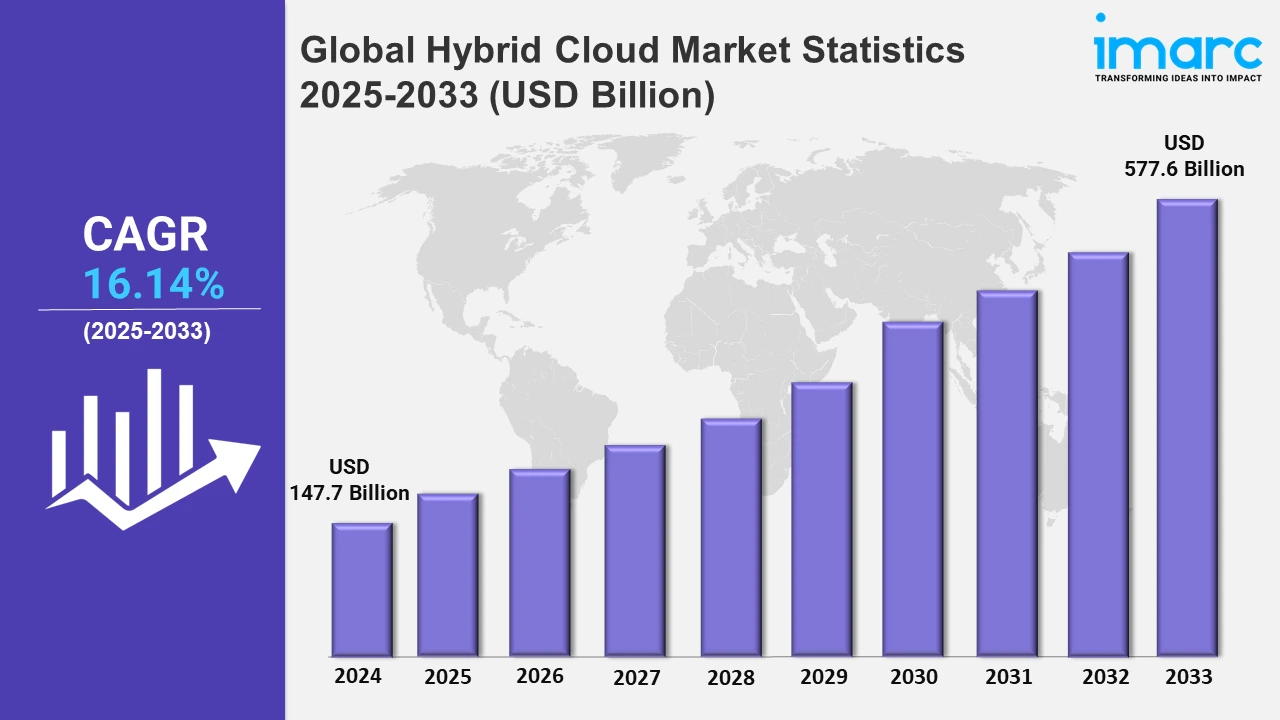

Global Hybrid Cloud Market to Grow at 16.14% during 2025-2033, Reaching USD 577.6 Billion by 2033

Global Hybrid Cloud Market Statistics, Outlook and Regional Analysis 2025-2033

The global hybrid cloud market size was valued at USD 147.7 Billion in 2024, and it is expected to reach USD 577.6 Billion by 2033, exhibiting a growth rate (CAGR) of 16.14% from 2025 to 2033.

To get more information on this market, Request Sample

The growing need for robust data security and regulatory compliance is providing an impetus to the global hybrid cloud market. Organizations use hybrid models to safeguard sensitive data in private clouds while leveraging public cloud services for non-critical operations, ensuring adherence to data protection laws. This setup gives businesses more control over data management and reduces risks tied to public cloud storage. For instance, On October 29, 2024, Securiti, a cybersecurity solutions provider, launched Gencore AI, enabling enterprises to create generative AI systems with advanced security, compliance, and governance. It supports hybrid cloud environments, linking to numerous data systems and protecting sensitive data through knowledge graphs and LLM firewalls aligned with regulatory standards. Industries such as finance, healthcare, and government have stringent compliance requirements, making hybrid cloud solutions appealing. Customizable security protocols and data sovereignty capabilities allow businesses to secure critical information while benefiting from cloud flexibility and cost efficiency.

