Global Human Insulin Market Expected to Reach USD 85.1 Billion by 2033 - IMARC Group

Global Human Insulin Market Statistics, Outlook and Regional Analysis 2025-2033

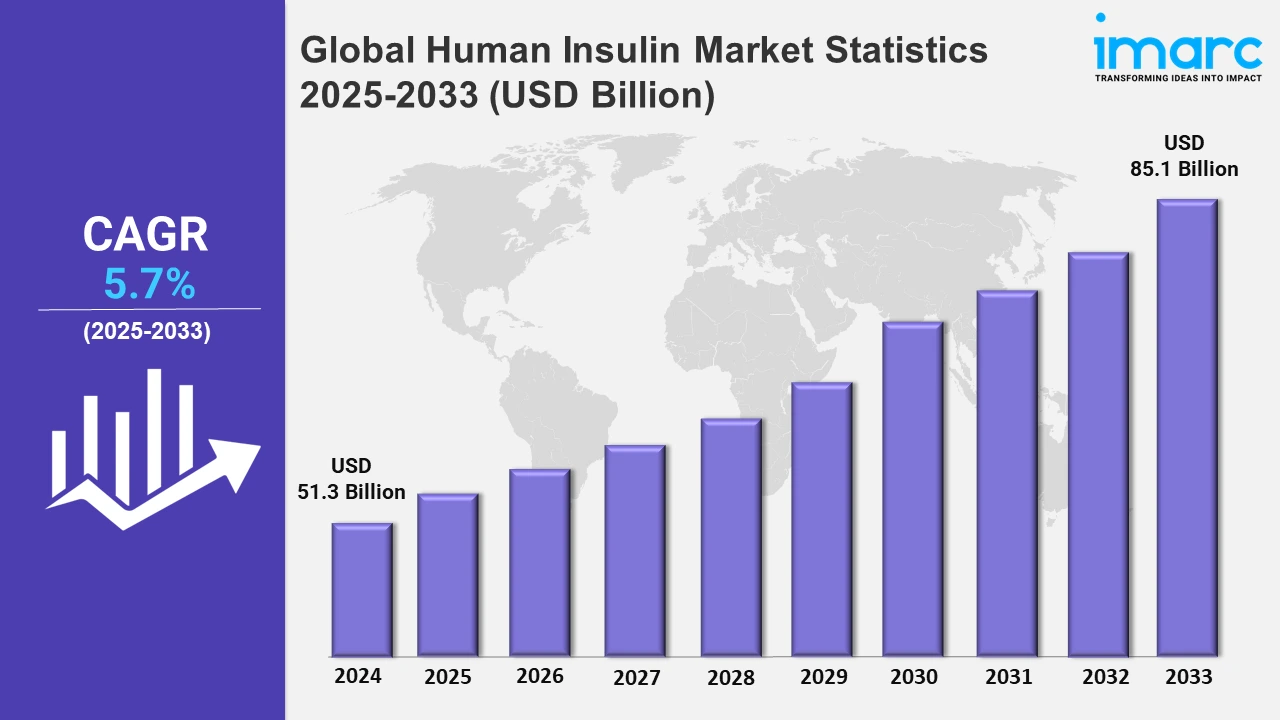

The global human insulin market size was valued at USD 51.3 Billion in 2024, and it is expected to reach USD 85.1 Billion by 2033, exhibiting a growth rate (CAGR) of 5.7% from 2025 to 2033.

To get more information on this market, Request Sample

The market for human insulin is witnessing remarkable growth, driven by increased adoption of biosimilar insulins, making these insulins more affordable and accessible to patients globally. Correspondingly, support from the regulatory framework along with their cost advantage, is promoting large-scale production by the manufacturers. Biocon Biologics' recent US FDA approval on May 21, 2024, for its biosimilar Eylea, under the brand name YESAFILI, expanding into ophthalmology is a perfect example in this regard. YESAFILI, a VEGF inhibitor, is used in the treatment of conditions like wet AMD and DME and has shown comparable quality, safety, and efficacy to its reference product. Biocon's approvals in Europe, the UK and an upcoming Canada launch continue to solidify its lead in biosimilars. In addition, the speedy integration of telemedicine and digital health solutions is revolutionizing diabetes care by allowing patients to monitor glucose levels and adjust the dosages of insulin with ease, leading to growing demand for human insulin products in the market.

Rapid changes in the market are also driven by an increased focus on patient-centered care and tailored treatment approaches. Innovations, such as smart insulin pens and automated insulin delivery systems, have enhanced patient experiences, reduced errors, and improved adherence. For instance, Medtronic recently received clearance from the FDA for its InPen smart insulin pen app, which provides real-time dose recommendations for missed or inaccurate mealtime insulin, and this was granted on November 22, 2024. As part of Smart MDI, the Simplera CGM system-integrated InPen promotes improved diabetes management through dose tracking, missed-dose alerts, and personalized insights all while being set to launch broadly soon. In addition to this, rising investments in diabetes research are driving the development of long-acting insulin formulations, addressing patients' needs for fewer injections and improving convenience. These continual advancements collectively propel the market by offering innovative solutions tailored to patient needs, further strengthening treatment outcomes, and expanding accessibility in the market.

Global Human Insulin Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of its advanced infrastructure, high consumer spending, strong technological adoption, and significant investments across diverse industries.

