Global Industrial Brakes Market Expected to Reach USD 1.9 Billion by 2033 – IMARC Group

Global Industrial Brakes Market Statistics, Outlook and Regional Analysis 2025-2033

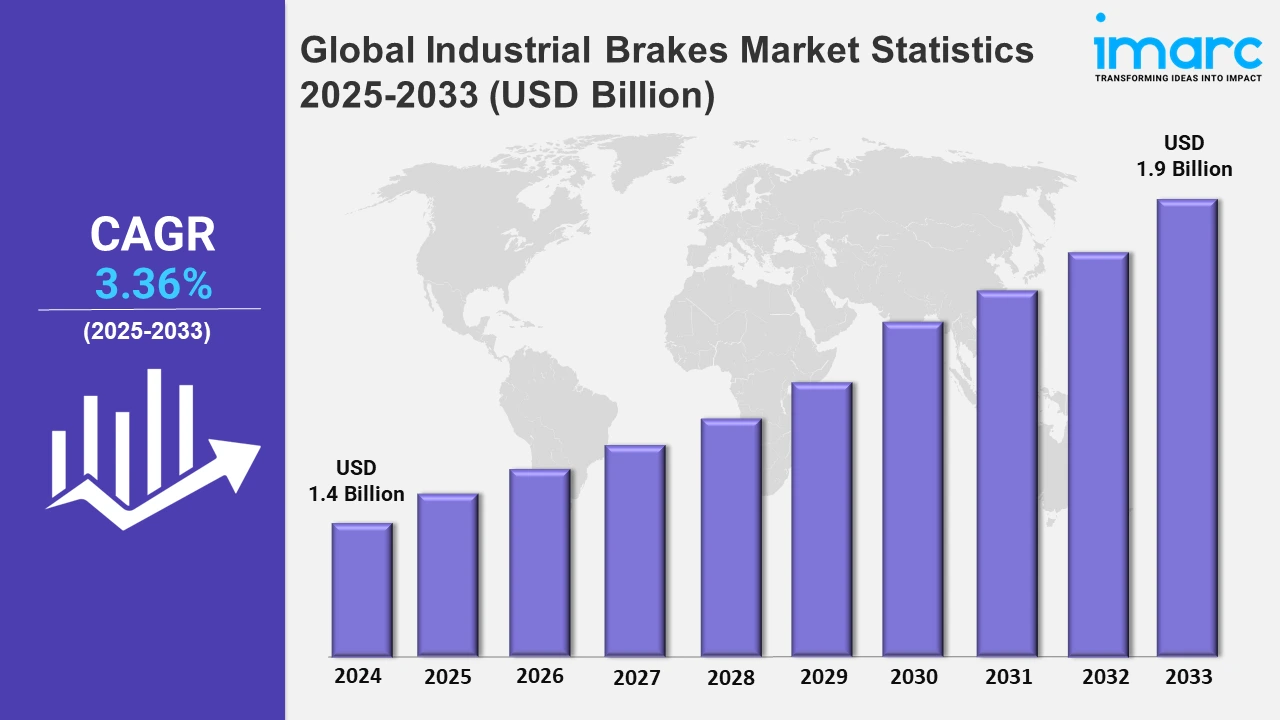

The global industrial brakes market size was valued at USD 1.4 Billion in 2024, and it is expected to reach USD 1.9 Billion by 2033, exhibiting a growth rate (CAGR) of 3.36% from 2025 to 2033.

To get more information on this market, Request Sample

The rising adoption of industrial automation is driving the demand for advanced and reliable braking systems. Automation technologies, such as robotics and automated machinery, are becoming essential across various industries like manufacturing, logistics, mining, and construction. These automated systems depend on industrial brakes to ensure precise control, enhanced safety, and efficient operation. In industrial automation, high-speed and high-precision equipment are employed, which requires braking systems that can handle different conditions. Advanced industrial brakes provide the necessary stopping power to avoid accidents, equipment damage, and operational downtime. They also ensure safe operations because they support emergency stopping and holding functions, especially in critical applications like material handling and assembly lines. Moreover, brakes can be integrated with sensors and control systems to offer better monitoring and real-time performance optimization. These features are very important for maintaining smooth operations in automated environments. As per the IMARC Group’s report, the global industrial automation services market is expected to reach USD 459.5 Billion by 2033.

The increasing construction activities, which require heavy machinery and equipment, are impelling the market growth. Construction activities, including residential, commercial, and infrastructure projects, rely heavily on machinery like cranes, hoists, elevators, and material handling equipment. These machines are equipped with industrial brakes to enable safe and efficient operations, particularly for stopping, holding, and emergency braking. Cranes and hoists, being integral to building construction, utilize reliable braking systems to ensure the controlled lifting and lowering of heavy materials. Industrial brakes are employed to prevent accidents, as they provide precise motion control and secure loads. Besides this, elevators that are used in high-rise construction depend on advanced braking systems for smooth operation and passenger safety. The IMARC Group’s report shows that the global buildings construction market is expected to reach USD 10.5 Trillion by 2033.

Global Industrial Brakes Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific accounts for the largest market share driven by the growing investments in infrastructure, rising demand for automation, and technological advancements.

