Global In Vitro Diagnostics Market Expected to Reach USD 181.5 Billion by 2033 - IMARC Group

Global In Vitro Diagnostics Market Statistics, Outlook and Regional Analysis 2025-2033

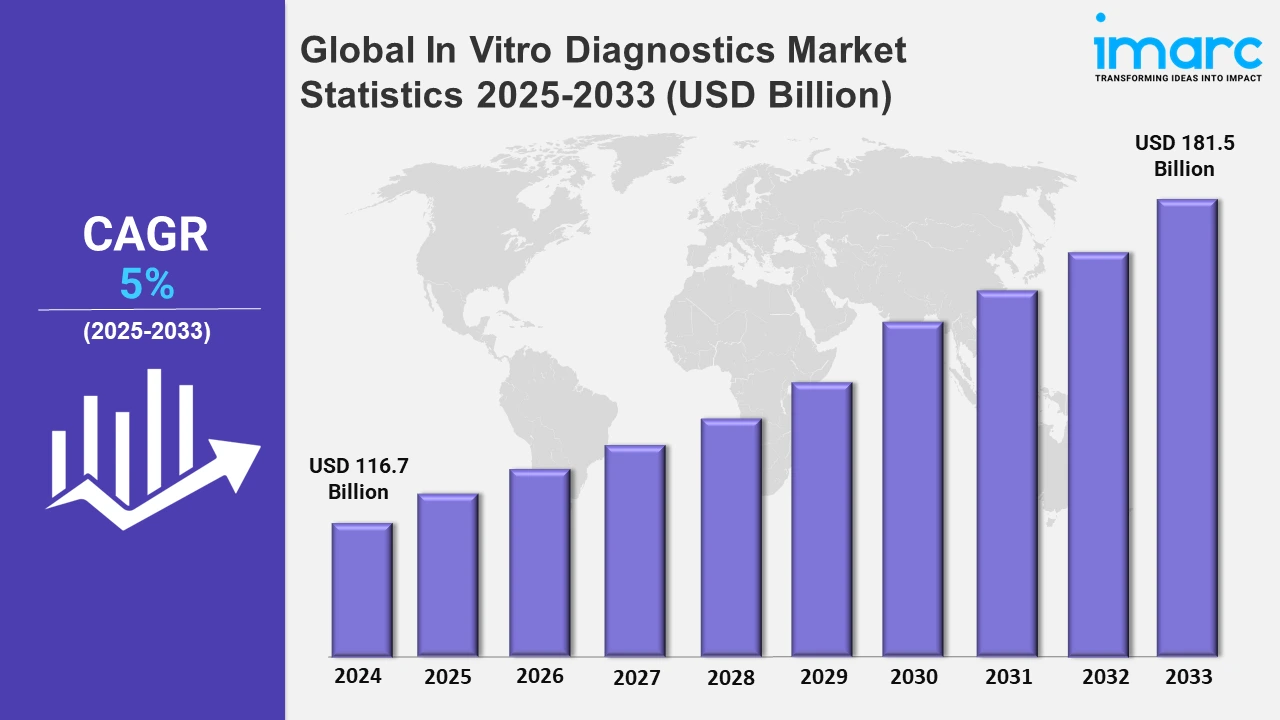

The global in vitro diagnostics market size was valued at USD 116.7 Billion in 2024, and it is expected to reach USD 181.5 Billion by 2033, exhibiting a growth rate (CAGR) of 5% from 2025 to 2033.

To get more information on this market, Request Sample

Recently, infectious illnesses and chronic conditions including cancer, diabetes, and heart disease are becoming more common worldwide, which is creating the need for advanced diagnostic tools. It has been revealed by industry estimates that the United States lose nearly 944,800 Americans lives to heart disease and stroke every single year. The country also receives around 1.7 million cancer diagnosis of American citizens each year which claims the lives of over 600,000 people. This data has increased the need of accurate diagnosis, early identification, and routine monitoring of various medical conditions in the country, all of which depend on in vitro diagnostic techniques. Thus, there is a hike in the requirement of diagnostics. Along with this, the percentage of geriatric people who are easily prone to these conditions is growing, which in turn, is creating the need for the adoption of these diagnostic techniques. It is believed that the population of individuals who are 50 years and older with one chronic illness will rise by 99.5% in the year 2050. It will reach 142.66 million from 71.522 million in 2020. This has put increased pressure on healthcare centers to adopt IVD technology.