Organizations are increasingly turning to hybrid cloud solutions for scalability and flexibility beyond what standalone public or private clouds offer. It allows seamless workload management between on-premises infrastructure and public cloud services, optimizing resources based on current demands. Hybrid cloud systems also enable efficient scaling during peak periods or specific projects, without the restrictions of fixed capacity, and as a result, businesses gain flexibility in choosing application deployment based on factors such as performance, security, or costs. A Gartner report highlights that by 2024, 90% of enterprises will adopt hybrid strategies, and by 2025, 50% of CIOs will connect performance metrics to sustainability goals. By 2026, 80% are expected to utilize generative AI, with 75% of enterprise data processing happening at the edge. This approach also simplifies migration to cloud-native solutions, blending the control of on-premises setups with the dynamic scalability of public cloud services, ensuring robust infrastructure management.

Global Hybrid Cloud Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of significant investments in digital transformation, advanced IT infrastructure, and early adoption of technologies such as artificial intelligence (AI) and edge computing.

North America Hybrid Cloud Market Trends:

The North American hybrid cloud market is propelled by substantial investments in digital transformation and cutting-edge IT infrastructure. Enterprises adopt hybrid models to maintain data security while benefiting from public cloud flexibility. The region’s growing focus on innovation and early tech adoption, particularly in AI and edge computing, strengthens its leadership in hybrid solutions. Notably, on August 27, 2024, Hitachi Vantara and Broadcom, both companies with headquarters in the US, launched a private and hybrid cloud solution integrating Hitachi UCP RS with VMware Cloud Foundation, advancing data management and infrastructure modernization. This solution offers flexible deployment, streamlined operations, 100% data availability, and sustainable features, reducing CO2 emissions by up to 96%.

Asia-Pacific Hybrid Cloud Market Trends:

The Asia Pacific region is experiencing rapid hybrid cloud adoption due to growing digitalization and the expanding tech ecosystem. Enterprises are choosing hybrid solutions to support flexible IT operations and to manage large-scale data processing needs. Favorable government policies promoting cloud technology and the rise of smart city initiatives contribute to market growth, especially in developing economies with increasing digital infrastructure.

Europe Hybrid Cloud Market Trends:

Europe’s hybrid cloud market growth is fueled by stringent data protection regulations and a focus on data sovereignty. Companies are increasingly leveraging hybrid models to comply with GDPR while accessing scalable public cloud resources. Industries such as finance and healthcare are key adopters, seeking enhanced security and compliance. Sustainability initiatives are also pushing organizations to integrate hybrid cloud strategies for optimized energy usage.

Latin America Hybrid Cloud Market Trends:

The market in Latin America is expanding as companies look for affordable, scalable IT solutions in the face of economic uncertainty. The adoption of hybrid cloud models allows companies to manage local data while benefiting from the scalability offered by public clouds. Regional development is bolstered by enhanced digital transformation initiatives, collaborations among tech firms, and rising investments in cloud infrastructure, leading to greater accessibility of hybrid solutions for mid-sized businesses.

Middle East and Africa Hybrid Cloud Market Trends:

In the Middle East and Africa, hybrid cloud adoption is driven by the need for data security, compliance, and the flexibility to scale operations. Industries such as banking and government are at the forefront, utilizing hybrid solutions to maintain on-premises control while leveraging the advantages of cloud technology. Initiatives to augment digital infrastructure and cloud-friendly policies are supporting this market's expansion.

Top Companies Leading in the Hybrid Cloud Industry

Some of the leading hybrid cloud market companies include Alibaba Group Holding Limited, Amazon Inc., Century Link Inc., Cisco Systems Inc., Citrix Systems Inc., Dell Technologies Inc., DXC Technology Company, Fujitsu Ltd. (Furukawa Group), Google (Alphabet Inc.), Hewlett Packard Enterprise Company, IBM Corporation, Microsoft Corporation, Oracle Corporation, Rackspace Inc., VMWare Inc., among many others. On September 9, 2024, Oracle and AWS launched the Oracle Database@AWS, enabling seamless integration of Oracle Autonomous Database and Oracle Exadata Database Service on AWS. This hybrid cloud solution offers customers unified support, simplified database management, and the flexibility to connect Oracle databases with AWS services. It also provides zero-ETL integration, simplified migration, and a unified procurement experience, supporting hybrid cloud architectures across industries.

