Global Identity Verification Market Expected to Reach USD 46.4 Billion by 2033 - IMARC Group

Global Identity Verification Market Statistics, Outlook and Regional Analysis 2025-2033

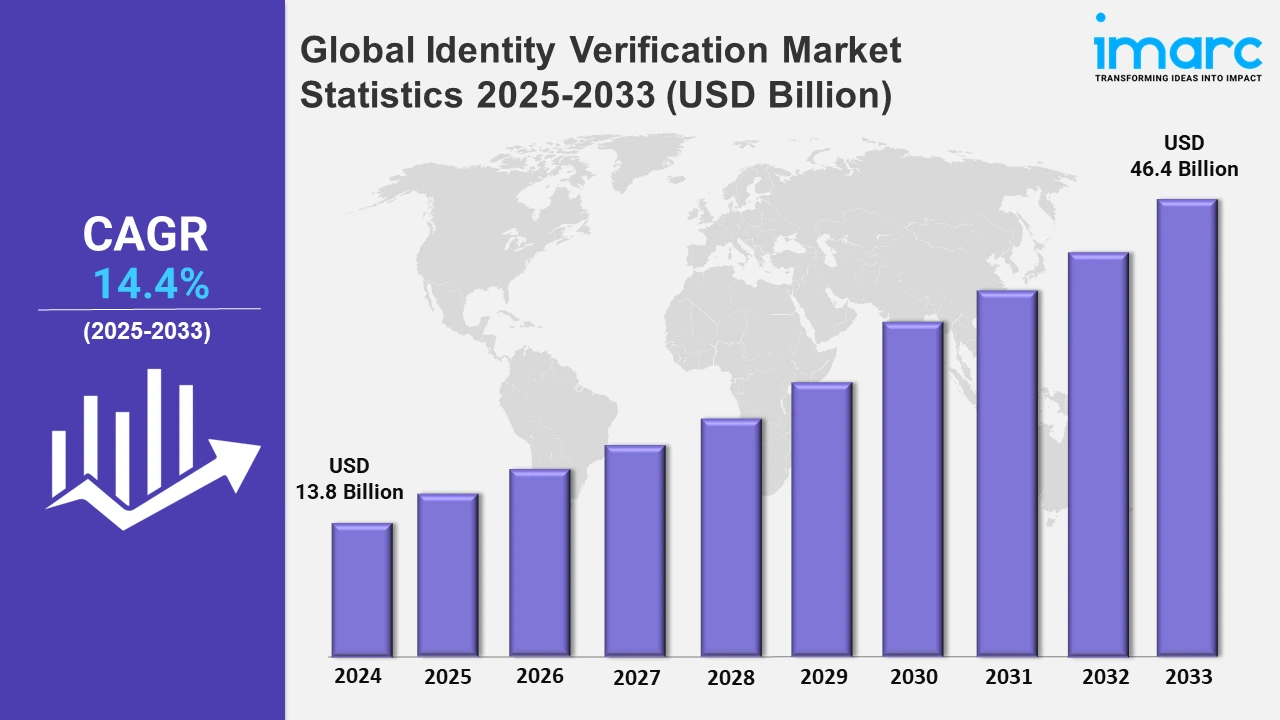

The global identity verification market size was valued at USD 13.8 Billion in 2024, and it is expected to reach USD 46.4 Billion by 2033, exhibiting a growth rate (CAGR) of 14.4% from 2025 to 2033.

To get more information on this market, Request Sample

The global identity verification market is primarily driven by the escalating need for secure digital environments across industries. In line with this, the rapid digitization of financial services, e-commerce, and government services is raising concerns about fraud, identity theft, and data breaches. Thus, businesses are increasingly adopting identity verification technologies to ensure secure transactions and compliance with stringent regulatory frameworks, such as GDPR, KYC, and AML mandates. Know-your-customer (KYC) registration agencies stated on April 24th, 2024, that 73% of the KYC record of 108.3 million was valid as of 31st March2024, and that a system was set in place for the other investors to do their validation. Based on the directive from the Securities and Exchange Board of India, all KYC records are kept in three buckets — KYC Validated, KYC Registered/Verified, and KYC On Hold by KYC registration agencies or KRAs. According to the release, 15% of the records are placed under the status of KYC Registered and the balance 12% are placed under KYC On Hold status. The proliferation of online transactions, fueled by growing internet penetration and the expansion of digital payment platforms, is increasing the demand for robust identity verification solutions. Additionally, advancements in AI and biometric technology are enabling faster and more accurate identity authentication, enhancing user experience while reducing fraud risks. These trends are further bolstered by the increasing preference for remote working and virtual interactions, which necessitate reliable verification tools to maintain trust and security in digital ecosystems.