Asia-Pacific Industrial Brakes Market Trends:

The Asia-Pacific region is enjoying the leading position in the market due to the rising number of industrial projects, particularly in countries like China, India, and Japan. The region benefits from the high number of manufacturing and construction activities that create the need for reliable braking systems to ensure safe and efficient operations. Government agencies and companies are investing in infrastructure projects and mining activities, which require industrial brakes. There is an abundance of low-cost raw materials and labor, which encourages local production. With innovations in industries like automotive, aerospace, and electronics manufacturing, the demand for good-quality machine tools with integrated braking systems is high so that economical and adept processes are ensured. According to the IMARC Group’s report, the Asia-Pacific machine tools market is projected to exhibit a growth rate (CAGR) of 4.19% during 2024-2032.

North America Industrial Brakes Market Trends:

North America accounts for a sizeable portion of the industrial brakes industry owing to its well-established manufacturing and aerospace industries. Companies adopt advanced technologies that enable the development of innovative braking solutions in automated and heavy machinery. Government agencies are also spending on renewable energy projects that need high-performance braking systems. To adhere to stringent safety regulations, companies also focus on operational efficiency, which encourages them to use reliable brakes.

Europe Industrial Brakes Market Trends:

The market for industrial brakes is expanding gradually in Europe, which can be attributed to its advanced automotive and aerospace industries. In the region, energy-efficient braking systems are used in sustainable practices and automation operations. Countries like Germany, France, and the UK have well-setup industrial bases, which require capable brakes. Besides this, companies spend on technological advancements and research and development (R&D) activities to develop affordable and effective industrial brakes.

Latin America Industrial Brakes Market Trends:

On account of the ongoing infrastructure developments as well as agricultural and mining activities, Latin America is experiencing industrial brakes market expansion. In countries like Brazil, Chile, and Mexico, there are high investments in construction and energy sectors that depend on industrial brakes. To modernize industrial operations and ensure workplace safety, industrial brakes are employed across the region.

Middle East and Africa Industrial Brakes Market Trends:

The market for industrial brakes in the Middle East and Africa region is distinguished by the construction and energy sector developments. Large-scale infrastructure projects, particularly in Gulf Cooperation Council (GCC) countries like Qatar, Bahrain, and UAE, create the need for braking systems in construction equipment. In the region, industrial brakes are also utilized in blowout preventers to secure valves during drilling operations and prevent leaks and other hazards.

Top Companies Leading in the Industrial Brakes Industry

Some of the leading industrial brakes market companies include Akebono Brake Industry Co. Ltd, Altra Industrial Motion Corporation, AMETEK Inc., Antec SA, Coremo Ocmea S.p.A., Eaton Corporation PLC, Hilliard Corporation, Kobelt Manufacturing Co. Ltd., Kor-Pak Corporation, RINGSPANN GmbH, SIBRE - Siegerland Bremsen GmbH, and Tolomatic Inc., among many others. In August 2024, SIBRE - Siegerland Bremsen GmbH, a prominent business in Haiger, Germany, announced the broadening of its product assortment and reach with a new plant in Kolkata, India for drum brakes.

Global Industrial Brakes Market Segmentation Coverage

- On the basis of the type, the market has been categorized into mechanical, hydraulic, pneumatic, electrical, and others, wherein electrical represents the leading segment. Electrical brakes offer superior precision, reliability, and energy efficiency. They are widely adopted in industries that need high levels of control and automation, such as manufacturing and robotics. They also provide smooth and accurate stopping, which makes them ideal for applications that demand safety and efficiency. Furthermore, electrical brakes can be assimilated with advanced control systems to make them more functional. They are easy to maintain and highly adaptable to modern smart systems.

- Based on the application, the market has been classified into holding brakes, dynamic and emergency brakes, and tension brakes, amongst which holding brakes dominate the market. They are important for ensuring safety during equipment downtime as well as emergencies. They are widely used in industries like construction, manufacturing, and energy, where machinery must remain stationary under load. Being reliable, they are utilized to secure heavy loads, prevent accidents, and reduce operational risks. Besides this, they are utilized in automated and heavy-duty machinery for holding brakes. Improvements in brake technology, such as enhanced load-holding capacities and durability, make holding brakes a preferred choice.

- On the basis of the end use industry, the market has been segregated into manufacturing, metal and mining, construction, marine and shipping, and others. Among these, manufacturing accounts for the majority of the market share because of its extensive use of heavy machinery and equipment that requires braking systems for efficient operations. Brakes are integral to processes that involve material handling, assembly lines, and precision machining, as they enable safety and productivity. They are also used in lifting equipment, such as cranes and hoists, to hold heavy loads during loading and unloading processes. In automated manufacturing lines, industrial brakes help to maintain the accurate positioning of parts.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1.4 Billion |

| Market Forecast in 2033 | USD 1.9 Billion |

| Market Growth Rate 2025-2033 | 3.36% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Mechanical, Hydraulic, Pneumatic, Electrical, Others |

| Applications Covered | Holding Brakes, Dynamic and Emergency Brakes, Tension Brakes |

| End Use Industries Covered | Manufacturing, Metal and Mining, Construction, Marine and Shipping, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Akebono Brake Industry Co. Ltd, Altra Industrial Motion Corporation, AMETEK Inc., Antec SA, Coremo Ocmea S.p.A., Eaton Corporation PLC, Hilliard Corporation, Kobelt Manufacturing Co. Ltd., Kor-Pak Corporation, RINGSPANN GmbH, SIBRE - Siegerland Bremsen GmbH, Tolomatic Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)