Global I-Joist Market Expected to Reach USD 4.7 Billion by 2033 - IMARC Group

Global I-Joist Market Statistics, Outlook and Regional Analysis 2025-2033

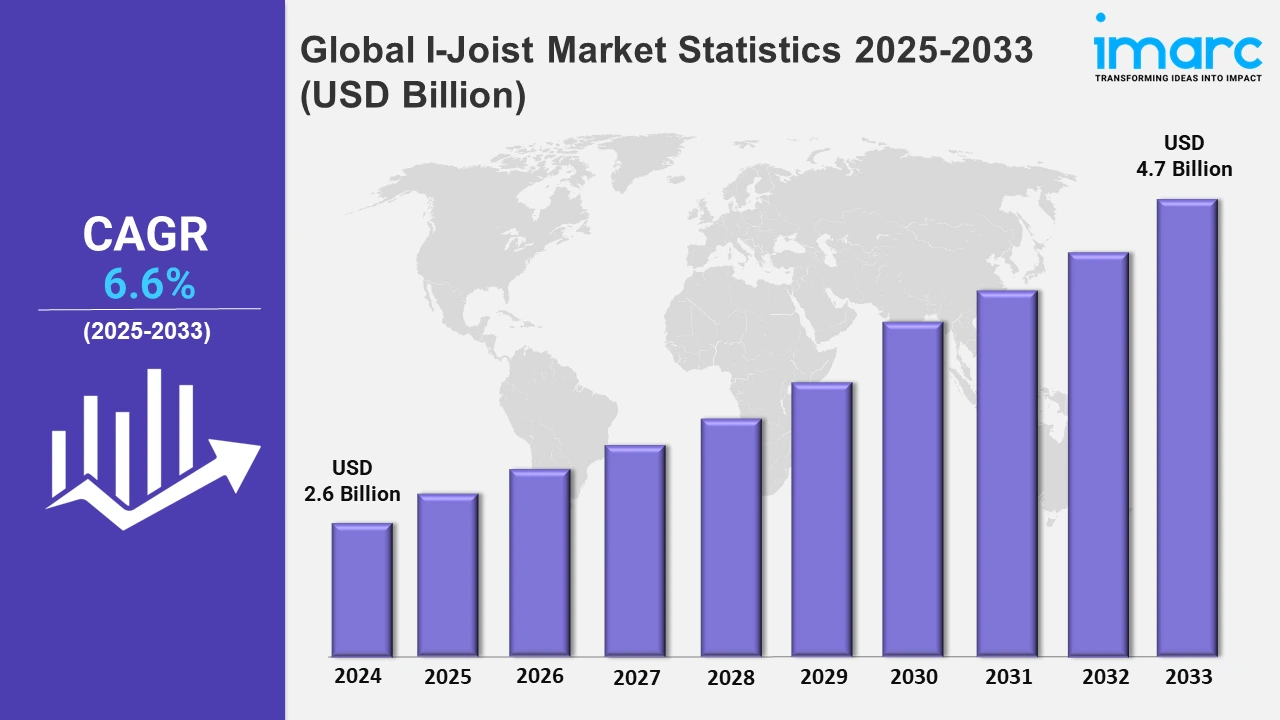

The global I-joist market size was valued at USD 2.6 Billion in 2024, and it is expected to reach USD 4.7 Billion by 2033, exhibiting a growth rate (CAGR) of 6.6% from 2025 to 2033.

To get more information on this market, Request Sample

A greater emphasis on sustainable construction materials is driving investments in modern manufacturing facilities, with a focus on the high-capacity production of I-joists to fulfill worldwide requirements for lightweight, efficient, and environmentally friendly building materials. For example, in February 2024, VMG Lignum Construction established a factory in Lithuania, the first in the Baltics and the third in Europe. With an annual capacity of 15 million meters of I-joists and 120,000 m³ of LVL, it targets worldwide markets for sustainable, high-performance materials for construction.