The rise in mobile device usage and the growing adoption of cloud-based identity solutions also contribute significantly to market growth. With smartphones becoming the primary medium for accessing online services, businesses are focusing on integrating seamless mobile identity verification methods to cater to tech-savvy consumers. Cloud-based solutions, offering scalability and cost efficiency, are becoming the backbone for enterprises seeking to adapt to dynamic consumer behaviors and regulatory demands. According to a research report by IMARC Group, the global cloud storage market size reached USD 117.6 Billion in 2024. The market is expected to reach USD 490.6 Billion by 2033, exhibiting a growth rate (CAGR) of 16.34% during 2025-2033. Furthermore, the expanding focus on customer-centric strategies is encouraging organizations to adopt identity verification processes that balance security with convenience. Emerging markets, driven by increasing internet adoption and smartphone penetration, are presenting lucrative growth opportunities for identity verification providers. As cyberattacks become more sophisticated, the demand for innovative and comprehensive identity verification technologies is accelerating, shaping the market’s trajectory.

Global Identity Verification Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of advanced technology adoption, stringent regulations, and high digital service usage. The region’s focus on cybersecurity and innovation reinforces its dominant position.

North America Identity Verification Market Trends:

North America currently leads the global identity verification market, mainly due to strong technological infrastructure and heavy adoption of advanced digital solutions across industries. The strong prevalence is largely driven by stringent regulatory requirements, such as the USA PATRIOT Act, KYC (Know Your Customer), and AML (Anti-Money Laundering) guidelines, making it mandatory for organizations to implement reliable identity verification processes. The increasing adoption of online services and digital transactions, along with the rising threat of cybercrime, is fueling the need for advanced verification technologies. On 7th August 2024, IBM introduced generative AI capabilities available to its Threat Detection and Response Services, improving its clients' security operations. The new Cybersecurity Assistant, built on the watsonx platform, enhances the detection and response of threats through reduced investigation times of alerts, from 48% and further enables automation to take control of up to 85% of alerts, leaving human analysts free to concentrate on critical cases. The region is further supported by the presence of key market players and innovation in AI, machine learning, and biometric solutions. Moreover, the increasing use of remote work and digital banking is positively influencing the demand for secure identity verification tools. With a technology-savvy population and a strong emphasis on cybersecurity, North America is leading in this market as the largest regional segment.

Asia-Pacific Identity Verification Market Trends:

The Asia Pacific region is one of the fastest-growing regions in the identity verification market due to increased internet penetration, a booming e-commerce sector, and the increased adoption of digital payment solutions. Governments and enterprises are enforcing stringent regulations to combat identity theft and fraud, which drives the demand further. Countries such as India and China, having huge populations and high smartphone usage, are significant contributors. Emerging economies in Southeast Asia are also utilizing cloud-based and biometric technologies to improve security and smoothen digital transactions.

Europe Identity Verification Market Trends:

Europe is a mature but constantly growing market for identity verification, which is supported by strict regulatory frameworks such as GDPR and eIDAS. A focus on data privacy and consumer protection in the region is leading to the widespread adoption of advanced verification technologies across the financial services, healthcare, and government sectors. Leading nations in the market include Germany, the UK, and France, due to their already well-established digital infrastructure. Growing inter-border transactions and online service uses further increase the demand from Europe for secure identity authentication solutions.

Latin America Identity Verification Market Trends:

The growing digitalization of banking and financial services, as well as the rising fraud and cybercrime concerns, drives the Latin American identity verification market. Brazil and Mexico are among the leading adopters of identity verification tools to meet KYC and AML compliance requirements. Growth in e-commerce and digital wallets is also pushing demand for secure solutions. Although the market is hampered by backward infrastructure in certain areas, progress is steady, given advances in mobile technology and regulatory initiatives.

Middle East and Africa Identity Verification Market Trends:

The Middle East and Africa remain an emerging market in terms of identity verification, attributed to the increasing digital transformation activities coupled with government-led efforts for security advancements. The region increasingly seeks online banking, e-commerce, and mobile financial services, which have significantly enhanced the need for sound systems of identity verification. The adoption of biometric technologies, particularly in countries like the UAE and South Africa, is rising. Despite infrastructural and economic disparities, the focus on digital inclusion and security is fostering growth in the market across this diverse region.