New, rapid breakthroughs in IVD technology improve access, accuracy, and speed of diagnostic processes and enhance the growth in this market. Some advancements are molecular diagnostics, point-of-care (POC) testing, and next-generation sequencing, which have transformed this industry. POC devices are known for rapid testing and results for patients' care in remote areas or emergencies. Besides, the industry is expanding because of the growing use of artificial intelligence (AI) and machine learning (ML) algorithms to improve diagnostic abilities with the help of pattern recognition and predictive analytics in test results. In addition, the increasing funding and efforts by public and private organizations and healthcare facilities are expected to capture the immense growth of the IVD market. Governments worldwide are spending funds to build diagnostic infrastructure in low and middle-income countries. For instance, the GOI recently announced Production Linked Incentive Scheme (PLI 2.0) to strengthen the IVD ecosystem in India by driving investment and growth in the sector and targets to develop global champions from the Indian landscape who would grow, export, and potentially have implication on the global value chains through use of ultimate technology. This move has significantly boosted the market for in vitro diagnostics of India, which is poised to be at around $2060 million by 2027 with the annual growth rate of 7.5%.

Global In Vitro Diagnostics Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of its comprehensive healthcare system, high rate of ailments, and extensive investment in innovative diagnostics.

North America In Vitro Diagnostics Market Trends:

Due to the rise in the utilization of cutting-edge technologies, better healthcare infrastructure, and booming research environment, North America commands the greatest share of the in vitro diagnostics (IVD) market. There is a high incidence of chronic illnesses in the region, like diabetes, cancer, and heart disease, that contributes to its leading position in the industry. It is believed that approximately 129 million Americans have at least one severe chronic illness. And 42% of Americans have two or more chronic diseases, while 12% have minimum five. This shows that an increasing number of Americans are suffering from multiple chronic illnesses, requiring the need for effective diagnostic measures to manage these conditions at the earliest possible. The region also has a well-established system for the payment of diagnostic testing to make it simpler for its citizens, thus favoring the market share. Additionally, the area is gaining from significant investments in point-of-care (POC) testing, molecular diagnostics, and customized treatment that has been possible through collaborations between private companies and government organizations.

Asia-Pacific In Vitro Diagnostics Market Trends:

Because of escalating healthcare expenses, a growing middle class, and an increase in the prevalence of chronic illnesses, Asia Pacific is becoming one of the IVD market's fastest-growing regions. Furthermore, the market is also expanding as the government promotes diagnostic upgrades and highlights healthcare infrastructure modifications. In addition, the growing rural healthcare initiatives and increased awareness of preventative care are broadening the scope of diagnostic services.

Europe In Vitro Diagnostics Market Trends:

Europe is a significant IVD market, owing to its emphasis on healthcare quality and accessibility. Aside from that, the heightened focus on early disease identification and management is a crucial factor driving the growth of this industry in Europe. Besides this, supportive healthcare policies and financing programs that promote the development and deployment of new diagnostic technologies in areas such as cancer and infectious illnesses are driving the market expansion in this region.

Latin America In Vitro Diagnostics Market Trends:

Latin America's IVD market is growing, owing to the region's combined burden of communicable and non-communicable diseases, which drives the need for improved diagnostic solutions. Furthermore, public and corporate investments in healthcare infrastructure are increasing access to diagnostics in urban areas. Furthermore, the growing recognition of the importance of early disease identification and the gradual implementation of novel technology hint at the region's future potential.

Middle East and Africa In Vitro Diagnostics Market Trends:

Owing to advances in healthcare infrastructure and government initiatives to prevent infectious diseases such as malaria and tuberculosis, the IVD market is gradually expanding in the Middle East and Africa region. Furthermore, this market is growing as it is funded more heavily in terms of diagnostic programs providing access to essential health services for disadvantaged areas.