Moreover, the engineered wood products industry is experiencing partnerships and agreements as key players focus on strategic acquisitions to broaden their capabilities and market share. These market developments aim to enhance portfolios, streamline operations, and meet the growing demand for high-performance and sustainable building materials in construction. For instance, in June 2022, Louisiana-Pacific Corporation announced an agreement with Pacific Woodtech to acquire LP's Engineered Wood Products (EWP) business for USD 210 Million. Furthermore, the I-joist industry is rapidly evolving, with manufacturers emphasizing environmentally friendly construction and energy-efficient designs. Engineered I-joists are preferred by builders and architects over traditional timber due to their higher strength-to-weight ratio and lower environmental effect. With expanding urbanization, modular construction techniques based on I-joists are gaining favor as a means of completing building projects more quickly and affordably. For example, Boise Cascade Company increased its engineered wood product capabilities by boosting I-joist production capacity in Alabama in January 2024. This investment addresses rising demand in North America, fueled by residential and commercial development projects. Such changes underscore the critical role companies play in developing and expanding manufacturing to fulfill the growing demand for sustainable and high-performance structural components in modern buildings.

Global I-Joist Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa. According to the report, North America accounted for the largest I-joist market share due to the presence of well-established supply chains and distribution networks.

North America I-Joist Market Trends:

North America holds the largest share of the market owing to the rising demand for environmentally friendly and energy-efficient construction materials. Builders use engineered wood components such as I-joists due to their strength and environmental friendliness. For example, Weyerhaeuser's Trus Joist products are popular among residential building businesses pursuing LEED certification, demonstrating the region's willingness to practice ecologically responsible construction.

Europe I-Joist Market Trends:

The market in Europe prioritizes innovation and automation to improve product performance and efficiency. Manufacturers invest in cutting-edge production facilities to fulfill strict construction standards. For example, STEICO SE's advanced I-joist lines, together with its dedication to sustainable forestry, meet Europe's need for lightweight, robust, and environmentally responsible structural components.

Asia Pacific I-Joist Market Trends:

Asia Pacific's growing urbanization is driving demand for I-joists in high-density housing and infrastructure progress. Countries such as China and India are significantly investing in infrastructure to sustain their growing populations and economies. For example, China's Belt and Road Initiative comprises multiple infrastructure projects that use engineered wood products, such as I-joists, to improve construction efficiency and sustainability.

Latin America I-Joist Market Trends:

The increasing requirement for affordable housing in Latin America has accelerated the introduction of I-joists. These low-cost and high-strength components facilitate lightweight construction in areas with changing building material costs. For example, in Brazil, I-joists are increasingly being employed in modular housing projects, helping provide accessible and long-lasting housing alternatives.

Middle East and Africa I-Joist Market Trends:

The Middle East and Africa region prioritizes climate-resilient building, making I-joists a feasible option because of their resilience to warping and wetness. For example, Saudi Arabia's Vision 2030 encourages contemporary construction technologies, with I-joists playing an important part in lightweight, sustainable, and weather-resistant building systems designed for the region's severe conditions.

Top Companies Leading in the I-Joist Industry

Some of the leading I-joist market companies include Boise Cascade, James Jones & Sons Limited, Nordic Structures, Pacific Woodtech Corporation (PWT), RedBuilt, LLC, Roseburg Forest Products Co., Södra, Stark Truss Company, Inc., STEICO SE, Weyerhaeuser Company, among many others. For example, in November 2021, Boise Cascade Company announced the expansion of its Ohio Valley Building Materials Distribution (BMD) network to broaden its product offering.

Global I-Joist Market Segmentation Coverage

- Based on the sector, the market has been classified into residential and commercial, wherein residential leads the market. The growing demand for custom-made layouts and open floor designs in the residential sector is a significant growth-inducing factor.

- Based on the new construction and replacement, the market has been categorized into new construction and replacement, amongst which new construction dominates the market. This is primarily driven by the expanding global population and rapid urbanization, which leads to an increasing need for new housing and commercial buildings.

- Based on the application, the market has been divided into floors, roofs, and other applications. Among these, floors show a clear dominance in the market as flooring involves large surface areas, and any inefficiency in material use leads to high costs.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 2.6 Billion |

| Market Forecast in 2033 | USD 4.7 Billion |

| Market Growth Rate 2025-2033 | 6.6% |

| Units | Billion USD, Million Cubic Metres |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Sectors Covered | Residential, Commercial |

| New Constructions and Replacements Covered | New Construction, Replacement |

| Applications Covered | Floors, Roofs, Other Applications |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Boise Cascade, James Jones & Sons Limited, Nordic Structures, Pacific Woodtech Corporation (PWT), RedBuilt, LLC, Roseburg Forest Products Co., Södra, Stark Truss Company, Inc., STEICO SE, Weyerhaeuser Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on I-Joist Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)