North America Human Insulin Market Trends:

The human insulin market in North America is growing due to rising diabetes prevalence and advancements in treatment technologies. According to the CDC, 38.4 million people of all ages in the U.S., or 11.6% of the population have diabetes, including 38.1 million adults aged 18 or older, accounting for 14.7% of all U.S. adults. Among adults aged 65 and older, the prevalence reaches 29.2%. Advancements in insulin delivery systems and increased awareness of diabetes management are driving demand. The region’s well-established healthcare infrastructure, strong government support, and research initiatives further support market expansion. The adoption of biosimilar insulins is improving affordability and accessibility. Additionally, innovative technologies like smart insulin pens are enhancing patient convenience and treatment outcomes, significantly influencing market trends.

Asia-Pacific Human Insulin Market Trends:

Asia Pacific presents an emerging opportunity for growth due to a significant diabetes burden and improving health infrastructure across the region. Increased urbanization and decreased levels of activity lead to a bolstered requirement for more insulin. Indian and Chinese governments are investing in steps to increase the accessibility to low-cost diabetes care to include biosimilar production, especially of insulin. Simultaneously, the increase in local presence provided an uplift to accelerate more growth in the region as well.

Europe Human Insulin Market Trends:

Europe's human insulin market is characterized by an aging population, rising obesity levels, and government initiatives to promote diabetic care. The region has been experiencing a trend toward the use of biosimilar insulins to cut the prices of healthcare without compromising on the quality. Reimbursement-friendly conditions in Germany, France, and the UK are making the market easier to access. The emphasis on personalized treatment approaches and digital solutions for diabetes monitoring is further enhancing market development.

Latin America Human Insulin Market Trends:

In Latin America, the human insulin market is expanding as a result of increasing diabetes prevalence and improving healthcare access. Economic development in countries like Brazil and Mexico is facilitating the adoption of advanced insulin delivery devices. Public and private partnerships are promoting awareness campaigns and enhancing the affordability of diabetes treatment. However, limited healthcare coverage in rural areas remains a challenge, creating disparities in market penetration.

Middle East and Africa Human Insulin Market Trends:

The Middle East and Africa region is slowly growing in the human insulin market attributed to increasing diabetes cases and awareness. Urbanization and changes in diet are the main causes for the increased demand for insulin. Government initiatives and collaboration with international organizations are improving access to diabetes care. However, economic constraints and underdeveloped healthcare infrastructure in certain areas limit market growth, particularly in low-income regions.

Top Companies Leading in the Human Insulin Industry

Some of the leading human insulin market companies include B. Braun Melsungen AG, Becton, Dickinson and Company (BD), Biocon, Eli Lilly and Company, Gulf Pharmaceutical Industries (Julphar), Novo Nordisk A/S, Pfizer Inc., Groupe Sanofi, SEDICO Co., Wockhardt Limited, and Ypsomed AG, among many others. On September 5, 2024, Eli Lilly announced positive phase 3 trial results for once-weekly insulin efsitora alfa (efsitora), showing non-inferior A1C reductions compared to daily basal insulins. In QWINT-1, efsitora achieved a 1.31% A1C reduction in insulin-naïve adults, while QWINT-3 demonstrated a 0.86% reduction in adults switching from basal insulin. Efsitora also improved time in range and reduced hypoglycemic events by up to 40%. The trials highlight its potential to simplify diabetes management with improved safety, efficacy, and reduced treatment burden.

Global Human Insulin Market Segmentation Coverage

- Based on product type, the market is classified into drugs (human insulin analogs and biosimilars (rapid acting, long acting, and premixed) and human insulin biologics (short acting, intermediate acting, and premixed)) and delivery devices (pens (reusable pens and disposable pens), pen needles (standard pen needles and safety pen needles), syringes, and others). Drugs are leading the market as their essentiality in diabetes is to provide a sure shot of glycemic control in both Type 1 and Type 2 diabetic patients. Increasing incidence of diabetes fuels the need for insulins and oral anti-diabetic drugs. New drug formulations like long-acting insulins and combination therapy keep the compliance in increasing the patient preference to this as the most widely chosen mode of treatment all around the world.

- On the basis of distribution channel, the market has been categorized into retail pharmacies, hospital pharmacies, online retail stores, and others. The retail pharmacies occupy the largest market share, as they are the most important distribution channel for drugs and supplies for diabetes treatment. Their presence is also widespread in urban and semi-urban areas, and they are easily accessible. Retail pharmacies also cater to the needs of patients by offering personalized support and quick refills, making them the best and most trusted source for diabetes management products.

- Based on disease type, the market is bifurcated type I and type II diabetes, amongst which type I diabetes dominates the market. The segment has the most significant market share given lifelong dependence on insulin therapy. Patients with Type 1 diabetes need to have constant administration of insulin to manage blood glucose levels, thus a steady demand. Increasing awareness and the development of new products in insulin delivery devices have also helped to strengthen the market's focus on addressing Type 1 diabetes patients.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 51.3 Billion |

| Market Forecast in 2033 | USD 85.1 Billion |

| Market Growth Rate 2025-2033 | 5.7% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Retail Pharmacies, Hospital Pharmacies, Online Retail Stores, Others |

| Disease Types Covered | Type I Diabetes, Type II Diabetes |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | B. Braun Melsungen AG, Becton, Dickinson and Company (BD), Biocon, Eli Lilly and Company, Gulf Pharmaceutical Industries (Julphar), Novo Nordisk A/S, Pfizer Inc., Groupe Sanofi, SEDICO Co., Wockhardt Limited, Ypsomed AG |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)