Global Industrial Ethernet Market Expected to Reach USD 21.1 Billion by 2033 - IMARC Group

Global Industrial Ethernet Market Statistics, Outlook and Regional Analysis 2025-2033

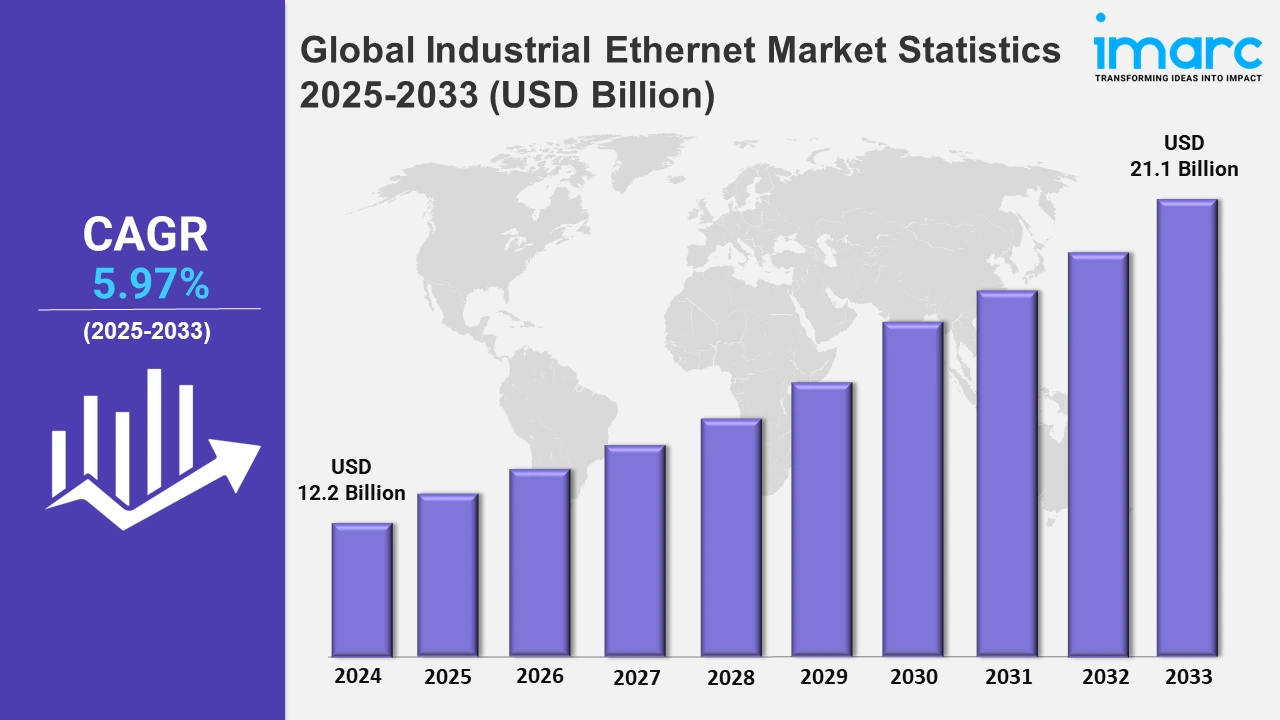

The global industrial ethernet market size was valued at USD 12.2 Billion in 2024, and it is expected to reach USD 21.1 Billion by 2033, exhibiting a growth rate (CAGR) of 5.97% from 2025 to 2033.

To get more information on this market, Request Sample

The industrial ethernet industry is growing, with high-bandwidth solutions that facilitate IT/OT convergence. New technologies prioritize scalable infrastructure with improved port density and quicker data aggregation to address the growing need for seamless communication and real-time industrial applications. For example, in July 2024, Moxa released its new MRX Series Layer 3 rackmount ethernet switches, which offer 64 ports and up to 16 10GbE ports to expedite data aggregation for industrial applications. With the EDS-4000/G4000 Series Layer 2 DIN-rail ethernet switches that provide 2.5GbE uplink choices, users can set up a high-bandwidth network infrastructure in order to achieve IT/OT convergence.

Moreover, the industry is embracing advanced networking technologies, including high-capacity layer 3 and layer 2 switches. These technologies boost scalability, speed up data transfer, and enable seamless integration of industrial systems, responding to the growing demand for connected industrial settings. For instance, in July 2024, Rockwell Automation and Cisco Systems, Inc. collaborated to develop the Stratix 5200 Ethernet switches. Furthermore, industrial ethernet providers are working to improve network stability and speed to enable real-time industrial automation activities. This includes developments in protocols such as EtherNet/IP and PROFINET, which allow for flawless data transport in challenging industrial situations. Additionally, the aftermarket segment provides considerable revenue prospects as companies migrate from outdated systems to ethernet-based networks for greater performance. High-performance ethernet solutions are selected for their reliability and efficiency in tough industrial environments.

