companies are moving toward sustainable practices, seeking alternatives to traditional materials like synthetic rubber and plastic, which contribute to environmental pollution. Consequently, manufacturers are now developing gloves made from biodegradable materials, such as natural rubber or recyclable thermoplastic elastomers to reduce carbon footprints and minimize waste, which is impelling the market growth. In June 2023, Unigloves launched the Nitrex RP sustainable glove range, which combines protective performance with eco-friendly manufacturing, using recycled plastics and water-based coatings. The gloves are certified to EN388, OEKO-TEX, and the Recycled Claim Standard; these gloves offer comfort, durability, and safety while reducing environmental impact and harmful chemicals. Furthermore, the increasing focus on hygiene and infection control, especially in healthcare, food processing, and laboratory settings, is fueling the demand for single-use disposable gloves to reduce cross-contamination risks, thereby fostering the market expansion.

Global Industrial Gloves Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of stringent workplace safety laws, especially in industries like manufacturing, construction, and healthcare.

North America Industrial Gloves Market Trends:

North America's dominance in the market is driven by strict workplace safety regulations, particularly in sectors like healthcare, construction, and manufacturing. High awareness of worker safety standards, coupled with rising demand for specialized protective gloves, reinforces market growth. Additionally, technological advancements and investments in eco-friendly materials contribute to North America's dominance in the market, as companies meet both regulatory requirements and environmental expectations, strengthening their market position. In December 2023, Medicom Group reached a key milestone in building Canada's first medical-grade nitrile glove plant, supported by $42 million from the Strategic Innovation Fund and $30 million from the Ontario government. The $165 million investment will create 135 jobs in Ontario, contributing to the production of eco-friendly, ethical gloves.

Asia-Pacific Industrial Gloves Market Trends:

The Asia-Pacific market is expanding rapidly due to increasing industrialization, particularly in the manufacturing and healthcare sectors. Growing awareness of worker safety, along with rising regulatory standards, fuels demand. Additionally, cost-effective glove production in countries like China and Malaysia supports market growth, meeting global and regional needs.

Europe Industrial Gloves Market Trends:

The Europe market is driven by stringent safety regulations and a strong emphasis on worker protection in sectors like healthcare, manufacturing, and construction. Increasing demand for sustainable, eco-friendly gloves also shapes the market as companies prioritize environmental responsibility, fostering innovations in biodegradable and recyclable glove materials across the region.

Latin America Industrial Gloves Market Trends:

The Latin America market is growing as industrialization and awareness of workplace safety increase across sectors like mining, construction, and manufacturing. Demand for affordable protective gear rises alongside stricter safety regulations, while investments in local production enhance accessibility, reducing dependence on imports and supporting regional market expansion.

Middle East and Africa Industrial Gloves Market Trends:

The Middle East and Africa market is driven by expanding oil and gas, construction, and healthcare sectors, which demand enhanced worker protection. Growing safety regulations and awareness boost glove adoption, while increased investments in infrastructure projects are impelling the market growth, especially for durable gloves suited to harsh environments.

Top Companies Leading in the Industrial Gloves Industry

Some of the leading industrial gloves market companies include 3M Company, Ansell Ltd., Cintas Corporation, Delta Plus group, DPL Group, Globus, Hartalega Holdings Berhad, Liberty Safety, Magid Glove & Safety Manufacturing Company LLC, Riverstone Resources Sdn Bhd, Shun Thai Rubber Gloves Industry Public Company Limited, Smart Glove, Top Glove Corporation Bhd, among many others.

In July 2024, Lakeland Industries, Inc. successfully acquired the fire and rescue business of LHD Group Deutschland GmbH and its subsidiaries in Hong Kong and Australia for $16.3 million. LHD, a leading provider of firefighter turnout gear and PPE maintenance, generates $27 million in annual revenue and employs 111 people globally, with headquarters in Germany.

Global Industrial Gloves Market Segmentation Coverage

- On the basis of the product, the market has been bifurcated into reusable and disposable gloves, wherein disposable gloves represent the leading segment. Disposable gloves dominate the market due to their widespread use in sectors like healthcare, food processing, and laboratories, where hygiene and contamination control are crucial. Their single-use nature reduces cross-contamination risks, aligning with strict regulatory standards, especially post-pandemic, driving demand and solidifying their position as the leading segment.

- Based on the material type, the market is classified into natural rubber, nitrile, vinyl, neoprene, polyethylene, and other gloves, amongst which natural rubber gloves dominate the market. The demand for natural rubber gloves is due to their high elasticity, durability, and cost-effectiveness. Widely used across healthcare, food handling, and industrial sectors, they provide excellent barrier protection and comfort. Their biodegradability also appeals to environmentally conscious consumers, reinforcing their dominance amidst rising sustainability preferences.

- On the basis of the sales channel, the market has been bifurcated into direct and distribution sales. In the industrial gloves market, direct sales involve manufacturers selling directly to large clients, offering cost savings and custom solutions. Distribution sales use third-party distributors or retailers, expanding market reach and accessibility, particularly for smaller buyers. Both channels cater to varied buyer needs, enhancing market penetration across sectors.

- Based on the end use, the market is segregated into pharmaceuticals, automotive and transportation, food, oil and gas, mining, chemicals, and others. In the industrial gloves market, pharmaceuticals require gloves for contamination control, automotive and transportation for safety, food for hygiene, oil and gas for chemical resistance, mining for protection, and chemicals for hazardous handling. Each segment's unique safety needs drive demand for specialized gloves across diverse industries.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 10.9 Billion |

| Market Forecast in 2033 | USD 19.7 Billion |

| Market Growth Rate 2025-2033 | 6.75% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Reusable Gloves, Disposable Gloves |

| Material Types Covered | Natural Rubber Gloves, Nitrile Gloves, Vinyl Gloves, Neoprene Gloves, Polyethylene Gloves, Others |

| Sales Channels Covered | Direct Sales, Distribution Sales |

| End Uses Covered | Pharmaceuticals, Automotive and Transportation, Food, Oil and Gas, Mining, Chemicals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Ansell Ltd., Cintas Corporation, Delta Plus group, DPL Group, Globus, Hartalega Holdings Berhad, Liberty Safety, Magid Glove & Safety Manufacturing Company LLC, Riverstone Resources Sdn Bhd, Shun Thai Rubber Gloves Industry Public Company Limited, Smart Glove, Top Glove Corporation Bhd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)