Top Companies Leading in the Identity Verification Industry

Some of the leading identity verification market companies include Acuant Inc., AuthenticID Inc., Equifax Inc., Experian PLC, Intellicheck Inc., Jumio Corporation, Mastercard Inc., Mitek Systems Inc., Onfido, Thales Group, TransUnion and Trulioo, among others. On 28th October 2024, AuthenticID launched the new holistic identity verification platform called AuthenticID360. AuthenticID360 ensures to provide robust verification, and strong risk signaling capabilities within just 2 seconds for executing any identity transaction. Authentication is the combination of authentic ID verification, biometric, Know Your Customer and Know Your Business checks on data, OFAC sanction, and advanced fraud watchlists together.

Global Identity Verification Market Segmentation Coverage

- On the basis of the type, the market has been categorized into biometrics and non-biometrics, wherein biometrics represent the leading segment. Biometrics has emerged as the largest type segment in the identity verification market due to its unparalleled accuracy, security, and user convenience. The adoption across industries, such as in finance, healthcare, or government services, is dominated by fingerprint scanning, facial recognition, and iris detection. The proliferation of handheld devices and advancements in artificial intelligence-driven biometric systems are providing accessibility and reliability. Inversely, with sophisticated malware, the need for stronger biometric verification grows strongly, making it dominant in the market.

- Based on the component, the market is classified into solutions and services, amongst which solutions dominate the market. Solutions hold the largest share in the identity verification market due to their ability to offer comprehensive, scalable identity management tools, such as advanced technologies including AI-powered authentication and biometric systems and document verification platforms. Businesses increasingly focus on solutions that are aimed at regulatory compliance, fraud prevention, and safe customer interaction. The growth in the adoption of cloud-based solutions further increases the attractiveness of the solution as it offers flexibility and cost-effectiveness. As the digital ecosystem expands, demand for robust identity verification solutions continues to outpace other market components.

- On the basis of the deployment mode, the market has been divided into on-premises and cloud-based. Among these, on-premises accounts for the majority of the market share. On-premises deployment leads the identity verification market, favored by organizations prioritizing control, security, and compliance over data. Industries like finance, healthcare, and government rely on on-premises solutions to safeguard sensitive data and meet stringent regulatory requirements. This deployment mode allows businesses to customize infrastructure and ensure uninterrupted operations, critical for sectors handling high volumes of sensitive transactions. Despite the growing shift to cloud-based models, on-premises systems remain essential for entities with heightened data security and privacy needs.

- Based on the organization size, the market is segregated into small and medium-sized enterprises, and large enterprises. Large businesses lead the identity verification market due to their high operational scale and increased need for secure and compliant processes. Organizations such as finance, retail, and telecommunication require handling large volumes of customer data and transactions. Preventive regulatory mandates including KYC and AML significantly fuel the adoption. Large enterprises, with vast budgets, invest in the leading-edge technologies of AI and biometrics to bolster security, reduce fraud risk, and ensure customer trust in digital ecosystems.

- On the basis of the vertical, the market has been categorized into BFSI, government and defense, healthcare and life sciences, retail and e-commerce, IT and telecommunication, energy and utilities, and others, wherein BFSI represent the leading segment. The BFSI sector dominated the identity verification market, mainly due to the need for fraud prevention, compliance, and secure transactions. Extensive adoption can be attributed to regulatory mandates such as KYC, AML, and CDD. With the advent of digital banking and financial technologies, institutions in the BFSI domain focus on more advanced solutions that include biometric authentication, and AI-driven tools, among others, to protect confidential data and ensure smooth onboarding of customers. Security and regulatory compliance thus entrench this sector's stronghold in the market.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 13.8 Billion |

| Market Forecast in 2033 | USD 46.4 Billion |

| Market Growth Rate 2025-2033 | 14.4% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Biometrics, Non-Biometrics |

| Components Covered | Solutions, Services |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Verticals Covered | BFSI, Government and Defense, Healthcare and Life Sciences, Retail and E-Commerce, IT and Telecommunication, Energy and Utilities, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Acuant Inc., AuthenticID Inc., Equifax Inc., Experian PLC, Intellicheck Inc., Jumio Corporation, Mastercard Inc., Mitek Systems Inc., Onfido, Thales Group, TransUnion and Trulioo |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Identity Verification Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)