Top Companies Leading in the In Vitro Diagnostics Industry

Some of the leading in vitro diagnostics market companies include Abbott Laboratories, Agilent Technologies, Inc., Beckman Coulter, Inc., bioMérieux, Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd, Illumina, Inc., Qiagen N.V, Shimadzu Corporation, Siemens Healthineers AG, Sysmex Corporation, and Thermo Fisher Scientific Inc., among many others.

In October 2024, the first mpox in vitro diagnostic (IVD) was listed by the World Health Organization (WHO) via its Emergency Use Listing (EUL) process, which was created by Abbott Molecular Inc. The Alinity m MPXV assay's certification for emergency usage is said to be crucial for increasing diagnostic capabilities in nations that are dealing with mpox epidemics.

Global In Vitro Diagnostics Market Segmentation Coverage

- On the basis of the test type, the market has been categorized into clinical chemistry, molecular diagnostics, immunodiagnostics, hematology, and others, wherein molecular diagnostics represent the leading segment. It is an essential tool for early diagnosis and individualized therapy since it provides unmatched accuracy in identifying viral and genetic disorders. Furthermore, an increasing requirement for accuracy in healthcare and improvements in technology like next-generation sequencing are prompting its broad delivery.

- Based on the product, the market is bifurcated into reagents and kits, and instruments. Reagents and kits are the most popular since they are often employed in diagnostic procedures. Additionally, the necessity for high-quality consumables and the growing number of diagnostic tests conducted worldwide are driving this segment's rise.

- On the basis of usability, the market has been divided into disposable IVD devices and reusable IVD devices. Disposable IVD devices are designed for single-use applications, ensuring sterility and reducing the risk of cross-contamination in diagnostic procedures. Moreover, reusable IVD devices are durable and cost-effective and are intended for repeated use with proper sterilization.

- Based on the application, the market is segregated into infectious disease, diabetes, cancer/oncology, cardiology, autoimmune disease, nephrology, and others. Among these, infectious diseases account for the majority of the market share. The persistent threat of infectious diseases, including human immunodeficiency virus (HIV) and tuberculosis, drives the demand for diagnostic tools to ensure timely detection and treatment. Moreover, governments and healthcare institutions prioritize these tests to prevent outbreaks and manage public health efficiently.

- On the basis of the end user, the market has been divided into hospitals laboratories, clinical laboratories, point-of-care testing centers, academic institutes, patients, and others. Hospital laboratories are useful for a wide range of inpatients and outpatients, and for comprehensive diagnostic testing, while clinical labs are known for pathological and diagnostic testing to offer patients and healthcare professionals advanced services. Point-of-care testing centers further provide fast, on-site diagnostic services to enable the making of decisions in areas that are remote or under emergent conditions. Academic institutions place increased emphasis on education and research, which advance diagnostic technology and procedures. For convenience and proactive health management, patients also rely on self-diagnostic tools and home testing kits.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 116.7 Billion |

| Market Forecast in 2033 | USD 181.5 Billion |

| Market Growth Rate 2025-2033 | 5% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Test Types Covered | Clinical Chemistry, Molecular Diagnostics, Immunodiagnostics, Hematology, Others |

| Products Covered | Reagents and Kits, Instruments |

| Usabilities Covered | Disposable IVD Devices, Reusable IVD Devices |

| Applications Covered | Infectious Disease, Diabetes, Cancer/Oncology, Cardiology, Autoimmune Disease, Nephrology, Others |

| End Users Covered | Hospitals Laboratories, Clinical Laboratories, Point-of-care Testing Centers, Academic Institutes, Patients, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, Agilent Technologies, Inc., Beckman Coulter, Inc., bioMérieux, Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd, Illumina, Inc., Qiagen N.V, Shimadzu Corporation, Siemens Healthineers AG, Sysmex Corporation, Thermo Fisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on In Vitro Diagnostics Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)