Global Hybrid Cloud Market Segmentation Coverage

- On the basis of the component, the market has been categorized into solutions and services, wherein solutions represent the leading segment as they address specific business challenges with tailored approaches, delivering immediate value. By integrating diverse technologies, solutions improve efficiency and streamline operations. They provide measurable outcomes, offering businesses a competitive edge. Additionally, solutions are scalable, adaptable to growth, and enable organizations to stay agile, ensuring long-term success in rapidly changing markets.

- The market is divided into professional services and managed services according to the type of service provided. Managed services lead the market given their affordability, adaptability, and support from experts. Using these services, companies can delegate IT duties, minimizing operational costs and concentrating on primary goals. Managed services also offer preventive maintenance, guaranteeing reduced downtime and improved security. Moreover, they provide tailored solutions, adjusting to changing technological requirements, and enable companies to remain competitive with advanced tools and innovation.

- On the basis of the service type, the market is classified into cloud management and orchestration, disaster recovery, and hybrid hosting, amongst which hybrid hosting dominates the market. This can be attributed to its blend of on-premises and cloud solutions, providing businesses with greater control and customization of their IT environments. This approach offers scalability and resilience, essential for handling varying workloads and ensuring business continuity. Hybrid hosting also supports data compliance needs while allowing seamless integration of legacy systems with modern cloud technologies, enhancing operational efficiency and agility.

- Based on the service model, the market has been divided into infrastructure as a service, platform as a service, and software as a service (SaaS). Among these, software as a service(SaaS) accounts for the majority of the market share as it provides businesses with scalable, on-demand applications that reduce infrastructure costs and streamline operations. SaaS solutions offer seamless integration with hybrid cloud models, enabling efficient data management and collaboration. The flexibility and accessibility of SaaS platforms render them essential for businesses aiming to enhance productivity and adapt quickly to market changes.

- On the basis of the organization size, the market has been categorized into small and medium enterprises (SMEs), and large enterprises. Small and medium enterprises (SMEs) hold a significant share in the hybrid cloud market due to their need for cost-effective, scalable IT solutions that support growth. Hybrid cloud offers flexibility, allowing smaller enterprises to manage operations efficiently without heavy upfront investments in infrastructure. Additionally, SMEs benefit from hybrid solutions' ability to balance security with public cloud accessibility, enhancing productivity and competitive advantage in dynamic markets.

- Based on the vertical, the market is segregated into government and public sector, healthcare, banking, finance, services, and insurance (BFSI), retail, information and communication technology, manufacturing, and others. The banking, finance, services, and insurance (BFSI) sector holds the largest share in the market due to its high data security requirements and the need for flexible infrastructure to handle vast transaction volumes. Hybrid cloud solutions support real-time data processing and advanced analytics, essential for financial forecasting and risk management. Additionally, regulatory compliance demands robust, customizable data control, making hybrid models ideal for the industry.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 147.7 Billion |

| Market Forecast in 2033 | USD 577.6 Billion |

| Market Growth Rate (2025-2033) | 16.14% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Solutions, Services |

| Services Covered | Professional Services, Managed Services |

| Service Types Covered | Cloud Management and Orchestration, Disaster Recovery, Hybrid Hosting |

| Service Models Covered | Infrastructure as a Service, Platform as a Service, Software as a Service |

| Organization Sizes Covered | Small and Medium Enterprises (SMEs), Large Enterprises |

| Verticals Covered | Government and Public Sector, Healthcare, Banking, Finance, Services and Insurance (BFSI), Retail, Information and Communication Technology, Manufacturing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alibaba Group Holding Limited, Amazon Inc., Century Link Inc., Cisco Systems Inc., Citrix Systems Inc., Dell Technologies Inc., DXC Technology Company, Fujitsu Ltd. (Furukawa Group), Google (Alphabet Inc.), Hewlett Packard Enterprise Company, IBM Corporation, Microsoft Corporation, Oracle Corporation, Rackspace Inc., VMWare Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Hybrid Cloud Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)