Global Industrial Ethernet Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe accounted for the largest industrial ethernet market share on account of its strong industrial base, advanced manufacturing practices, and early adoption of automation technologies.

North America Industrial Ethernet Market Trends:

The industrial ethernet market in North America is driven by enhanced automation in sectors such as manufacturing and energy. Companies, including Rockwell Automation and Cisco Systems, are pioneers in adopting ethernet protocols such as EtherNet/IP for real-time monitoring and control. For example, Rockwell Automation's solutions enable the seamless integration of industrial devices, therefore boosting smart manufacturing efforts and increasing production efficiency.

Europe Industrial Ethernet Market Trends:

Europe holds the largest share of the market owing to the adoption of Industry 4.0 adoption, which has pushed the usage of industrial ethernet for smooth machine communication in smart factories. Germany excels in the integration of ethernet-based networks for predictive maintenance and operational efficiency. For example, Siemens offers industrial ethernet solutions that improve automation in the automotive and equipment industries, which is consistent with the region's dedication to innovative manufacturing technology and sustainable industrial practices.

Asia Pacific Industrial Ethernet Market Trends:

Asia Pacific's fast industrialization and government-backed digitization programs are driving up industrial ethernet use. Countries such as China use this technology for smart manufacturing and real-time data exchange. For example, Huawei's industrial ethernet solutions are widely utilized in manufacturing plants, allowing for effective automation and contributing to the region's status as a global leader in industrial production and technology adoption.

Latin America Industrial Ethernet Market Trends:

The market in Latin America is expanding owing to automation in industries such as oil and gas. Ethernet-based solutions improve operational safety and efficiency in energy production. For example, Petrobras, a Brazilian oil giant, employs ethernet solutions to enhance pipeline monitoring, assuring dependable and cost-effective operations that are critical to the region's energy industry.

Middle East and Africa Industrial Ethernet Market Trends:

Industrial ethernet adoption in the Middle East and Africa is being driven by energy and manufacturing infrastructure initiatives. The UAE has integrated ethernet networks to improve industrial automation and efficiency. For example, ABB supplies ethernet-based solutions for industrial plants, therefore contributing to the region's economic diversification and technical growth goals.

Top Companies Leading in the Industrial Ethernet Industry

Some of the leading industrial ethernet market companies include ABB Ltd., Advantech Co. Ltd., Beckhoff Automation, Belden Inc., Cisco Systems Inc., Honeywell International Inc., Moxa Inc., OMRON Corporation, Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Weidmüller GmbH & Co KG, among many others. For example, in July 2024, ABB Ltd. introduced the FSV400 Vortex flowmeters and FSS400 Swirl, which have ethernet-APL connectivity and can transmit field data at high speeds. This ethernet-APL technology opens up new opportunities for digital data collection and analysis in the chemical, oil and gas, and hydrogen sectors.

Global Industrial Ethernet Market Segmentation Coverage

- On the basis of the offering, the market has been bifurcated into hardware, software, and services, wherein hardware represents the most preferred segment owing to the growing requirement for robust and dependable physical infrastructure to enable high-speed data transfer and seamless connection in industrial settings.

- Based on the protocol, the market is categorized into EtherNet/IP, EtherCAT, PROFINET, POWERLINK, SERCOS III, and others, amongst which PROFINET dominates the market. This is primarily driven by its superior performance, scalability, and adaptability. This protocol offers real-time communication, which is required for automation and control systems to ensure exact and coordinated operations in a variety of industrial applications.

- On the basis of the end user, the market has been divided into automotive and transportation, electrical and electronics, pharmaceutical and medical devices, aerospace and defense, energy and power, oil and gas, food and beverages, and others. Among these, automotive and transportation exhibit a clear dominance in the market on account of the industry's growing dependence on automation, robots, and smart manufacturing processes to improve production efficiency and product quality.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 12.2 Billion |

| Market Forecast in 2033 | USD 21.1 Billion |

| Market Growth Rate 2025-2033 | 5.97% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered | Hardware, Software, Services |

| Protocols Covered | EtherNet/IP, EtherCAT, PROFINET, POWERLINK, SERCOS III, Others |

| End Users Covered | Automotive and Transportation, Electrical and Electronics, Pharmaceutical and Medical Devices, Aerospace and Defense, Energy and Power, Oil and Gas, Food and Beverages, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Advantech Co. Ltd., Beckhoff Automation, Belden Inc., Cisco Systems Inc., Honeywell International Inc., Moxa Inc., OMRON Corporation, Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Weidmüller GmbH & Co KG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)